HRC vote skeleton

XXXX (R-XX) SENATE VOTE REPORT Democratic Senatorial Campaign Committee

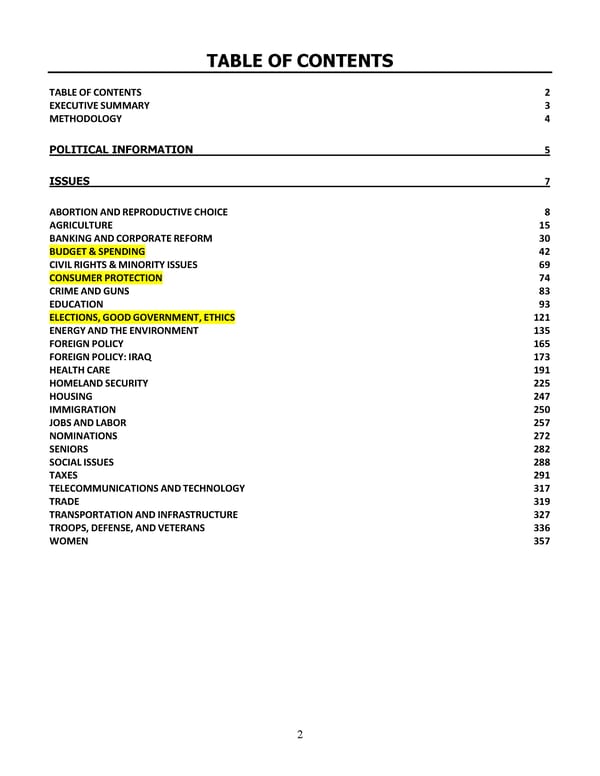

TABLE OF CONTENTS TABLE OF CONTENTS 2 EXECUTIVE SUMMARY 3 METHODOLOGY 4 POLITICAL INFORMATION 5 ISSUES 7 ABORTION AND REPRODUCTIVE CHOICE 8 AGRICULTURE 15 BANKING AND CORPORATE REFORM 30 BUDGET & SPENDING 42 CIVIL RIGHTS & MINORITY ISSUES 69 CONSUMER PROTECTION 74 CRIME AND GUNS 83 EDUCATION 93 ELECTIONS, GOOD GOVERNMENT, ETHICS 121 ENERGY AND THE ENVIRONMENT 135 FOREIGN POLICY 165 FOREIGN POLICY: IRAQ 173 HEALTH CARE 191 HOMELAND SECURITY 225 HOUSING 247 IMMIGRATION 250 JOBS AND LABOR 257 NOMINATIONS 272 SENIORS 282 SOCIAL ISSUES 288 TAXES 291 TELECOMMUNICATIONS AND TECHNOLOGY 317 TRADE 319 TRANSPORTATION AND INFRASTRUCTURE 327 TROOPS, DEFENSE, AND VETERANS 336 WOMEN 357 2

EXECUTIVE SUMMARY MCCONNELLMCCONNELLXXXXX 3

METHODOLOGY DISCLAIMER: As with all projects of this nature, we strongly urge you to double-check any specific information before using it for official campaign purposes, including press releases and paid communications. The DSCC research department is available to assist in these efforts at any time. 4

5

ISSUES AGRICULTURE HIGHLIGHTS INTEREST GROUP RATINGS CAMPAIGN CONTRIBUTIONS THE XXXX RECORD FARM BILL 2008: XXXX Voted To Override Bush Vet Of the Farm Bill Reauthorization. In June 2008, XXXX voted to override President Bush’s veto of the five-year authorization of agriculture programs. In addition to reauthorizing crop subsidies, the new farm law tightens income eligibility limits for payments, boosts funding for food stamps, expands conservation programs and offers new incentives for alternative energy. Another section restored in the legislation authorized trade and international food assistance programs. The override attempt passed 80-14. [CQ Today, 6/18/08; Vote 151, 6/18/08] XXXX Voted For the Farm Bill Reauthorization. In June 2008, XXXX voted for a new version of the $289 billion farm bill that included a trade-related title accidentally left out of the version that Congress sent to President Bush the previous month. The legislation is identical to the conference report on the farm bill that lawmakers approved in May. However, the trade title was inadvertently dropped from the version that Bush vetoed. The bill passed 77-15, with a threat of another veto by the President. [CQ Today, 6/05/08; Vote 144, 6/05/08] XXXX Voted For the Farm Bill Reauthorization. In May 2008, XXXX voted in favor of overriding President Bush’s veto of the five-year farm bill. However, an error by a House enrollment clerk, who dropped one of the original bill’s 15 titles before sending it to the White House, would require the Senate to vote again on the bill. The veto override passed 82-13. [CQ Today, 5/22/06; Vote 140, 5/22/08] XXXX Supported the Farm Bill Reauthorization Conference Report. In May 2008, XXXX voted for the $289 billion farm bill conference report that would reauthorize crop subsidies, land conservation programs, food stamps and other agriculture entitlement programs. The measure appeals to both rural and urban members, largely because of the $10.3 billion in new funding in the bill. That sum includes about 6

$1.2 billion to restock food banks and $1 billion for a school snack program. The measure will also establish a $3.8 billion trust fund to help farmers in flood- and drought-prone areas. The measure also contains provisions designed to guard against speculation in energy markets by setting record-keeping requirements for electronic energy traders and requiring them to provide an audit trail. [CQ Today, 5/15/08; Vote 130, 5/15/08] 2002: XXXX Voted Against the 2002 Farm Bill, Massive Subsidy Increases. In 2002, XXXX voted against a new farm bill re-establishing programs that supply payments to farmers when commodity prices fall below a specified level. It also raised mandatory and direct farm program spending by $73.5 billion over 10 years, provided $243 billion for food stamps and restored benefits for legal immigrants, and increased conservation spending to $17.1 billion. It also lowered the total limit on payments to individual farmers to $360,000 and authorized a new $1 billion dairy program for three and a half years. [Vote 103, 5/8/02] XXXX Voted For The 2001 Farm Bill. In 2001, XXXX voted for the 2001 Farm Bill. The Farm Bill XXXX supported would amend and extend for 5 years farm income support, land conservation, credit assistance, food assistance, trade promotion, marketing assistance, and rural development programs. Mandatory spending, primarily on farm income support programs, would be substantially increased, and several new mandatory-spending programs would be created. Democrats said the bill would cost $170 billion over 10 years. The vote was on a cloture motion to close debate on the motion to proceed to the Agriculture, Conservation, and Rural Enhancement Act of 2001. [Vote 352, 12/5/01; National Journal’s Congress Daily, 12/5/01] XXXX Opposed Expanding on Reforms That Were Begun in the Last Farm Bill. In 2001, XXXX voted against expanding on the reforms that were begun in the last farm bill and increase funding for the Environmental Quality Incentives Program (EQIP). Overall, the amendment would spend the same amount over the baseline over 10 years as the Harkin amendment. The motion to table was agreed to, 55-40. [Vote 374, 12/18/01] XXXX Voted Against Harkin’s Substitute 2001 Farm Bill. XXXX voted against the Farm Bill which would have renewed federal farm programs set to expire in October 2002. [Vote 377, 12/23/01] DAIRY & LIVESTOCK XXXX Voted to Ease Restrictions on Importing Canadian Beef, Ignored Mad Cow Fears. In 2005, XXXX voted to allow the Department of Agriculture to ease restrictions on Canadian beef. McConnell voted against a joint resolution that would block a proposed Department of Agriculture regulation that would have eased restrictions on the importation of Canadian beef. The U.S. border was closed to Canadian cattle after the 2003 discovery of mad cow disease in Alberta. The Bush Administration argued that easing the restrictions would help convince Japan to consider accepting U.S. beef, “a critical step for reviving the $7.5 billion beef and cattle industry,” but American cattle ranchers feared that Canadian cattle could spread disease within the U.S. and “make it impossible to resume the beef trade with Japan.” [Vote 19, 3/3/05; New York Times, 3/4/05] XXXX Voted to Not Allow Kobe Beef to Come Into U.S., Even If Japan Continued Ban on U.S. Beef. In 2005, XXXX was one of 26 Senators who voted to ban beef imports from Japan until that country opened its borders to U.S. beef. [Vote 236, 9/20/05; Omaha World-Herald, 9/21/05] XXXX Voted to Delay COOL For Two Years. XXXX voted for the FY04 Omnibus Appropriations bill, which gave retailers an extra two years to begin putting country-of-origin labels on food. Working with the Bush Administration, Republicans added an amendment to the Omnibus Bill that delayed the implementation of Country of Origin Labeling until 2006. The Bush Administration had been resisting implementation because meat packers and processors, especially large corporations like Tyson and Cargill Foods, do not favor COOL. These companies want it killed because they are afraid it will cut into profits. [Vote 3, 1/22/04; Aberdeen American News, 1/30/04; Washington Post, 2/3/04; Congressional Quarterly, 1/21/04] 7

Critics Slammed COOL Delay That Was Worked Out Behind Closed Doors. Discussing the two-year delay of county-of-origin labeling requirements in 2004, Dave Frederickson, president of the National Farmers Union, said, “I am appalled that this attack on the country-of-origin food labeling law was not debated in public.” [Star Tribune, 1/23/04] XXXX Voted Against Requiring Country Of Origin On Meat Labels. In a vote against small American ranchers, 29 Republicans, including XXXX, bowed to the pressure from huge, big business, international meat producers and vote to kill a Daschle amendment that would have mandated that all meat sold in the US be labeled, displaying the country the animal was raised. Country of Origin labeling is also important following the discovery of livestock inflicted with Mad Cow disease in Canada. The motion to kill the Daschle bill did not pass. [Vote 443, 11/6/03] XXXX Voted to Restrict Federal Environmental Subsidies For Certain Livestock Operations. In 2002, XXXX voted to restrict federal environmental subsidies for new and expanding livestock operations. [Vote 15, 2/6/02; National Journal's Congress Daily, 2/7/02] XXXX Voted to Place Livestock Contracts Under The Jurisdiction Of The Packers And Stockyards Act. In 2002, XXXX voted to put livestock production contracts under the jurisdiction of the Packers and Stockyards Act. It would also permit parties to a contract for the sale or production of livestock or poultry to discuss terms or details of the contract with a legal adviser, lender, accountant, executive or manager, landlord, or family member. The vote was on the Harkin modified amendment to the Daschle (for Harkin) substitute amendment to the Agriculture, Conservation, and Rural Enhancement Act of 2001 (S. 1731). The amendment was agreed to, 82-14. [Vote 16, 2/6/02] XXXX Voted For The Packer Ban. In 2002, XXXX voted in favor of banning most meatpackers from owning or controlling livestock for more than 14 days before slaughter. Cooperatives and small packers would be excluded from the ban. Packers, who would have up to 18 months to sell off any livestock that they own, said the restrictions make it harder for them to procure adequate supplies of top-quality meat. The vote was on a motion to table the Harkin (for Grassley) amendment to the Agriculture, Conservation, and Rural Enhancement Act of 2001. [Vote 23, 2/12/02; Associated Press, 12/1/01; Associated Press, 2/12/02] XXXX Voted Against Replacing Dairy Program With New System Benefiting Western Farmers. In 2002, XXXX voted against an effort to replace Farm Bill’s $2 billion dairy program with a system that would have been more favorable to large Western dairy producers. The vote was on a motion to table the Domenici modified amendment to the Agriculture, Conservation, and Rural Enhancement Act of 2001. [Vote 29, 2/13/02; National Journal’s Congress Daily, 2/13/02] XXXX Voted To Alter USDA Meat And Poultry Inspection Standards. In 2001, XXXX voted to prohibit the USDA from using funds from this Act to apply the mark of inspection to any meat or poultry product that was shown to be adulterated. It would also instruct the Secretary of Agriculture to submit a report on the role of microbiological monitoring and standards relating to indicator organisms and pathogens in determining the effectiveness and adequacy of Food Safety and Inspection Service Hazard Analysis and Critical Control Point (HACCP) meat and poultry safety programs. The vote was on the Nelson (of Nebraska)/Miller amendment to the Harkin amendment to the Agriculture, Rural Development, and Related Agencies Appropriations Bill for fiscal year 2001 (H.R. 2330). The motion to table failed, 45-50. [Vote 314, 10/25/01] XXXX Opposed Allowing the Dept. of Agriculture to Enforce Pathogen and Salmonella Standards. XXXX, on October 25, 2001, voted for the Nelson [NE] amendment to H.R.2330, which was an amendment to eliminate the Harkin amendment to H.R.2330. The Harkin amendment, which was supported by AARP, the American Food Safety Institute, American Public Health Association, the Consumer Federation of America, the National Farmers Union, the National Parent Teachers Association, and Consumers Union, was an amendment to clarify that the Agriculture Department has the authority to enforce pathogen reduction standards, including standards on salmonella, in meat and poultry plants. The Nelson [NE] amendment replaced the Harkin amendment with a watered-down provision to prevent funds from being used to apply inspection marks to meat and poultry products 8

that are shown to be contaminated. [Vote 314, 10/25/01; CQ Monitor News, 12/04/01, and Tom Harkin, Floor Statement, 10/25/01] XXXX Voted Against Dairy Program That Helps Small Farmers. On a vote of 51-47, Democrats won an important agriculture vote to support a $2 billion dairy program. The American Farm Bureau said, “This was the vote on the farm bill… it was the most critical vote other than final passage.” XXXX voted to kill the $500 million program to set the floor for milk prices for 12 Northeastern states, where most of the small dairy farmers operate. The program should help small dairy farmers compete with their larger rivals. [Vote 362, 12/11/01; CQ Monitor, 12/11/01] XXXX Opposed Democratic Substitute Amendments to Dairy Provisions of the Farm Bill. In 2001, XXXX twice opposed invoking cloture on the Daschle (for Harkin) substitute amendment to the Agriculture, Conservation, and Rural Enhancement Act of 2001 (S. 1731). The amendment would make changes to the dairy provisions in the bill; those changes would result in certain States gaining larger percentages of the new taxpayer subsidies in the bill for dairy producers. The cloture motion was rejected, 53-45. [Vote 368, 12/13/01; Vote 372, 12/18/01] XXXX Voted Against Tightening Meat And Poultry Microbiological Performance Standards. In 2000, XXXX voted against an amendment that would prohibit the Department of Agriculture (USDA) from using funds to label as "inspected and passed" any meat or poultry products that did not meet microbiological performance standards established by the Secretary of Agriculture. The amendment was rejected, 48-49. [Vote 221, 7/20/00] XXXX Voted For Increasing Funding For The Grain Inspection, Packers, And Stockyard Administration. In 2000, XXXX vote for an amendment that would increase funding for the Grain Inspection, Packers, and Stockyard Administration (GIPSA) by $3.95 million (to $31.219 million). The amendment would cut funding for the Economic Research Service by an equal amount. The motion to table was agreed to, 51-47. [Vote 220, 7/20/00] XXXX Opposed An Amendment To Tighten Meat And Poultry Standards. In 2000, XXXX voted against an amendment that would prohibit the Department of Agriculture from using funds to label as "inspected and passed" any meat or poultry products that did not meet microbiological performance standards established by the Secretary of Agriculture. The motion to table failed, 49-49. [Vote 218, 7/20/00] XXXX Voted Against Drop Grazing Fee Requirements. In 2000, XXXX voted against an amendment that would strike language requiring the Bureau of Land Management to reissue 10-year grazing permits and leases under the same terms and conditions as provided in the expiring permits or leases if the BLM were to fail to process renewal applications for those permits and lease renewals before their expiration. The amendment was rejected 38- 62. [Vote 175, 7/12/00] XXXX Voted in Favor of the Northeast Interstate Dairy Compact. In 1999, XXXX voted in favor of the Northeast Dairy Compact, which requires milk processors to pay a minimum price for milk they purchase from farmers, depending on the purpose for which the milk will be used. The bill’s opponents reflect states with larger dairy producers and processors than those in the Northeast, which want to eliminate the competition of the Northeastern dairy farmers. The vote was on whether to close debate on the conference report on FY 2000 D.C. Appropriations Bill and thus end a filibuster by Senators opposed to the extension of the Northeast Interstate Dairy Compact. The motion to invoke cloture was agreed to 87-9. [Vote 373, 11/19/99] XXXX Voted Against Requiring Country-Of-Origin Labeling. In 1998, XXXX voted against requiring country-of-origin labeling for beef and lamb. The motion to table was agreed to 53-41. [Vote 267, 9/14/98] DISASTER & EMERGENCY ASSISTANCE XXXX Voted For $4.8 Billion in Drought, Flood Relief for Farmers. In 2006, XXXX voted to add $4.8 billion in emergency funding for drought, flood and fire relief to farmers and ranchers in fiscal year 2007. “Our farm and ranch families really face a desperate situation,” argued Sen. Kent Conrad, who sponsored the funding proposal to 9

cover the 2006 crop year. [Vote 271, 12/5/06; Southwest Farm Press, 12/8/06; Omaha World-Herald, 12/7/06] XXXX Voted In Favor Of Giving Disaster Assistance to Farmers. In October 2004, XXXX voted for a resolution that would express the sense of the Senate that Congress should provide emergency spending for disaster assistance to eligible agricultural producers that is not offset by subsequent cuts to the farm bill. [Vote 209, 10/9/04] XXXX Voted Against Nearly Doubling Funding for Drought Relief for Farmers to $5.9 Billion. In 2003, XXXX voted against providing $5.9 billion for drought relief, which would have roughly doubled funding for farmers affected by drought. It would also have limited drought relief to farmers who have suffered at least 35 percent crop loss. [Vote 16, 1/22/03] XXXX Voted to Focus $3.1 Billion in Drought Relief for Farmers on Those Most Adversely Affected. In 2003, XXXX voted to reapportion the $3.1 billion of drought relief already contained in the measure. It would limit drought relief to farmers in designated counties or who have at least 35 percent of crop loss. The vote was on the Cochran, R-MS. amendment to the Fiscal 2003 Omnibus Appropriations bill. [Vote 15, 1/22/03] XXXX Voted Against Relief for Crop Losses. In November 2003, XXXX voted against an amendment that have would required the Agriculture secretary to spend such sums as necessary from the Commodity Credit Corporation for emergency financial assistance to farmers that have incurred qualifying crop and livestock losses for 2001, 2002 or 2003. [Vote 440, 11/5/03] XXXX Voted For $6 Billion in Disaster Aid for Farmers. In September 2002, XXXX voted in favor of an amendment that would provide nearly $6 billion in disaster aid for farmers. Farmers would be eligible if their losses exceed 35 percent of their average crop. Farmers would receive 60 percent of the market value of any losses that exceed 35 percent. Ranchers also would be compensated for disaster losses under a similar formula. The underlying Byrd amendment would provide $825 million to replace funds that previously were taken out for emergency wildfire suppression expenses. The substitute would appropriate $19.3 billion in fiscal 2003 for the Interior Department and related agencies and programs. XXXX was one of only 16 Senators to vote against the disaster aid. [Vote 212, 9/10/02] XXXX Voted Against Adding Emergency Funds For Crop And Livestock Losses. In 2002, XXXX voted against adding $2.4 billion in Commodity Credit Corporation emergency spending, for crop and livestock losses. The American Indian Livestock Program would receive $12 million of the $500 million provided for livestock losses. The vote was on waiving section 205 of the Budget Resolution for fiscal year 2001 for the consideration of the Baucus amendment to the Daschle (for Harkin) substitute amendment to The Agriculture, Conservation, and Rural Enhancement Act of 2001 (S. 1731). The motion was agreed to, 69-30. [Vote 25, 2/12/02] XXXX Opposed Adding Emergency Funds For Ranchers And Farmers. In 2002, XXXX voted against adding $2.3 billion in fiscal year (FY) 2002 emergency agricultural spending for ranchers and farmers. Specifically, it would provide $1.8 billion for the Crop Disaster Program for losses incurred in calendar year 2001 and $500 million for the Livestock Assistance Program, $12 million of which would be earmarked for the American Indian Livestock Feed Program. The vote was on waiving section 205(b) of H.Con. Res. 290 for fiscal year 2001 for the consideration of the Baucus amendment (No. 2701) to the Daschle substitute amendment (No. 2698) to the Hope for Children Act (H.R. 622). The motion was rejected, 57-33. [Vote 2, 1/24/02] XXXX Voted For A GOP Sponsored Special Assistance Farm Bill With $5.5 Billion In Assistance Instead Of $7.5 Billion. In 2001, XXXX supported a Republican substitute proposal to decrease the emergency agriculture assistance in the bill from the Democratic proposed $7.49 billion to $5.5 billion. President Bush threatened to veto anything with a price tag of more than $5.5 billion. Senate Agriculture Committee Chairman Tom Harkin, D-IA. said $5.5 billion was inadequate and that mainstream farm groups agreed the larger sum was needed. The amendment that McConnell voted against tabling would include $4.6 billion for Agricultural Market Transition Act (AMTA) payments, $129 million for tobacco farmer payments to quota holders, and $133.4 million for specialty crop grants to States based on the proportionate share of specialty crops they each produced. The vote was on a 10

motion to table the Lugar substitute amendment to the Agriculture Emergency Supplemental. [Vote 261, 7/31/01; Des Moines Register, 8/1/01; Des Moines Register, 8/2/01] XXXX Voted For The Conference Report On The Agricultural Risk Protections Act. In 2000, XXXX voted for the conference report on the Agricultural Risk Protection Act (H.R. 2559). The conference report included a total of $15.3 billion in agricultural economic assistance, of which $7.1 billion would be to provide immediate financial assistance to farmers and $8.2 billion would be to pay for improvements and increased subsidies over 5 years to the Federal crop insurance program. The crop insurance reforms in this bill would encourage producers to undertake additional risk management activities and encourage increased participation in the crop insurance program. It would also address perceived regional inequities in the program, and expand and improve the risk management tools available to specialty crop producers. The conference report was agreed to, 91-4. [Vote 115, 5/25/00] XXXX Voted For Senate Passage Of A Bill To Help Farmers Manage Agricultural Risks. In 2000, XXXX voted for final passage of the Risk Management for the 21st Century Act (H.R. 2559). The bill, as amended, would raise insurance premium subsidies to make Federal crop and revenue insurance policies more affordable for farmers, particularly at higher levels of coverage. The bill would also encourage the development of insurance coverage for specialty crops and revenue insurance on a whole farm rather than on a commodity-by-commodity basis. The bill passed, 95-5. [Vote 44, 3/23/00] XXXX Opposed Disaster Relief Aid for Farmers. XXXX voted three times to kill amendments to an agriculture appropriations bill that would have provided as much as $10.8 billion in emergency agriculture assistance to farmer and ranchers, including disaster relief and income loss payments. [Vote 250, 8/3/99; Vote 255, 8/4/99; Vote 256, 8/4/99] ETHANOL AND RENEWABLE ENERGY SEE ENERGY AND ENVIRONMENT CHAPTER F XXXX Twice Voted Against Ethanol Provisions in 2005. In 2005, XXXX voted for an amendment that would have striped ethanol requirements from an amendment to the Energy Bill requiring the use of renewable fuels. Immediately following that vote, XXXX voted against adding to the Energy Bill provisions that would have required refiners to annually use 8 billion gallons of renewable fuels by 2012. [Vote 139, 6/15/05; Vote 138, 6/15/05] XXXX Voted For An Energy Bill That Would Double Use Of Ethanol And Direct $16 Billion Towards Development And Conservation. On July 31, 2003, XXXX voted for a “sweeping national energy policy that would double the use of corn-based ethanol and direct $16 billions in tax credits and incentives to spur energy development and conservation.” The AP reported: “The way was cleared for passage of the bill when Senate Republicans abandoned legislation they had been struggling over and resurrected an energy package approved by the Senate last year when Democrats were in control.” The bill would spur production of a natural gas pipeline in Alaska and rescind a Depression-era law that restricted merger activities of utility holding companies. According to CQ, the vote was on passage of a “bill that would overhaul the nation’s energy policies, restructure the electricity system and provide for approximately $15 billion in energy-related tax incentives.” It also would direct the National Highway Traffic Safety Administration (NHTSA) to set a new CAFE standard within 15 months to two years. It would encourage the use of alternative energy and require utilities to increase their reliance on renewable fuels. [HR 6, Vote 317, 7/31/03; Associated Press, 7/31/03] XXXX Voted Against Increase Liability Standards For Renewable Fuels and Ethanol; Renewables Would Have Same Standards As Any Other Fuel. In 2003 and 2005, XXXX voted against requiring that a renewable fuel used for motor vehicles or a fuel containing a renewable additive be subject to liability standards equal to or greater than those used for any other fuel or fuel additive. Iowa Senators Harkin and Grassley voted against the amendment. The amendment would have required gasoline refineries to use 5 billion gallons of ethanol or other alternative renewable fuels annually by 2012, phased out the use of MTBE, and eliminated a requirement that 11

gasoline sold in regions with high levels of air pollution contain 2 percent oxygen by volume. [Vote 208, 6/5/03, Vote 137, 6/14/05] XXXX Voted To Mandate Use of Ethanol or Renewable Fuels; Required Refineries To Use 5 Billion Gallons Annually By 2012. On June 5, 2003, XXXX voted to require gasoline refineries to use 5 billion gallons of ethanol or other alternative renewable fuels annually by 2012, phase out the use of methyl tertiary butyl ether (MTBE) and eliminate a requirement that gasoline sold in regions with high levels of air pollution contain 2 percent oxygen by volume. [Vote 209, 6/5/03; Des Moines Register, 6/6/03] XXXX Opposed Measure To Allow States To Decide Whether To Require Ethanol In Gasoline. On June 3, 2003, XXXX voted against an amendment that would have allowed states to decide whether ethanol should be required as an additive in gasoline. The AP reported, “The vote signaled the Senate's strong support of a proposal that would double ethanol use in gasoline to 5 billion gallons a year by 2012 and require refineries nationwide to use the fuel, except for Hawaii and Alaska.” Sen. Dianne Feinstein, the amendment’s sponsor, argued that requiring that California refiners use ethanol could cause supply shortages and lead to price spikes at the pump. She argued the requirement would have benefited mainly Midwest corn farmers and ethanol producers. The Feinstein amendment would have allowed states to exempt refiners from using ethanol if it could demonstrate to the EPA that federal clean air standards could be met without the corn-based additive. The amendment was to amend the Frist amendment, which would require gasoline refineries to use 5 billion gallons of ethanol or other alternative renewable fuels annually by 2012, phase out the use of methyl tertiary butyl ether (MTBE) and eliminate a requirement that gasoline sold in regions with high levels of air pollution contain 2 percent oxygen by volume. [Vote 203, 6/3/03; AP, 6/3/03] XXXX Opposed Measure To Allow Governors To Opt Out of Ethanol Requirements. On June 3, 2003, XXXX voted against an amendment that would have allowed governors to decide whether ethanol should be required as an additive in gasoline. The amendment, which was sponsored by Sen. Dianne Feinstein, was offered to a bill that would require gasoline refineries to use 5 billion gallons of ethanol or other alternative renewable fuels annually by 2012. The Feinstein amendment was to amend the Frist amendment, which would require gasoline refineries to use 5 billion gallons of ethanol or other alternative renewable fuels annually by 2012, phase out the use of methyl tertiary butyl ether (MTBE) and eliminate a requirement that gasoline sold in regions with high levels of air pollution contain 2 percent oxygen by volume. [Vote 204, 6/3/03; AP, 6/3/03] XXXX Voted To Against Allowing State and Geographic Exemptions to Ethanol Requirements If Gas Prices Would Rise By 10 Cents / Gallon. On June 4, 2003, XXXX voted against an amendment which added language that would give the President authority to exempt a state or geographic region from specific ethanol requirements for 30 days if the Energy secretary determined that the requirements had caused or will cause the average cost of gasoline to increase by at least 10 cents per gallon. The underlying amendment would require gasoline refineries to use 5 billion gallons of ethanol or other alternative renewable fuels annually by 2012, phase out the use of methyl tertiary butyl ether (MTBE) and eliminate a requirement that gasoline sold in regions with high levels of air pollution contain 2 percent oxygen by volume. [Vote 206, 6/4/03] XXXX Voted Against Exempt All But Midwestern States From Ethanol Mandate. On June 5, 2003, XXXX voted against an amendment which added language that have would exempted all states except for those in the Midwest from the ethanol mandate contained in the underlying Frist amendment. The Frist amendment also required gasoline refineries to use 5 billion gallons of ethanol or other alternative renewable fuels annually by 2012, phase out the use of methyl tertiary butyl ether (MTBE) and eliminate a requirement that gasoline sold in regions with high levels of air pollution contain 2 percent oxygen by volume. [Vote 207, 6/5/03] XXXX Voted For Energy Bill That Would Double Use Of Ethanol And Direct $16 Billion Towards Development And Conservation. On July 31, 2003, XXXX voted for a “sweeping national energy policy that 12

would have doubled the use of corn-based ethanol and direct $16 billions in tax credits and incentives to spur energy development and conservation.” [Vote 317, 7/31/03; AP, 7/31/03] XXXX Supported An Energy Bill That Included a Mandate To Triple Ethanol Production And $14 Billion In Energy Tax Incentives. In 2002, XXXX supported an energy bill that tripled the amount of ethanol to be used as an additive in gasoline and included a $14 billion in energy tax incentives for production and for conservation. The vote was on a cloture motion on the Daschle further modified substitute amendment to the National Laboratories Partnership Improvement Act of 2001. [Vote 77, 4/23/02; Associated Press, 4/23/02; Associated Press, 4/24/02] XXXX Voted Against Giving Foreign Companies That Convert Chicken Droppings Into Fuel A Tax Break. In July 1999, XXXX voted for an amendment to the Taxpayer Refund Act of 1999 by Sen. Ashcroft that would have struck a provision of the bill providing a tax credit for companies that use chicken waste (manure) to make electricity. According to the Baltimore Sun, "But by a vote of 77-23, the senators beat back an effort to delete a Roth plan that would provide a $50 million tax credit for converting chicken manure to electricity. The tax credit is intended as an incentive for a British company that is considering building power plants in the Delmarva Peninsula and in Minnesota equipped with new technology that converts the chicken droppings into fuel. Sen. John Ashcroft, a Missouri Republican, argued that this proposal "gives a break to foreign corporations when there are U.S. companies capable" of converting chicken manure "into something useful." Two companies in his home state, Ashcroft said, turn poultry waste into pollution-free fertilizer." The amendment was rejected 23-77. [Vote 246, 7/30/99; Baltimore Sun, Hosler, 7/31/99] SPENDING, SUBSIDIES, AND TAXES XXXX Opposed Amendment to Cut Farm Subsidies. In December 2007, XXXX voted against an amendment to the Farm Bill that would have cut more than $2 billion in spending from the federal crop insurance program and used the savings to fund improvements to conservation programs and nutrition programs, and to reduce the federal budget deficit. The amendment failed 32-63. [Vote 428, 12/13/07; CQ Today, 12/11/07] XXXX Rejected Additional $2 Billion for Ag Programs. In 2006, XXXX voted against adding $2 billion for agriculture programs to the fiscal 2007 Budget Resolution and offsetting the increase by closing corporate tax loopholes. [Vote 66, 3/16/06] XXXX Voted To Keep $74.5 Million for Ag Programs. XXXX voted not to cut $74.5 million in funding for crop, dairy and livestock programs from the fiscal year 2006 Supplemental appropriations bill. Sen. John McCain, who proposed the funding cut, argued that the money would reward productivity and, as such, did not belong in an emergency spending bill. [Vote 108, 5/3/06; National Journal’s CongressDaily, 5/4/06; McCain Press Release, 5/3/06] XXXX Voted to Cut $2.8 Billion From Ag Programs. In March 2005, XXXX voted to cut mandatory agriculture funding by $2.8 billion between 2006 and 2010. Sen. Max Baucus and other critics argued that the cuts were not proportionate to agriculture's share of the federal budget, representing 16.5% of the mandatory spending cuts but only 1% of the entire federal budget. "Agriculture is a small portion of the federal budget, and it is expected to shoulder huge cuts," Baucus said. [Vote 69, 3/17/05; CQ Today, 3/18/05; Gannett News Service, 3/18/05] XXXX Voted Against Capping Farm Subsidies. In 2005, XXXX voted against a motion to cap farm commodity program payments at $250,000 a year for married couples and $125,000 per individual, down from the existing limit of $360,000. A cap was expected to be hardest on Southern cotton and rice growers who depend more on federal subsidies than Midwest grain producers. The proposal XXXX rejected also would delay the 2.5% across- the-board cut in farm program payments, adopted by the Senate Agriculture Committee, for one year, until 2007. [Vote 290, 11/3/05; Wichita Eagle, 11/3/05; National Journal’s CongressDaily, 11/3/05; Des Moines Register, 11/3/05] 13

XXXX Voted Against Energy Tax Credit for Farmers. In November 2005, XXXX voted against providing a Federal tax credit to farmers for 30 percent of their 2005 energy costs up to $3,000 per farmer. Qualified energy costs included those for fuels, utilities, fertilizers, heating and drying used in farming businesses of taxpayers during calendar year 2005. The $3 billion tax credit would be offset by closing tax loopholes for big oil companies. [Vote 345, 11/17/05; Congressional Record, 11/17/05] XXXX Voted to Fund the Conservation Reserve Program. In November 2003, XXXX voted against an amendment that would bar the Agriculture Department from apportioning funds made available from other conservation programs to fund technical assistance for the Conservation Reserve Program. [Vote 442, 11/6/03] XXXX Voted Against the 2002 Farm Bill, Massive Subsidy Increases. In 2002, XXXX voted against a new farm bill re-establishing programs that supply payments to farmers when commodity prices fall below a specified level. It also raised mandatory and direct farm program spending by $73.5 billion over 10 years, provided $243 billion for food stamps and restored benefits for legal immigrants, and increased conservation spending to $17.1 billion. It also lowered the total limit on payments to individual farmers to $360,000 and authorized a new $1 billion dairy program for three and a half years. [Vote 103, 5/8/02] XXXX Voted Against Restrict Federal Environmental Subsidies For Certain Livestock Operations. In 2002, XXXX voted against restrict federal environmental subsidies for new and expanding livestock operations. The Wellstone amendment would exclude new large Confined Animal Feeding Operations (CAFOs) from receiving Environmental Quality Incentives Program (EQIP) cost-share funds. The amendment was rejected, 44-52. [Vote 15, 2/6/02; National Journal's Congress Daily, 2/7/02] XXXX Voted For A $275,000-Per-Farm Cap On Agriculture Subsidies. In 2002, XXXX voted against killing a $275,000-per-farm cap on agriculture subsidies. Under existing rules, farms could receive unlimited subsidies for production of grain, cotton and soybeans, and growers could get $80,000 more under a separate program that provides fixed annual payments. Southern Democrats trying to protect subsidies to large cotton and rice operations threatened to abandon the bill if the payment limit were approved. Republican Senator Grassley of Iowa earned praise from Democrat Senator Harkin of Iowa for playing a major role by pushing for the cap. The vote was on a motion to table the Dorgan/Grassley amendment to the Agriculture, Conservation, and Rural Enhancement Act of 2001. [Vote 18, 2/7/02; Associated Press, 2/7/02; Des Moines Register, 2/14/02] XXXX Voted Against An Amendment To Create A Uniform Aid Program For Farmers. XXXX voted against eliminating existing commodity programs and in lieu thereof add a new commodity program that would give a $7,000 annual payment from 2003 through 2006 to all agricultural producers with $20,000 or more in annual income from farming. The vote was on the Lugar amendment to the Daschle (for Harkin) substitute amendment to the Agriculture, Conservation, and Rural Enhancement Act of 2001 (S. 1731). The amendment was rejected, 11-85. [Vote 19, 2/7/02] XXXX Voted to Lower Crop Subsidies In Order To Create IRA-Style Savings Accounts For Farmers. In 2002, XXXX voted to lower crop subsidies slightly in order to create IRA-style savings accounts for farmers, an idea endorsed by the Bush administration. The vote was on the Harkin perfecting amendment to the Agriculture, Conservation, and Rural Enhancement Act of 2001. [Vote 26, 2/12/02; Associated Press, 2/12/02] XXXX Voted Against Final Passage Of The 2002 Senate Rural Enhancement Act. In 2002, XXXX voted against final passage, as amended, of the Agriculture, Conservation, and Rural Enhancement Act of 2001 (H.R. 2646). The farm bill substantially increased mandatory spending, primarily on farm income support programs. Most of the assistance went to large farms that produce crops for which assistance has historically been given. The bill also included substantial sums for food assistance programs (primarily the Food Stamp Program). The bill passed, 58-40. [Vote 30, 2/13/02] XXXX Voted to Increase Agricultural Spending And Keep The Bush Tax Cut. In 2001, XXXX voted to increase spending by $3.5 billion for the Natural Resources and Environment function and $60 billion for the Agriculture function, with the stated goal of further funding agriculture's mandatory Commodity Credit Corporation 14

price supports, related programs, and conservation. The amendment would utilize $63.5 billion from the on-budget surpluses and would not reduce the President's proposed 10-year, $1.6 trillion tax relief package. The amendment was agreed to, 51-49. [Vote 67, 4/4/01] XXXX Voted Against Reducing Tax Cuts And Increasing Agricultural Spending. In 2001, XXXX voted against denying $88 billion of the $1.6 trillion in tax cuts and would instead spend it on the Natural Resources and Environment function and the Agriculture function, with the stated hope that it would be spent on emergency assistance for agricultural commodities producers in FY 2001 and on farm and conservation programs during FYs 2002- 2011. The amendment was rejected, 47-53. [Vote 68, 4/4/01] XXXX Voted For A Budget Resolution That Included A $66.15 Billion Agriculture Reserve Fund. In 2001, XXXX voted for the conference report to the House Concurrent Budget Resolution for fiscal years 2002-2011 (H.Con. Res. 83). The bill included $66.15 billion agriculture reserve fund ($63 billion for agriculture programs and $3.15 billion for conservation programs). The conference report was agreed to, 53-47. [Vote 98, 5/10/01] XXXX Voted to Stall the Senate’s Farm Aid Legislation. On a vote of 49-48, the Senate rejected a measure to bring the Senate’s Agriculture bill to the floor for a vote. XXXX chose the party line over a bill to provide $7.4 billion in farm aid to America’s farmers who were hurt by low prices in 2001. Senator Harkin’s (D-IA) agriculture committee passed the $7.4 billion supplemental bill to aid farmers and to provide money for conservation programs. When the bill went to the floor, Republicans used stalling tactics to run the clock out before the Senate’s summer recess. [Vote 273, 8/3/01] XXXX Voted In Support of 2001 Farm Bill. In 2001, XXXX voted to support the 2001 Farm Bill. The Farm Bill XXXX supported would amend and extend for 5 years farm income support, land conservation, credit assistance, food assistance, trade promotion, marketing assistance, and rural development programs. Mandatory spending, primarily on farm income support programs, would be substantially increased, and several new mandatory- spending programs would be created. Democrats said the bill would cost $170 billion over 10 years. The vote was on a cloture motion to close debate on the motion to proceed to the Agriculture, Conservation, and Rural Enhancement Act of 2001. [Vote 352, 12/5/01; National Journal’s Congress Daily, 12/5/01] XXXX Voted Against Harkin’s Substitute 2001 Farm Bill. XXXX voted against the Farm Bill which would have renewed federal farm programs set to expire in October 2002. [Vote 377, 12/23/01] XXXX Voted To Phase Out The Sugar Program. In 2001, XXXX voted in support of phasing out the sugar program and would spend any savings that occurred on the Food Stamp Program. The motion to table was agreed to, 71-29. [Vote 364, 12/12/01] XXXX Opposed Creating A $30 Billion Reserve Fund for Farmers. In March 1999, XXXX voted to table an amendment to the Concurrent Budget Resolution for Fiscal Years 2000-2009 by Sen. Dorgan that would strike the bills $6 billion reserve fund for farmers and replace it with a $30 billion reserve fund for farmers. The motion to table was agreed to 53-45. [Vote 75, 3/25/99] XXXX Voted Against Assistance to Tobacco Farmers. In April 1998, XXXX voted against an amendment to the Senate Concurrent Budget Resolution for Fiscal Year 1999-2003 by Sen. Robb that would have amended the section creating a tobacco reserve fund in order to allow the Federal receipts that may come from new tobacco taxes be used to provide transition assistance to tobacco farmers as well as to strengthen the Medicare Hospital Trust Fund. Motion Rejected 31-67. [Vote 83, 4/2/98] XXXX Voted Against Eliminating Support for Tobacco Farmers. In 1997, XXXX voted against eliminating federal support for crop insurance for tobacco farmers. The motion to table was agreed to 53-47. [Vote 196, 7/23/97] MISCELLANEOUS 15

XXXX Voted Against Reauthorizing Mexican Rural Development Funding. In July 2003, XXXX voted against an amendment that have would authorized $100 million in fiscal 2004 for aid to Mexico, focused on micro credit lending, small business and entrepreneurial development, assistance for small farms and farmers hurt by declining coffee prices, and strengthening a system of private property ownership in rural communities. It would also express the sense of Congress that the U.S. government should work with Mexico on rural development assistance programs. [Vote 268, 7/10/03] XXXX Voted in Favor of Protecting North American Catfish From Vietnamese Imports. In 2001, XXXX voted to ensure that only North American catfish were allowed to be labeled as “catfish.” The amendment XXXX voted to table would have blocked an attempt to protect the domestic catfish industry from fish imported from Vietnam that are being sold as catfish. The vote was on a motion to table the Lugar (for McCain) amendment to the Daschle (for Harkin) substitute amendment to the Agriculture, Conservation, and Rural Enhancement Act of 2001. [S 1731, Vote 373, 12/18/01; Congressional Quarterly Daily Monitor, 12/18/01] XXXX Voted Against Killing an Attempt to Allow Agriculture Secretary To Review Other Federal Agencies' Actions. In 2001, XXXX voted against killing an attempt to allow the Agriculture secretary to review other federal agencies' actions and recommend that the president overturn them if they harm farmers economic security or personal safety. Amendment sponsor Christopher S. Bond, R-Mo., said it would have been a "lifesaver to help farmers oppressed by bad federal regulations." Opponents said the provision would have made it impossible to enforce the Endangered Species Act, the Clean Water Act and other laws. The vote was on a motion to table the Bond amendment to the Daschle (for Harkin) substitute amendment to the Agriculture, Conservation, and Rural Enhancement Act of 2001. [Vote 365, 12/13/01; Congressional Quarterly Daily Monitor, 12/13/01] XXXX Voted to Give Farmers More Options In Disputes With Agribusinesses. In 2001, XXXX supported an amendment designed to give farmers more options in disputes with agribusinesses. The amendment XXXX voted for would reform mandatory arbitration clauses in agriculture contracts. Farmers would get a choice as to whether arbitration, mediation or civil action is the proper forum for resolving their disputes. The vote was on the Feingold/Grassley amendment to the Daschle (for Harkin) substitute amendment to the Agriculture, Conservation, and Rural Enhancement Act of 2001. [Vote 366, 12/13/01; Congressional Quarterly Daily Monitor, 12/13/01; United Press International, 12/14/01] XXXX Opposed Measure Placing a Moratorium on Mergers or Acquisitions Involving Giant Agribusiness. XXXX voted against an amendment to the Bankruptcy Reform Act of 1999 that would have placed a moratorium on mergers or acquisitions involving agribusinesses in which one business had annual net revenue or assets of more than $100 million and the other business had annual net revenue or assets of more than $10 million. The moratorium would have lasted for 18 months or until legislation was passed to limit concentration in agriculture markets. Farmer cooperatives would be exempt from the moratorium. The amendment was rejected 27-71. [Vote 366, 11/17/99] XXXX Voted to Allow Alien Agriculture Workers. XXXX voted in favor of an amendment by Sen. Gordon Smith that established a system of registries for domestic temporary and seasonal agriculture workers, streamlined the process of hiring foreign agriculture workers when domestic workers were unavailable. The amendment was agreed to 68-31. [Vote 233, 7/23/98] 16

BANKING AND CORPORATE REFORM HIGHLIGHTS THE XXXX RECORD BAILOUT / TARP XXXX Voted Against the $700 Billion Financial Rescue Package (TARP). In October 2008, XXXX voted against a Senate version of the $700 billion financial rescue package, which would allow Treasury to use the money, in installments, to buy certain mortgage assets. The bailout’s core provisions are essentially unchanged from the version (HR 3997) defeated in the House, but the Senate bill added a provision expanding FDIC insurance coverage and a provision to extend expiring tax provisions. The tax measure would stop the alternative minimum tax (AMT) from reaching into the pockets of millions more Americans; expand existing tax breaks for renewable energy, and renew the research and development credit for businesses. The bill passed 74-25. [CQ Today, 10/01/08; Vote 213, 10/01/08] XXXX Voted to Prevent Release of the Second Half of the $700 Billion in Financial Rescue Funds. In January 2009, XXXX voted for a resolution of disapproval that would have withheld the remaining half of the $700 billion bailout fund provided under the 2008 financial industry rescue package. The resolution was rejected 42-52. [Vote 5, 1/15/09] AUTO BAILOUT XXXX Voted Against a $14 Billion Emergency Loan Package for American Automakers. In December 2008, XXXX voted against a motion to invoke cloture on a “shell” bill that would be used as a vehicle for the $14 billion emergency loan package for U.S. automakers. The bill would authorize up to $14 billion in bridge loans to the Big Three automakers. The amounts would have to be sufficient to fund operations at the automakers and avoid a company failure. The auto companies would have to submit long-term restructuring plans to the new administrator for approval by March 31, or 30 days later, if given an extension, or the loans would be recalled. The administrator would have to establish rules limiting certain executive compensation at participating auto companies. The motion failed 52-35, short of the 60 needed. [CQ Today, 12/11/08; Vote 215, 12/11/08] BANKRUPTCY REFORM XXXX Voted for Final Passage of Bankruptcy Bill. In March 2005, XXXX voted for final passage of the Bankruptcy Reform bill. The bill created a means test tied to the median incomes of individual states to determine whether personal bankruptcy filers were able to repay some or all of their debts. Those deemed able to pay would be pushed into Chapter 13 bankruptcy, which results in a court-ordered repayment plan; those with insufficient assets would be allowed to file under Chapter 7, which erases debts after the forfeiture of certain assets. The bill would exempt disabled veterans from the means test if their debts were incurred primarily when they were on active duty or performing homeland defense duties. It also would make a number of debts non-dischargeable, including student loans, child support, alimony and luxury payments over $500 made within three months of a bankruptcy filing. [Vote 44, 3/10/05] XXXX Voted to Give Bankruptcy Courts Only Limited Access to Protected Assets. In March 2005, XXXX voted for an amendment that would allow bankruptcy courts to access assets in asset protection trusts up to 10 years 17

before the owner filed a bankruptcy petition. It also would require courts to show that the owner of such a trust had the intent of defrauding creditors and employees. [Vote 42, 3/10/05] XXXX Voted to Place Restraints on Bankruptcy Courts. In March 2005, XXXX voted against an amendment that would strike language in the underlying amendment that would require bankruptcy courts to show that the owner of an asset protection trust had the intent of defrauding creditors and employees. The Talent amendment would allow bankruptcy courts to access assets in such trusts up to 10 years before the owner filed a bankruptcy petition. [Vote 41, 3/10/05] XXXX Voted to Toughen Bankruptcy Laws on Disabled Workers. In March 2005, XXXX voted against an amendment that would change the bill’s definition of current monthly income to specify that the definition excludes income from a debtor’s former job and income from any activity the debtor can no longer engage in due to disability. [Vote 37, 3/10/05] XXXX Voted to Toughen Bankruptcy Laws on Single Parents. In March 2005, XXXX voted against an amendment that would exempt debtors from the means test if they failed to receive alimony or child support in any consecutive 12-month period in the two years before filing a bankruptcy petition and the amount exceeded 35 percent of the debtor’s household income. [Vote 36, 3/10/05] XXXX Voted Against Ensuring that Debtors had Enough Money to Provide for their Children. In March 2005, XXXX voted against an amendment to the Bankruptcy reform bill that would have ensured that debtors would have had the resources to provide for their family while in bankruptcy. The amendment would have altered the means test to provide greater flexibility when calculating a debtor’s ability to pay, and broaden allowable monthly expenses to ensure that parents had the resources to support their children throughout bankruptcy. It also would have allowed debtors to keep personal property found in or around the home, excluding cars, and ensure that support payments and tax refunds not become the property of the bankruptcy estate. [Vote 34, 3/9/05] XXXX Voted to Toughen Bankruptcy Laws on Teenagers. In March 2005, XXXX voted against an amendment that would not allow creditors to file a bankruptcy claim if the claim is based on the extension of credit to individuals age 21 or younger who, at the time the credit was extended, did not have a parental or spousal co-signer, had an income level below the poverty line and already had six or more unsecured credit cards. [Vote 33, 3/9/05] XXXX Voted Against Exempting Low Income Workers from Means Test in Bankruptcy Bill. In March 2005 XXXX voted against an amendment that would have exempted low income workers from the means test in the Bankruptcy Reform Bill. The amendment would have exempted any workers who made below the median income. [Vote 31, 3/9/05] XXXX Voted for Cloture on Bankruptcy Bill, that Made it More Difficult for Debtors to Seek Relief. In March 2005, XXXX voted to end debate on the Bankruptcy Reform Bill. The bill made it easier for a bankruptcy court to move debtors from Chapter 7 of the bankruptcy code, which allowed most debts to be discharged, to Chapter 13, which required a reorganization of debts under a repayment. [Vote 29, 3/8/05] XXXX Voted to Protect Violent Protesters Including Abortion Protestors from Liability by Allowing Them to Declare Bankruptcy. In March 2005, XXXX voted against an amendment to the Bankruptcy Overhaul bill that would have prohibited violent protesters, such as anti-abortion activists, from escaping court-ordered fines or judgments by filing for bankruptcy protection. It would have barred such debtors from discharging debts, such as damages, court fines, penalties, citations or attorney fees, incurred from acts of violence or potential acts of violence. [Vote 28, 3/8/05] XXXX Voted Against Punishing Corporate Fraud in Bankruptcy Court. In March 2005, XXXX voted against an amendment to the Bankruptcy Overhaul bill that would have punished perpetrators of corporate fraud in bankruptcy court. The amendment would have increased the period of time during which a bankruptcy court could recapture assets of corporate executives who mad fraudulent transfers from one to four years. It also gave employees and retirees a priority unsecured claim in bankruptcy court for the value of company stock held for their 18

benefit in an employee pension plan, unless the beneficiary had the option to invest the assets in another way. [Vote 25, 3/3/05] XXXX Voted Against Allowing Employees to Recoup Back Pay and Healthcare Costs if Their Employer Declared Bankruptcy. XXXX voted against an Amendment to the Bankruptcy Reform bill that would have allowed employees to recover up to $15,000 in back pay or other compensation owed to them if their company declared bankruptcy. The amendment would also have entitled retirees to payment equal to the cost of buying health insurance for a period of 18 months if an employer reduced retiree health care benefits as part of a bankruptcy plan. [Vote 24, 3/3/05] XXXX Voted Against Making It Illegal To Hide Assets In Bankruptcy. XXXX voted against prohibiting debtors from transferring more than $125,000 in assets into an asset protection trust within the 10-year period prior to filing bankruptcy. The amendment was rejected 39-56. [Vote 23, 3/3/05] XXXX Voted Against Protecting Debtors from Lenders Who Violate the Truth in Lending Act. In March 2005, XXXX voted against an amendment that would prohibit high cost mortgage lenders from collecting on their claims in bankruptcy court if they extend credit in violation of the Truth in Lending Act. [Vote 22, 3/3/05] XXXX Voted Against Protecting Victims of Identity Theft From Provisions of Bankruptcy Bill. In March 2005, XXXX voted against an amendment to the Bankruptcy Reform bill that would have protected the rights of those who suffered from identity theft to file for bankruptcy. The amendment would have exempted victims of identity theft from the means test provisions of the bill. [Vote 21, 3/3/05] XXXX Voted Against Setting Credit Card Interest Rating Ceiling. In March 2005, XXXX voted against an amendment to the Bankruptcy reform bill that would have set 30 percent ceiling on interest rates for loans or credit cards. [Vote 20, 3/3/05] XXXX Voted Against an Amendment to Exempt Debtors from Bankruptcy Means Test if they Lost Their Job While Taking Care of a Sick Family Member. In March 2005, XXXX voted against an amendment to the Bankruptcy Reform bill, which would have exempted debtors from the means test in the bill if they were taking care of a sick family member. The amendment covered any individuals who incurred substantial medical debt on behalf of a family member, such as a parent or grandparent, or who experienced a reduction in employment status while caring for such a family member. [Vote 18, 3/2/05] XXXX Twice Voted to Make it More Difficult For People with High Medical Expenses from Filing for Bankruptcy. In March 2005, XXXX twice voted to make it more difficult for those with high medical expenses to file for bankruptcy. XXXX voted against an amendment to the Bankruptcy reform bill that would have exempted debtors from a bankruptcy means test if their financial troubles were caused by medical expenses. XXXX also voted against amendment hat would have allowed those declaring bankruptcy. [Vote 17, 3/2/05; Vote 16, 3/2/05] XXXX Voted Against Amendment Requiring Credit Card Companies to Give Credit Counseling to Debtors. In March 2005, XXXX voted against an amendment to the Bankruptcy Overhaul bill that would have required credit card companies to give debtors information about credit counseling. The amendment would have required credit card companies to issue a warning notification on monthly statements stating that a minimum payment would increase the amount of interest paid and the time it would take to repay the outstanding balance. It would also have required companies to disclose the amount required for the consumer to pay off the outstanding balance in three years, if no further advances were made. It also would require credit card companies to provide a toll free number for consumers to receive information about credit counseling and debt management assistance. [Vote 15, 3/2/05] XXXX Voted Against Allowing Elderly to Claim Federal Homestead Exemption. In March 2005, XXXX voted against an amendment that would have created a federal homestead exemption of $75,000 for debtors over the age of 62. [Vote 14, 3/2/05] 19

XXXX Voted Against Exempting Troops, Veterans, and their Widows from Means Tests. In March 2005, XXXX voted against an amendment to the Bankruptcy Overhaul bill that would have exempted members of the armed forces, veterans, and spouses of service members who die in military service from application of the bill’s means test provisions. It also would have allowed them claim a minimum homestead exemption of $75,000 or choose the exemption in the state in which they file, whichever is higher. [Vote 13, 3/1/05] XXXX Voted to Make it Easier for Low Income Veterans and Active Duty Service Members to Claim “Safe Harbor” Provision of Bankruptcy Bill. In March 2005, XXXX voted for an amendment to the Bankruptcy Overhaul bill that made it more difficult for low-income veterans, debtors who have medical conditions, or those called or ordered to active duty to qualify for the “safe harbor” provision of the bill. The amendment required these individuals to satisfy all the procedural requirements of a means test used by bankruptcy judges to determine whether debtors have the ability to repay some or all of their debts. [Vote 12, 3/1/05] XXXX Voted For Senate Passage Of The Bankruptcy Reform Act Of 2001. In 2001, XXXX voted to send negotiators the Senate version of the Bankruptcy Reform legislation making it tougher for people to erase credit card and other debt in bankruptcy court. The legislation XXXX voted for would enact reforms to prevent upper- income creditors who have the means of repaying some or all of their debts from unjustly filing for bankruptcy and to protect consumers from unfair credit practices. Under the bill, a bankruptcy judge would be allowed to dismiss a Chapter 7 case if the system was being “abused” or, alternatively, to convert it into a Chapter 11 or a Chapter 13 case if the system was being abused and if the petitioner consents. The conference committees could not successfully reach a compromise, and as such, the bill never became law. The vote was on passage of the Bankruptcy Reform Act of 2001. [HR 333, Vote 236, 7/17/01] XXXX Voted Not To Require A Study Of The Bankruptcy Bill’s Effects. In 2001, XXXX voted Sen. Wellstone’s amendment to require the General Accounting Office (GAO): to conduct a study of the effects of the underlying bill on the number and cost of chapter 7 and chapter 13 filings, on the number and success rate of chapter 13 plan confirmations, on consumer credit, and on the ability of debtors below median income to obtain bankruptcy relief; to report the results of the study to Congress within two years of the bill's date of enactment; and to collect data on the number of reaffirmations by debtors under title 11, the identity of the creditors in such reaffirmations, and the type of debt that is reaffirmed. The amendment was agreed to, 52-46. [HR 333, Vote 235, 7/17/01] XXXX Voted To Pass The Senate Bankruptcy Reform Act Of 2001. In 2001, XXXX voted for the most sweeping overhaul of bankruptcy laws in 20 years, to prevent upper-income creditors who have the means of paying some or all of their debts from unjustly filing for bankruptcy, and to enact reforms to protect consumers from unfair credit practices. The legislation applies a new standard for determining whether people filing for bankruptcy should be forced to repay their debts under a court-approved reorganization plan rather than having them dissolved. If a debtor were found to have sufficient income to repay at least 25 percent of the debt over five years, a reorganization plan generally would be required. The vote was on final Senate passage, as amended, of the Bankruptcy Reform Act of 2001. [S 420, Vote 36, 3/15/01; Associated Press, 3/15/01] XXXX Voted Against Lifting A Limit On A Debtor’s Chapter 13 Bankruptcy Filings. In 2001, XXXX voted against Wellstone’s amendment that would strike the bill provision that prohibits a debtor from filing for bankruptcy under chapter 13 more than once every 5 years (under chapter 13, a debtor enters into a repayment plan to eliminate a portion of his or her debt over a number of years, after which any remaining debts are discharged). The amendment was rejected, 36-63. [S 420, Vote 34, 3/15/01] XXXX Voted Against Separating Spouses Incomes In Bankruptcy Proceedings. In 2001, XXXX voted against amending the means test that the bill used to determine whether a bankrupt's income level is above the median level for the State. The amendment would change the part of the test that will require both the income of a debtor and a debtor's spouse to be considered in the means test to a requirement that both spouses' income be considered only in joint cases. The amendment was agreed to, 56-43. [S 420, Vote 32, 3/15/01] 20

XXXX Voted To Protect The Confidentiality Of Children In Bankruptcy Proceedings. In 2001, XXXX voted for the Leahy modified amendment to the Bankruptcy Reform Act of 2001 (S. 420). The amendment would provide that a debtor in bankruptcy proceedings could be required to provide information regarding a minor child but could not be required to disclose in public records the name of that child. A debtor could be required to disclose the name of a minor child in a nonpublic record maintained by the bankruptcy court; a bankruptcy judge, trustee, or auditor could inspect that record but would be required to maintain the confidentiality of the identity of the child. The amendment was agreed to, 99-0. [S 240, Vote 31, 3/15/01] XXXX Voted Against Capping The Amount Of Home Equity Shielded From Creditors In Bankruptcy Court At $125,000. In 2001, XXXX voted against an effort to cap the amount of home equity shielded from creditors in bankruptcy court at $125,000. Bush, who supported a sweeping overhaul of the bankruptcy laws, was opposed to the $125,000 cap. The provision was designed to close a loophole in current law, the so-called homestead exemption, which allowed wealthy debtors to shield their assets in luxury homes. The vote was on an amendment to the Bankruptcy Reform Act of 2001. After the vote, the amendment was adopted by voice vote. [S 420, Vote 30, 3/15/01; Associated Press, 7/17/01] XXXX Voted to Invoke Cloture on Bankruptcy Overhaul. In March 2001, XXXX voted to invoke cloture (thus limiting debate) on the bill that would revise bankruptcy laws to make it easier for courts to move debtors from Chapter 7 of the bankruptcy code, which allows most debts to be discharged, to Chapter 13, which requires a reorganization of debts under a repayment plan. [S 420, Vote 29, 3/14/01] XXXX Voted Not To Deny Bankruptcy Claims For Loans With Annualized Interest Rates In Excess of 100%. In 2001, XXXX voted against supporting the Wellstone modified amendment to the Bankruptcy Reform Act of 2001 (S. 420). The Wellstone modified amendment would deny any claims of lenders in bankruptcy if those claims were for loans they gave which, if they had been given on an annualized basis, would have had interest rates in excess of 100 percent. For instance, if a "payday" lender gave a $100 loan for 1 week for a fee of $5, the equivalent yearly fee would be $260, or 260 percent, so that lender would not be entitled under the Wellstone amendment to recover any of the loan amount if the borrower declared bankruptcy. The motion to table was agreed to, 58-41. [S 420, Vote 28, 3/14/01] XXXX Opposed Consumer Protections and Stiffer Penalties for Predatory Lenders. In 2001, XXXX voted to reject added restrictions on credit card companies, requirements that the companies disclose more information to consumers and stiffer penalties for predatory lenders. The vote was on substitute amendment to the Bankruptcy Reform Act of 2001. [S 420, Vote 27, 3/14/01] XXXX Voted Against Limiting The Discharge Of California Utilities’ Debts. In 2001, XXXX voted to table the Wyden amendment to the Bankruptcy Reform Act of 2001 (S. 420). The Wyden amendment would prohibit, in Chapter 11 proceedings, the discharge of a California private utility's debts incurred from the receipt of wholesale electric power that was sold under an order issued by the Secretary of Energy under the Federal Power Act. The motion to table was agreed to, 67-30. [S 420, Vote 26, 3/14/01] XXXX Opposed Making It Illegal To Give A Credit Card To A Minor, With Certain Exceptions. In 2001, XXXX voted against making it illegal to give a credit card or open-end credit plan to anyone under the age of 21 unless: a parent, legal guardian, spouse, or other individual with means of repaying any debts incurred cosigned for the credit card or credit plan; the person under the age of 21 submitted information indicating an independent means of repaying any obligation arising from the proposed extension of credit; or the applicant provided proof that he had completed a credit counseling course by an approved non-profit budget and credit counseling agency. The motion to table was agreed to, 58-41. [S 420, Vote 25, 3/13/01] XXXX Voted Not To Hold Secondary Mortgage Companies Liable For Claims Against Acquired Assets. In 2001, XXXX voted against requiring any secondary mortgage company which purchased the financial assets (credit contracts and transactions) of a financial institution which had filed for bankruptcy to be held liable for all claims and defenses related to those assets to the same extent that the secondary company would have been held liable had the sale taken place other than under bankruptcy. The motion to table failed, 44-55. [S 420 Vote 24, 3/13/01] 21

XXXX Voted Against Protecting Retirement Accounts During Bankruptcy. In March 2001, XXXX voted against an amendment that would remove the provision in the bill that would provide a $1 million cap on the amount of individual retirement account contributions protected by bankruptcy. [S 420, Vote 21, 3/13/01] XXXX Voted Not To Cap Credit Cards Issued To Minors. In 2001, XXXX voted against requiring a $2,500 cap on any credit card issued to an adult under the age of 21, unless he or she submitted an application with the signature of his or her parent or guardian indicating joint liability for debt or unless he or she submitted financial information indicating an ability to repay the debt that the card accrued. Also, the amendment would require the written approval of the cosigner to increase credit lines for accounts for which the cosigner was liable. The motion to table was agreed to, 55-42. [S 420, Vote 20, 3/13/01] XXXX Voted Against Striking Small Business Bankruptcy Reforms. XXXX voted against the Kerry amendment (No. 26) to the Bankruptcy Reform Act of 2001 (S. 420). The Kerry amendment would strike small business bankruptcy reforms, including streamlined, standardized forms so small business debtors would be able to manage bankruptcies more cheaply. Nationwide, uniform reporting requirements would be established that would simplify current procedures. The amendment would also require a study and report on the subject of small business bankruptcies. The motion to table was agreed to, 55-41. [S 420, Vote 19, 3/8/01] MISCELLANEOUS XXXX Voted Against Ending “Janitors Insurance” Corporate Loophole. In 2003, XXXX voted against an amendment that would remove a provision of the tax code that allows a company to purchase life insurance policies for non-critical employees without the employee’s knowledge, making the company eligible for a tax break. [S 1054, Vote 175, 5/15/03; National Journal’s “The Hotline,” 5/16/03; Senator Edwards release, 5/15/03] XXXX Voted For An Amendment To Require Notification Of Customers When Their Financial Information Will Be Shared. In November 2003, XXXX voted for an amendment that would strike the section of the bill related to the sharing of information between subsidiaries owned by the same company and replace it with provisions that would require financial institutions to notify consumers that their financial information will be shared with affiliates and provide customer the right to opt out. [S 1753, Vote 434, 11/4/03] XXXX Voted Against Requiring the FERC to Review Mergers. In July 2003, XXXX voted for the Domenici, R-NM, motion to table (kill) the Bingaman, D-NM, amendment to the Domenici amendment. The Bingaman amendment would strike language from the underlying amendment pertaining to electric utility mergers and replace it with language that would expand the power of the Federal Energy Regulatory Commission (FERC) to review mergers, acquisitions and disposition of assets of holding companies that own utilities; certain electric and gas company mergers; and generation facilities. It would establish stronger standards for FERC approval of such transactions and provide for expedited review of certain transactions. The Domenici amendment would repeal the 1935 Public Utilities Holding Company Act and lift restrictions on who can own utilities. It would clarify that FERC has no power to compel utilities to join regional power transmission organizations. Some of the cost of expanding wholesale power transmission networks would shift from households to major industrial utility customers and the utilities that serve them. [S 14, Vote 313, 7/30/03] XXXX Voted Against Closing “Enron Loophole” and Increasing Energy Trading Regulation and Transparency. In 2003, XXXX to kill an amendment that regulated online trading of energy derivatives and imposed stringent penalties for market manipulation. Sen. Dianne Feinstein (D-CA) described her amendment as closing the “Enron loophole” by attempting to fix the Commodity Futures Modernization Act of 2000 that exempted energy trading from regulation after intensive lobbying by Enron. The exemption allows firms to buy and sell billions of dollars worth of electricity, natural gas, oil, gasoline, and other petroleum products without disclosing information on those deals to the Commodity Futures Trading Commission (CFTC). The amendment would give the Commodity Futures Trading Commission (CFTC) regulatory oversight of all derivative transactions of energy commodities, except for metals. It would subject electronic transactions to broad disclosure and transparency requirements, require electronic trading facilities and dealer markets to maintain sufficient capital to 22

cover all operations, and require the CFTC and the Federal Energy Regulatory Commission to meet quarterly and discuss how derivative energy markets are functioning. [S 14, Vote 218, 6/11/03; Oil Daily, 6/11/03] XXXX Voted to Overhaul Regulation of the Accounting Industry. In July 2002, XXXX voted for a bill that would require more complete disclosure of corporate finances and overhaul regulation of the accounting industry. It would establish a new oversight board, funded by fees on publicly traded companies, to police accounting firms. The agreement would forbid firms from providing investment banking, management consulting and other services for publicly traded companies. It would require additional corporate reporting and disclosure requirements. In cases of security fraud, it would impose civil monetary penalties and require executives engaged in financial misconduct to pay back bonuses and profits. The money would be placed in a fund for defrauded investors. It also would bar executive loans. The agreement would create a criminal penalty for securities fraud and obstruction of justice involving document shredding and require top corporate executives to certify company financial statements. [HR 3763, Vote 192, 7/25/02] XXXX Voted for Greater Accountability for SEC Firms. In July 2002, XXXX voted for a bill that would require more complete disclosure of corporate finances and overhaul regulation of the accounting industry. The bill would establish a new oversight board to police accounting firms, and forbid firms from providing investment banking, management consulting and other services for publicly traded companies. It would create new criminal penalties for shareholder fraud and obstruction of justice involving document shredding and require chief executives and chief financial officers to attest to the accuracy of financial statements included in SEC filings. [S 2673, Vote 176, 7/15/02] XXXX Voted to Increase Ethics Requirement for Attorneys Representing SEC Firms. In July 2002, XXXX voted for an amendment that would require the SEC to establish new rules setting professional standards of conduct for attorneys representing public companies who appear before the SEC, including a rule requiring an attorney to report evidence of a material violation of securities law to the company's chief legal counsel or chief executive officer, or to the board of directors if necessary. [S 2673, Vote 175, 7/15/02] XXXX Voted to Pass the Corporate Reform Bill, Which Stiffened Penalties For Fraud And Tightened Oversight Of The Accounting Industry. In 2002, XXXX voted for a corporate reform bill that created stiff penalties for business fraud and tightened oversight of the accounting industry. John McCain and Carl Levin, the only two dissenters to the bill, opposed the bill after their efforts to add other reform measures, such as a proposal that would require companies to count executives’ stock options as an expense against earnings, were rebuffed. The vote was on a motion to invoke cloture on the bill. [S 2673, Vote 173, 7/12/02; Associated Press, 7/12/02] XXXX Voted to Curb Attorney Solicitation. In July 2002, XXXX voted for an amendment that would require attorneys to make a written disclosure of potential fees and other matters before retention by a client. It also would prohibit unsolicited communications concerning a potential civil action for personal injury or wrongful death until 45 days following the incident. Violators would be subject to a maximum penalty of $5,000 for each violation. This was an amendment to the Edwards amendment, which would require the Securities and Exchange Commission (SEC) to establish new rules setting professional standards of conduct for attorneys representing public companies who appear before the SEC, including a rule requiring an attorney to report evidence of a material violation of securities law to the company's chief legal counsel or chief executive officer, or to the board of directors if necessary. [S 2673, Vote 172, 7/11/02] XXXX Voted to Increase Penalties for Corporate Wrongdoing. In July 2002, XXXX voted for an amendment that would increase the maximum sentences for corporate wrongdoing from five years to 10 years. It also would allow the government to charge obstruction against individuals who acted alone, even if tampering took place prior to a grand jury subpoena issuance. It would allow the Securities and Exchange Commission (SEC) to seek an order in federal court imposing a 45 day freeze on "extraordinary" payments to corporate executives and request the Sentencing Commission to adopt stronger penalties for fraud when the crime is committed by a corporate officer or a corporate director. [S 2673, Vote 171, 7/10/02] 23

XXXX Voted to Toughen Penalties for Mail and Wire Fraud. In July 2002, XXXX voted for an amendment that would raise the maximum penalties for mail and wire fraud from five years to 10 years, raise the penalty for federal pension law violations from one year to 10 years, and provide the same penalties for conspiracy as for the underlying crime. It also would direct the U.S. Sentencing Commission to review and amend sentencing guidelines and policy statements to provide for increased penalties to reflect the increases in the maximum penalties provided under the bill. Corporate officials of regulated companies would be required to certify that financial reports accurately reflect the financial condition of the company. It would create criminal penalties of up to five years for recklessly and knowingly failing to certify and up to 10 years for willfully failing to certify. [S 2673, Vote 170, 7/10/02] XXXX Voted to Toughen Penalties for Individuals who Defraud Shareholders. In July 2002, XXXX voted for an amendment that would create a 10-year securities fraud felony for anyone who knowingly defrauds shareholders, and direct the U.S. Sentencing Commission to raise penalties in obstruction of justice cases where evidence is destroyed. It also would create a 10-year felony for the destruction of evidence when records are under subpoena, require the preservation of key financial audits for five years, and create a five-year felony for intentionally destroying such documents. It would provide whistleblower protections for employees of publicly traded companies and lengthen the statute of limitations on securities fraud cases. [S 2673, Vote 169, 7/10/02] XXXX Voted to Allow Financial Institutions to Impose an ATM Surcharge. In 1998, XXXX voted to kill the D’Amato amendment to S.1301, which was an amendment to prohibit financial institutions from imposing a surcharge -- a charge in addition to the interchange fee -- for the use of ATMs. [Vote 275, 9/17/98] XXXX Voted to Allow Credit Card Companies from Terminating Customers Who Avoid Finance Charges. In 1998, XXXX voted to kill the Reed amendment to S.1301, which was an amendment to prohibit credit card companies from terminating or refusing to renew credit to consumers who avoid finance charges by paying off their balances. The amendment also would prohibit creditors from charging such consumers a fee in lieu of finance charges. [Vote 273, 9/17/98] 24