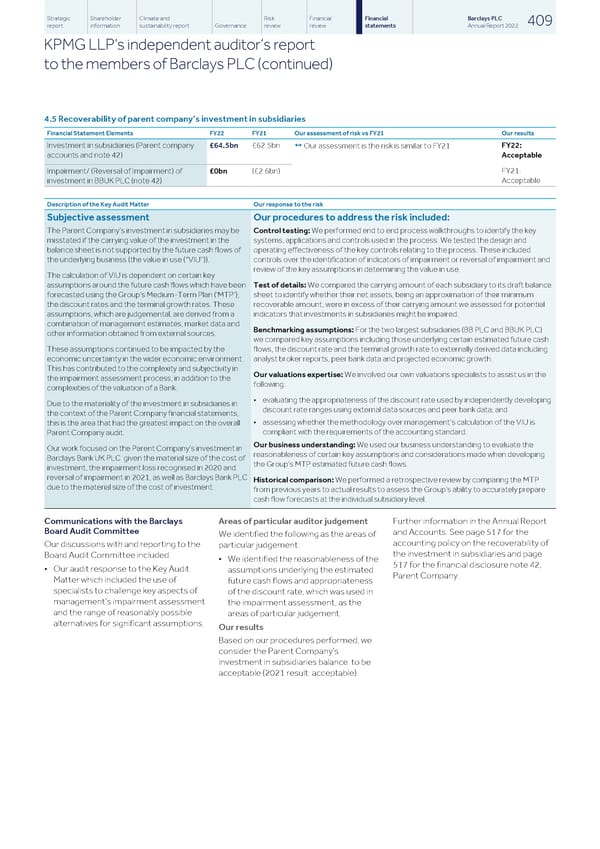

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 409 report information sustainability report Governance review review statements Annual Report 2022 KPMG LLP’s independent auditor’s report to the members of Barclays PLC (continued) 4.5 Recoverability of parent company’s investment in subsidiaries Financial Statement Elements FY22 FY21 Our assessment of risk vs FY21 Our results Investment in subsidiaries (Parent company £64.5bn £62.5bn FY22: 1 Our assessment is the risk is similar to FY21 accounts and note 42) Acceptable FY21: Impairment/ (Reversal of Impairment) of £0bn (£2.6bn) Acceptable investment in BBUK PLC (note 42) Description of the Key Audit Matter Our response to the risk Subjective assessment Our procedures to address the risk included: The Parent Company’s investment in subsidiaries may be Control testing: We performed end to end process walkthroughs to identify the key misstated if the carrying value of the investment in the systems, applications and controls used in the process. We tested the design and balance sheet is not supported by the future cash flows of operating effectiveness of the key controls relating to the process. These included the underlying business (the value in use (“VIU”)). controls over the identification of indicators of impairment or reversal of impairment and review of the key assumptions in determining the value in use. The calculation of VIU is dependent on certain key assumptions around the future cash flows which have been Test of details: We compared the carrying amount of each subsidiary to its draft balance forecasted using the Group’s Medium-Term Plan (‘MTP’), sheet to identify whether their net assets, being an approximation of their minimum the discount rates and the terminal growth rates. These recoverable amount, were in excess of their carrying amount we assessed for potential assumptions, which are judgemental, are derived from a indicators that investments in subsidiaries might be impaired. combination of management estimates, market data and Benchmarking assumptions: For the two largest subsidiaries (BB PLC and BBUK PLC) other information obtained from external sources. we compared key assumptions including those underlying certain estimated future cash flows, the discount rate and the terminal growth rate to externally derived data including These assumptions continued to be impacted by the economic uncertainty in the wider economic environment. analyst broker reports, peer bank data and projected economic growth. This has contributed to the complexity and subjectivity in Our valuations expertise: We involved our own valuations specialists to assist us in the the impairment assessment process, in addition to the following: complexities of the valuation of a Bank. • evaluating the appropriateness of the discount rate used by independently developing Due to the materiality of the investment in subsidiaries in discount rate ranges using external data sources and peer bank data; and the context of the Parent Company financial statements, • assessing whether the methodology over management’s calculation of the VIU is this is the area that had the greatest impact on the overall compliant with the requirements of the accounting standard. Parent Company audit. Our business understanding: We used our business understanding to evaluate the Our work focused on the Parent Company’s investment in reasonableness of certain key assumptions and considerations made when developing Barclays Bank UK PLC given the material size of the cost of the Group’s MTP estimated future cash flows. investment, the impairment loss recognised in 2020 and reversal of impairment in 2021, as well as Barclays Bank PLC Historical comparison: We performed a retrospective review by comparing the MTP due to the material size of the cost of investment. from previous years to actual results to assess the Group’s ability to accurately prepare cash flow forecasts at the individual subsidiary level. Communications with the Barclays Areas of particular auditor judgement Further information in the Annual Report Board Audit Committee and Accounts: See page 517 for the We identified the following as the areas of accounting policy on the recoverability of Our discussions with and reporting to the particular judgement: the investment in subsidiaries and page Board Audit Committee included: • We identified the reasonableness of the 517 for the financial disclosure note 42; • Our audit response to the Key Audit assumptions underlying the estimated Parent Company. Matter which included the use of future cash flows and appropriateness specialists to challenge key aspects of of the discount rate, which was used in management’s impairment assessment the impairment assessment, as the and the range of reasonably possible areas of particular judgement. alternatives for significant assumptions. Our results Based on our procedures performed, we consider the Parent Company’s investment in subsidiaries balance to be acceptable (2021 result: acceptable).

Barclays PLC - Annual Report - 2022 Page 410 Page 412

Barclays PLC - Annual Report - 2022 Page 410 Page 412