2023 Open Enrollment

Make an Investment in yourself

YOUR HEALTH IS YOUR WEALTH Make an Investment in Yourself 2 0 2 3 OPEN 2023 OPEN ENROLLMENT ENROLLMENT September 18, 2023 through October 13, 2023 A

WELCOME TO THE CSU OPEN ENROLLMENT FOR 2024 YOUR HEALTH IS YOUR WEALTH Make an Investment in Yourself 1

OPEN ENROLLMENT BEGINS SEPTEMBER 18, 2023 AND ENDS OCTOBER 13, 2023. This guide is intended to cover plan changes effective January 1, 2024. It provides you with an overview of all available CSU benefts. If you are uncertain which benefts apply to you, check with your campus benefts offce. Your health plan beneft is provided in partnership with the California Public Employees' Retirement System (CalPERS). Full details on health plans are available on the CalPERS website, calpers.ca.gov. Access to your Health Plan Statement will be available online through my|CalPERS on September 11, 2023. If you have any questions, contact the CalPERS Customer Contact Center at (888) CalPERS or (888) 225-7377. TABLE OF CONTENTS Welcome 2 FlexCash 10 Start Planning 3 Vision Plans 11–12 What’s Changing for 2024? 4 Dental Plans 13 Tips for Selecting a Health Plan 5 Basic Life, AD&D and Long-Term Disability 13 CalPERS Health Plan Statement 5 Health Care and Dependent Care Reimbursement Plans 14 Exploring Wellness at the CSU 6 Voluntary Benefts 15–16 Employee and Dependent Eligibility 7 Benefciary Information 17 Understanding How Different Health Plans Work 8 Frequently Asked Questions 17 Health Plans Premium Rates 9–10 Open Enrollment Checklist 18 2

This is a modal window.

START PLANNING Open Enrollment is your annual opportunity to review your benefts, your family's needs and to fne-tune your benefts package to match. Many life events can occur during the year that can affect the types of plans and amount of coverage you need. Think about the changes you and your family have experienced in the past year or anticipate in the coming year. Then determine which beneft plans and programs will suit your needs best. ENROLL OR MAKE CHANGES SEPTEMBER 18, 2023 THROUGH OCTOBER 13, 2023 Ready, Set, Enroll... Please be sure to review this guide in its entirety, because it provides The following benefts are not restricted to Open Enrollment, but we important changes for 2024 and an overview of all available benefts. encourage you to review them during this time: During Open Enrollment, you can enroll in, change or cancel the • 403(b) Supplemental Retirement Plan following beneft plans: • Fee Waiver and Reduction Program • CalPERS Health • Empathia - Employee Assistance Program • Delta Dental (employees are automatically enrolled) • Dependent Care Reimbursement Account (must re-enroll • The Standard Insurance (voluntary life, AD&D, each year) long-term disability) • Health Care Reimbursement Account (must re-enroll each year) • California Casualty Auto, Home and Renters Insurance • ARAG Legal Insurance (enrollment and cancellation may occur • Nationwide Pet Insurance only during Open Enrollment) • Vision Service Plan (VSP) Basic and Premier Plans (enrollment and cancellation may occur only during Open Enrollment for the Premier Plan) − The Premier Plan can only be canceled during Open Enrollment after completing 12 months of enrollment • The Standard Critical and Accident Insurance 3

WHAT’S CHANGING FOR 2024 CSU Health Plans: The CalPERS Board of Administration administers the health plans on behalf of the CSU. Monthly costs vary depending on the health plan you choose. You can view a snapshot of your 2024 monthly costs on pages 8-9 of this guide. ! ATTENTION 2024 Health Plan Expansions OVERVIEW OF PLAN CHANGES EFFECTIVE FOR 2024 Health Plan Rate Changes Legal Insurance Plan Carrier Change Effective January 1, 2024, rates for most health plans will change. and Enhancements Please refer to pages 8-9 to review the monthly employee cost. Effective January 1, 2024 voluntary legal insurance benefts will now ® HealthNet Smart Care Removed from the be provided by ARAG . You’ll receive greater legal protection with no CalPERS Health Program loss in coverage at a lower price. ARAG offers you access to local network attorneys who can help you address life’s legal situations. Effective January 1, 2024, HealthNet Smart Care will no longer be Plus, network attorney fees are 100% paid in full for most covered an available health plan to CSU employees. Employees who are in matters. ARAG legal plan coverage can only be enrolled in during this plan will need to elect a different health plan coverage during Open Enrollment. Open Enrollment. Employees currently enrolled in HealthNet Smart Care will be administratively transferred to Blue Shield Access+ effective January 1, 2024 if they don’t make a plan change. Members in Napa County will be transferred to Western Health Advantage, effective January 1, 2024 if a plan change is not made. • Blue Shield Access+ EPO plan expansion into Del Norte and San Benito counties. • UnitedHealthcare Harmony HMO plan expansion into Santa Clara and Santa Cruz counties. Health Plan Exit • Anthem Traditional from Glenn County: Members, and their dependents who live in Glenn County who do not choose another health plan during Open Enrollment, will automatically be enrolled in Blue Shield Access+ effective January 1, 2024. 4

This is a modal window.

TIPS FOR SELECTING A HEALTH PLAN You may want to consider factors such as access to doctors, range of benefts, cost of services, monthly premiums, restrictions to specifc groups of doctors, referral and authorization by a primary care physician (PCP), and access to specialist or prescription drugs and restriction on a plan formulary or list of preferred drugs. Other tips to keep in mind: • Identify your needs and the needs of your family members. • Understand the basics of how your health plan’s network is managed e.g., whether it's a PPO, EPO or HMO plan (See page 7). • Consider your out-of-pocket costs, as well as copays for prescription drugs, offce visits, lab tests and hospitalization. • Review your health plan availability by county and ZIP code. • Review your health plan’s covered benefts and exclusions. • Consider any life changes that may occur during the upcoming year. • Consider coverage if you travel or have a dependent in college in another state. CALPERS HEALTH PLAN STATEMENT The CalPERS Health Plan Statement will be available online September 11, 2023. The online statement will: • Allow you 24/7 access to view and/or print your customized health enrollment information. • Inform you of specifc health beneft changes that may affect you in the upcoming year. • Provide you with direct access to all CalPERS Open Enrollment information. Other available resources include the 2024 Health Beneft Summary, Health Program Guide, Evidence of Coverage, Open Enrollment Newsletter and the health plan websites. Log in to your personalized my|CalPERS account to access your online statement. If you do not have a CalPERS account, create one by going to the my|CalPERS login page and select “Register Now.” Please note, CSU employees are not able to change their health plan through the my|CalPERS system. Contact your campus human resources/benefts offce for additional information. To identify the available plans in your area, use the CalPERS online tool, Health Plan Search by Zip Code. 5

EXPLORING WELLNESS AT THE CSU In partnership with our vendors providing health, dental, vision, employee assistance program and fnancial wellness, the CSU is committed to promoting a culture of wellness through healthy lifestyles that enhance the quality of life for our faculty and staff. Wellness is a lifestyle that integrates body, mind and spirit. The CSU encourages faculty and staff to participate in programs, activities and services that contribute to their wellness and the wellness of CSU communities. Featured below are the wellness programs employees may participate in. Good health is more than not being ill, it’s also a dynamic state of well-being that acknowledges the importance and inseparability of wellness. Check with your campus human resources/benefts offce for further details about these programs. Emotional Wellness— Physical Wellness— Intellectual Wellness— How you feel How you live How you think CSU campuses provide Employee CSU health plans offered through CSU faculty and staff have access Assistance Program (EAP) offered CalPERS feature many programs and to programs designed to enhance through Empathia to both staff and classes promoting a healthier you. professional development, expand faculty. EAPs provide free, confdential Many CSU campuses have wellness knowledge and improve skills. The counseling and referral services. programs that encourage healthy CSU Fee Waiver and Reduction Employees have 24-hour access to living and eating. Program provides CSU employees confdential services supporting and their eligible dependents the emotional well-being, safety and opportunity to attend classes at CSU productivity in the workplace. campuses at reduced rates. Fee waiver courses include undergraduate, graduate, credential, online and summer term courses if they are state-supported. Occupational Wellness— Financial Wellness— How you perform How you manage your fnances The CSU supports occupational wellness by assisting Financial wellness is a critical part of employee well-being employees in their career development. At the CSU, because money can be a huge source of anxiety. The Learning and Development provides options for employees CSU offers many programs to help employees become to expand their job-related learning. We believe learning is fnancially ft. They include CalPERS retirement, income a lifelong process that can enhance employees’ personal protection benefts (including life insurance and disability) and professional development. Through CSULearn, and investment options for future fnancial security through systemwide Learning and Development offers a myriad the CSU Supplemental Retirement Plan 403(b). Fidelity of self-paced e-learning courses, books, videos and Investments offers employees free personalized fnancial on-the-job trainings that are available 24/7. This provides counseling and helps with maximizing retirement savings CSU employees an opportunity to expand their skills and and other fnancial goals. knowledge and potentially advance in the workplace. 6

This is a modal window.

ELIGIBILITY • To qualify for most benefts, you must initially have employment exceeding six months, with a time base of at least .50. • Academic-year lecturers and coaches are eligible for benefts if appointed for a minimum of one semester or two consecutive quarters with a time base of .40 or greater. • Affordable Care Act (ACA)—Employees who do not meet eligibility requirements listed above may qualify for health care under ACA. • If you do not meet any of the eligibility criteria above, you may still be eligible to enroll in many of the voluntary plans. DEPENDENT ELIGIBILITY Dependents of an eligible employee include: • Spouse (unless legally separated or divorced); • Domestic partner (registered through the California secretary of state process); and • Dependent children from birth to the end of the month in which the child turns 26. A dependent child includes a step, natural, adopted, domestic partner’s, a child certifed disabled before age 26 or a child living with the employee in a parent-child relationship and is economically dependent upon the employee. For a list of required supporting documentation, please contact your campus benefts offce. 7

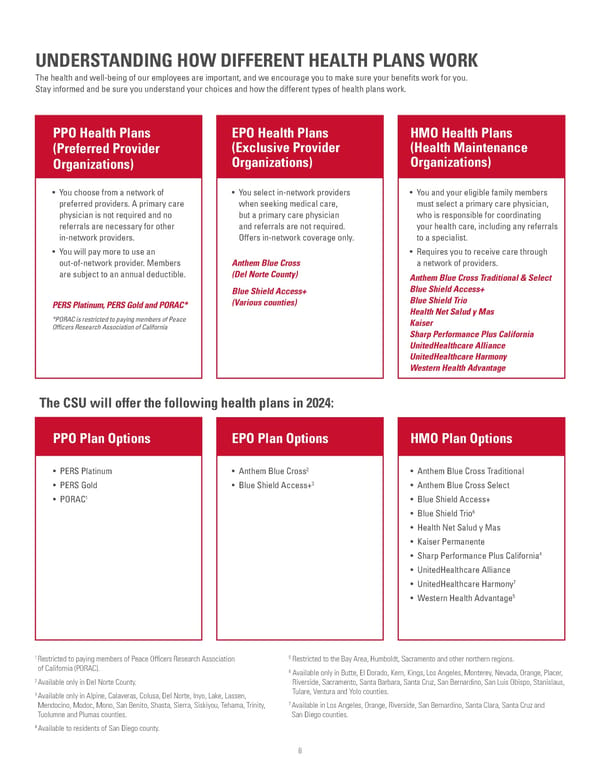

UNDERSTANDING HOW DIFFERENT HEALTH PLANS WORK The health and well-being of our employees are important, and we encourage you to make sure your benefts work for you. Stay informed and be sure you understand your choices and how the different types of health plans work. PPO Health Plans EPO Health Plans HMO Health Plans (Preferred Provider (Exclusive Provider (Health Maintenance Organizations) Organizations) Organizations) • You choose from a network of • You select in-network providers • You and your eligible family members preferred providers. A primary care when seeking medical care, must select a primary care physician, physician is not required and no but a primary care physician who is responsible for coordinating referrals are necessary for other and referrals are not required. your health care, including any referrals in-network providers. Offers in-network coverage only. to a specialist. • You will pay more to use an • Requires you to receive care through out-of-network provider. Members Anthem Blue Cross a network of providers. are subject to an annual deductible. (Del Norte County) Anthem Blue Cross Traditional & Select Blue Shield Access+ Blue Shield Access+ PERS Platinum, PERS Gold and PORAC* (Various counties) Blue Shield Trio Health Net Salud y Mas *PORAC is restricted to paying members of Peace Kaiser Offcers Research Association of California Sharp Performance Plus California UnitedHealthcare Alliance UnitedHealthcare Harmony Western Health Advantage The CSU will offer the following health plans in 2024: PPO Plan Options EPO Plan Options HMO Plan Options 2 • PERS Platinum • Anthem Blue Cross • Anthem Blue Cross Traditional 3 • PERS Gold • Blue Shield Access+ • Anthem Blue Cross Select • PORAC1 • Blue Shield Access+ 6 • Blue Shield Trio • Health Net Salud y Mas • Kaiser Permanente 4 • Sharp Performance Plus California • UnitedHealthcare Alliance 7 • UnitedHealthcare Harmony 5 • Western Health Advantage 1 5 Restricted to paying members of Peace Offcers Research Association Restricted to the Bay Area, Humboldt, Sacramento and other northern regions. of California (PORAC). 6 Available only in Butte, El Dorado, Kern, Kings, Los Angeles, Monterey, Nevada, Orange, Placer, 2 Available only in Del Norte County. Riverside, Sacramento, Santa Barbara, Santa Cruz, San Bernardino, San Luis Obispo, Stanislaus, 3 Tulare, Ventura and Yolo counties. Available only in Alpine, Calaveras, Colusa, Del Norte, Inyo, Lake, Lassen, 7 Mendocino, Modoc, Mono, San Benito, Shasta, Sierra, Siskiyou, Tehama, Trinity, Available in Los Angeles, Orange, Riverside, San Bernardino, Santa Clara, Santa Cruz and Tuolumne and Plumas counties. San Diego counties. 4 Available to residents of San Diego county. 8

2024 CalPERS HEALTH BENEFITS PROGRAM BASIC PLAN RATES Monthly Employee Cost All Employee Groups Unit 6 Enrolled 2024 (except Unit 6) HEALTH PLAN Employee Total 2024 2024 2023 2024 2024 2023 & Eligible Monthly Amount Amount Amount Amount Amount Amount Dependents Premium Paid by Paid by Paid by Paid by Paid by Paid by CSU Employee Employee CSU Employee Employee ANTHEM BLUE CROSS Employee Only $925.57 $925.57 $0.00 $20.85 $925.57 $0.00 $15.85 SELECT HMO CALIFORNIA Employee + 1 $1,851.14 $1,851.14 $0.00 $108.70 $1,851.14 $0.00 $98.70 Employee + 2 or more $2,406.48 $2,366.00 $40.48 $226.01 $2,386.00 $20.48 $206.01 ANTHEM BLUE CROSS Employee Only $1,197.94 $983.00 $214.94 $233.65 $988.00 $209.94 $228.65 TRADITIONAL HMO Employee + 1 $2,395.88 $1,890.00 $505.88 $534.30 $1,900.00 $495.88 $524.30 CALIFORNIA Employee + 2 or more $3,114.64 $2,366.00 $748.64 $779.29 $2,386.00 $728.64 $759.29 ANTHEM BLUE CROSS EPO Employee Only $1,215.87 $983.00 $232.87 $200.89 $988.00 $227.87 $195.89 CALIFORNIA Employee + 1 $2,431.74 $1,890.00 $541.74 $468.78 $1,900.00 $531.74 $458.78 (Restricted to Del Norte County) Employee + 2 or more $3,161.26 $2,366.00 $795.26 $694.11 $2,386.00 $775.26 $674.11 BLUE SHIELD ACCESS+ Employee Only $892.49 $892.49 $0.00 $0.00 $892.49 $0.00 $0.00 CALIFORNIA Employee + 1 $1,784.98 $1,784.98 $0.00 $0.00 $1,784.98 $0.00 $0.00 Employee + 2 or more $2,320.47 $2,320.47 $0.00 $66.79 $2,320.47 $0.00 $46.79 BLUE SHIELD ACCESS+ Employee Only $892.49 $892.49 $0.00 $0.00 $892.49 $0.00 $0.00 EPO CALIFORNIA Employee + 1 $1,784.98 $1,784.98 $0.00 $0.00 $1,784.98 $0.00 $0.00 (Restricted to certain counties) Employee + 2 or more $2,320.47 $2,320.47 $0.00 $66.79 $2,320.47 $0.00 $46.79 BLUE SHIELD TRIO Employee Only $810.24 $810.24 $0.00 $0.00 $810.24 $0.00 $0.00 (Restricted to certain counties) Employee + 1 $1,620.48 $1,620.48 $0.00 $0.00 $1,620.48 $0.00 $0.00 Employee + 2 or more $2,106.62 $2,106.62 $0.00 $0.00 $2,106.62 $0.00 $0.00 HEALTH NET SALUD Y MAS Employee Only $656.96 $656.96 $0.00 $0.00 $656.96 $0.00 $0.00 CALIFORNIA Employee + 1 $1,313.92 $1,313.92 $0.00 $0.00 $1,313.92 $0.00 $0.00 Employee + 2 or more $1,708.10 $1,708.10 $0.00 $0.00 $1,708.10 $0.00 $0.00 KAISER PERMANENTE Employee Only $964.15 $964.15 $0.00 $0.00 $964.15 $0.00 $0.00 CALIFORNIA Employee + 1 $1,928.30 $1,890.00 $38.30 $6.36 $1,900.00 $28.30 $0.00 Employee + 2 or more $2,506.79 $2,366.00 $140.79 $92.97 $2,386.00 $120.79 $72.97 STATE EMPLOYER MONTHLY CONTRIBUTION RATE The employer contribution rates below are what the CSU contributes toward your monthly health premium. The employee cost shown above is any amount above the employer contribution. Coverage Level All Employees Unit 6 (except Unit 6) Employee Only $983 $988 Employee + One $1,890 $1,900 Employee + Family $2,366 $2,386 9

2024 CalPERS HEALTH BENEFITS PROGRAM BASIC PLAN RATES Monthly Employee Cost All Employee Groups Unit 6 Enrolled 2024 (except Unit 6) HEALTH PLAN Employee Total 2024 2024 2023 2024 2024 2023 & Eligible Monthly Amount Amount Amount Amount Amount Amount Dependents Premium Paid by Paid by Paid by Paid by Paid by Paid by CSU Employee Employee CSU Employee Employee KAISER PERMANENTE - Employee Only $1,312.45 $983.00 $329.45 $272.43 $988.00 $324.45 $267.43 OUT OF STATE Employee + 1 $2,624.90 $1,890.00 $734.90 $611.86 $1,900.00 $724.90 $601.86 Employee + 2 or more $3,412.37 $2,366.00 $1,046.37 $880.12 $2,386.00 $1,026.37 $860.12 PERS PLATINUM Employee Only $1,215.87 $983.00 $232.87 $200.89 $988.00 $227.87 $195.89 Employee + 1 $2,431.74 $1,890.00 $541.74 $468.78 $1,900.00 $531.74 $458.78 Employee + 2 or more $3,161.26 $2,366.00 $795.26 $694.11 $2,386.00 $775.26 $674.11 PERS GOLD Employee Only $859.31 $859.31 $0.00 $0.00 $859.31 $0.00 $0.00 Employee + 1 $1,718.62 $1,718.62 $0.00 $0.00 $1,718.62 $0.00 $0.00 Employee + 2 or more $2,234.21 $2,234.21 $0.00 $0.00 $2,234.21 $0.00 $0.00 PEACE OFFICERS RESEARCH Employee Only $853.00 $853.00 $0.00 $0.00 ASSOCIATION OF CALIFORNIA Employee + 1 $1,708.00 $1,708.00 $0.00 $0.00 N/A N/A N/A (PORAC)* Employee + 2 or more $2,220.00 $2,220.00 $0.00 $0.00 SHARP PERFORMANCE PLUS Employee Only $833.24 $833.24 $0.00 $0.00 $833.24 $0.00 $0.00 CALIFORNIA Employee + 1 $1,666.48 $1,666.48 $0.00 $0.00 $1,666.48 $0.00 $0.00 (Restricted to San Diego County) Employee + 2 or more $2,166.42 $2,166.42 $0.00 $0.00 $2,166.42 $0.00 $0.00 Employee Only $882.98 $882.98 $0.00 $0.00 $882.98 $0.00 $0.00 UNITEDHEALTHCARE ALLIANCE HMO CALIFORNIA Employee + 1 $1,765.96 $1,765.96 $0.00 $0.00 $1,765.96 $0.00 $0.00 Employee + 2 or more $2,295.75 $2,295.75 $0.00 $64.47 $2,295.75 $0.00 $44.47 UNITEDHEALTHCARE Employee Only $763.70 $763.70 $0.00 $0.00 $763.70 $0.00 $0.00 HARMONY HMO CALIFORNIA Employee + 1 $1,527.40 $1,527.40 $0.00 $0.00 $1,527.40 $0.00 $0.00 Employee + 2 or more $1,985.62 $1,985.62 $0.00 $0.00 $1,985.62 $0.00 $0.00 WESTERN HEALTH Employee Only $807.23 $807.23 $0.00 $0.00 $807.23 $0.00 $0.00 ADVANTAGE Employee + 1 $1,614.46 $1,614.46 $0.00 $0.00 $1,614.46 $0.00 $0.00 (Restricted to Bay Area, Sacramento and other Northern regions) Employee + 2 or more $2,098.80 $2,098.80 $0.00 $0.00 $2,098.80 $0.00 $0.00 *This plan is restricted to employees in Unit 8, State University Police Association (SUPA) and requires membership. FLEXCASH FlexCash is available if you are eligible for health and dental coverage FlexCash Amount and have other non-CSU group medical and/or dental coverage. During Open Enrollment, you may enroll in or make changes to your Medical $128 existing FlexCash election. Dental $12 Total $140 10

VISION PLANS The CSU’s Vision Service Plan Basic and Premier Vision Service Plan (VSP) The CSU automatically provides the Basic plan for eligible employees and their families at no cost to the employee. Employees also have the option to upgrade to the Premier plan for a small monthly fee. If the employee elects the Premier plan, any dependents they wish to cover must also be enrolled. For additional information, visit csuactives.vspforme.com or call (800) 400-4569. Overview of the Basic and Premier Plan Eligibility Premier Vision Plans Eligibility requirements are the same across all plans (health, dental Eye exams are an important part of overall health care for the entire and vision) and defned in this guide under eligibility. However, unlike family. The Vision Benefts Summary on the next page may help you with health and dental, the Premier Plan requires all dependents to decide which plan best fts the needs of you and your family. also be enrolled in the Premier Plan coverage or they will lose their Basic vision coverage. You cannot enroll in the Basic and Premier The VSP offers a large network of contracting providers, including vision plans at the same time or split enrollments by leaving any optometrists and ophthalmologists. When a contracting network dependents in the Basic vision plan. provider is used, the care is considered “in-network.” Out-of-pocket Monthly Cost of Coverage costs will be less, and the highest level of benefts is received. If a provider outside the network is used, the care is considered “out-of- Enrolled Employee and Basic Premier network.” Coverage is still provided, but the out-of-pocket costs will be signifcantly higher. Eligible Dependents Plan Plan Which Plan Is Right for You? Employee Only $0 $4.03 The plans utilize the VSP network of providers, but your out-of-pocket costs associated with the plans will vary. Employee + One $0 $15.01 The best vision plan for you depends on several factors: Employee + Family $0 $28.41 • What are your anticipated vision expenses for 2024? • What can you afford to pay out of pocket (in terms of copayments) when vision care is needed? • Do you have other vision insurance? Employee Coverage for CSU CSU and VSP provide you with a choice of affordable vision plans. You have a choice between the Basic Plan, or may upgrade to the Premier Plan for enhanced benefts. • Basic Plan: Advantage Premier Network • Premier Plan: Choice Network 11

YOUR VSP VISION BENEFITS SUMMARY Coverage with a VSP Provider—Basic Plan Coverage with a VSP Provider—Premier Plan Beneft Description Copay Beneft Description Copay WellVision • Focuses on your eyes and overall wellness $10 WellVision • Focuses on your eyes and overall wellness $10 Exam • Routine retinal imaging Up to $39 Exam • Routine retinal imaging Up to $39 • Every calendar year • Every calendar year • Retinal imaging for members with diabetes • Retinal imaging for members with diabetes covered-in-full. covered-in-full. • Additional exams and services beyond routine care $20 • Additional exams and services beyond routine care $20 Essential to treat immediate issues from pink eye to sudden per exam Essential to treat immediate issues from pink eye to sudden per exam Medical Eye changes in vision or to monitor ongoing conditions Medical Eye changes in vision or to monitor ongoing conditions Care such as dry eye, diabetic eye disease, glaucoma Care such as dry eye, diabetic eye disease, glaucoma and more. and more. • Coordination with your medical coverage may apply. • Coordination with your medical coverage may apply. Ask your VSP network doctor for details. Ask your VSP network doctor for details. • Available as needed • Available as needed Prescription Glasses Prescription Glasses • $110 allowance for a wide selection of frames • $210 allowance for a wide selection of frames • $130 allowance for featured frame brands • $230 allowance for featured frame brands Frame • 20% savings on the amount over your allowance Frame* • 20% savings on the amount over your allowance • Every other calendar year • $115 Walmart/Sam’s Club/Costco frame allowance $0 • Every calendar year $0 • Single vision, lined bifocal, and lined trifocal lenses • Single vision, lined bifocal, and lined trifocal lenses Lenses • Impact-resistant lenses for dependent children Lenses • Impact-resistant lenses for dependent children † • Every other calendar year • Every calendar year • UV protection $0 • UV protection $0 • Standard progressive lenses $55 • Tinted lenses $0 Lens • Premium progressive lenses $95-$105 Lens • Standard progressive lenses $0 Enhancements • Custom progressive lenses $150-$175 Enhancements • Premium progressive lenses $95-$105 • Average savings of 20–25% on other lens • Custom progressive lenses $150-$175 enhancements • Average savings of 30% on other lens enhancements • Every other calendar year • Every calendar year Contacts • $120 allowance for contacts and contact lens exam Contacts • $200 allowance for contacts and contact lens exam (ftting and evaluation) (ftting and evaluation) • 15% savings on a contact lens exam • 15% savings on a contact lens exam (instead of $0 (instead of $0 glasses) (ftting and evaluation) glasses) (ftting and evaluation) † • Every calendar year • Every other calendar year • $110 allowance for ready-made non-prescription • $210 allowance for ready-made non-prescription VSP sunglasses, or ready-made non-prescription blue VSP sunglasses, or ready-made non-prescription blue light fltering glasses, instead of prescription glasses $0 TM TM light fltering glasses, instead of prescription glasses $0 Lightcare * or contacts. Lightcare * or contacts. • Every other calendar year • Every calendar year VSP Computer • Evaluates your vision needs related to computer use Vision Care • $95 allowance for a wide selection of frames (Employee-only • Single vision, lined bifocal, lined trifocal and occupational lenses $10 † coverage) • Every other calendar year Glasses and Sunglasses • Discover all current eyewear offers and savings at vsp.com/offers • 20% savings on additional glasses and sunglasses, including lens enhancements, from any VSP provider within 12 months of your WellVision Exam. Additional Exclusive Member Extras Savings • Save up to 60% on digital hearing aids with TruHearing. Visit vsp.com/offers/special-offers/hearing-aids for details. • Contact lens rebates, lens satisfaction guarantees, and more offers at vsp.com/offers. • Everyday savings on entertainment, health and wellness, travel and more with VSP Simple Values. Laser Vision Correction • Average of 15% off the regular price; discounts available at contracted facilities. †Only available to VSP members with applicable plan benefts. Frame brands and promotions are subject to change. ‡Savings based on doctor’s retail price and vary by plan and purchase selection; average savings determined after benefts are applied. Ask your VSP network doctor for more details. *Coverage with a retail chain may be different or not apply. †New lenses will be approved every calendar year if the new prescription differs from the original by at least .50 diopter sphere or cylinder, there’s a change in the axis of 15 degrees or more, or a difference in vertical prism greater than one prism. VSP guarantees member satisfaction from VSP providers only. Coverage information is subject to change. In the event of a confict between this information and your organization’s contract with VSP, the terms of the contract will prevail. Based on applicable laws, benefts may vary by location. In the state of Washington, VSP Vision Care, Inc., is the legal name of the corporation through which VSP does business. TruHearing is not available directly from VSP in the states of California and Washington. To learn about your privacy rights and how your protected health information may be used, see the VSP Notice of Privacy Practices on vsp.com. ©2023 Vision Service Plan. All rights reserved. VSP, Eyeconic, and WellVision Exam are registered trademarks, and VSP LightCare and VSP Premier Edge are trademarks of Vision Service Plan. Flexon and Dragon are registered trademarks of Marchon Eyewear, Inc. All other brands or marks are the property of their respective owners. 104702 VCCM 12

DENTAL PLANS Delta Dental and DeltaCare USA The CSU pays 100% of the monthly premium cost for dental coverage for you and your eligible dependents, including a spouse or a registered domestic partner and/or children up to age 26. For additional information, visit deltadentalins.com/csu, or call (800) 626-3108 if you are enrolled in the Delta Dental PPO Plan. Call (844) 519-8751 if enrolled in the DeltaCare USA Plan. When it comes to choosing a dental plan, you want benefts to ft the needs of you and your family. Delta Dental PPO and DeltaCare USA both offer comprehensive dental coverage, quality care and excellent customer service. REMINDER: Recent Enhancements for the SmileWay Wellness Beneft available under the Delta Dental PPO Plan includes: • When you visit a PPO dentist, your diagnostic and preventive services (such as cleanings and exams) will not count toward your maximum. • Enhanced coverage has been added for gum disease associated with a number of diagnosed systemic conditions (amyotrophic lateral sclerosis (ALS), cancer, chronic kidney disease, diabetes, heart disease, HIV/AIDS, Huntington’s disease, joint replacement, lupus, opiod misuse and addiction, Parkinson’s disease, rheumatoid arthritis, Sjogren’s syndrome or stroke). Delta Dental PPO DeltaCare USA This plan allows you to select the dentist of your choice. A prepaid dental health maintenance organization (DHMO) Both you and Delta Dental have a shared responsibility of is available for California residents only. All covered dental paying the dentist for services rendered. If you choose a services must be performed by DeltaCare USA panel dentists. dentist who participates in the Delta Dental PPO network No claim forms are required. Each covered dental service and/or the Delta Dental Premier network in California, claims has a specifc copayment amount and several services are will be fled on your behalf. covered at no charge. You will receive an identifcation card Please note: If you select a dentist from the Delta Dental PPO Network, you will and welcome letter, which lists your DeltaCare USA panel pay less in out-of-pocket expenses. dentist. The welcome letter will list your DeltaCare USA panel dentist. You may change your assigned dentist by contacting DeltaCare USA. OTHER EMPLOYER-PROVIDED BENEFITS CSU Employer-Paid Basic Life, AD&D and Long-Term Disability The CSU provides Basic Life, Accidental Death & Dismemberment (AD&D) and Long-Term Disability (LTD) to specifc employee groups at no cost through The Standard. Some components of the Basic Life insurance contain travel assistance, portability of insurance, funeral arrangements, identity theft prevention and estate planning. LTD insurance is intended to replace a portion of your income by providing a monthly beneft if you cannot work for an extended period of time because of illness or injury. 13

HEALTH CARE & DEPENDENT CARE REIMBURSEMENT PLANS Health Care Reimbursement Account Plan This plan allows you to set aside a portion of your pay on a pretax basis to reimburse yourself for eligible health, dental and vision care expenses for you, your spouse/registered domestic partner and eligible dependent(s). You may contribute up to $3,050 for the 2024 plan year through payroll deduction. Enrollment in the Health Care Reimbursement Account (HCRA) is required each year along with your designated contribution amounts. The 2024 monthly maximum is $254.16. ASIFlex is the claims administrator for this plan. Debit Card ASIFlex Mobile App FSAstore You can check your balance from The ASIFlex Card (a limited use Employees can purchase eligible products and pre-paid debit card) provides an the palm of your hand with the services through the Flexible Spending Account easy way to pay for out-of-pocket ASIFlex Mobile App. Submit claims (FSA) site, FSAstore. FSAstore.com has the health care expenses for you, your from anywhere, anytime. The app is largest inventory of FSA-eligible products and spouse, and any tax dependents. available to download in the Apple services on the web. It’s a website you can trust to The advantage of the card is that Store and Google Play. provide competitive pricing and quick turnaround you do not have to pay with cash or for Flexible Spending Account information and a personal credit card. The ASIFlex shopping. Cardless pay is now available through Card will allow you to pay directly the FSAstore by simply choosing the ASIFlex from your health care account and Payment option during the checkout process. Most can be used at health care providers FSA debit cards, as well as all major credit cards that accept VISA and certain retail are accepted. Please note: although it accepts merchants that inventory eligible FSA debit cards, ASIFlex might require a receipt for health care products. your purchase to substantiate the claim. Additional information about both plans can be obtained at asiflex.com or by calling ASIFlex at (800) 659-3035. Dependent Care Reimbursement Account Plan The Dependent Care Reimbursement Account plan (DCRA) allows you to set aside a portion of your pay on a pretax basis to reimburse yourself for childcare expenses for your eligible dependent child(ren) under the age of 13. Additionally, if you have an older dependent who lives with you and requires assistance with day-to-day living and is listed as a dependent on your annual tax return, you can claim these eligible expenses through your DCRA. You may contribute up to $5,000 each plan year ($2,500 if married, fling a separate tax return) through payroll deduction. Neither contributions nor reimbursements are taxed. Enrollment in the DCRA is required each year along with your designated contribution amounts. The 2024 monthly maximum amount is $416.66. ASIFlex is the claims administrator for this plan. 14

VOLUNTARY BENEFITS Critical Illness Group Critical Illness Insurance is offered through The Standard, which provides a lump-sum payment to cover out-of-pocket medical expenses and costs associated with life changes following the diagnosis of a covered critical illness. In addition, there are cash benefts for specifed health screenings. You and/or your spouse/registered domestic partner must be between the ages of 18-64 and enrolled in a health insurance plan to participate in this plan. To learn more about this beneft and/or enroll, go to standard.com/mybenefits/csu or call (800) 378-5745. Accident Insurance Accidents can happen when least expected, and while they can’t always be prevented, you can have the fnancial support to make your recovery less expensive and stressful. This insurance, provided by The Standard, can help with out-of-pocket expenses such as deductibles, copays, transportation to medical centers, and more. To learn more about this beneft and/or enroll, go to standard.com/mybenefits/csu or call (800) 378-5745. Legal Insurance ® You can’t predict the future, but you can plan for it. An ARAG legal insurance plan isn’t just for the serious issues. It’s for events you plan for, like getting married or creating a will. Or the unexpected situations, like a traffc ticket or landlord dispute. Network attorney fees are 100% paid in full for most covered matters. Beneft from a wide range of coverage and services to protect you and your loved ones. Employees can enroll only during open enrollment. To learn more about this plan and enroll, go to ARAGlegal.com/CSU or call (800) 247-4184. Auto, Home and Renters Insurance Discounted auto, home and renters insurance is offered exclusively to all CSU employees (excluding rehired annuitants and students) through California Casualty. Employees can save an average of over $500 and receive unique benefts like: free/waived deductible if your vehicle is hit/vandalized on campus, identity theft protection, 12-month rate lock guarantee, no charge personal property coverage up to $500 and payroll deduction available at no cost to active employees or monthly E-Z Pay Plans with skip payment options. Employees can enroll at any time. For more insurance information, safety resources or to get a quote, visit calcas.com/csu or call (866) 680-5142. Life Insurance You have the opportunity to purchase group life insurance for you and your eligible dependents. Employees have the opportunity to enroll or increase supplemental life insurance at any time. However, evidence of insurability may be required. To learn more about this beneft and/or to enroll, go to standard.com/mybenefits/csu or call (800) 378-5745. Long-Term Disability (LTD) You have the opportunity to purchase a level of group disability insurance with either a 30-day or 90-day waiting period. Employees automatically enrolled in the CSU employer-paid LTD plan are not eligible to participate in this voluntary plan. To learn more about this beneft and/or to enroll, go to standard.com/mybenefits/csu or call (800) 378-5745. Accidental Death and Dismemberment (AD&D) Insurance You are eligible to purchase group Accidental Death and Dismemberment (AD&D) insurance that covers you and your dependents in the event of death or dismemberment as a result of a covered accident. You may elect up to $1 million in coverage. Coverage for spouse/registered domestic partner and dependent child(ren) coverage are also available. To learn more about this beneft and/or to enroll, go to standard.com/mybenefits/csu or call (800) 378-5745. 15

California State University (CSU) 403(b) Nationwide Pet Insurance Supplemental Retirement Plan (SRP) Whether they have two legs or four, every family member deserves The CSU provides you the opportunity to participate in the 403(b) quality health care. That’s why this pet health insurance gives you the Supplemental Retirement Plan (SRP). The SRP is a voluntary program freedom to use any vet, anywhere, including specialist and emergency that can help you save money on taxes, invest in your future and providers. Nationwide offers various beneft options for your pets. supplement your income in retirement. By contributing into the This insurance can cover your pet’s accidents, illness and even CSU 403(b) SRP, you can improve your chances of reaching your preventive care and wellness services. Plans are available for dogs, retirement goals. cats, birds, small mammals and exotics (such as reptiles). To learn more about this plan and/or to enroll, visit petinsurance.com/calstate or call Whether retirement is a long way off or right around the corner, by (877) 738-7874. participating in the CSU 403(b) SRP, you could make a big difference in Empathia Life Matters preparing for your future. Start with what you can and build from there. The important thing is that you start! Employee Assistance Program (EAP) There are two ways you can contribute: The Employee Assistance Program provides free, confdential Pretax Option counseling and referral services to eligible employees and members Save for retirement by investing monthly pretax contributions in of their household—including dependents living away from home— tax-deferred investments. Pretax contributions mean more savings go 24-hour access to confdential services that support emotional toward your retirement goals than after-tax savings. well-being, safety and productivity in the workplace. This program is provided by the CSU as part of the state’s commitment to promoting Roth Contribution (After-Tax) Option employee health and well-being. It is offered at no charge to you Unlike a traditional pretax 403(b), a Roth 403(b) allows you to contribute and is a valuable source of support and information during diffcult after-tax dollars and then withdraw tax-free dollars from your account times as well as consultations on day-to-day concerns. The EAP is an when you retire. assessment, short-term counseling and referral service designed to Advantages of saving in the CSU 403(b) SRP: assist you and your family in managing everyday concerns. In addition to in-person EAP counseling, LifeMatters offers phone counseling • Easy and convenient—Contributions are automatically deducted sessions by appointment. These sessions may be scheduled through the from your pay. program’s toll-free number and are conducted by providers located and • Tax-advantaged—Both pretax and Roth options available. licensed in the state of California. To access benefts, please call • Variety of investment options—It’s easy to fnd an investment (800) 367-7474, or visit Life Matters online at mylifematters.com. strategy that helps you meet your goals. Contact your campus benefts offce for your campus-assigned password. • Guidance and education—Free consultations with Fidelity retirement planners are available at all campuses and virtually. UPDATE YOUR • Time is an asset—The sooner you start saving toward retirement, the more you beneft from compounding interest. BENEFICIARY INFORMATION • Consolidate your retirement assets—Your campus Fidelity retirement planner can assist you in rolling over your balances When was the last time you checked from previous employers or your other CSU legacy 403(b)s accounts. your designated benefciaries? How to Enroll Open Enrollment is the ideal time to review your benefciary You may enroll in the plan at any time. You can: designations. Please review them to ensure your information • Call Fidelity at (877) 278-3699 and mention CSU plan is current. number 50537. Final Pay Warrant • Complete a paper form, available at your campus Campus Payroll Offce benefts offce. Retirement • Go online to NetBenefits.com/calstate: CalPERS my.calpers.ca.gov − Click on the “Enroll Now” button 403(b) Supplemental Retirement Plan − Enter your information, including CSU plan number 50537 Fidelity Investments netbenefits.com/calstate More Information Any other CSU 403(b) Legacy Vendor • Go to csyou.calstate.edu/srp Employer-Paid Basic Life Insurance and Accidental Death • Visit your campus benefts offce. & Dismemberment (AD&D) • CSU employees are entitled to complimentary one-on-one The Standard standard.com/mybenefts/csu consultations with a Fidelity Retirement Planner on campus. Voluntary Life Insurance, AD&D, Critical Illness and Schedule your appointment by calling (800) 642-7131 or online at Accident Insurance NetBenefits.com/calstate The Standard standard.com/mybenefits/csu • Regular review of your contributions and investment elections 401(k) and 457 keep you on track towards reaching your retirement goals. Savings Plus savingsplusnow.com 16

FREQUENTLY ASKED QUESTIONS 1. What is Open Enrollment? 8. What happens if I miss the Open The Open Enrollment period is the time each year when all Enrollment period or if I fail to enroll employees can enroll in benefts coverage or change their during my frst 60 days of employment current benefts coverage for the upcoming calendar year. as a new hire? 2. What are the Open Enrollment dates If you have not previously been enrolled in health coverage this year? through CSU and have not provided proof of other coverage, The Open Enrollment period for benefts is September 18, 2023 HIPAA offers two provisions—Special Enrollment and Late through October 13, 2023. Enrollment—for employees and their eligible family members to enroll in a CalPERS health plan outside of the initial enrollment 3. Who is eligible to participate? period and the Open Enrollment period. Active employees with appointments that exceed six months Special enrollment must be requested within 60 calendar and one day, with a time base of at least .50. days of one of the following qualifying events: Academic-year lecturers and coaches are eligible for benefts • Loss of other non-CalPERS coverage. if appointed for a minimum of one semester or two consecutive • Marriage/registered domestic partnership. quarters with a time base of .40 or greater. • Birth/adoption. Employees who do not meet eligibility requirements listed above • Court-ordered coverage. may qualify for health care under the Affordable Care Act (ACA). • Divorce/termination of registered domestic partnership. Employees who do not meet the eligibility criteria above may still be Late enrollment allows an employee to request enrollment if they eligible to enroll in many of the voluntary plans (HCRA, DCRA, auto, declined or canceled enrollment for themselves or their eligible home and renters insurance, pet insurance, the legal plan, or the dependents, and the special enrollment exceptions do not apply. 401(k), 457 and 403(b) plans). Late enrollment is applied as follows: 4. Do all current eligible employees need • A 90-day waiting period is required. to enroll or re-enroll for benefts during • The effective date of enrollment will be the frst of Open Enrollment? the month following the 90-day waiting period after required documentation has been provided to the Your current benefts elections (except for dependent care and campus benefts offce. health care reimbursement accounts) will roll over to the 2024 Employees on leave of absence during Open Enrollment may plan year. You must re-enroll in the fexible spending accounts change plans and add/delete dependents. Employees who do every year. not change plans and add/delete dependents during the Open Enrollment period may do so within 60 days of the date they 5. What is a fexible spending account? return to regular pay status. Flexible Spending Accounts (FSAs) allow you to set aside 9. Who do I contact with money—tax-free—then use that money when you have certain additional questions? everyday expenses, such as costs related to child care and health care. CSU offers you two FSAs: The Healthcare Reimbursement Please direct any questions to your campus benefts offce. Account and the Dependent Care Reimbursement Account. You must enroll (or re-enroll) in the fexible spending accounts annually to participate. 6. What is the effective date of my new beneft choices? The new beneft choices are effective January 1, 2024. 7. How do I fnd out if my doctor participates in CalPERS health plans? Visit calpers.ca.gov to access the Health Plan Search by ZIP Code tool to fnd doctors or medical groups in your search. Information is subject to change on a weekly basis. Before making any plan changes, contact the doctor or health plan to confrm availability. 17

OPEN ENROLLMENT CHECKLIST TOPIC CHECKLIST Ensure your dependents are still eligible to participate. Spouse and Dependents • Is your dependent reaching the age of 26? You may be required to remove them soon. • Are they under 26? They are still eligible for benefts. Make sure all your benefciaries are up to date. Check for each of the following: • CalPERS Retirement Plan Benefciary Designations • 403(b), 457, 401(k) • The Standard Employer/Voluntary (life and AD&D insurance coverage) • Your last pay warrant Have you recently experienced any of the following qualifying events? • Marriage or divorce Qualifying Events (QE) • Birth or adoption of a child • Domestic partnership or resolution of partnership • Death of a spouse/partner/child • HCRA offers tax-saving benefts that can be used to pay for out-of-pocket medical expenses not covered by insurance, such as copayments, eyeglasses or dental care. • DCRA can be used for dependent care and also provides tax savings. Health Care Reimbursement • Be sure to enroll because this beneft doesn’t roll over. Account (HCRA) & Dependent Care Keep in mind the following maximum contributions for 2024: Reimbursement Account (DCRA) • HCRA maximum contribution is $3,050 (annually) • DCRA maximum contribution is $5,000 (annually)* *The maximum contribution for married couples fling separate tax returns is $2,500. • Have the health care needs of you and/or your family changed over the last year? If yes, it may be time to consider a health insurance plan with a different coverage option. Health Care Needs • Be sure your medical doctor is still contracted with your current health plan. • Visit your campus beneft fair to meet with various vendors. • Review your benefts to determine the best options available to you and your family. Check out the voluntary plans for additional coverage/services: • Auto, Home and Renters Insurance • Critical Illness and Accident Insurance Voluntary Plans • Legal Insurance • Pet Insurance • Voluntary Life, AD&D and Long-Term Disability Coverage SRP helps you save money on taxes, invest in your future and supplement your income in retirement. Enrolling today could make a big difference in preparing for your retirement! California State University 403(b) You are entitled to complimentary Fidelity fnancial wellness consultations. To schedule your Supplemental Retirement Plan (SRP) appointment, call (800) 642-7131. (Plan Number 50537) To enroll, visit netbenefits.com/calstate or call Fidelity at (877) 278-3699 or ask your campus benefts offce for the enrollment form. 18

QUESTIONS? Direct any Open Enrollment questions to your local campus benefts offce. For additional information regarding beneft providers’ telephone numbers and websites, visit calstate.edu/openenrollment. ABOUT THIS GUIDE This guide describes the beneft plans available to you as an employee of the California State University. The details of these plans are contained in the offcial Evidence of Coverage (EOC) booklets or plan documents. This guide is meant only to cover the major points of each plan. It does not contain all of the details that are included in the EOC or offcial plan documents. If there is ever a question about one of these plans, or if there is a confict between the information in this guide and the formal language of the EOC or offcial plan documents, the formal wording in the EOC or offcial plan document will govern. 401 Golden Shore, Long Beach, CA 90802-4210 | calstate.edu