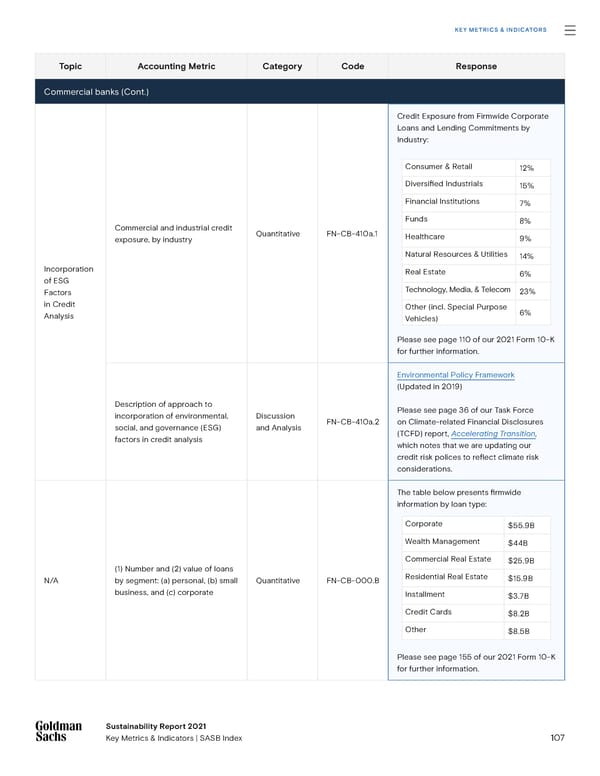

KEY METRICS & INDICATORS Topic Accounting Metric Category Code Response Commercial banks (Cont.) Credit Exposure from Firmwide Corporate Loans and Lending Commitments by Industry: Consumer & Retail 12% Diversi昀椀ed Industrials 15% Financial Institutions 7% Funds 8% Commercial and industrial credit Quantitative FN-CB-410a.1 exposure, by industry Healthcare 9% Natural Resources & Utilities 14% Incorporation Real Estate 6% of ESG Factors Technology, Media, & Telecom 23% in Credit Other (incl. Special Purpose Analysis Vehicles) 6% Please see page 110 of our 2021 Form 10-K for further information. Environmental Policy Framework (Updated in 2019) Description of approach to Please see page 36 of our Task Force incorporation of environmental, Discussion FN-CB-410a.2 on Climate-related Financial Disclosures social, and governance (ESG) and Analysis (TCFD) report, Accelerating Transition, factors in credit analysis which notes that we are updating our credit risk polices to re昀氀ect climate risk considerations. The table below presents 昀椀rmwide information by loan type: Corporate $55.9B Wealth Management $44B Commercial Real Estate $25.9B (1) Number and (2) value of loans N/A by segment: (a) personal, (b) small Quantitative FN-CB-000.B Residential Real Estate $15.9B business, and (c) corporate Installment $3.7B Credit Cards $8.2B Other $8.5B Please see page 155 of our 2021 Form 10-K for further information. SSuussttaaiinnaabbiilliittyy Re Reppoorrtt 2 2002121 KKeey My Meettrriiccs & Is & Innddiiccatatoorrs | Ss ASB Index 107

Goldman Sachs sustainability report Page 106 Page 108

Goldman Sachs sustainability report Page 106 Page 108