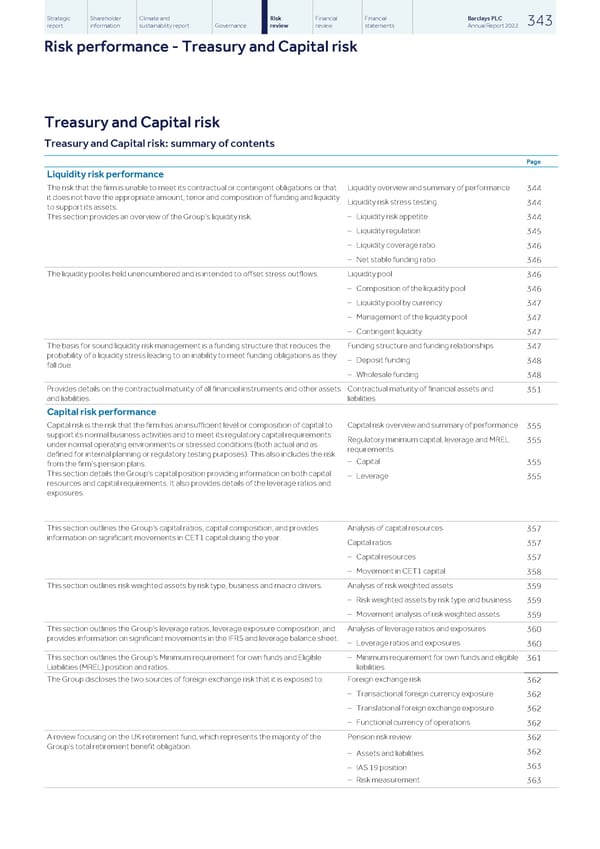

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 343 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Treasury and Capital risk Treasury and Capital risk Treasury and Capital risk: summary of contents Page Liquidity risk performance The risk that the firm is unable to meet its contractual or contingent obligations or that Liquidity overview and summary of performance 344 it does not have the appropriate amount, tenor and composition of funding and liquidity Liquidity risk stress testing 344 to support its assets. – Liquidity risk appetite This section provides an overview of the Group’s liquidity risk. 344 – Liquidity regulation 345 – Liquidity coverage ratio 346 – Net stable funding ratio 346 The liquidity pool is held unencumbered and is intended to offset stress outflows. Liquidity pool 346 – Composition of the liquidity pool 346 – Liquidity pool by currency 347 – Management of the liquidity pool 347 – Contingent liquidity 347 The basis for sound liquidity risk management is a funding structure that reduces the Funding structure and funding relationships 347 probability of a liquidity stress leading to an inability to meet funding obligations as they – Deposit funding 348 fall due. – Wholesale funding 348 Provides details on the contractual maturity of all financial instruments and other assets Contractual maturity of financial assets and 351 and liabilities. liabilities Capital risk performance Capital risk is the risk that the firm has an insufficient level or composition of capital to Capital risk overview and summary of performance 355 support its normal business activities and to meet its regulatory capital requirements Regulatory minimum capital, leverage and MREL 355 under normal operating environments or stressed conditions (both actual and as requirements defined for internal planning or regulatory testing purposes). This also includes the risk – Capital 355 from the firm’s pension plans. This section details the Group’s capital position providing information on both capital – Leverage 355 resources and capital requirements. It also provides details of the leverage ratios and exposures. This section outlines the Group’s capital ratios, capital composition, and provides Analysis of capital resources 357 information on significant movements in CET1 capital during the year. Capital ratios 357 – Capital resources 357 – Movement in CET1 capital 358 This section outlines risk weighted assets by risk type, business and macro drivers. Analysis of risk weighted assets 359 – Risk weighted assets by risk type and business 359 – Movement analysis of risk weighted assets 359 This section outlines the Group’s leverage ratios, leverage exposure composition, and Analysis of leverage ratios and exposures 360 provides information on significant movements in the IFRS and leverage balance sheet. – Leverage ratios and exposures 360 This section outlines the Group’s Minimum requirement for own funds and Eligible – Minimum requirement for own funds and eligible 361 Liabilities (MREL) position and ratios. liabilities The Group discloses the two sources of foreign exchange risk that it is exposed to. Foreign exchange risk 362 – Transactional foreign currency exposure 362 – Translational foreign exchange exposure 362 – Functional currency of operations 362 A review focusing on the UK retirement fund, which represents the majority of the Pension risk review 362 Group’s total retirement benefit obligation. 362 – Assets and liabilities 363 – IAS 19 position – Risk measurement 363

Barclays PLC - Annual Report - 2022 Page 344 Page 346

Barclays PLC - Annual Report - 2022 Page 344 Page 346