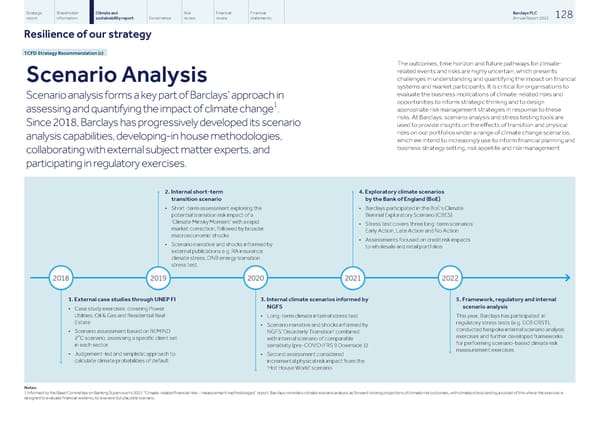

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 128 report information sustainability report Governance review review statements Annual Report 2022 Resilience of our strategy TCFD Strategy Recommendation (c) The outcomes, time horizon and future pathways for climate- related events and risks are highly uncertain, which presents challenges in understanding and quantifying the impact on financial Scenario Analysis systems and market participants. It is critical for organisations to evaluate the business implications of climate-related risks and Scenario analysis forms a key part of Barclays’ approach in opportunities to inform strategic thinking and to design 1 appropriate risk management strategies in response to these assessing and quantifying the impact of climate change . risks. At Barclays, scenario analysis and stress testing tools are Since 2018, Barclays has progressively developed its scenario used to provide insights on the effects of transition and physical risks on our portfolios under a range of climate change scenarios, analysis capabilities, developing-in house methodologies, which we intend to increasingly use to inform financial planning and business strategy setting, risk appetite and risk management. collaborating with external subject matter experts, and participating in regulatory exercises. 2. Internal short-term 4. Exploratory climate scenarios transition scenario by the Bank of England (BoE) • Short-term assessment exploring the • Barclays participated in the BoE’s Climate potential transition risk impact of a Biennial Exploratory Scenario (CBES) ‘Climate Minsky Moment’ with a rapid • Stress test covers three long-term scenarios: market correction, followed by broader Early Action, Late Action and No Action macroeconomic shocks • Assessments focused on credit risk impacts • Scenario narrative and shocks informed by to wholesale and retail portfolios external publications e.g. RA insurance climate stress, DNB energy transition stress test. 1. External case studies through UNEP FI 3. Internal climate scenarios informed by 5. Framework, regulatory and internal NGFS scenario analysis • Case study exercises covering Power Utilities, Oil & Gas and Residential Real • Long-term climate internal stress test This year, Barclays has participated in Estate regulatory stress tests (e.g. ECB CRST), • Scenario narrative and shocks informed by conducted bespoke internal scenario analysis • Scenario assessment based on REMIND NGFS ‘Disorderly Transition’ combined o exercises and further developed frameworks 2 C scenario, assessing a specific client set with internal scenario of comparable for performing scenario-based climate risk in each sector sensitivity (pre-COVID IFRS 9 Downside 1) measurement exercises • Judgement-led and simplistic approach to • Second assessment considered calculate climate probabilities of default incremental physical risk impact from the ‘Hot House World’ scenario Notes: 1 Informed by the Basel Committee on Banking Supervision's 2021 "Climate-related financial risks - measurement methodologies" report, Barclays considers climate scenario analysis as forward-looking projections of climate risk outcomes, with climate stress testing a subset of this where the exercise is designed to evaluate financial resiliency to a severe but plausible scenario.

Barclays PLC - Annual Report - 2022 Page 129 Page 131

Barclays PLC - Annual Report - 2022 Page 129 Page 131