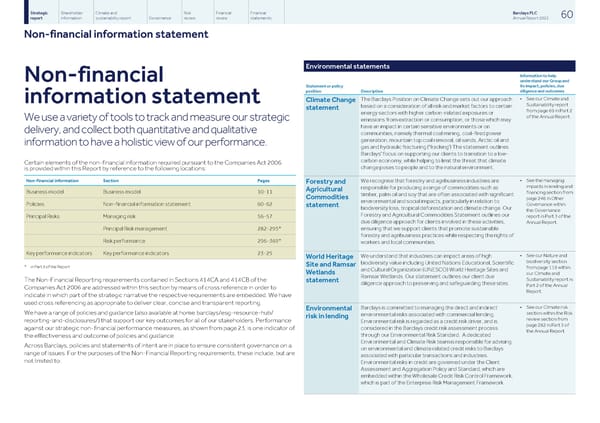

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 60 report information sustainability report Governance review review statements Annual Report 2022 Non-financial information statement Environmental statements Information to help Non-financial understand our Group and its impact, policies, due Statement or policy diligence and outcomes position Description • See our Climate and The Barclays Position on Climate Change sets out our approach Climate Change information statement Sustainability report based on a consideration of all risk and market factors to certain statement from page 69 in Part 2 energy sectors with higher carbon-related exposures or of the Annual Report. We use a variety of tools to track and measure our strategic emissions from extraction or consumption, or those which may have an impact in certain sensitive environments or on delivery, and collect both quantitative and qualitative communities, namely thermal coal mining, coal-fired power generation, mountain top coal removal, oil sands, Arctic oil and information to have a holistic view of our performance. gas and hydraulic fracturing ('fracking') The statement outlines Barclays' focus on supporting our clients to transition to a low- carbon economy, while helping to limit the threat that climate Certain elements of the non-financial information required pursuant to the Companies Act 2006 change poses to people and to the natural environment. is provided within this Report by reference to the following locations: • See the managing Non-financial information Section Pages We recognise that forestry and agribusiness industries are Forestry and impacts in lending and responsible for producing a range of commodities such as Agricultural Business model Business model 10-11 financing section from timber, palm oil and soy that are often associated with significant Commodities page 246 in Other environmental and social impacts, particularly in relation to Governance within Policies Non-financial information statement 60-62 statement biodiversity loss, tropical deforestation and climate change. Our the Governance Forestry and Agricultural Commodities Statement outlines our report in Part 3 of the Principal Risks Managing risk 56-57 due diligence approach for clients involved in these activities, Annual Report. ensuring that we support clients that promote sustainable Principal Risk management 282-295* forestry and agribusiness practices while respecting the rights of Risk performance 296-369* workers and local communities. Key performance indicators Key performance indicators 23-25 • See our Nature and We understand that industries can impact areas of high World Heritage biodiversity section biodiversity value including United Nations Educational, Scientific Site and Ramsar * in Part 3 of the Report from page 119 within and Cultural Organization (UNESCO) World Heritage Sites and Wetlands our Climate and Ramsar Wetlands. Our statement outlines our client due Sustainability report in The Non-Financial Reporting requirements contained in Sections 414CA and 414CB of the statement diligence approach to preserving and safeguarding these sites. Part 2 of the Annual Companies Act 2006 are addressed within this section by means of cross reference in order to Report. indicate in which part of the strategic narrative the respective requirements are embedded. We have used cross referencing as appropriate to deliver clear, concise and transparent reporting. • See our Climate risk Barclays is committed to managing the direct and indirect Environmental We have a range of policies and guidance (also available at home.barclays/esg-resource-hub/ section within the Risk environmental risks associated with commercial lending. risk in lending review section from reporting-and-disclosures/) that support our key outcomes for all of our stakeholders. Performance Environmental risk is regarded as a credit risk driver, and is page 282 in Part 3 of considered in the Barclays credit risk assessment process against our strategic non-financial performance measures, as shown from page 23, is one indicator of the Annual Report. through our Environmental Risk Standard. A dedicated the effectiveness and outcome of policies and guidance. Environmental and Climate Risk team is responsible for advising Across Barclays, policies and statements of intent are in place to ensure consistent governance on a on environmental and climate related credit risks to Barclays range of issues. For the purposes of the Non-Financial Reporting requirements, these include, but are associated with particular transactions and industries. not limited to: Environmental risks in credit are governed under the Client Assessment and Aggregation Policy and Standard, which are embedded within the Wholesale Credit Risk Control Framework, which is part of the Enterprise Risk Management Framework.

Barclays PLC - Annual Report - 2022 Page 61 Page 63

Barclays PLC - Annual Report - 2022 Page 61 Page 63