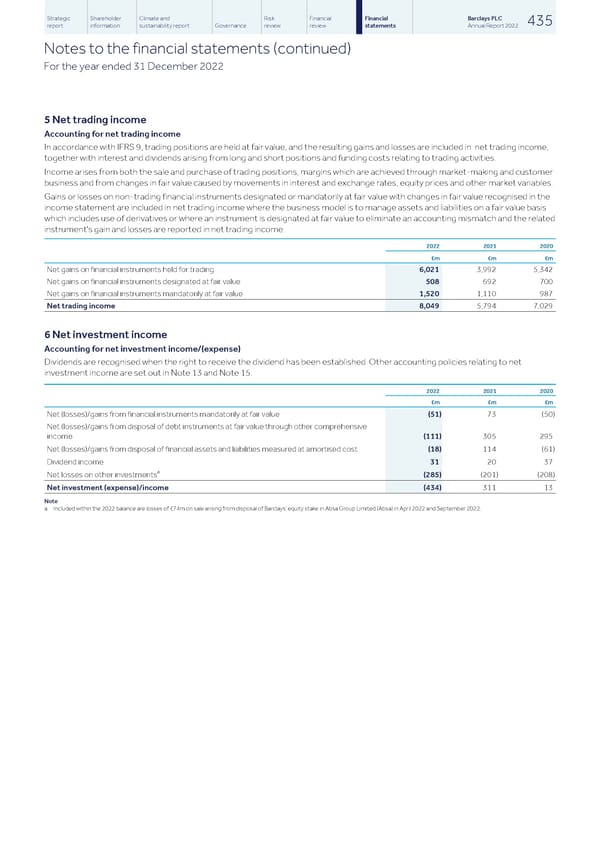

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 435 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) For the year ended 31 December 2022 5 Net trading income Accounting for net trading income In accordance with IFRS 9, trading positions are held at fair value, and the resulting gains and losses are included in net trading income, together with interest and dividends arising from long and short positions and funding costs relating to trading activities. Income arises from both the sale and purchase of trading positions, margins which are achieved through market-making and customer business and from changes in fair value caused by movements in interest and exchange rates, equity prices and other market variables. Gains or losses on non-trading financial instruments designated or mandatorily at fair value with changes in fair value recognised in the income statement are included in net trading income where the business model is to manage assets and liabilities on a fair value basis which includes use of derivatives or where an instrument is designated at fair value to eliminate an accounting mismatch and the related instrument's gain and losses are reported in net trading income. 2022 2021 2020 £m £m £m Net gains on financial instruments held for trading 6,021 3,992 5,342 Net gains on financial instruments designated at fair value 508 692 700 Net gains on financial instruments mandatorily at fair value 1,520 1,110 987 Net trading income 8,049 5,794 7,029 6 Net investment income Accounting for net investment income/(expense) Dividends are recognised when the right to receive the dividend has been established. Other accounting policies relating to net investment income are set out in Note 13 and Note 15. 2022 2021 2020 £m £m £m Net (losses)/gains from financial instruments mandatorily at fair value (51) 73 (50) Net (losses)/gains from disposal of debt instruments at fair value through other comprehensive income (111) 305 295 Net (losses)/gains from disposal of financial assets and liabilities measured at amortised cost (18) 114 (61) Dividend income 31 20 37 a Net losses on other investments (285) (201) (208) Net investment (expense)/income (434) 311 13 Note a Included within the 2022 balance are losses of £74m on sale arising from disposal of Barclays’ equity stake in Absa Group Limited (Absa) in April 2022 and September 2022.

Barclays PLC - Annual Report - 2022 Page 436 Page 438

Barclays PLC - Annual Report - 2022 Page 436 Page 438