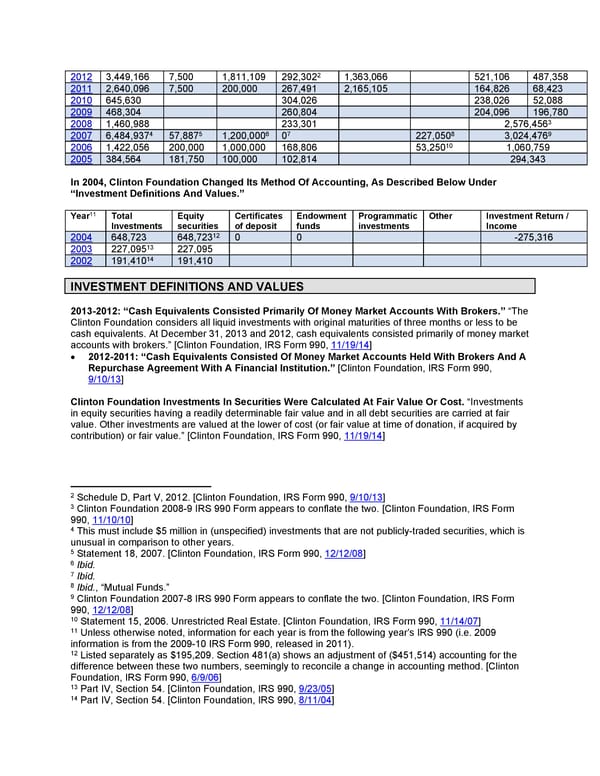

2012 3,449,166 7,500 1,811,109 292,3022 1,363,066 521,106 487,358 2011 2,640,096 7,500 200,000 267,491 2,165,105 164,826 68,423 2010 645,630 304,026 238,026 52,088 2009 468,304 260,804 204,096 196,780 2008 1,460,988 233,301 2,576,4563 4 5 6 7 8 9 2007 6,484,937 57,887 1,200,000 0 227,050 3,024,476 2006 1,422,056 200,000 1,000,000 168,806 53,25010 1,060,759 2005 384,564 181,750 100,000 102,814 294,343 In 2004, Clinton Foundation Changed Its Method Of Accounting, As Described Below Under “Investment Definitions And Values.” Year11 Total Equity Certificates Endowment Programmatic Other Investment Return / Investments securities of deposit funds investments Income 2004 648,723 648,72312 0 0 -275,316 2003 227,09513 227,095 2002 191,41014 191,410 INVESTMENT DEFINITIONS AND VALUES 2013-2012: “Cash Equivalents Consisted Primarily Of Money Market Accounts With Brokers.” “The Clinton Foundation considers all liquid investments with original maturities of three months or less to be cash equivalents. At December 31, 2013 and 2012, cash equivalents consisted primarily of money market accounts with brokers.” [Clinton Foundation, IRS Form 990, 11/19/14] 2012-2011: “Cash Equivalents Consisted Of Money Market Accounts Held With Brokers And A Repurchase Agreement With A Financial Institution.” [Clinton Foundation, IRS Form 990, 9/10/13] Clinton Foundation Investments In Securities Were Calculated At Fair Value Or Cost. “Investments in equity securities having a readily determinable fair value and in all debt securities are carried at fair value. Other investments are valued at the lower of cost (or fair value at time of donation, if acquired by contribution) or fair value.” [Clinton Foundation, IRS Form 990, 11/19/14] 2 Schedule D, Part V, 2012. [Clinton Foundation, IRS Form 990, 9/10/13] 3 Clinton Foundation 2008-9 IRS 990 Form appears to conflate the two. [Clinton Foundation, IRS Form 990, 11/10/10] 4 This must include $5 million in (unspecified) investments that are not publicly-traded securities, which is unusual in comparison to other years. 5 Statement 18, 2007. [Clinton Foundation, IRS Form 990, 12/12/08] 6 Ibid. 7 Ibid. 8 Ibid., “Mutual Funds.” 9 Clinton Foundation 2007-8 IRS 990 Form appears to conflate the two. [Clinton Foundation, IRS Form 990, 12/12/08] 10 Statement 15, 2006. Unrestricted Real Estate. [Clinton Foundation, IRS Form 990, 11/14/07] 11 Unless otherwise noted, information for each year is from the following year’s IRS 990 (i.e. 2009 information is from the 2009-10 IRS Form 990, released in 2011). 12 Listed separately as $195,209. Section 481(a) shows an adjustment of ($451,514) accounting for the difference between these two numbers, seemingly to reconcile a change in accounting method. [Clinton Foundation, IRS Form 990, 6/9/06] 13 Part IV, Section 54. [Clinton Foundation, IRS 990, 9/23/05] 14 Part IV, Section 54. [Clinton Foundation, IRS 990, 8/11/04]

Clinton Foundation Master Doc Page 13 Page 15

Clinton Foundation Master Doc Page 13 Page 15