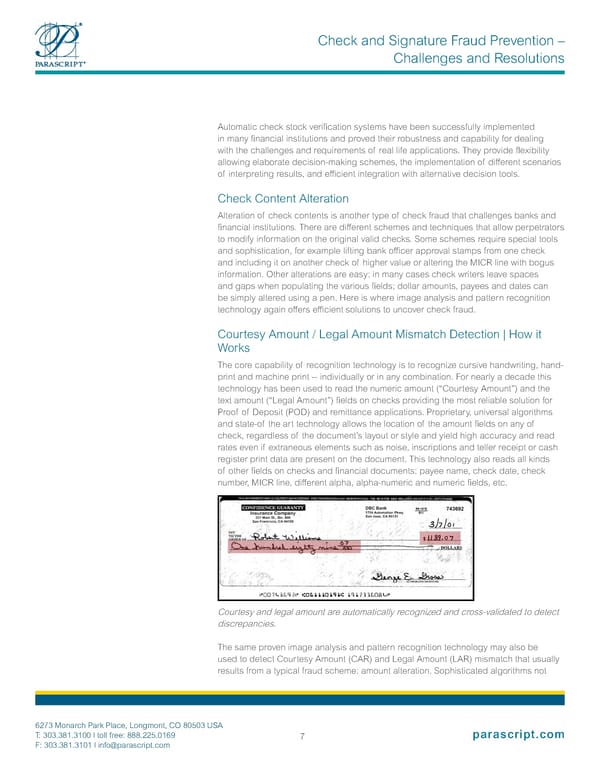

Check and Signature Fraud Prevention – Challenges and Resolutions Automatic check stock verification systems have been successfully implemented in many financial institutions and proved their robustness and capability for dealing with the challenges and requirements of real life applications. They provide flexibility allowing elaborate decision-making schemes, the implementation of different scenarios of interpreting results, and efficient integration with alternative decision tools. Check Content Alteration Alteration of check contents is another type of check fraud that challenges banks and financial institutions. There are different schemes and techniques that allow perpetrators to modify information on the original valid checks. Some schemes require special tools and sophistication, for example lifting bank officer approval stamps from one check and including it on another check of higher value or altering the MICR line with bogus information. Other alterations are easy: in many cases check writers leave spaces and gaps when populating the various fields; dollar amounts, payees and dates can be simply altered using a pen. Here is where image analysis and pattern recognition technology again offers efficient solutions to uncover check fraud. Courtesy Amount / Legal Amount Mismatch Detection | How it Works The core capability of recognition technology is to recognize cursive handwriting, hand- print and machine print -- individually or in any combination. For nearly a decade this technology has been used to read the numeric amount (“Courtesy Amount”) and the text amount (“Legal Amount”) fields on checks providing the most reliable solution for Proof of Deposit (POD) and remittance applications. Proprietary, universal algorithms and state-of the art technology allows the location of the amount fields on any of check, regardless of the document’s layout or style and yield high accuracy and read rates even if extraneous elements such as noise, inscriptions and teller receipt or cash register print data are present on the document. This technology also reads all kinds of other fields on checks and financial documents: payee name, check date, check number, MICR line, different alpha, alpha-numeric and numeric fields, etc. Courtesy and legal amount are automatically recognized and cross-validated to detect discrepancies. The same proven image analysis and pattern recognition technology may also be used to detect Courtesy Amount (CAR) and Legal Amount (LAR) mismatch that usually results from a typical fraud scheme: amount alteration. Sophisticated algorithms not 6273 Monarch Park Place, Longmont, CO 80503 USA | T: 303.381.3100 toll free: 888.225.0169 parascript.com 7 | F: 303.381.3101 [email protected]

White Paper Check and Signature Fraud web Page 6 Page 8

White Paper Check and Signature Fraud web Page 6 Page 8