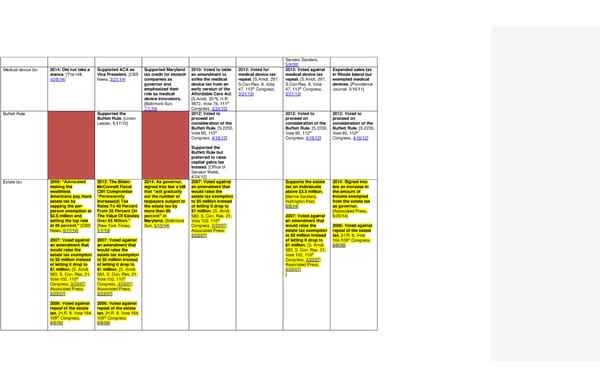

Senator Sanders, 5/6/08] Medical device tax 2014: Did not take a stance. [The Hill, 10/8/14] Supported ACA as Vice President. [CBS News, 3/21/14] Supported Maryland tax credit for biotech companies as governor and emphasized their role as medical device innovators. [Baltimore Sun, 7/1/14] 2010: Voted to table an amendment to strike the medical device tax from an early version of the Affordable Care Act. [S.Amdt. 3579, H.R. 4872, Vote 79, 111th Congress, 3/24/10] 2013: Voted for medical device tax repeal. [S.Amdt. 297, S.Con.Res. 8, Vote 47, 113th Congress, 3/21/13] 2013: Voted against medical device tax repeal. [S.Amdt. 297, S.Con.Res. 8, Vote 47, 113th Congress, 3/21/13] Expanded sales tax in Rhode Island but exempted medical devices. [Providence Journal, 3/16/11] Buffett Rule Supported the Buffett Rule. [Union Leader, 5/17/12] 2012: Voted to proceed on consideration of the Buffett Rule. [S.2230, Vote 65, 112th Congress, 4/16/12] Supported the Buffett Rule but preferred to raise capital gains tax instead. [Office of Senator Webb, 4/24/12] 2012: Voted to proceed on consideration of the Buffett Rule. [S.2230, Vote 65, 112th Congress, 4/16/12] 2012: Voted to proceed on consideration of the Buffett Rule. [S.2230, Vote 65, 112th Congress, 4/16/12] Estate tax 2008: “Advocated making the wealthiest Americans pay more estate tax by capping the per-person exemption at $3.5 million and setting the top rate at 45 percent.” [CBS News, 6/17/14] 2007: Voted against an amendment that would raise the estate tax exemption to $5 million instead of letting it drop to $1 million. [S. Amdt. 583, S. Con. Res. 21, Vote 102, 110th Congress, 3/23/07; Associated Press, 3/23/07] 2006: Voted against repeal of the estate tax. [H.R. 8, Vote 164, 109th Congress, 6/8/06] 2013: The Biden-McConnell Fiscal Cliff Compromise “Permanently Increase[d] Tax Rates To 40 Percent From 35 Percent On The Value Of Estates Over $5 Million.” [New York Times, 1/1/13] 2007: Voted against an amendment that would raise the estate tax exemption to $5 million instead of letting it drop to $1 million. [S. Amdt. 583, S. Con. Res. 21, Vote 102, 110th Congress, 3/23/07; Associated Press, 3/23/07] 2006: Voted against repeal of the estate tax. [H.R. 8, Vote 164, 109th Congress, 6/8/06] 2014: As governor, signed into law a bill that “will gradually cut the number of taxpayers subject to the estate tax by more than 80 percent” in Maryland. [Baltimore Sun, 5/15/14] 2007: Voted against an amendment that would raise the estate tax exemption to $5 million instead of letting it drop to $1 million. [S. Amdt. 583, S. Con. Res. 21, Vote 102, 110th Congress, 3/23/07; Associated Press, 3/23/07] Supports the estate tax on individuals above $3.5 million. [Bernie Sanders, Huffington Post, 9/8/14] 2007: Voted against an amendment that would raise the estate tax exemption to $5 million instead of letting it drop to $1 million. [S. Amdt. 583, S. Con. Res. 21, Vote 102, 110th Congress, 3/23/07; Associated Press, 3/23/07] ] 2014: Signed into law an increase in the amount of income exempted from the estate tax as governor. [Associated Press, 6/20/14] 2006: Voted against repeal of the estate tax. [H.R. 8, Vote 164,109th Congress, 6/8/06]

2016 Democrats Position Cheat Sheet 7/7/15 Page 18 Page 20

2016 Democrats Position Cheat Sheet 7/7/15 Page 18 Page 20