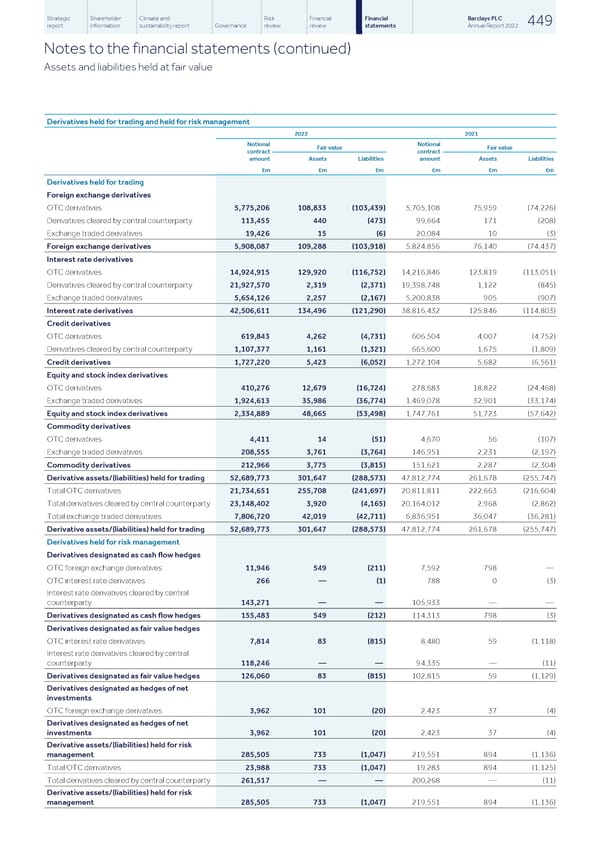

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 449 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Assets and liabilities held at fair value Derivatives held for trading and held for risk management 2022 2021 Notional Notional Fair value Fair value contract contract amount Assets Liabilities amount Assets Liabilities £m £m £m £m £m £m Derivatives held for trading Foreign exchange derivatives OTC derivatives 5,775,206 108,833 (103,439) 5,705,108 75,959 (74,226) Derivatives cleared by central counterparty 113,455 440 (473) 99,664 171 (208) Exchange traded derivatives 19,426 15 (6) 20,084 10 (3) Foreign exchange derivatives 5,908,087 109,288 (103,918) 5,824,856 76,140 (74,437) Interest rate derivatives OTC derivatives 14,924,915 129,920 (116,752) 14,216,846 123,819 (113,051) Derivatives cleared by central counterparty 21,927,570 2,319 (2,371) 19,398,748 1,122 (845) Exchange traded derivatives 5,654,126 2,257 (2,167) 5,200,838 905 (907) Interest rate derivatives 42,506,611 134,496 (121,290) 38,816,432 125,846 (114,803) Credit derivatives OTC derivatives 619,843 4,262 (4,731) 606,504 4,007 (4,752) Derivatives cleared by central counterparty 1,107,377 1,161 (1,321) 665,600 1,675 (1,809) Credit derivatives 1,727,220 5,423 (6,052) 1,272,104 5,682 (6,561) Equity and stock index derivatives OTC derivatives 410,276 12,679 (16,724) 278,683 18,822 (24,468) Exchange traded derivatives 1,924,613 35,986 (36,774) 1,469,078 32,901 (33,174) Equity and stock index derivatives 2,334,889 48,665 (53,498) 1,747,761 51,723 (57,642) Commodity derivatives OTC derivatives 4,411 14 (51) 4,670 56 (107) Exchange traded derivatives 208,555 3,761 (3,764) 146,951 2,231 (2,197) Commodity derivatives 212,966 3,775 (3,815) 151,621 2,287 (2,304) Derivative assets/(liabilities) held for trading 52,689,773 301,647 (288,573) 47,812,774 261,678 (255,747) Total OTC derivatives 21,734,651 255,708 (241,697) 20,811,811 222,663 (216,604) Total derivatives cleared by central counterparty 23,148,402 3,920 (4,165) 20,164,012 2,968 (2,862) Total exchange traded derivatives 7,806,720 42,019 (42,711) 6,836,951 36,047 (36,281) Derivative assets/(liabilities) held for trading 52,689,773 301,647 (288,573) 47,812,774 261,678 (255,747) Derivatives held for risk management Derivatives designated as cash flow hedges OTC foreign exchange derivatives 11,946 549 (211) 7,592 798 — OTC interest rate derivatives 266 — (1) 788 0 (3) Interest rate derivatives cleared by central counterparty 143,271 — — 105,933 — — Derivatives designated as cash flow hedges 155,483 549 (212) 114,313 798 (3) Derivatives designated as fair value hedges OTC interest rate derivatives 7,814 83 (815) 8,480 59 (1,118) Interest rate derivatives cleared by central counterparty 118,246 — — 94,335 — (11) Derivatives designated as fair value hedges 126,060 83 (815) 102,815 59 (1,129) Derivatives designated as hedges of net investments OTC foreign exchange derivatives 3,962 101 (20) 2,423 37 (4) Derivatives designated as hedges of net investments 3,962 101 (20) 2,423 37 (4) Derivative assets/(liabilities) held for risk management 285,505 733 (1,047) 219,551 894 (1,136) Total OTC derivatives 23,988 733 (1,047) 19,283 894 (1,125) Total derivatives cleared by central counterparty 261,517 — — 200,268 — (11) Derivative assets/(liabilities) held for risk management 285,505 733 (1,047) 219,551 894 (1,136)

Barclays PLC - Annual Report - 2022 Page 450 Page 452

Barclays PLC - Annual Report - 2022 Page 450 Page 452