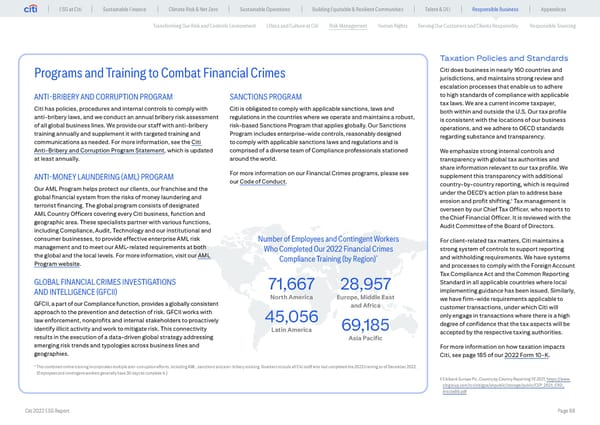

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices Transforming Our Risk and Controls Environment Ethics and Culture at Citi Risk Management Human Rights Serving Our Customers and Clients Responsibly Responsible Sourcing Taxation Policies and Standards Programs and Training to Combat Financial Crimes Citi does business in nearly 160 countries and jurisdictions, and maintains strong review and escalation processes that enable us to adhere ANTI-BRIBERY AND CORRUPTION PROGRAM SANCTIONS PROGRAM to high standards of compliance with applicable tax laws. We are a current income taxpayer, Citi has policies, procedures and internal controls to comply with Citi is obligated to comply with applicable sanctions, laws and both within and outside the U.S. Our tax profile anti-bribery laws, and we conduct an annual bribery risk assessment regulations in the countries where we operate and maintains a robust, is consistent with the locations of our business of all global business lines. We provide our staff with anti-bribery risk-based Sanctions Program that applies globally. Our Sanctions operations, and we adhere to OECD standards training annually and supplement it with targeted training and Program includes enterprise-wide controls, reasonably designed regarding substance and transparency. communications as needed. For more information, see the Citi to comply with applicable sanctions laws and regulations and is Anti-Bribery and Corruption Program Statement, which is updated comprised of a diverse team of Compliance professionals stationed We emphasize strong internal controls and at least annually. around the world. transparency with global tax authorities and share information relevant to our tax profile. We ANTI-MONEY LAUNDERING (AML) PROGRAM For more information on our Financial Crimes programs, please see supplement this transparency with additional our Code of Conduct. country-by-country reporting, which is required Our AML Program helps protect our clients, our franchise and the under the OECD’s action plan to address base global financial system from the risks of money laundering and 1 terrorist financing. The global program consists of designated erosion and profit shifting. Tax management is AML Country Officers covering every Citi business, function and overseen by our Chief Tax Officer, who reports to geographic area. These specialists partner with various functions, the Chief Financial Officer. It is reviewed with the including Compliance, Audit, Technology and our institutional and Audit Committee of the Board of Directors. consumer businesses, to provide effective enterprise AML risk Number of Employees and Contingent Workers For client-related tax matters, Citi maintains a management and to meet our AML-related requirements at both Who Completed Our 2022 Financial Crimes strong system of controls to support reporting the global and the local levels. For more information, visit our AML * and withholding requirements. We have systems Program website. Compliance Training (by Region) and processes to comply with the Foreign Account Tax Compliance Act and the Common Reporting GLOBAL FINANCIAL CRIMES INVESTIGATIONS 71,667 28,957 Standard in all applicable countries where local AND INTELLIGENCE (GFCII) implementing guidance has been issued. Similarly, North America Europe, Middle East we have firm-wide requirements applicable to GFCII, a part of our Compliance function, provides a globally consistent and Africa customer transactions, under which Citi will approach to the prevention and detection of risk. GFCII works with 45,056 only engage in transactions where there is a high law enforcement, nonprofits and internal stakeholders to proactively 69,185 degree of confidence that the tax aspects will be identify illicit activity and work to mitigate risk. This connectivity Latin America accepted by the respective taxing authorities. results in the execution of a data-driven global strategy addressing Asia Pacific emerging risk trends and typologies across business lines and For more information on how taxation impacts geographies. Citi, see page 185 of our 2022 Form 10-K. * This combined online training incorporates multiple anti-corruption efforts, including AML, sanctions and anti-bribery training. Numbers include all Citi staff who had completed the 2022 training as of December 2022. (Employees and contingent workers generally have 30 days to complete it.) 1 Citibank Europe Plc, Country by Country Reporting YE 2021, https://www. citigroup.com/rcs/citigpa/akpublic/storage/public/CEP_2021_CRD_ Article89.pdf Citi 2022 ESG Report Page 68

Global ESG Report 2022 Citi Bookmarked Page 67 Page 69

Global ESG Report 2022 Citi Bookmarked Page 67 Page 69