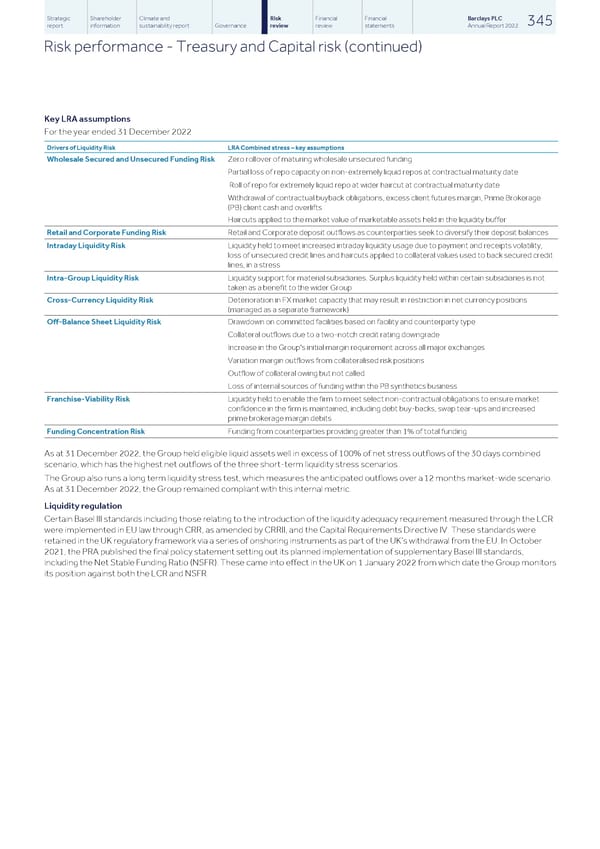

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 345 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Treasury and Capital risk (continued) Key LRA assumptions For the year ended 31 December 2022 Drivers of Liquidity Risk LRA Combined stress – key assumptions Wholesale Secured and Unsecured Funding Risk Zero rollover of maturing wholesale unsecured funding Partial loss of repo capacity on non-extremely liquid repos at contractual maturity date Roll of repo for extremely liquid repo at wider haircut at contractual maturity date Withdrawal of contractual buyback obligations, excess client futures margin, Prime Brokerage (PB) client cash and overlifts Haircuts applied to the market value of marketable assets held in the liquidity buffer Retail and Corporate Funding Risk Retail and Corporate deposit outflows as counterparties seek to diversify their deposit balances Intraday Liquidity Risk Liquidity held to meet increased intraday liquidity usage due to payment and receipts volatility, loss of unsecured credit lines and haircuts applied to collateral values used to back secured credit lines, in a stress Intra-Group Liquidity Risk Liquidity support for material subsidiaries. Surplus liquidity held within certain subsidiaries is not taken as a benefit to the wider Group Cross-Currency Liquidity Risk Deterioration in FX market capacity that may result in restriction in net currency positions (managed as a separate framework) Off-Balance Sheet Liquidity Risk Drawdown on committed facilities based on facility and counterparty type Collateral outflows due to a two-notch credit rating downgrade Increase in the Group's initial margin requirement across all major exchanges Variation margin outflows from collateralised risk positions Outflow of collateral owing but not called Loss of internal sources of funding within the PB synthetics business Franchise-Viability Risk Liquidity held to enable the firm to meet select non-contractual obligations to ensure market confidence in the firm is maintained, including debt buy-backs, swap tear-ups and increased prime brokerage margin debits Funding Concentration Risk Funding from counterparties providing greater than 1% of total funding As at 31 December 2022, the Group held eligible liquid assets well in excess of 100% of net stress outflows of the 30 days combined scenario, which has the highest net outflows of the three short-term liquidity stress scenarios. The Group also runs a long term liquidity stress test, which measures the anticipated outflows over a 12 months market-wide scenario. As at 31 December 2022, the Group remained compliant with this internal metric. Liquidity regulation Certain Basel III standards including those relating to the introduction of the liquidity adequacy requirement measured through the LCR were implemented in EU law through CRR, as amended by CRRII, and the Capital Requirements Directive IV. These standards were retained in the UK regulatory framework via a series of onshoring instruments as part of the UK’s withdrawal from the EU. In October 2021, the PRA published the final policy statement setting out its planned implementation of supplementary Basel III standards, including the Net Stable Funding Ratio (NSFR). These came into effect in the UK on 1 January 2022 from which date the Group monitors its position against both the LCR and NSFR.

Barclays PLC - Annual Report - 2022 Page 346 Page 348

Barclays PLC - Annual Report - 2022 Page 346 Page 348