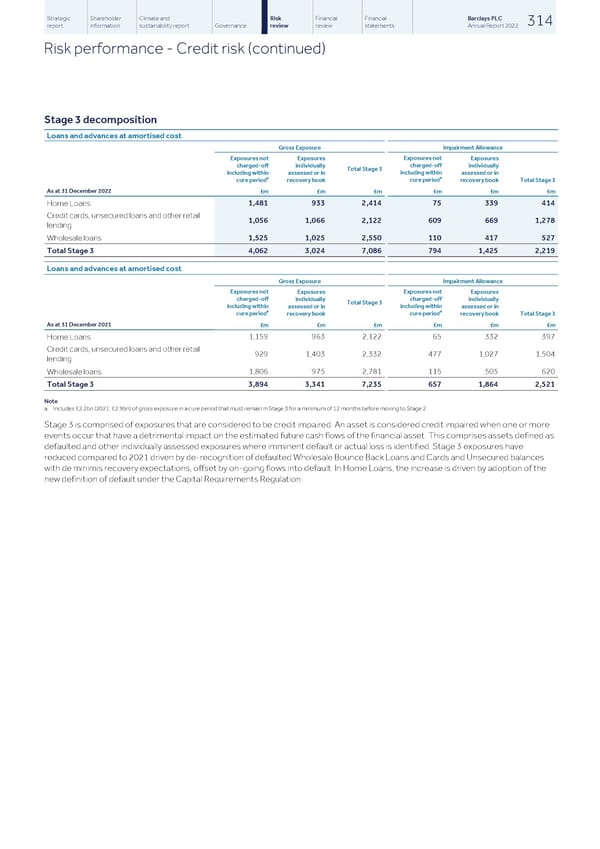

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 314 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Credit risk (continued) Stage 3 decomposition Loans and advances at amortised cost Gross Exposure Impairment Allowance Exposures not Exposures not Exposures Exposures charged-off charged-off individually individually Total Stage 3 including within including within assessed or in assessed or in a a cure period cure period recovery book recovery book Total Stage 3 As at 31 December 2022 £m £m £m £m £m £m 1,481 933 2,414 75 339 414 Home Loans Credit cards, unsecured loans and other retail 1,056 1,066 2,122 609 669 1,278 lending 1,525 1,025 2,550 110 417 527 Wholesale loans Total Stage 3 4,062 3,024 7,086 794 1,425 2,219 Loans and advances at amortised cost Gross Exposure Impairment Allowance Exposures not Exposures not Exposures Exposures charged-off charged-off individually individually Total Stage 3 including within including within assessed or in assessed or in a a cure period cure period recovery book recovery book Total Stage 3 As at 31 December 2021 £m £m £m £m £m £m 1,159 963 2,122 65 332 397 Home Loans Credit cards, unsecured loans and other retail 929 1,403 2,332 477 1,027 1,504 lending 1,806 975 2,781 115 505 620 Wholesale loans Total Stage 3 3,894 3,341 7,235 657 1,864 2,521 Note a Includes £2.2bn (2021: £2.9bn) of gross exposure in a cure period that must remain in Stage 3 for a minimum of 12 months before moving to Stage 2. Stage 3 is comprised of exposures that are considered to be credit impaired. An asset is considered credit impaired when one or more events occur that have a detrimental impact on the estimated future cash flows of the financial asset. This comprises assets defined as defaulted and other individually assessed exposures where imminent default or actual loss is identified. Stage 3 exposures have reduced compared to 2021 driven by de-recognition of defaulted Wholesale Bounce Back Loans and Cards and Unsecured balances with de minimis recovery expectations, offset by on-going flows into default. In Home Loans, the increase is driven by adoption of the new definition of default under the Capital Requirements Regulation.

Barclays PLC - Annual Report - 2022 Page 315 Page 317

Barclays PLC - Annual Report - 2022 Page 315 Page 317