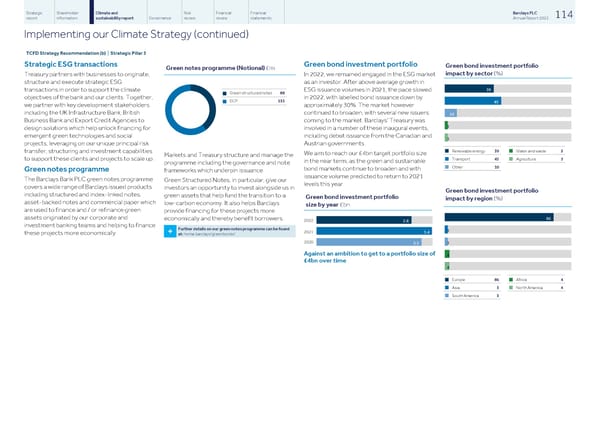

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 114 report information sustainability report Governance review review statements Annual Report 2022 Implementing our Climate Strategy (continued) TCFD Strategy Recommendation (b) | Strategic Pillar 3 Strategic ESG transactions Green bond investment portfolio Green bond investment portfolio Green notes programme (Notional) £m impact by sector (%) Treasury partners with businesses to originate, In 2022, we remained engaged in the ESG market structure and execute strategic ESG as an investor. After above average growth in 39 transactions in order to support the climate ESG issuance volumes in 2021, the pace slowed Green structured notes 88 n objectives of the bank and our clients. Together, in 2022, with labelled bond issuance down by ECP 135 45 n we partner with key development stakeholders approximately 30%. The market however including the UK Infrastructure Bank, British continued to broaden, with several new issuers 10 Business Bank and Export Credit Agencies to coming to the market. Barclays’ Treasury was 3 design solutions which help unlock financing for involved in a number of these inaugural events, emergent green technologies and social including debut issuance from the Canadian and 3 projects, leveraging on our unique principal risk Austrian governments. Renewable energy 39 Water and waste 3 transfer, structuring and investment capabilities n n We aim to reach our £4bn target portfolio size Markets and Treasury structure and manage the Transport 45 Agriculture 3 to support these clients and projects to scale up. n n in the near term, as the green and sustainable programme including the governance and note Other 10 n bond markets continue to broaden and with Green notes programme frameworks which underpin issuance. issuance volume predicted to return to 2021 The Barclays Bank PLC green notes programme Green Structured Notes, in particular, give our levels this year. covers a wide range of Barclays issued products investors an opportunity to invest alongside us in Green bond investment portfolio including structured and index-linked notes, green assets that help fund the transition to a Green bond investment portfolio impact by region (%) asset-backed notes and commercial paper which low-carbon economy. It also helps Barclays size by year £bn are used to finance and / or refinance green provide financing for these projects more assets originated by our corporate and 86 economically and thereby benefit borrowers. 2022 2.8 investment banking teams and helping to finance Further details on our green notes programme can be found 3 2021 3.4 + these projects more economically. at: home.barclays/greenbonds/ 2020 3 3.1 Against an ambition to get to a portfolio size of 4 £4bn over time 4 Europe 86 Africa 4 n n Asia 3 North America 4 n n South America 3 n

Barclays PLC - Annual Report - 2022 Page 115 Page 117

Barclays PLC - Annual Report - 2022 Page 115 Page 117