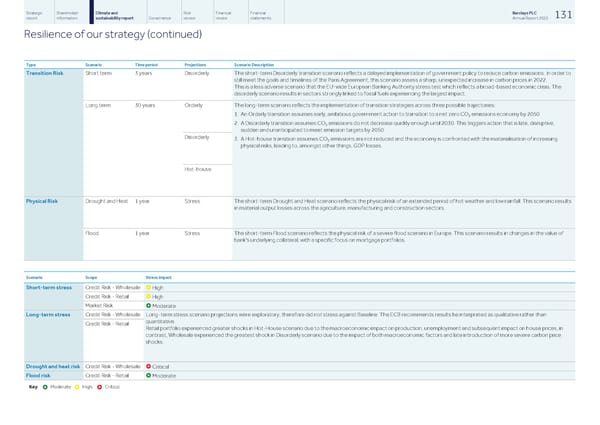

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 131 report information sustainability report Governance review review statements Annual Report 2022 Resilience of our strategy (continued) Type Scenario Time period Projections Scenario Description Transition Risk Short term 3 years Disorderly The short-term Disorderly transition scenario reflects a delayed implementation of government policy to reduce carbon emissions. In order to still meet the goals and timelines of the Paris Agreement, this scenario assess a sharp, unexpected increase in carbon prices in 2022. This is a less adverse scenario that the EU-wide European Banking Authority stress test which reflects a broad-based economic crisis. The disorderly scenario results in sectors strongly linked to fossil fuels experiencing the largest impact. Long term 30 years Orderly The long-term scenario reflects the implementation of transition strategies across three possible trajectories: 1. An Orderly transition assumes early, ambitious government action to transition to a net zero CO emissions economy by 2050 2 2. A Disorderly transition assumes CO emissions do not decrease quickly enough until 2030. This triggers action that is late, disruptive, 2 sudden and unanticipated to meet emission targets by 2050 Disorderly 3. A Hot-house transition assumes CO emissions are not reduced and the economy is confronted with the materialisation of increasing 2 physical risks, leading to, amongst other things, GDP losses. Hot-house Physical Risk Drought and Heat 1 year Stress The short-term Drought and Heat scenario reflects the physical risk of an extended period of hot weather and low rainfall. This scenario results in material output losses across the agriculture, manufacturing and construction sectors. Flood 1 year Stress The short-term Flood scenario reflects the physical risk of a severe flood scenario in Europe. This scenario results in changes in the value of bank's underlying collateral, with a specific focus on mortgage portfolios. Scenario Scope Stress impact Short-term stress Credit Risk - Wholesale £ High Credit Risk - Retail £ High Market Risk £ Moderate Long-term stress Credit Risk - Wholesale Long-term stress scenario projections were exploratory, therefore did not stress against Baseline. The ECB recommends results be interpreted as qualitative rather than quantitative. Credit Risk - Retail Retail portfolio experienced greater shocks in Hot-House scenario due to the macroeconomic impact on production, unemployment and subsequent impact on house prices, in contrast, Wholesale experienced the greatest shock in Disorderly scenario due to the impact of both macroeconomic factors and late introduction of more severe carbon price shocks. Drought and heat risk Credit Risk - Wholesale £ Critical Flood risk Credit Risk - Retail £ Moderate Key Moderate High Critical £ £ £

Barclays PLC - Annual Report - 2022 Page 132 Page 134

Barclays PLC - Annual Report - 2022 Page 132 Page 134