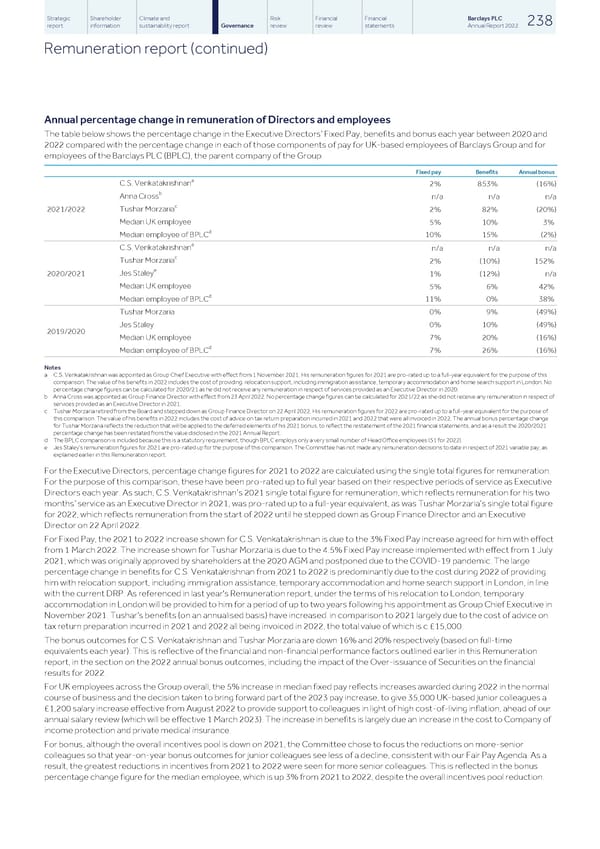

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 238 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Annual percentage change in remuneration of Directors and employees The table below shows the percentage change in the Executive Directors’ Fixed Pay, benefits and bonus each year between 2020 and 2022 compared with the percentage change in each of those components of pay for UK-based employees of Barclays Group and for employees of the Barclays PLC (BPLC), the parent company of the Group. Fixed pay Benefits Annual bonus a C.S. Venkatakrishnan 2% 853% (16%) b Anna Cross n/a n/a n/a c Tushar Morzaria 2021/2022 2% 82% (20%) Median UK employee 5% 10% 3% d Median employee of BPLC 10% 15% (2%) a C.S. Venkatakrishnan n/a n/a n/a c Tushar Morzaria 2% (10%) 152% e Jes Staley 2020/2021 1% (12%) n/a Median UK employee 5% 6% 42% d Median employee of BPLC 11% 0% 38% Tushar Morzaria 0% 9% (49%) Jes Staley 0% 10% (49%) 2019/2020 Median UK employee 7% 20% (16%) d Median employee of BPLC 7% 26% (16%) Notes a C.S. Venkatakrishnan was appointed as Group Chief Executive with effect from 1 November 2021. His remuneration figures for 2021 are pro-rated up to a full-year equivalent for the purpose of this comparison. The value of his benefits in 2022 includes the cost of providing relocation support, including immigration assistance, temporary accommodation and home search support in London. No percentage change figures can be calculated for 2020/21 as he did not receive any remuneration in respect of services provided as an Executive Director in 2020. b Anna Cross was appointed as Group Finance Director with effect from 23 April 2022. No percentage change figures can be calculated for 2021/22 as she did not receive any remuneration in respect of services provided as an Executive Director in 2021. c Tushar Morzaria retired from the Board and stepped down as Group Finance Director on 22 April 2022. His remuneration figures for 2022 are pro-rated up to a full-year equivalent for the purpose of this comparison. The value of his benefits in 2022 includes the cost of advice on tax return preparation incurred in 2021 and 2022 that were all invoiced in 2022. The annual bonus percentage change for Tushar Morzaria reflects the reduction that will be applied to the deferred elements of his 2021 bonus, to reflect the restatement of the 2021 financial statements, and as a result the 2020/2021 percentage change has been restated from the value disclosed in the 2021 Annual Report. d The BPLC comparison is included because this is a statutory requirement, though BPLC employs only a very small number of Head Office employees (51 for 2022). e Jes Staley's remuneration figures for 2021 are pro-rated up for the purpose of this comparison. The Committee has not made any remuneration decisions to date in respect of 2021 variable pay, as explained earlier in this Remuneration report. For the Executive Directors, percentage change figures for 2021 to 2022 are calculated using the single total figures for remuneration. For the purpose of this comparison, these have been pro-rated up to full year based on their respective periods of service as Executive Directors each year. As such, C.S. Venkatakrishnan’s 2021 single total figure for remuneration, which reflects remuneration for his two months’ service as an Executive Director in 2021, was pro-rated up to a full-year equivalent, as was Tushar Morzaria’s single total figure for 2022, which reflects remuneration from the start of 2022 until he stepped down as Group Finance Director and an Executive Director on 22 April 2022. For Fixed Pay, the 2021 to 2022 increase shown for C.S. Venkatakrishnan is due to the 3% Fixed Pay increase agreed for him with effect from 1 March 2022. The increase shown for Tushar Morzaria is due to the 4.5% Fixed Pay increase implemented with effect from 1 July 2021, which was originally approved by shareholders at the 2020 AGM and postponed due to the COVID-19 pandemic. The large percentage change in benefits for C.S. Venkatakrishnan from 2021 to 2022 is predominantly due to the cost during 2022 of providing him with relocation support, including immigration assistance, temporary accommodation and home search support in London, in line with the current DRP. As referenced in last year's Remuneration report, under the terms of his relocation to London, temporary accommodation in London will be provided to him for a period of up to two years following his appointment as Group Chief Executive in November 2021. Tushar’s benefits (on an annualised basis) have increased in comparison to 2021 largely due to the cost of advice on tax return preparation incurred in 2021 and 2022 all being invoiced in 2022, the total value of which is c.£15,000. The bonus outcomes for C.S. Venkatakrishnan and Tushar Morzaria are down 16% and 20% respectively (based on full-time equivalents each year). This is reflective of the financial and non-financial performance factors outlined earlier in this Remuneration report, in the section on the 2022 annual bonus outcomes, including the impact of the Over-issuance of Securities on the financial results for 2022. For UK employees across the Group overall, the 5% increase in median fixed pay reflects increases awarded during 2022 in the normal course of business and the decision taken to bring forward part of the 2023 pay increase, to give 35,000 UK-based junior colleagues a £1,200 salary increase effective from August 2022 to provide support to colleagues in light of high cost-of-living inflation, ahead of our annual salary review (which will be effective 1 March 2023). The increase in benefits is largely due an increase in the cost to Company of income protection and private medical insurance. For bonus, although the overall incentives pool is down on 2021, the Committee chose to focus the reductions on more-senior colleagues so that year-on-year bonus outcomes for junior colleagues see less of a decline, consistent with our Fair Pay Agenda. As a result, the greatest reductions in incentives from 2021 to 2022 were seen for more senior colleagues. This is reflected in the bonus percentage change figure for the median employee, which is up 3% from 2021 to 2022, despite the overall incentives pool reduction.

Barclays PLC - Annual Report - 2022 Page 239 Page 241

Barclays PLC - Annual Report - 2022 Page 239 Page 241