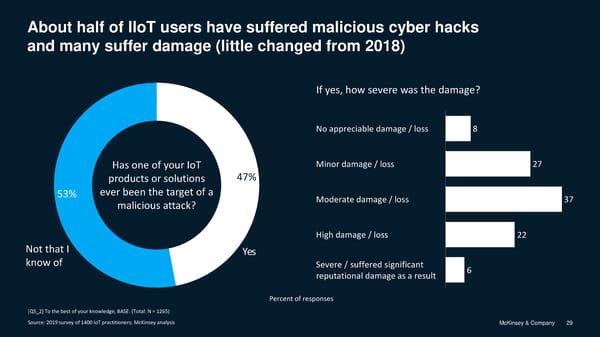

About half of IIoT users have suffered malicious cyber hacks and many suffer damage (little changed from 2018) If yes, how severe was the damage? No appreciable damage / loss 8 Has one of your IoT Minor damage / loss 27 products or solutions 47% 53% ever been the target of a Moderate damage / loss 37 malicious attack? High damage / loss 22 Not that I Yes know of Severe / suffered significant 6 reputational damage as a result Percent of responses [Q5_2] To the best of your knowledge, BASE: (Total: N = 1265) Source: 2019 survey of 1400 IoT practitioners; McKinsey analysis McKinsey & Company 29

Industrial Internet of Things 2019 Impact and Adoption Page 29 Page 31

Industrial Internet of Things 2019 Impact and Adoption Page 29 Page 31