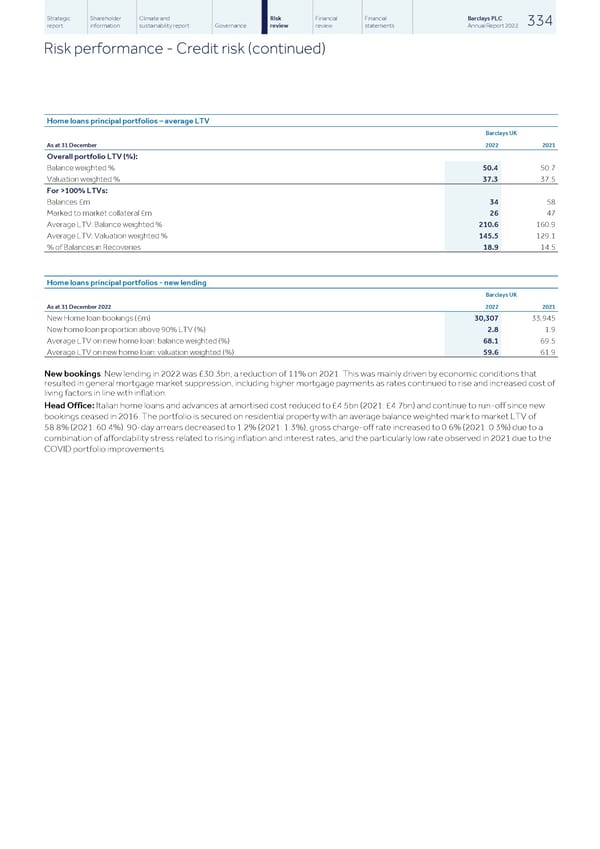

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 334 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Credit risk (continued) Home loans principal portfolios – average LTV Barclays UK As at 31 December 2022 2021 Overall portfolio LTV (%): Balance weighted % 50.4 50.7 Valuation weighted % 37.3 37.5 For >100% LTVs: Balances £m 34 58 Marked to market collateral £m 26 47 Average LTV: Balance weighted % 210.6 160.9 Average LTV: Valuation weighted % 145.5 129.1 % of Balances in Recoveries 18.9 14.5 Home loans principal portfolios - new lending Barclays UK As at 31 December 2022 2022 2021 New Home loan bookings (£m) 30,307 33,945 New home loan proportion above 90% LTV (%) 2.8 1.9 Average LTV on new home loan: balance weighted (%) 68.1 69.5 Average LTV on new home loan: valuation weighted (%) 59.6 61.9 New bookings: New lending in 2022 was £30.3bn, a reduction of 11% on 2021. This was mainly driven by economic conditions that resulted in general mortgage market suppression, including higher mortgage payments as rates continued to rise and increased cost of living factors in line with inflation. Head Office: Italian home loans and advances at amortised cost reduced to £4.5bn (2021: £4.7bn) and continue to run-off since new bookings ceased in 2016. The portfolio is secured on residential property with an average balance weighted mark to market LTV of 58.8% (2021: 60.4%). 90-day arrears decreased to 1.2% (2021: 1.3%), gross charge-off rate increased to 0.6% (2021: 0.3%) due to a combination of affordability stress related to rising inflation and interest rates, and the particularly low rate observed in 2021 due to the COVID portfolio improvements.

Barclays PLC - Annual Report - 2022 Page 335 Page 337

Barclays PLC - Annual Report - 2022 Page 335 Page 337