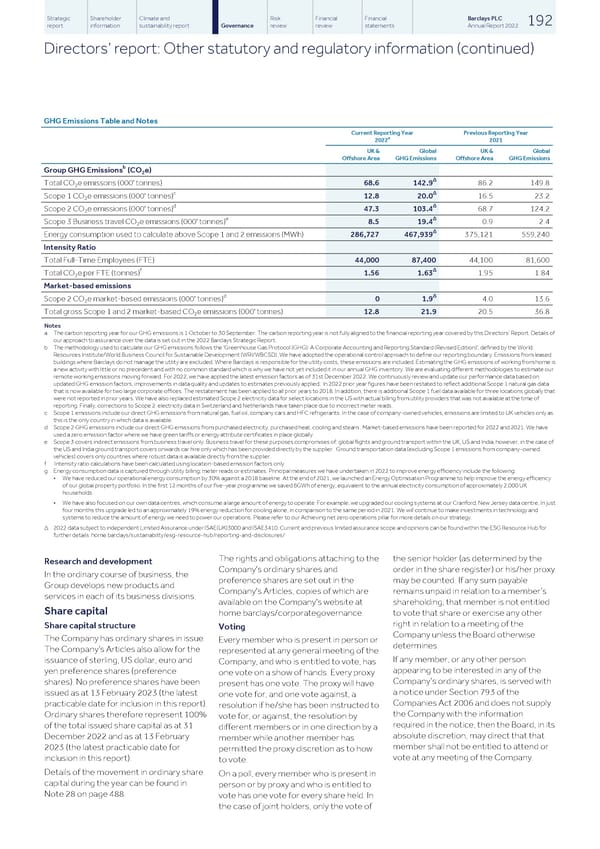

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 192 report information sustainability report Governance review review statements Annual Report 2022 Directors’ report: Other statutory and regulatory information (continued) GHG Emissions Table and Notes Current Reporting Year Previous Reporting Year a 2022 2021 UK & Global UK & Global Offshore Area GHG Emissions Offshore Area GHG Emissions b Group GHG Emissions (CO e) 2 Δ Total CO e emissons (000' tonnes) 68.6 142.9 86.2 149.8 2 c Δ Scope 1 CO e emissions (000' tonnes) 12.8 20.0 16.5 23.2 2 d Δ Scope 2 CO e emissions (000' tonnes) 47.3 103.4 68.7 124.2 2 e Δ Scope 3 Business travel CO e emissions (000' tonnes) 8.5 19.4 0.9 2.4 2 Δ Energy consumption used to calculate above Scope 1 and 2 emissions (MWh) 286,727 467,939 375,121 559,240 Intensity Ratio Total Full-Time Employees (FTE) 44,000 87,400 44,100 81,600 f Δ Total CO e per FTE (tonnes) 1.56 1.63 1.95 1.84 2 Market-based emissions d Δ Scope 2 CO e market-based emissions (000' tonnes) 0 1.9 4.0 13.6 2 Total gross Scope 1 and 2 market-based CO e emissions (000' tonnes) 12.8 21.9 20.5 36.8 2 Notes a The carbon reporting year for our GHG emissions is 1 October to 30 September. The carbon reporting year is not fully aligned to the financial reporting year covered by this Directors’ Report. Details of our approach to assurance over the data is set out in the 2022 Barclays Strategic Report. b The methodology used to calculate our GHG emissions follows the 'Greenhouse Gas Protocol (GHG): A Corporate Accounting and Reporting Standard (Revised Edition)', defined by the World Resources Institute/World Business Council for Sustainable Development (WRI/WBCSD). We have adopted the operational control approach to define our reporting boundary. Emissions from leased buildings where Barclays do not manage the utility are excluded. Where Barclays is responsible for the utility costs, these emissions are included. Estimating the GHG emissions of working from home is a new activity with little or no precedent and with no common standard which is why we have not yet included it in our annual GHG inventory. We are evaluating different methodologies to estimate our remote working emissions moving forward. For 2022, we have applied the latest emission factors as of 31st December 2022. We continuously review and update our performance data based on updated GHG emission factors, improvements in data quality and updates to estimates previously applied. In 2022 prior year figures have been restated to reflect additional Scope 1 natural gas data that is now available for two large corporate offices. The restatement has been applied to all prior years to 2018. In addition, there is additional Scope 1 fuel data available for three locations globally that were not reported in prior years. We have also replaced estimated Scope 2 electricity data for select locations in the US with actual billing from utility providers that was not available at the time of reporting. Finally, corrections to Scope 2 electricity data in Switzerland and Netherlands have taken place due to incorrect meter reads. c Scope 1 emissions include our direct GHG emissions from natural gas, fuel oil, company cars and HFC refrigerants. In the case of company-owned vehicles, emissions are limited to UK vehicles only as this is the only country in which data is available. d Scope 2 GHG emissions include our direct GHG emissions from purchased electricity, purchased heat, cooling and steam . Market-based emissions have been reported for 2022 and 2021. We have used a zero emission factor where we have green tariffs or energy attribute certificates in place globally. e Scope 3 covers indirect emissions from business travel only. Business travel for these purposes compromises of: global flights and ground transport within the UK, US and India, however, in the case of the US and India ground transport covers onwards car hire only which has been provided directly by the supplier. Ground transportation data (excluding Scope 1 emissions from company-owned vehicles) covers only countries where robust data is available directly from the supplier. f Intensity ratio calculations have been calculated using location-based emission factors only. g Energy consumption data is captured through utility billing; meter reads or estimates. Principal measures we have undertaken in 2022 to improve energy efficiency include the following: • We have reduced our operational energy consumption by 30% against a 2018 baseline. At the end of 2021, we launched an Energy Optimisation Programme to help improve the energy efficiency of our global property portfolio. In the first 12 months of our five-year programme we saved 6GWh of energy, equivalent to the annual electricity consumption of approximately 2,000 UK households. • We have also focused on our own data centres, which consume a large amount of energy to operate. For example, we upgraded our cooling systems at our Cranford, New Jersey data centre, In just four months this upgrade led to an approximately 19% energy reduction for cooling alone, in comparison to the same period in 2021. We will continue to make investments in technology and systems to reduce the amount of energy we need to power our operations. Please refer to our Achieving net zero operations pillar for more details on our strategy. Δ 2022 data subject to independent Limited Assurance under ISAE(UK)3000 and ISAE3410. Current and previous limited assurance scope and opinions can be found within the ESG Resource Hub for further details: home.barclays/sustainability/esg-resource-hub/reporting-and-disclosures/ The rights and obligations attaching to the the senior holder (as determined by the Research and development Company's ordinary shares and order in the share register) or his/her proxy In the ordinary course of business, the preference shares are set out in the may be counted. If any sum payable Group develops new products and Company's Articles, copies of which are remains unpaid in relation to a member’s services in each of its business divisions. available on the Company's website at shareholding, that member is not entitled Share capital home.barclays/corporategovernance. to vote that share or exercise any other right in relation to a meeting of the Share capital structure Voting Company unless the Board otherwise The Company has ordinary shares in issue. Every member who is present in person or determines. The Company’s Articles also allow for the represented at any general meeting of the If any member, or any other person issuance of sterling, US dollar, euro and Company, and who is entitled to vote, has appearing to be interested in any of the yen preference shares (preference one vote on a show of hands. Every proxy Company’s ordinary shares, is served with shares). No preference shares have been present has one vote. The proxy will have a notice under Section 793 of the issued as at 13 February 2023 (the latest one vote for, and one vote against, a Companies Act 2006 and does not supply practicable date for inclusion in this report). resolution if he/she has been instructed to the Company with the information Ordinary shares therefore represent 100% vote for, or against, the resolution by required in the notice, then the Board, in its of the total issued share capital as at 31 different members or in one direction by a absolute discretion, may direct that that December 2022 and as at 13 February member while another member has member shall not be entitled to attend or 2023 (the latest practicable date for permitted the proxy discretion as to how vote at any meeting of the Company. inclusion in this report). to vote. Details of the movement in ordinary share On a poll, every member who is present in capital during the year can be found in person or by proxy and who is entitled to Note 28 on page 488. vote has one vote for every share held. In the case of joint holders, only the vote of

Barclays PLC - Annual Report - 2022 Page 193 Page 195

Barclays PLC - Annual Report - 2022 Page 193 Page 195