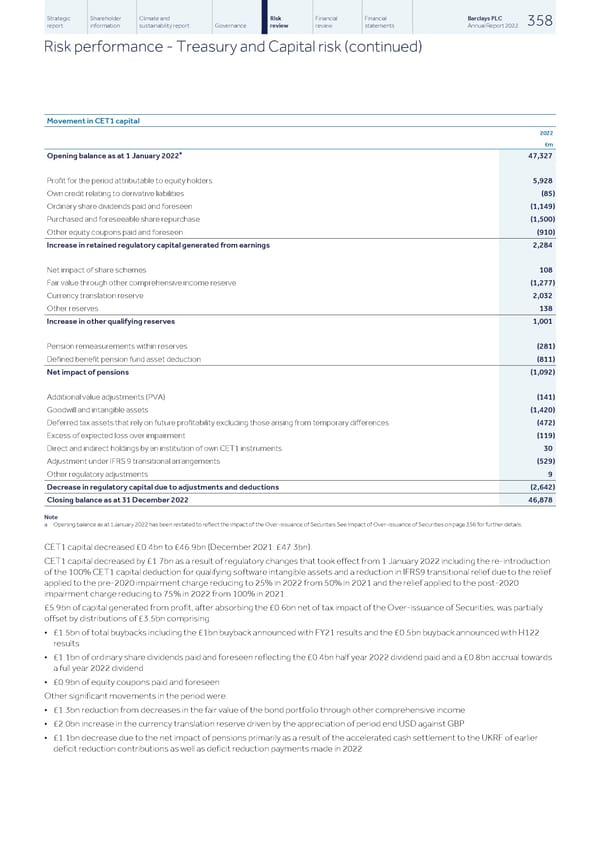

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 358 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Treasury and Capital risk (continued) Movement in CET1 capital 2022 £m a Opening balance as at 1 January 2022 47,327 Profit for the period attributable to equity holders 5,928 Own credit relating to derivative liabilities (85) Ordinary share dividends paid and foreseen (1,149) Purchased and foreseeable share repurchase (1,500) Other equity coupons paid and foreseen (910) Increase in retained regulatory capital generated from earnings 2,284 Net impact of share schemes 108 Fair value through other comprehensive income reserve (1,277) Currency translation reserve 2,032 Other reserves 138 Increase in other qualifying reserves 1,001 Pension remeasurements within reserves (281) Defined benefit pension fund asset deduction (811) Net impact of pensions (1,092) Additional value adjustments (PVA) (141) Goodwill and intangible assets (1,420) Deferred tax assets that rely on future profitability excluding those arising from temporary differences (472) Excess of expected loss over impairment (119) Direct and indirect holdings by an institution of own CET1 instruments 30 Adjustment under IFRS 9 transitional arrangements (529) Other regulatory adjustments 9 Decrease in regulatory capital due to adjustments and deductions (2,642) Closing balance as at 31 December 2022 46,878 Note a Opening balance as at 1January 2022 has been restated to reflect the impact of the Over-issuance of Securities.See Impact of Over-issuance of Securities on page 356 for further details. CET1 capital decreased £0.4bn to £46.9bn (December 2021: £47.3bn). CET1 capital decreased by £1.7bn as a result of regulatory changes that took effect from 1 January 2022 including the re-introduction of the 100% CET1 capital deduction for qualifying software intangible assets and a reduction in IFRS9 transitional relief due to the relief applied to the pre-2020 impairment charge reducing to 25% in 2022 from 50% in 2021 and the relief applied to the post-2020 impairment charge reducing to 75% in 2022 from 100% in 2021. £5.9bn of capital generated from profit, after absorbing the £0.6bn net of tax impact of the Over-issuance of Securities, was partially offset by distributions of £3.5bn comprising: • £1.5bn of total buybacks including the £1bn buyback announced with FY21 results and the £0.5bn buyback announced with H122 results • £1.1bn of ordinary share dividends paid and foreseen reflecting the £0.4bn half year 2022 dividend paid and a £0.8bn accrual towards a full year 2022 dividend • £0.9bn of equity coupons paid and foreseen Other significant movements in the period were: • £1.3bn reduction from decreases in the fair value of the bond portfolio through other comprehensive income • £2.0bn increase in the currency translation reserve driven by the appreciation of period end USD against GBP • £1.1bn decrease due to the net impact of pensions primarily as a result of the accelerated cash settlement to the UKRF of earlier deficit reduction contributions as well as deficit reduction payments made in 2022

Barclays PLC - Annual Report - 2022 Page 359 Page 361

Barclays PLC - Annual Report - 2022 Page 359 Page 361