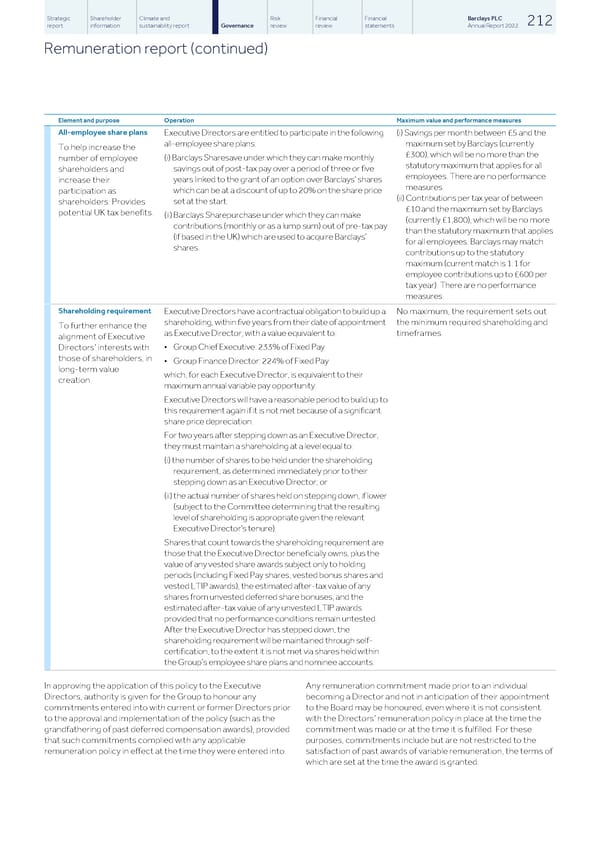

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 212 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Element and purpose Operation Maximum value and performance measures All-employee share plans Executive Directors are entitled to participate in the following (i) Savings per month between £5 and the all-employee share plans: maximum set by Barclays (currently To help increase the £300), which will be no more than the (i) Barclays Sharesave under which they can make monthly number of employee statutory maximum that applies for all savings out of post-tax pay over a period of three or five shareholders and employees. There are no performance years linked to the grant of an option over Barclays’ shares increase their measures. which can be at a discount of up to 20% on the share price participation as (ii) Contributions per tax year of between set at the start. shareholders. Provides £10 and the maximum set by Barclays potential UK tax benefits. (ii) Barclays Sharepurchase under which they can make (currently £1,800), which will be no more contributions (monthly or as a lump sum) out of pre-tax pay than the statutory maximum that applies (if based in the UK) which are used to acquire Barclays’ for all employees. Barclays may match shares. contributions up to the statutory maximum (current match is 1:1 for employee contributions up to £600 per tax year). There are no performance measures. Shareholding requirement Executive Directors have a contractual obligation to build up a No maximum, the requirement sets out shareholding, within five years from their date of appointment the minimum required shareholding and To further enhance the as Executive Director, with a value equivalent to: timeframes. alignment of Executive • Group Chief Executive: 233% of Fixed Pay Directors’ interests with those of shareholders, in • Group Finance Director: 224% of Fixed Pay long-term value which, for each Executive Director, is equivalent to their creation. maximum annual variable pay opportunity. Executive Directors will have a reasonable period to build up to this requirement again if it is not met because of a significant share price depreciation. For two years after stepping down as an Executive Director, they must maintain a shareholding at a level equal to: (i) the number of shares to be held under the shareholding requirement, as determined immediately prior to their stepping down as an Executive Director; or (ii) the actual number of shares held on stepping down, if lower (subject to the Committee determining that the resulting level of shareholding is appropriate given the relevant Executive Director’s tenure). Shares that count towards the shareholding requirement are those that the Executive Director beneficially owns, plus the value of any vested share awards subject only to holding periods (including Fixed Pay shares, vested bonus shares and vested LTIP awards), the estimated after-tax value of any shares from unvested deferred share bonuses, and the estimated after-tax value of any unvested LTIP awards provided that no performance conditions remain untested. After the Executive Director has stepped down, the shareholding requirement will be maintained through self- certification, to the extent it is not met via shares held within the Group’s employee share plans and nominee accounts. In approving the application of this policy to the Executive Any remuneration commitment made prior to an individual Directors, authority is given for the Group to honour any becoming a Director and not in anticipation of their appointment commitments entered into with current or former Directors prior to the Board may be honoured, even where it is not consistent to the approval and implementation of the policy (such as the with the Directors’ remuneration policy in place at the time the grandfathering of past deferred compensation awards), provided commitment was made or at the time it is fulfilled. For these that such commitments complied with any applicable purposes, commitments include but are not restricted to the remuneration policy in effect at the time they were entered into. satisfaction of past awards of variable remuneration, the terms of which are set at the time the award is granted.

Barclays PLC - Annual Report - 2022 Page 213 Page 215

Barclays PLC - Annual Report - 2022 Page 213 Page 215