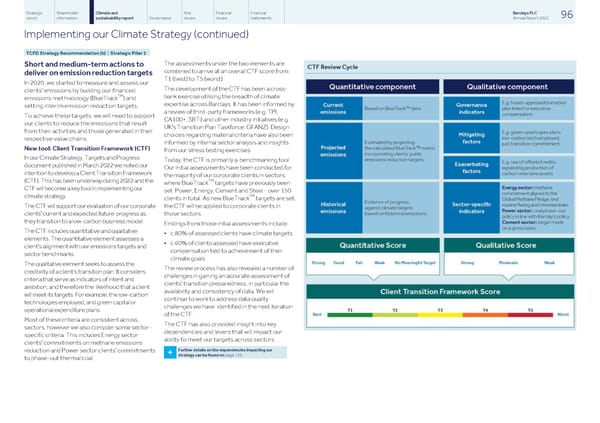

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 96 report information sustainability report Governance review review statements Annual Report 2022 Implementing our Climate Strategy (continued) TCFD Strategy Recommendation (b) | Strategic Pillar 2 The assessments under the two elements are Short and medium-term actions to combined to arrive at an overall CTF score from deliver on emission reduction targets T1 (best) to T5 (worst). In 2020, we started to measure and assess our The development of the CTF has been a cross- clients' emissions by building our financed TM bank exercise utilising the breadth of climate emissions methodology (BlueTrack ) and expertise across Barclays. It has been informed by setting interim emission reduction targets, a review of third-party frameworks (e.g. TPI, To achieve these targets, we will need to support CA100+, SBTi) and other industry initiatives (e.g. our clients to reduce the emissions that result UK's Transition Plan Taskforce, GFANZ). Design from their activities and those generated in their choices regarding material criteria have also been respective value chains. informed by internal sector analysis and insights New tool: Client Transition Framework (CTF) from our stress testing exercises. In our Climate Strategy, Targets and Progress Today, the CTF is primarily a benchmarking tool. document published in March 2022 we noted our Our initial assessments have been conducted for intention to develop a Client Transition Framework the majority of our corporate clients in sectors TM (CTF). This has been underway during 2022 and the where BlueTrack targets have previously been CTF will become a key tool in implementing our set: Power, Energy, Cement and Steel - over 150 TM climate strategy. clients in total. As new BlueTrack targets are set, The CTF will support our evaluation of our corporate the CTF will be applied to corporate clients in clients' current and expected future progress as those sectors. they transition to a low-carbon business model. Findings from those initial assessments include: The CTF includes quantitative and qualitative • c.80% of assessed clients have climate targets elements. The quantitative element assesses a • c.60% of clients assessed have executive client's alignment with our emissions targets and compensation tied to achievement of their sector benchmarks. climate goals. The qualitative element seeks to assess the The review process has also revealed a number of credibility of a client’s transition plan. It considers challenges in gaining an accurate assessment of criteria that serve as indicators of intent and clients' transition preparedness, in particular the ambition, and therefore the likelihood that a client availability and consistency of data. We will will meet its targets. For example, the low-carbon continue to work to address data quality technologies employed, and green capital or challenges we have identified in the next iteration operational expenditure plans. of the CTF. Most of these criteria are consistent across The CTF has also provided insight into key sectors, however we also consider some sector- dependencies and levers that will impact our specific criteria. This includes Energy sector ability to meet our targets across sectors. clients' commitments on methane emissions Further details on the dependencies impacting our reduction and Power sector clients' commitments + strategy can be found on page 135. to phase-out thermal coal.

Barclays PLC - Annual Report - 2022 Page 97 Page 99

Barclays PLC - Annual Report - 2022 Page 97 Page 99