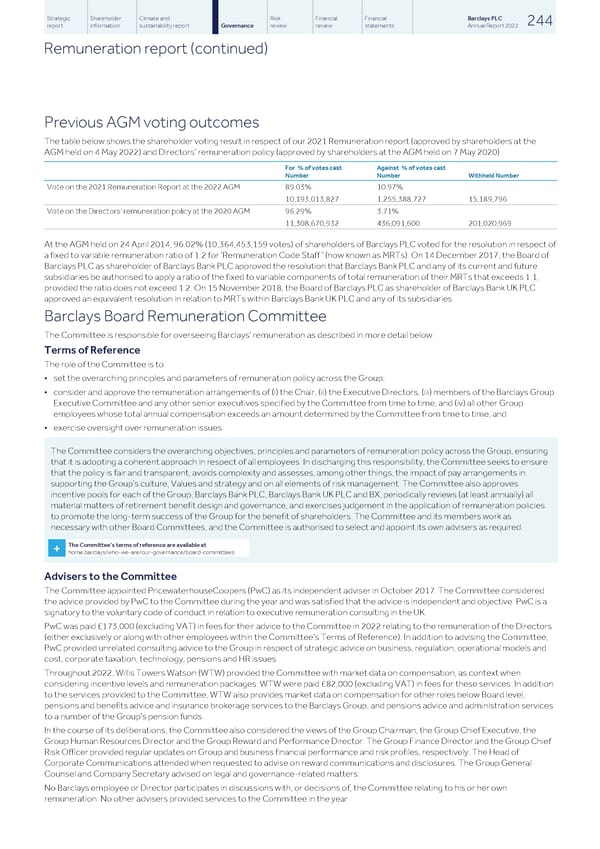

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 244 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Previous AGM voting outcomes The table below shows the shareholder voting result in respect of our 2021 Remuneration report (approved by shareholders at the AGM held on 4 May 2022) and Directors’ remuneration policy (approved by shareholders at the AGM held on 7 May 2020). For % of votes cast Against % of votes cast Number Number Withheld Number Vote on the 2021 Remuneration Report at the 2022 AGM 89.03% 10.97% 10,193,013,827 1,255,388,727 15,189,796 Vote on the Directors’ remuneration policy at the 2020 AGM 96.29% 3.71% 11,308,670,932 436,091,600 201,020,969 At the AGM held on 24 April 2014, 96.02% (10,364,453,159 votes) of shareholders of Barclays PLC voted for the resolution in respect of a fixed to variable remuneration ratio of 1:2 for ‘Remuneration Code Staff ’ (now known as MRTs). On 14 December 2017, the Board of Barclays PLC as shareholder of Barclays Bank PLC approved the resolution that Barclays Bank PLC and any of its current and future subsidiaries be authorised to apply a ratio of the fixed to variable components of total remuneration of their MRTs that exceeds 1:1, provided the ratio does not exceed 1:2. On 15 November 2018, the Board of Barclays PLC as shareholder of Barclays Bank UK PLC approved an equivalent resolution in relation to MRTs within Barclays Bank UK PLC and any of its subsidiaries. Barclays Board Remuneration Committee The Committee is responsible for overseeing Barclays’ remuneration as described in more detail below. Terms of Reference The role of the Committee is to: • set the overarching principles and parameters of remuneration policy across the Group; • consider and approve the remuneration arrangements of (i) the Chair, (ii) the Executive Directors, (iii) members of the Barclays Group Executive Committee and any other senior executives specified by the Committee from time to time, and (iv) all other Group employees whose total annual compensation exceeds an amount determined by the Committee from time to time; and • exercise oversight over remuneration issues. The Committee considers the overarching objectives, principles and parameters of remuneration policy across the Group, ensuring that it is adopting a coherent approach in respect of all employees. In discharging this responsibility, the Committee seeks to ensure that the policy is fair and transparent, avoids complexity and assesses, among other things, the impact of pay arrangements in supporting the Group’s culture, Values and strategy and on all elements of risk management. The Committee also approves incentive pools for each of the Group, Barclays Bank PLC, Barclays Bank UK PLC and BX, periodically reviews (at least annually) all material matters of retirement benefit design and governance, and exercises judgement in the application of remuneration policies to promote the long-term success of the Group for the benefit of shareholders. The Committee and its members work as necessary with other Board Committees, and the Committee is authorised to select and appoint its own advisers as required. The Committee’s terms of reference are available at + home.barclays/who-we-are/our-governance/board-committees Advisers to the Committee The Committee appointed PricewaterhouseCoopers (PwC) as its independent adviser in October 2017. The Committee considered the advice provided by PwC to the Committee during the year and was satisfied that the advice is independent and objective. PwC is a signatory to the voluntary code of conduct in relation to executive remuneration consulting in the UK. PwC was paid £173,000 (excluding VAT) in fees for their advice to the Committee in 2022 relating to the remuneration of the Directors (either exclusively or along with other employees within the Committee’s Terms of Reference). In addition to advising the Committee, PwC provided unrelated consulting advice to the Group in respect of strategic advice on business, regulation, operational models and cost, corporate taxation, technology, pensions and HR issues. Throughout 2022, Willis Towers Watson (WTW) provided the Committee with market data on compensation, as context when considering incentive levels and remuneration packages. WTW were paid £82,000 (excluding VAT) in fees for these services. In addition to the services provided to the Committee, WTW also provides market data on compensation for other roles below Board level, pensions and benefits advice and insurance brokerage services to the Barclays Group, and pensions advice and administration services to a number of the Group's pension funds. In the course of its deliberations, the Committee also considered the views of the Group Chairman, the Group Chief Executive, the Group Human Resources Director and the Group Reward and Performance Director. The Group Finance Director and the Group Chief Risk Officer provided regular updates on Group and business financial performance and risk profiles, respectively. The Head of Corporate Communications attended when requested to advise on reward communications and disclosures. The Group General Counsel and Company Secretary advised on legal and governance-related matters. No Barclays employee or Director participates in discussions with, or decisions of, the Committee relating to his or her own remuneration. No other advisers provided services to the Committee in the year.

Barclays PLC - Annual Report - 2022 Page 245 Page 247

Barclays PLC - Annual Report - 2022 Page 245 Page 247