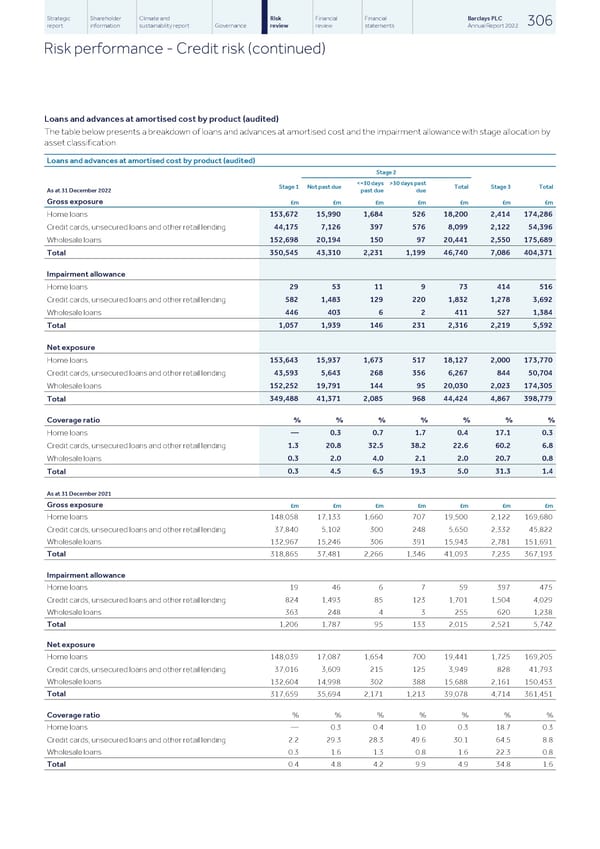

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 306 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Credit risk (continued) Loans and advances at amortised cost by product (audited) The table below presents a breakdown of loans and advances at amortised cost and the impairment allowance with stage allocation by asset classification. Loans and advances at amortised cost by product (audited) Stage 2 30 days past Stage 1 Not past due Total Stage 3 Total As at 31 December 2022 past due due Gross exposure £m £m £m £m £m £m £m 153,672 15,990 1,684 526 18,200 2,414 174,286 Home loans 44,175 7,126 397 576 8,099 2,122 54,396 Credit cards, unsecured loans and other retail lending 152,698 20,194 150 97 20,441 2,550 175,689 Wholesale loans 350,545 43,310 2,231 1,199 46,740 7,086 404,371 Total Impairment allowance 29 53 11 9 73 414 516 Home loans 582 1,483 129 220 1,832 1,278 3,692 Credit cards, unsecured loans and other retail lending 446 403 6 2 411 527 1,384 Wholesale loans 1,057 1,939 146 231 2,316 2,219 5,592 Total Net exposure 153,643 15,937 1,673 517 18,127 2,000 173,770 Home loans 43,593 5,643 268 356 6,267 844 50,704 Credit cards, unsecured loans and other retail lending 152,252 19,791 144 95 20,030 2,023 174,305 Wholesale loans 349,488 41,371 2,085 968 44,424 4,867 398,779 Total Coverage ratio % % % % % % % — 0.3 0.7 1.7 0.4 17.1 0.3 Home loans 1.3 20.8 32.5 38.2 22.6 60.2 6.8 Credit cards, unsecured loans and other retail lending 0.3 2.0 4.0 2.1 2.0 20.7 0.8 Wholesale loans 0.3 4.5 6.5 19.3 5.0 31.3 1.4 Total As at 31 December 2021 Gross exposure £m £m £m £m £m £m £m Home loans 148,058 17,133 1,660 707 19,500 2,122 169,680 37,840 5,102 300 248 5,650 2,332 45,822 Credit cards, unsecured loans and other retail lending Wholesale loans 132,967 15,246 306 391 15,943 2,781 151,691 Total 318,865 37,481 2,266 1,346 41,093 7,235 367,193 Impairment allowance Home loans 19 46 6 7 59 397 475 824 1,493 85 123 1,701 1,504 4,029 Credit cards, unsecured loans and other retail lending Wholesale loans 363 248 4 3 255 620 1,238 Total 1,206 1,787 95 133 2,015 2,521 5,742 Net exposure Home loans 148,039 17,087 1,654 700 19,441 1,725 169,205 37,016 3,609 215 125 3,949 828 41,793 Credit cards, unsecured loans and other retail lending Wholesale loans 132,604 14,998 302 388 15,688 2,161 150,453 Total 317,659 35,694 2,171 1,213 39,078 4,714 361,451 Coverage ratio % % % % % % % Home loans — 0.3 0.4 1.0 0.3 18.7 0.3 2.2 29.3 28.3 49.6 30.1 64.5 8.8 Credit cards, unsecured loans and other retail lending Wholesale loans 0.3 1.6 1.3 0.8 1.6 22.3 0.8 Total 0.4 4.8 4.2 9.9 4.9 34.8 1.6

Barclays PLC - Annual Report - 2022 Page 307 Page 309

Barclays PLC - Annual Report - 2022 Page 307 Page 309