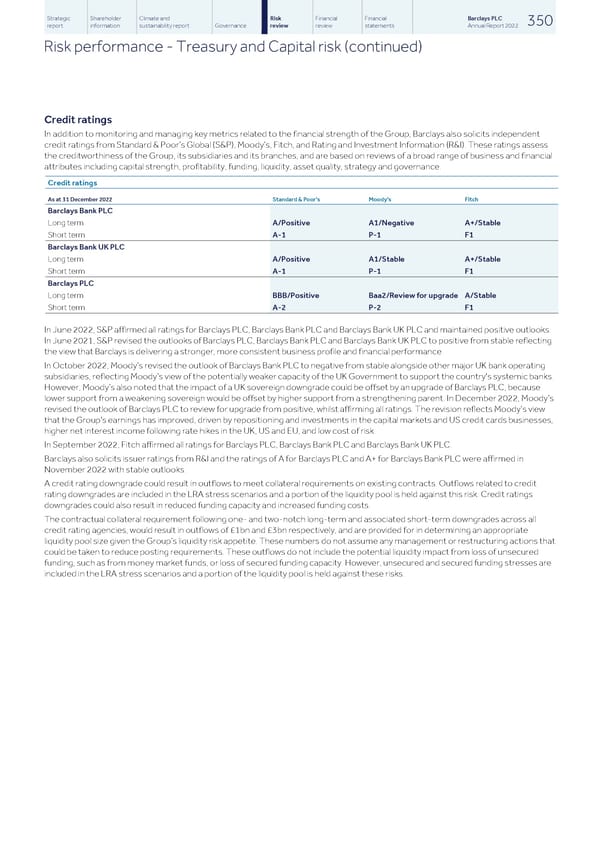

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 350 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Treasury and Capital risk (continued) Credit ratings In addition to monitoring and managing key metrics related to the financial strength of the Group, Barclays also solicits independent credit ratings from Standard & Poor’s Global (S&P), Moody’s, Fitch, and Rating and Investment Information (R&I). These ratings assess the creditworthiness of the Group, its subsidiaries and its branches, and are based on reviews of a broad range of business and financial attributes including capital strength, profitability, funding, liquidity, asset quality, strategy and governance. Credit ratings As at 31 December 2022 Standard & Poor's Moody's Fitch Barclays Bank PLC A/Positive A1/Negative A+/Stable Long term A-1 P-1 F1 Short term Barclays Bank UK PLC A/Positive A1/Stable A+/Stable Long term A-1 P-1 F1 Short term Barclays PLC BBB/Positive Baa2/Review for upgrade A/Stable Long term A-2 P-2 F1 Short term In June 2022, S&P affirmed all ratings for Barclays PLC, Barclays Bank PLC and Barclays Bank UK PLC and maintained positive outlooks. In June 2021, S&P revised the outlooks of Barclays PLC, Barclays Bank PLC and Barclays Bank UK PLC to positive from stable reflecting the view that Barclays is delivering a stronger, more consistent business profile and financial performance. In October 2022, Moody’s revised the outlook of Barclays Bank PLC to negative from stable alongside other major UK bank operating subsidiaries, reflecting Moody’s view of the potentially weaker capacity of the UK Government to support the country's systemic banks. However, Moody’s also noted that the impact of a UK sovereign downgrade could be offset by an upgrade of Barclays PLC, because lower support from a weakening sovereign would be offset by higher support from a strengthening parent. In December 2022, Moody’s revised the outlook of Barclays PLC to review for upgrade from positive, whilst affirming all ratings. The revision reflects Moody’s view that the Group's earnings has improved, driven by repositioning and investments in the capital markets and US credit cards businesses, higher net interest income following rate hikes in the UK, US and EU, and low cost of risk. In September 2022, Fitch affirmed all ratings for Barclays PLC, Barclays Bank PLC and Barclays Bank UK PLC. Barclays also solicits issuer ratings from R&I and the ratings of A for Barclays PLC and A+ for Barclays Bank PLC were affirmed in November 2022 with stable outlooks. A credit rating downgrade could result in outflows to meet collateral requirements on existing contracts. Outflows related to credit rating downgrades are included in the LRA stress scenarios and a portion of the liquidity pool is held against this risk. Credit ratings downgrades could also result in reduced funding capacity and increased funding costs. The contractual collateral requirement following one- and two-notch long-term and associated short-term downgrades across all credit rating agencies, would result in outflows of £1bn and £3bn respectively, and are provided for in determining an appropriate liquidity pool size given the Group’s liquidity risk appetite. These numbers do not assume any management or restructuring actions that could be taken to reduce posting requirements. These outflows do not include the potential liquidity impact from loss of unsecured funding, such as from money market funds, or loss of secured funding capacity. However, unsecured and secured funding stresses are included in the LRA stress scenarios and a portion of the liquidity pool is held against these risks.

Barclays PLC - Annual Report - 2022 Page 351 Page 353

Barclays PLC - Annual Report - 2022 Page 351 Page 353