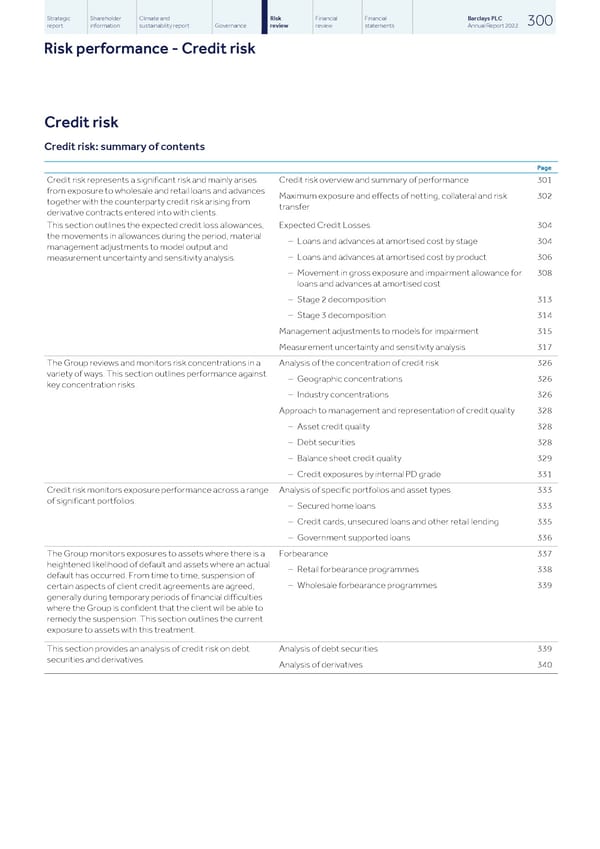

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 300 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Credit risk Credit risk Credit risk: summary of contents Page Credit risk represents a significant risk and mainly arises Credit risk overview and summary of performance 301 from exposure to wholesale and retail loans and advances Maximum exposure and effects of netting, collateral and risk 302 together with the counterparty credit risk arising from transfer derivative contracts entered into with clients. This section outlines the expected credit loss allowances, Expected Credit Losses 304 the movements in allowances during the period, material – Loans and advances at amortised cost by stage 304 management adjustments to model output and – Loans and advances at amortised cost by product 306 measurement uncertainty and sensitivity analysis. – Movement in gross exposure and impairment allowance for 308 loans and advances at amortised cost – Stage 2 decomposition 313 – Stage 3 decomposition 314 Management adjustments to models for impairment 315 Measurement uncertainty and sensitivity analysis 317 The Group reviews and monitors risk concentrations in a Analysis of the concentration of credit risk 326 variety of ways. This section outlines performance against – Geographic concentrations 326 key concentration risks. – Industry concentrations 326 Approach to management and representation of credit quality 328 – Asset credit quality 328 – Debt securities 328 – Balance sheet credit quality 329 – Credit exposures by internal PD grade 331 Credit risk monitors exposure performance across a range Analysis of specific portfolios and asset types 333 of significant portfolios. – Secured home loans 333 – Credit cards, unsecured loans and other retail lending 335 – Government supported loans 336 The Group monitors exposures to assets where there is a Forbearance 337 heightened likelihood of default and assets where an actual – Retail forbearance programmes 338 default has occurred. From time to time, suspension of – Wholesale forbearance programmes 339 certain aspects of client credit agreements are agreed, generally during temporary periods of financial difficulties where the Group is confident that the client will be able to remedy the suspension. This section outlines the current exposure to assets with this treatment. This section provides an analysis of credit risk on debt Analysis of debt securities 339 securities and derivatives. Analysis of derivatives 340

Barclays PLC - Annual Report - 2022 Page 301 Page 303

Barclays PLC - Annual Report - 2022 Page 301 Page 303