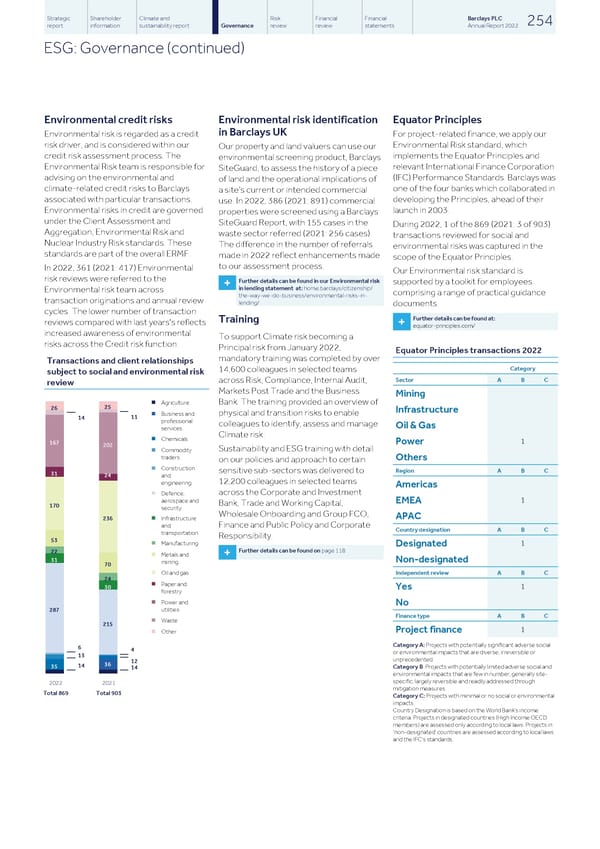

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 254 report information sustainability report Governance review review statements Annual Report 2022 ESG: Governance (continued) Environmental credit risks Environmental risk identification Equator Principles in Barclays UK Environmental risk is regarded as a credit For project-related finance, we apply our risk driver, and is considered within our Environmental Risk standard, which Our property and land valuers can use our credit risk assessment process. The implements the Equator Principles and environmental screening product, Barclays Environmental Risk team is responsible for relevant International Finance Corporation SiteGuard, to assess the history of a piece advising on the environmental and (IFC) Performance Standards. Barclays was of land and the operational implications of climate-related credit risks to Barclays one of the four banks which collaborated in a site’s current or intended commercial associated with particular transactions. developing the Principles, ahead of their use. In 2022, 386 (2021: 891) commercial Environmental risks in credit are governed launch in 2003. properties were screened using a Barclays under the Client Assessment and SiteGuard Report, with 155 cases in the During 2022, 1 of the 869 (2021: 3 of 903) Aggregation, Environmental Risk and waste sector referred (2021: 256 cases). transactions reviewed for social and Nuclear Industry Risk standards. These The difference in the number of referrals environmental risks was captured in the standards are part of the overall ERMF. made in 2022 reflect enhancements made scope of the Equator Principles. to our assessment process. In 2022, 361 (2021: 417) Environmental Our Environmental risk standard is risk reviews were referred to the Further details can be found in our Environmental risk supported by a toolkit for employees + in lending statement at: home.barclays/citizenship/ Environmental risk team across comprising a range of practical guidance the-way-we-do-business/environmental-risks-in- transaction originations and annual review lending/ documents. cycles. The lower number of transaction Further details can be found at: Training reviews compared with last years's reflects + equator-principles.com/ increased awareness of environmental To support Climate risk becoming a risks across the Credit risk function. Principal risk from January 2022, Equator Principles transactions 2022 mandatory training was completed by over Transactions and client relationships Category 14,600 colleagues in selected teams subject to social and environmental risk Sector A B C across Risk, Compliance, Internal Audit, review Markets Post Trade and the Business Mining n Agriculture Bank. The training provided an overview of 25 26 Infrastructure physical and transition risks to enable n Business and 11 14 professional colleagues to identify, assess and manage Oil & Gas services Climate risk. n Chemicals 1 Power 167 202 Sustainability and ESG training with detail n Commodity traders Others on our policies and approach to certain n Construction Region A B C sensitive sub-sectors was delivered to 31 24 and 12,200 colleagues in selected teams engineering Americas across the Corporate and Investment n Defence, aerospace and 1 EMEA Bank, Trade and Working Capital, 170 security Wholesale Onboarding and Group FCO, APAC n Infrastructure 236 Finance and Public Policy and Corporate and Country designation A B C transportation Responsibility. 53 n Manufacturing 1 Designated Further details can be found on page 118 22 n Metals and + 31 Non-designated mining 70 n Oil and gas Independent review A B C 24 n Paper and 1 30 Yes forestry n Power and No utilities 287 Finance type A B C n Waste 215 1 Project finance n Other Category A: Projects with potentially significant adverse social 6 4 or environmental impacts that are diverse, irreversible or 13 unprecedented. 12 36 14 35 Category B: Projects with potentially limited adverse social and 14 environmental impacts that are few in number, generally site- specific, largely reversible and readily addressed through 2022 2021 mitigation measures. Total 869 Total 903 Category C: Projects with minimal or no social or environmental impacts. Country Designation is based on the World Bank's income criteria. Projects in designated countries (High Income OECD members) are assessed only according to local laws. Projects in 'non-designated' countries are assessed according to local laws and the IFC's standards.

Barclays PLC - Annual Report - 2022 Page 255 Page 257

Barclays PLC - Annual Report - 2022 Page 255 Page 257