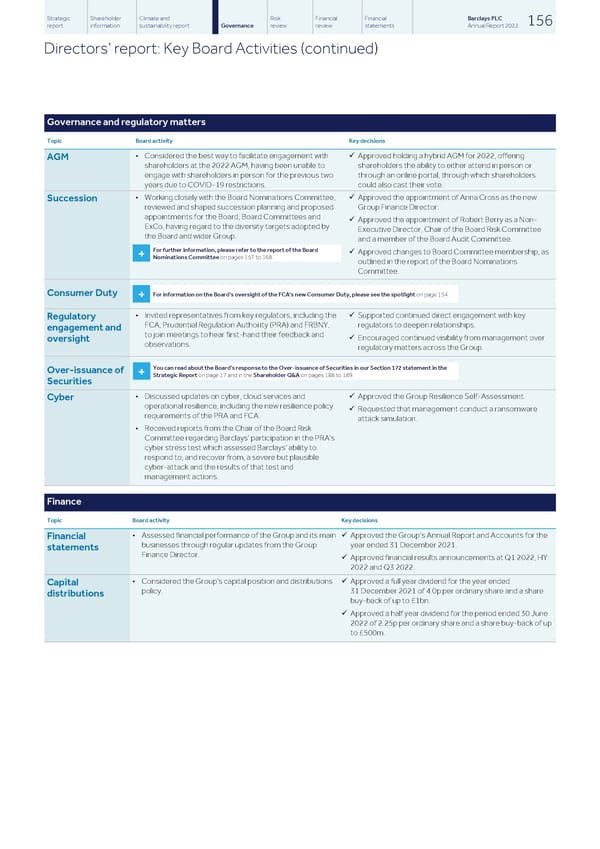

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 156 report information sustainability report Governance review review statements Annual Report 2022 Directors’ report: Key Board Activities (continued) Governance and regulatory matters Topic Board activity Key decisions • Considered the best way to facilitate engagement with üApproved holding a hybrid AGM for 2022, offering AGM shareholders at the 2022 AGM, having been unable to shareholders the ability to either attend in person or engage with shareholders in person for the previous two through an online portal, through which shareholders years due to COVID-19 restrictions. could also cast their vote. • Working closely with the Board Nominations Committee, üApproved the appointment of Anna Cross as the new Succession reviewed and shaped succession planning and proposed Group Finance Director. appointments for the Board, Board Committees and üApproved the appointment of Robert Berry as a Non- ExCo, having regard to the diversity targets adopted by Executive Director, Chair of the Board Risk Committee the Board and wider Group. and a member of the Board Audit Committee. For further information, please refer to the report of the Board üApproved changes to Board Committee membership, as + Nominations Committee on pages 157 to 168. outlined in the report of the Board Nominations Committee. Consumer Duty For information on the Board's oversight of the FCA's new Consumer Duty, please see the spotlight on page 154. + • Invited representatives from key regulators, including the üSupported continued direct engagement with key Regulatory FCA, Prudential Regulation Authority (PRA) and FRBNY, regulators to deepen relationships. engagement and to join meetings to hear first-hand their feedback and üEncouraged continued visibility from management over oversight observations. regulatory matters across the Group. You can read about the Board's response to the Over-issuance of Securities in our Section 172 statement in the Over-issuance of + Strategic Report on page 17 and in the Shareholder Q&A on pages 188 to 189. Securities • Discussed updates on cyber, cloud services and üApproved the Group Resilience Self-Assessment. Cyber operational resilience, including the new resilience policy üRequested that management conduct a ransomware requirements of the PRA and FCA. attack simulation. • Received reports from the Chair of the Board Risk Committee regarding Barclays’ participation in the PRA’s cyber stress test which assessed Barclays’ ability to respond to, and recover from, a severe but plausible cyber-attack and the results of that test and management actions. Finance Topic Board activity Key decisions • Assessed financial performance of the Group and its main ü Approved the Group’s Annual Report and Accounts for the Financial businesses through regular updates from the Group year ended 31 December 2021. statements Finance Director. üApproved financial results announcements at Q1 2022, HY 2022 and Q3 2022. • Considered the Group’s capital position and distributions üApproved a full year dividend for the year ended Capital policy. 31 December 2021 of 4.0p per ordinary share and a share distributions buy-back of up to £1bn. üApproved a half year dividend for the period ended 30 June 2022 of 2.25p per ordinary share and a share buy-back of up to £500m.

Barclays PLC - Annual Report - 2022 Page 157 Page 159

Barclays PLC - Annual Report - 2022 Page 157 Page 159