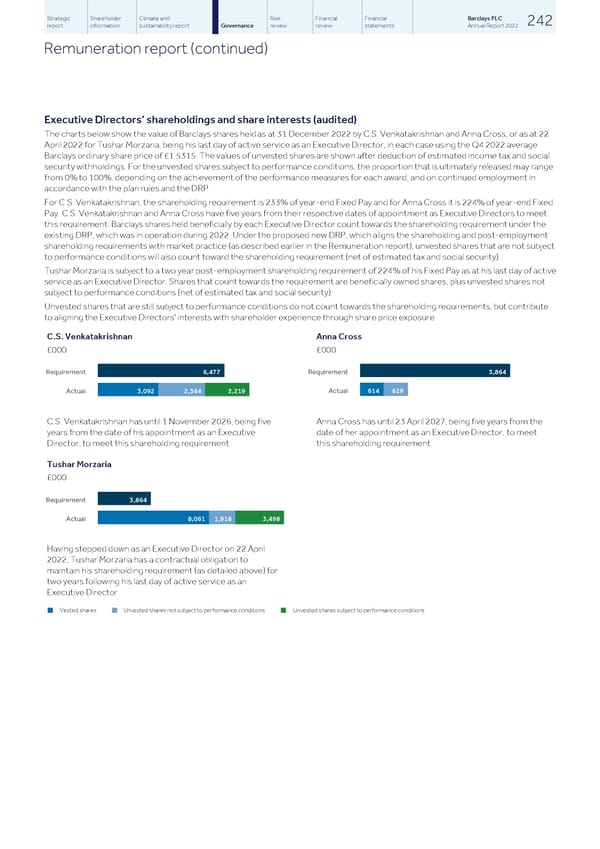

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 242 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Executive Directors’ shareholdings and share interests (audited) The charts below show the value of Barclays shares held as at 31 December 2022 by C.S. Venkatakrishnan and Anna Cross, or as at 22 April 2022 for Tushar Morzaria, being his last day of active service as an Executive Director, in each case using the Q4 2022 average Barclays ordinary share price of £1.5315. The values of unvested shares are shown after deduction of estimated income tax and social security withholdings. For the unvested shares subject to performance conditions, the proportion that is ultimately released may range from 0% to 100%, depending on the achievement of the performance measures for each award, and on continued employment in accordance with the plan rules and the DRP. For C.S. Venkatakrishnan, the shareholding requirement is 233% of year-end Fixed Pay and for Anna Cross it is 224% of year-end Fixed Pay. C.S. Venkatakrishnan and Anna Cross have five years from their respective dates of appointment as Executive Directors to meet this requirement. Barclays shares held beneficially by each Executive Director count towards the shareholding requirement under the existing DRP, which was in operation during 2022. Under the proposed new DRP, which aligns the shareholding and post-employment shareholding requirements with market practice (as described earlier in the Remuneration report), unvested shares that are not subject to performance conditions will also count toward the shareholding requirement (net of estimated tax and social security). Tushar Morzaria is subject to a two year post-employment shareholding requirement of 224% of his Fixed Pay as at his last day of active service as an Executive Director. Shares that count towards the requirement are beneficially owned shares, plus unvested shares not subject to performance conditions (net of estimated tax and social security). Unvested shares that are still subject to performance conditions do not count towards the shareholding requirements, but contribute to aligning the Executive Directors' interests with shareholder experience through share price exposure. C.S. Venkatakrishnan Anna Cross £000 £000 Requirement 6,477 Requirement 3,864 Actual 614 629 Actual 3,092 2,364 2,219 C.S. Venkatakrishnan has until 1 November 2026, being five Anna Cross has until 23 April 2027, being five years from the years from the date of his appointment as an Executive date of her appointment as an Executive Director, to meet Director, to meet this shareholding requirement. this shareholding requirement. Tushar Morzaria £000 Requirement 3,864 Actual 8,061 1,918 3,498 Having stepped down as an Executive Director on 22 April 2022, Tushar Morzaria has a contractual obligation to maintain his shareholding requirement (as detailed above) for two years following his last day of active service as an Executive Director. Vested shares Unvested shares not subject to performance conditions Unvested shares subject to performance conditions n n n

Barclays PLC - Annual Report - 2022 Page 243 Page 245

Barclays PLC - Annual Report - 2022 Page 243 Page 245