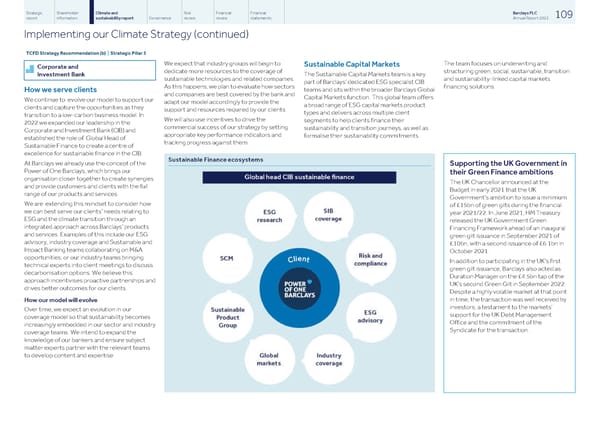

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 109 report information sustainability report Governance review review statements Annual Report 2022 Implementing our Climate Strategy (continued) TCFD Strategy Recommendation (b) | Strategic Pillar 3 We expect that industry groups will begin to The team focuses on underwriting and Sustainable Capital Markets Corporate and dedicate more resources to the coverage of structuring green, social, sustainable, transition The Sustainable Capital Markets team is a key Investment Bank sustainable technologies and related companies. and sustainability-linked capital markets part of Barclays’ dedicated ESG specialist CIB As this happens, we plan to evaluate how sectors financing solutions. teams and sits within the broader Barclays Global How we serve clients and companies are best covered by the bank and Capital Markets function. This global team offers We continue to evolve our model to support our adapt our model accordingly to provide the a broad range of ESG capital markets product clients and capture the opportunities as they support and resources required by our clients. types and delivers across multiple client transition to a low-carbon business model. In We will also use incentives to drive the segments to help clients finance their 2022 we expanded our leadership in the commercial success of our strategy by setting sustainability and transition journeys, as well as Corporate and Investment Bank (CIB) and appropriate key performance indicators and formalise their sustainability commitments. established the role of Global Head of tracking progress against them. Sustainable Finance to create a centre of excellence for sustainable finance in the CIB. At Barclays we already use the concept of the Supporting the UK Government in Power of One Barclays, which brings our their Green Finance ambitions organisation closer together to create synergies The UK Chancellor announced at the and provide customers and clients with the full Budget in early 2021 that the UK range of our products and services. Government’s ambition to issue a minimum We are extending this mindset to consider how of £15bn of green gilts during the financial we can best serve our clients’ needs relating to year 2021/22. In June 2021, HM Treasury ESG and the climate transition through an released the UK Government Green integrated approach across Barclays’ products Financing Framework ahead of an inaugural and services. Examples of this include our ESG green gilt issuance in September 2021 of advisory, industry coverage and Sustainable and £10bn, with a second issuance of £6.1bn in Impact Banking teams collaborating on M&A October 2021. opportunities; or our industry teams bringing In addition to participating in the UK’s first technical experts into client meetings to discuss green gilt issuance, Barclays also acted as decarbonisation options. We believe this Duration Manager on the £4.5bn tap of the approach incentivises proactive partnerships and UK’s second Green Gilt in September 2022. drives better outcomes for our clients. Despite a highly volatile market at that point in time, the transaction was well received by How our model will evolve investors; a testament to the markets’ Over time, we expect an evolution in our support for the UK Debt Management coverage model so that sustainability becomes Office and the commitment of the increasingly embedded in our sector and industry Syndicate for the transaction. coverage teams. We intend to expand the knowledge of our bankers and ensure subject matter experts partner with the relevant teams to develop content and expertise.

Barclays PLC - Annual Report - 2022 Page 110 Page 112

Barclays PLC - Annual Report - 2022 Page 110 Page 112