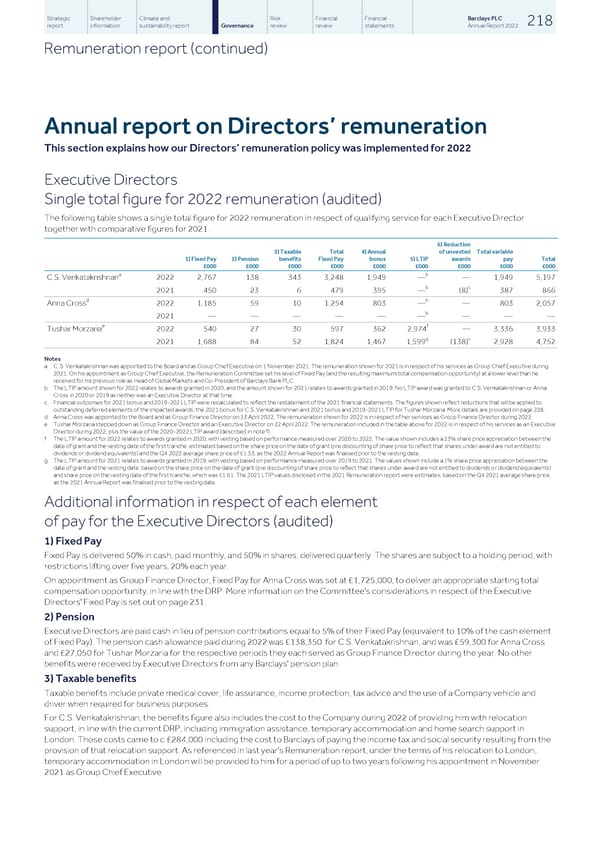

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 218 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Annual report on Directors’ remuneration This section explains how our Directors’ remuneration policy was implemented for 2022 Executive Directors Single total figure for 2022 remuneration (audited) The following table shows a single total figure for 2022 remuneration in respect of qualifying service for each Executive Director together with comparative figures for 2021. 6) Reduction 3) Taxable Total 4) Annual of unvested Total variable 1) Fixed Pay 2) Pension benefits Fixed Pay bonus 5) LTIP awards pay Total £000 £000 £000 £000 £000 £000 £000 £000 £000 a b C.S. Venkatakrishnan 2022 2,767 138 343 3,248 1,949 — — 1,949 5,197 b c 2021 450 23 6 479 395 — (8) 387 866 d b Anna Cross 2022 1,185 59 10 1,254 803 — — 803 2,057 b 2021 — — — — — — — — — e f Tushar Morzaria 2022 540 27 30 597 362 2,974 — 3,336 3,933 g c 2021 1,688 84 52 1,824 1,467 1,599 (138) 2,928 4,752 Notes a C. S. Venkatakrishnan was appointed to the Board and as Group Chief Executive on 1 November 2021. The remuneration shown for 2021 is in respect of his services as Group Chief Executive during 2021. On his appointment as Group Chief Executive, the Remuneration Committee set his level of Fixed Pay (and the resulting maximum total compensation opportunity) at a lower level than he received for his previous role as Head of Global Markets and Co-President of Barclays Bank PLC. b The LTIP amount shown for 2022 relates to awards granted in 2020, and the amount shown for 2021 relates to awards granted in 2019. No LTIP award was granted to C.S. Venkatakrishnan or Anna Cross in 2020 or 2019 as neither was an Executive Director at that time. c Financial outcomes for 2021 bonus and 2019-2021 LTIP were recalculated to reflect the restatement of the 2021 financial statements. The figures shown reflect reductions that will be applied to outstanding deferred elements of the impacted awards, the 2021 bonus for C.S. Venkatakrishnan and 2021 bonus and 2019-2021 LTIP for Tushar Morzaria. More details are provided on page 228. d Anna Cross was appointed to the Board and as Group Finance Director on 23 April 2022. The remuneration shown for 2022 is in respect of her services as Group Finance Director during 2022. e Tushar Morzaria stepped down as Group Finance Director and an Executive Director on 22 April 2022. The remuneration included in the table above for 2022 is in respect of his services as an Executive Director during 2022, plus the value of the 2020-2022 LTIP award (described in note f). f The LTIP amount for 2022 relates to awards granted in 2020, with vesting based on performance measured over 2020 to 2022. The value shown includes a 23% share price appreciation between the date of grant and the vesting date of the first tranche, estimated based on the share price on the date of grant (pre discounting of share price to reflect that shares under award are not entitled to dividends or dividend equivalents) and the Q4 2022 average share price of £1.53, as the 2022 Annual Report was finalised prior to the vesting date. g The LTIP amount for 2021 relates to awards granted in 2019, with vesting based on performance measured over 2019 to 2021. The values shown include a 1% share price appreciation between the date of grant and the vesting date, based on the share price on the date of grant (pre discounting of share price to reflect that shares under award are not entitled to dividends or dividend equivalents) and share price on the vesting date of the first tranche, which was £1.61. The 2021 LTIP values disclosed in the 2021 Remuneration report were estimates, based on the Q4 2021 average share price, as the 2021 Annual Report was finalised prior to the vesting date. Additional information in respect of each element of pay for the Executive Directors (audited) 1) Fixed Pay Fixed Pay is delivered 50% in cash, paid monthly, and 50% in shares, delivered quarterly. The shares are subject to a holding period, with restrictions lifting over five years, 20% each year. On appointment as Group Finance Director, Fixed Pay for Anna Cross was set at £1,725,000, to deliver an appropriate starting total compensation opportunity, in line with the DRP. More information on the Committee's considerations in respect of the Executive Directors' Fixed Pay is set out on page 231. 2) Pension Executive Directors are paid cash in lieu of pension contributions equal to 5% of their Fixed Pay (equivalent to 10% of the cash element of Fixed Pay). The pension cash allowance paid during 2022 was £138,350 for C.S. Venkatakrishnan, and was £59,300 for Anna Cross and £27,050 for Tushar Morzaria for the respective periods they each served as Group Finance Director during the year. No other benefits were received by Executive Directors from any Barclays' pension plan. 3) Taxable benefits Taxable benefits include private medical cover, life assurance, income protection, tax advice and the use of a Company vehicle and driver when required for business purposes. For C.S. Venkatakrishnan, the benefits figure also includes the cost to the Company during 2022 of providing him with relocation support, in line with the current DRP, including immigration assistance, temporary accommodation and home search support in London. Those costs came to c.£284,000 including the cost to Barclays of paying the income tax and social security resulting from the provision of that relocation support. As referenced in last year's Remuneration report, under the terms of his relocation to London, temporary accommodation in London will be provided to him for a period of up to two years following his appointment in November 2021 as Group Chief Executive.

Barclays PLC - Annual Report - 2022 Page 219 Page 221

Barclays PLC - Annual Report - 2022 Page 219 Page 221