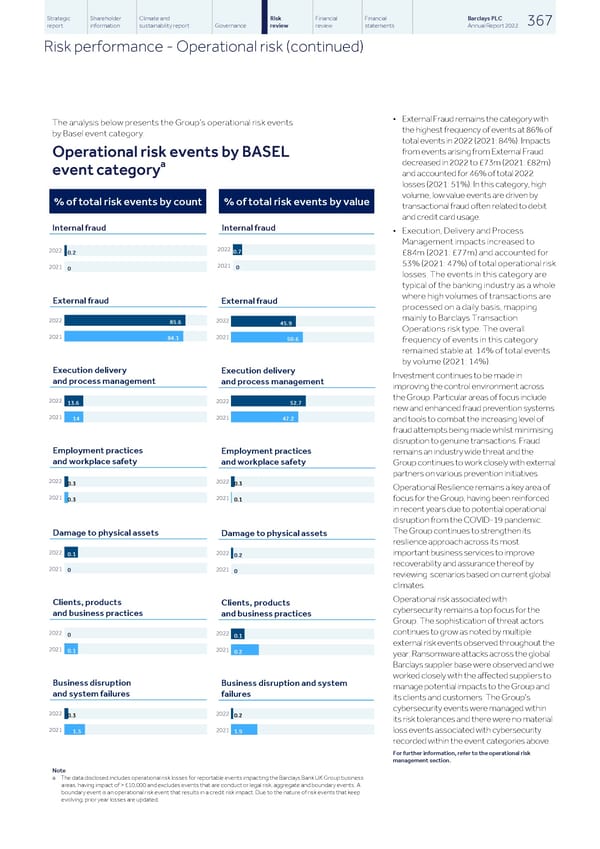

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 367 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Operational risk (continued) • External Fraud remains the category with The analysis below presents the Group’s operational risk events the highest frequency of events at 86% of by Basel event category: total events in 2022 (2021: 84%). Impacts from events arising from External Fraud Operational risk events by BASEL decreased in 2022 to £73m (2021: £82m) a event category and accounted for 46% of total 2022 losses (2021: 51%). In this category, high volume, low value events are driven by % of total risk events by count % of total risk events by value transactional fraud often related to debit and credit card usage. Internal fraud Internal fraud • Execution, Delivery and Process Management impacts increased to 2022 2022 0.7 0.2 £84m (2021: £77m) and accounted for 53% (2021: 47%) of total operational risk 2021 2021 0 0 losses. The events in this category are typical of the banking industry as a whole where high volumes of transactions are External fraud External fraud processed on a daily basis, mapping mainly to Barclays Transaction 2022 2022 85.6 45.9 Operations risk type. The overall 2021 2021 84.1 50.6 frequency of events in this category remained stable at 14% of total events by volume (2021: 14%). Execution delivery Execution delivery Investment continues to be made in and process management and process management improving the control environment across the Group. Particular areas of focus include 2022 2022 13.6 52.7 new and enhanced fraud prevention systems 2021 2021 14 47.2 and tools to combat the increasing level of fraud attempts being made whilst minimising disruption to genuine transactions. Fraud Employment practices Employment practices remains an industry wide threat and the and workplace safety and workplace safety Group continues to work closely with external partners on various prevention initiatives. 2022 2022 0.3 0.3 Operational Resilience remains a key area of 2021 2021 focus for the Group, having been reinforced 0.3 0.1 in recent years due to potential operational disruption from the COVID-19 pandemic. The Group continues to strengthen its Damage to physical assets Damage to physical assets resilience approach across its most 2022 2022 important business services to improve 0.1 0.2 recoverability and assurance thereof by 2021 2021 0 0 reviewing scenarios based on current global climates. Operational risk associated with Clients, products Clients, products cybersecurity remains a top focus for the and business practices and business practices Group. The sophistication of threat actors continues to grow as noted by multiple 2022 2022 0 0.1 external risk events observed throughout the 2021 2021 0.1 0.2 year. Ransomware attacks across the global Barclays supplier base were observed and we worked closely with the affected suppliers to Business disruption Business disruption and system manage potential impacts to the Group and and system failures failures its clients and customers. The Group’s cybersecurity events were managed within 2022 2022 0.3 0.2 its risk tolerances and there were no material 2021 2021 loss events associated with cybersecurity 1.5 1.9 recorded within the event categories above. For further information, refer to the operational risk management section. Note a The data disclosed includes operational risk losses for reportable events impacting the Barclays Bank UK Group business areas, having impact of > £10,000 and excludes events that are conduct or legal risk, aggregate and boundary events. A boundary event is an operational risk event that results in a credit risk impact. Due to the nature of risk events that keep evolving, prior year losses are updated.

Barclays PLC - Annual Report - 2022 Page 368 Page 370

Barclays PLC - Annual Report - 2022 Page 368 Page 370