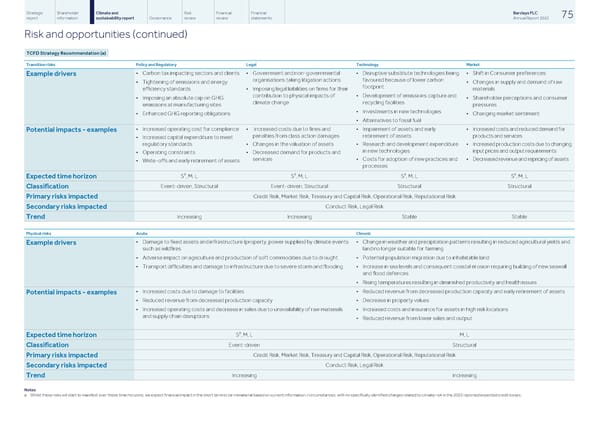

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 75 report information sustainability report Governance review review statements Annual Report 2022 Risk and opportunities (continued) TCFD Strategy Recommendation (a) Transition risks Policy and Regulatory Legal Technology Market • Carbon tax impacting sectors and clients • Government and non-governmental • Disruptive substitute technologies being • Shift in Consumer preferences Example drivers organisations taking litigation actions favoured because of lower carbon • Tightening of emissions and energy • Changes in supply and demand of raw footprint efficiency standards • Imposing legal liabilities on firms for their materials contribution to physical impacts of • Development of emissions capture and • Imposing an absolute cap on GHG • Shareholder perceptions and consumer climate change recycling facilities emissions at manufacturing sites pressures • Investments in new technologies • Enhanced GHG reporting obligations • Changing market sentiment • Alternatives to fossil fuel • Increased operating cost for compliance • Increased costs due to fines and • Impairment of assets and early • Increased costs and reduced demand for Potential impacts - examples penalties from class action damages retirement of assets products and services • Increased capital expenditure to meet regulatory standards • Changes in the valuation of assets • Research and development expenditure • Increased production costs due to changing in new technologies input prices and output requirements • Operating constraints • Decreased demand for products and services • Costs for adoption of new practices and • Decreased revenue and repricing of assets • Write-offs and early retirement of assets processes a a a a S , M, L S , M, L S , M, L S , M, L Expected time horizon Event-driven, Structural Event-driven, Structural Structural Structural Classification Credit Risk, Market Risk, Treasury and Capital Risk, Operational Risk, Reputational Risk Primary risks impacted Conduct Risk, Legal Risk Secondary risks impacted Increasing Increasing Stable Stable Trend Physical risks Acute Chronic • Damage to fixed assets and infrastructure (property, power supplies) by climate events • Change in weather and precipitation patterns resulting in reduced agricultural yields and Example drivers such as wildfires land no longer suitable for farming • Adverse impact on agriculture and production of soft commodities due to drought • Potential population migration due to inhabitable land • Transport difficulties and damage to infrastructure due to severe storm and flooding • Increase in sea levels and consequent coastal erosion requiring building of new seawall and flood defences • Rising temperatures resulting in diminished productivity and health issues • Increased costs due to damage to facilities • Reduced revenue from decreased production capacity and early retirement of assets Potential impacts - examples • Reduced revenue from decreased production capacity • Decrease in property values • Increased operating costs and decrease in sales due to unavailability of raw materials • Increased costs and insurance for assets in high risk locations and supply chain disruptions • Reduced revenue from lower sales and output a S , M, L M, L Expected time horizon Event-driven Structural Classification Credit Risk, Market Risk, Treasury and Capital Risk, Operational Risk, Reputational Risk Primary risks impacted Conduct Risk, Legal Risk Secondary risks impacted Increasing Increasing Trend Notes: a Whilst these risks will start to manifest over these time horizons, we expect financial impact in the short term to be immaterial based on current information / circumstances, with no specifically identified charges related to climate risk in the 2022 reported expected credit losses.

Barclays PLC - Annual Report - 2022 Page 76 Page 78

Barclays PLC - Annual Report - 2022 Page 76 Page 78