401K Summary

Learn how your employer-sponsored 401(k) plan can help you save and invest for a secure retirement. This summary explains contributions, investment options, and how to maximize your benefit.

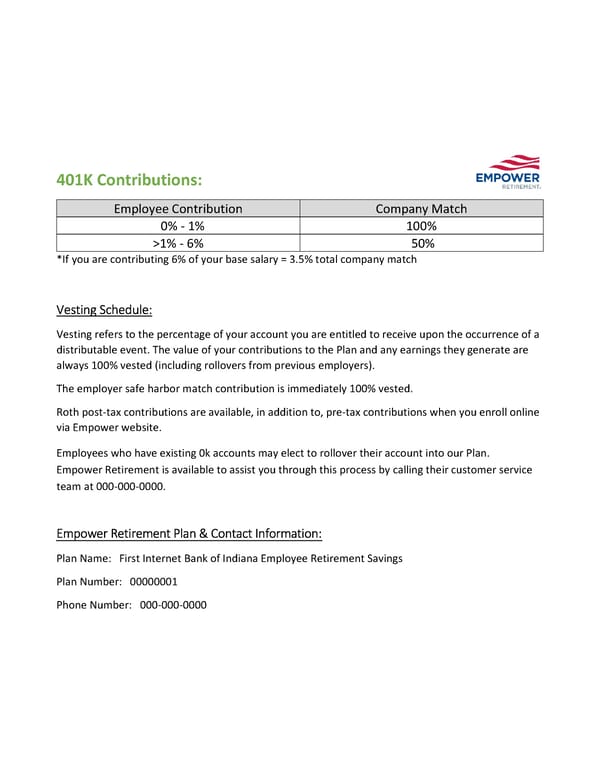

401K Contributions: Employee Contribution Company Match 0% - 1% 100% >1% - 6% 50% *If you are contributing 6% of your base salary = 3.5% total company match Vesting Schedule: Vesting refers to the percentage of your account you are entitled to receive upon the occurrence of a distributable event. The value of your contributions to the Plan and any earnings they generate are always 100% vested (including rollovers from previous employers). The employer safe harbor match contribution is immediately 100% vested. Roth post-tax contributions are available, in addition to, pre-tax contributions when you enroll online via Empower website. Employees who have existing 0k accounts may elect to rollover their account into our Plan. Empower Retirement is available to assist you through this process by calling their customer service team at 000-000-0000. Empower Retirement Plan & Contact Information: Plan Name: First Internet Bank of Indiana Employee Retirement Savings Plan Number: 00000001 Phone Number: 000-000-0000

401K Summary Page 2

401K Summary Page 2