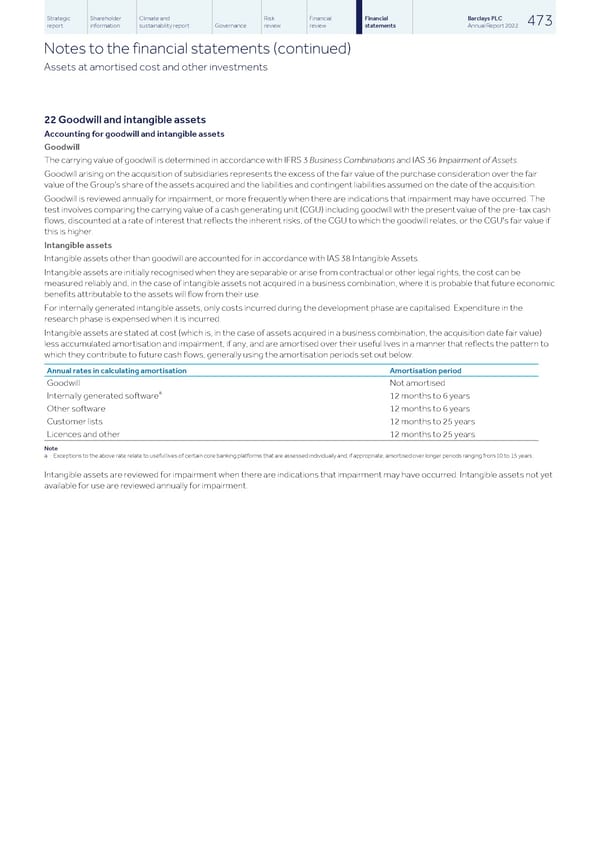

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 473 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Assets at amortised cost and other investments 22 Goodwill and intangible assets Accounting for goodwill and intangible assets Goodwill The carrying value of goodwill is determined in accordance with IFRS 3 Business Combinations and IAS 36 Impairment of Assets. Goodwill arising on the acquisition of subsidiaries represents the excess of the fair value of the purchase consideration over the fair value of the Group’s share of the assets acquired and the liabilities and contingent liabilities assumed on the date of the acquisition. Goodwill is reviewed annually for impairment, or more frequently when there are indications that impairment may have occurred. The test involves comparing the carrying value of a cash generating unit (CGU) including goodwill with the present value of the pre-tax cash flows, discounted at a rate of interest that reflects the inherent risks, of the CGU to which the goodwill relates, or the CGU's fair value if this is higher. Intangible assets Intangible assets other than goodwill are accounted for in accordance with IAS 38 Intangible Assets. Intangible assets are initially recognised when they are separable or arise from contractual or other legal rights, the cost can be measured reliably and, in the case of intangible assets not acquired in a business combination, where it is probable that future economic benefits attributable to the assets will flow from their use. For internally generated intangible assets, only costs incurred during the development phase are capitalised. Expenditure in the research phase is expensed when it is incurred. Intangible assets are stated at cost (which is, in the case of assets acquired in a business combination, the acquisition date fair value) less accumulated amortisation and impairment, if any, and are amortised over their useful lives in a manner that reflects the pattern to which they contribute to future cash flows, generally using the amortisation periods set out below: Annual rates in calculating amortisation Amortisation period Goodwill Not amortised a Internally generated software 12 months to 6 years Other software 12 months to 6 years Customer lists 12 months to 25 years Licences and other 12 months to 25 years Note a Exceptions to the above rate relate to useful lives of certain core banking platforms that are assessed individually and, if appropriate, amortised over longer periods ranging from 10 to 15 years. Intangible assets are reviewed for impairment when there are indications that impairment may have occurred. Intangible assets not yet available for use are reviewed annually for impairment.

Barclays PLC - Annual Report - 2022 Page 474 Page 476

Barclays PLC - Annual Report - 2022 Page 474 Page 476