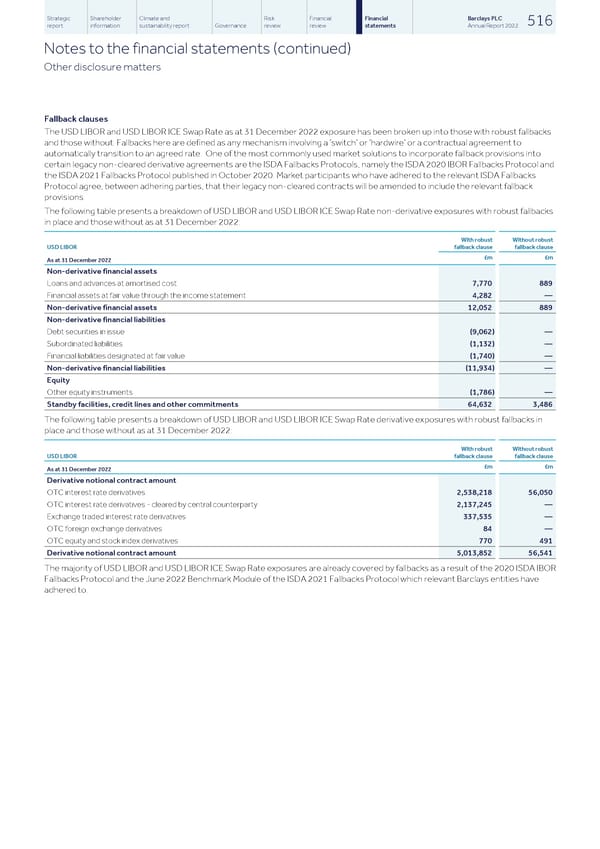

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 516 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Other disclosure matters Fallback clauses The USD LIBOR and USD LIBOR ICE Swap Rate as at 31 December 2022 exposure has been broken up into those with robust fallbacks and those without. Fallbacks here are defined as any mechanism involving a ‘switch’ or ‘hardwire’ or a contractual agreement to automatically transition to an agreed rate. One of the most commonly used market solutions to incorporate fallback provisions into certain legacy non-cleared derivative agreements are the ISDA Fallbacks Protocols, namely the ISDA 2020 IBOR Fallbacks Protocol and the ISDA 2021 Fallbacks Protocol published in October 2020. Market participants who have adhered to the relevant ISDA Fallbacks Protocol agree, between adhering parties, that their legacy non-cleared contracts will be amended to include the relevant fallback provisions. The following table presents a breakdown of USD LIBOR and USD LIBOR ICE Swap Rate non-derivative exposures with robust fallbacks in place and those without as at 31 December 2022: With robust Without robust USD LIBOR fallback clause fallback clause £m £m As at 31 December 2022 Non-derivative financial assets 7,770 889 Loans and advances at amortised cost 4,282 — Financial assets at fair value through the income statement 12,052 889 Non-derivative financial assets Non-derivative financial liabilities (9,062) — Debt securities in issue (1,132) — Subordinated liabilities (1,740) — Financial liabilities designated at fair value (11,934) — Non-derivative financial liabilities Equity (1,786) — Other equity instruments 64,632 3,486 Standby facilities, credit lines and other commitments The following table presents a breakdown of USD LIBOR and USD LIBOR ICE Swap Rate derivative exposures with robust fallbacks in place and those without as at 31 December 2022: With robust Without robust USD LIBOR fallback clause fallback clause £m £m As at 31 December 2022 Derivative notional contract amount 2,538,218 56,050 OTC interest rate derivatives 2,137,245 — OTC interest rate derivatives - cleared by central counterparty 337,535 — Exchange traded interest rate derivatives 84 — OTC foreign exchange derivatives 770 491 OTC equity and stock index derivatives 5,013,852 56,541 Derivative notional contract amount The majority of USD LIBOR and USD LIBOR ICE Swap Rate exposures are already covered by fallbacks as a result of the 2020 ISDA IBOR Fallbacks Protocol and the June 2022 Benchmark Module of the ISDA 2021 Fallbacks Protocol which relevant Barclays entities have adhered to.

Barclays PLC - Annual Report - 2022 Page 517 Page 519

Barclays PLC - Annual Report - 2022 Page 517 Page 519