RELAYTO/ for Media

More than 85,000 people from across the globe descended on Austin, Texas, for the 32nd annual South by Southwest (SXSW) Conference. At their ready: more than 5,000 speakers, across 2,200-plus sessions, who made it apparent that it truly takes a cross-functional village to innovate and change the world.

My focus was on the SXSW Interactive track. I always learn a ton, but this year-my sixth-I wanted to hear what stood out to those around me.

Here is what they shared.

Stories And Experiences

"SXSW 2018 was the year of brand experiences, intentional awareness, and emotional intelligence. Brands that can create experiences to connect with fans, enable serendipity, and lead with high EQs will create lasting, meaningful impressions, and enable word-of-mouth storytelling."

- Adam Leidhecker, Brand Strategist, Coplex

"My SXSW experience can be wrapped up in one word: Westworld, [whose SXSW activation] embodied everything SXSW should be: engaging, interactive, focused on technology, socially conscious, entertaining, and a true convergence of all the ideas that have been staples of SXSW for years."

- Angelique Toschi-LaRue, Content Strategist, Shakey's USA

"The key theme of SXSWi for me was empathy and ethics in tech, primarily driven by millennial hunger for authenticity and purpose, but also their zero tolerance for bad CX."

- Oisin Lunny, Chief Evangelist, OpenMarket

Emerging Tech

"SXSW covered AI, blockchain, and data. Marketers [need to learn more] about these new technologies and how they will impact marketing. The future of retail for brands and retailers is autonomous."

- Anne Marie Stephen, CEO, Kwolia; Founder, Retail Innovation Lounge

"SXSW looks five-plus years into the future. The best takeaways from a conference of future-looking technologists and business leaders comes from the people who attend the event. Ten years ago this was true with the emerging social media practitioners. Today it is the same for the AI, machine learning, and blockchain movers and shakers."

- Wayne Kurtzman, Research Director, Social and Experiential Solutions, IDC

"Immersive experiences at SXSW clearly show the value that brands are placing on influencers to extend the reach of their marketing efforts, and media brands are leading the charge. Experiences drive buzz and create the desire brands are looking for in today's cluttered media landscape."

- Brian Rudolph, VP Experience Design, ARKE

Brand Relationships

"I saw a panel titled 'Why your Marketing is Broke.' The experts discussed the major issues of generational marketing, brand marketing, and current tactics. The key takeaway is relationships matter. Whether it is a brand-to-consumer or a brand-to-influencer, you need to be authentic to your brand value."

- Elizabeth Quintanilla, Chief Marketing Gunslinger

"Influencer marketing is going from a cool-to-have to a must-have, with brand marketers talking about treating it like a form of media and measuring it like media so they can compare it to other forms of advertising. Likes and views are being replaced by eCPM, eCPV, and eCPE."

- Paul Kontonis, CMO, WHOSAY

Social Good

"It was clear that the concept of social purpose has achieved mainstream and will become table stakes soon. Brands and companies will have to create more value than they try to capture. It will not be able to compete without this weaved into the fabric of their DNA."

- Bruno Guicardi, President, CI&T

"The thing that was most fascinating to me was the number of startups focused on social good and big-world issues. ... What they are telling us is that good can come from innovation and tech."

- Chris Valentine, Producer, SXSW Accelerator (Note: I was part of the 2018 SXSW Accelerator Advisory Board; winners were announced on March 11.)

Power Of Diversity

"In the '5 Major Generational Shifts & Understanding Gen Z' presentation, I heard that if you want to create authentic content, you need to have diversity in your marketing team. If your goal is growth, it's your duty to appeal to the widest audience possible by having a diverse team."

- Naomi Assaraf, Co-Founder, CMO, cloudHQ

"Female empowerment was a major topic of conversation this year, anchored by strong talks like we had from Melinda Gates."

- Hugh Forrest, Chief Programming Officer, SXSW

Mobile Matters

" John Maeda's ' Design in Tech Report 2018' keynote highlighted that 'time spent on mobile has surged, while time spent on other media has slowly declined, with a staggering 96% of people using a smartphone to get things done.' Computational design is everywhere."

- Alex Shevelenko, CEO and Founder, RELAYTO

Standing Out

"At SXSW, there was a lot of brand clutter fighting for attention. [To me] the best ideas were the simplest and based on an insight."

- Jim Stengel, Author, "Unleashing the Innovators"

If you'd like to experience SXSW virtually, check out the daily highlight videos and #SXSW thread. You also can listen to recordings of hundreds of sessions.

The attraction of prediction markets as a system of governance can be summed up by the economist Alex Tabarrok who said: "a bet is a tax on bulls**t". Futarchy, the idea of using prediction markets as a guide to help organizations make decisions, was formalized by economist Robin Hanson in the 1990s.

The way Futarchy works is when an organization sets out some objective it is trying to maximize, and then allows people to economically back the choices they believe will achieve that goal. If a decision between X and Y needs to be made, tokens for X and Y are issued and a market for each token is created. Whichever market shows the higher price, that will dictate the decision to be taken, and on the winning market holders of the token are later paid out based on how well the organization ends up achieving its objective.

The wisdom of the crowd would lay bare the hierarchical way people act inside certain structures, which is based on how they want to be perceived and their small scale personal goals. Hanson has done academic research experiments but has never really succeeded implementing prediction markets in a corporate context. He claims people like top managers are perhaps afraid of markets arriving at decisions that might make them look stupid or superfluous.

Where Futarchy has met resistance trying to sneak inside established systems of governance, blockchain aims to recreate existing systems, and as such is looking for decentralized governance solutions.

Vitalik Buterin, the inventor of the Ethereum public blockchain, has been blogging about the potential of blockchain Futarchy for the past couple of years, and now sees many such projects about to blossom.

He said: "With blockchain we have a new class of entity, things like DAOs (decentralized autonomous organizations) that people are starting to come up with, and this kind of entity doesn't have a traditional governance structure.

See all of the best photos of the week in these slideshows

People are interested in figuring out what a governance structure for that might look like. And at the same time blockchains are an environment where markets are very easy to make and so it seems like their might be a natural fit for building this sort of thing."

It's worth taking a step back here. We now have the technology to explore entirely new forms of crypto-economic democracy; a potential paradigm shift in governance within all sorts of organizations.

Buterin points to a number of projects looking at this in the Ethereum ecosystem such as Maker DAO that creates and insures the dai stable coin on the Ethereum Blockchain, as well as prediction markets like Gnosis and Augur.

Outside of Ethereum, there is a project called Truth Coin/Hivemind which is looking into this.

To outsiders, the evolution of DAO voting systems appeared to have been stopped in its tracks by the costly compromise to The DAO. But in fact many projects had been quietly working toward fruition before the hype and continue to do so.

Buterin said: "The DAO incident did not stop this whole concept or movement. I would probably compare it to something like the dotcom boom-obviously at a much smaller scale-where people started to get very excited as the concept started to finally get possible almost in reality.

"People's expectations did get a bit ahead of what was actually possible and there was bit of over excitement and then that all ended up screeching to a halt.

"But I think over the next year we are going to start seeing newer projects, a lot of which have been developing for the last half year, that are going to start coming online and developing their own designs, and which are going to end up very heavily learning from the problems of what's been tried before."

He pointed out that we are moving from a theoretical realm toward considering the actual infrastructure requirements for these futuristic systems to operate. "We are at this stage where the technology does exist. We are realizing that we need more infrastructure than we thought in order to make sure these things are actually safe.

"That infrastructure is starting to come online and the mood is changing and people are starting to really think about the specifics. There are a lot of things that you have to start thinking about when you are designing markets.

"If you look at them from a very far view you just see prices, but if you look at them from a very fine micro-structure view, you start thinking about liquidity, bids, asks, order books, order book design, front running, what happens when you have derivatives on top of prices and incentive compatibility issues.

"I think DAOs are starting to enter that stage and I think we are going to see several major kinds of designs emerge. We saw a simple voting DAO as one example, but then with simple DAOs you have to protect against majority collusion attacks. We are starting to see two or three designs in the middle. In many cases it's going to be the fine details that actually make or break in terms of whether a project succeeds or fails."

Buterin's long view regarding the state of public blockchain governance draws analogy from the history of U.S. democracy.

He said: "Both Bitcoin and Ethereum at this point have had exactly one sort of substantial governance crisis. I would argue that in the grand scheme of things, where we are at right now is maybe where U.S. democracy was in like 1795. This isn't even the Civil War; this is like the War of Independence."

Delivering financial services to the developing world's unbanked people will add $3.7 trillion to the GDP of emerging economies within a decade, according to a recent report by McKinsey.

Some two billion individuals and 200 million micro, small and midsize businesses in emerging economies today lack access to savings and credit, while those with access must often pay high fees for a limited range of products. Bringing about financial inclusion is a collaborative effort from the level of central banks, cooperating in mobile money systems, down to micro-finance projects providing business loans to street vendors in sub-Saharan Africa.

For instance, the Bill & Melinda Gates Foundation has a dedicated team for financial inclusion and digital innovation. Kosta Peric, the Gates Foundation's deputy director of Financial Services for the Poor, said: "When I talk to banks, it's a call to action, letting them know that financial inclusion can be a profitable business. It requires a different approach and a mix of new technologies, but has huge potential both on the country side and also for profit making private entities that are looking for new markets."

Peric has seen much more focus lately from governments and central banks in Africa and Asia. He also mentioned some interesting concrete examples of innovation, such as a recently launched interoperable mobile money system covering the whole of Peru and run by its central bank. Meanwhile, four mobile money providers in Tanzania have begun interoperating, and showing quite dramatic increases in volume.

"These types of innovation are how we envisage our Level One Project, which is to foster the creation of a fully digital and super low cost and very scalable system that also interconnects with what already exists," said Peric.

An example of what he means is clearing and settlement between different providers. At best you can expect things to be settled the next business day. "So this doesn't work," said Peric. "In a digital system that is focused on the needs of financial inclusion and poor people it needs to be real time and irrevocable. We have looked at ways to make it almost real time or as close as possible.

"This reduces risk in the system. These providers could be non-banks and under the regulatory regimes of most countries they would be subject to risk controls, to prevent one of them from failing by owing too much money to others."

There are potential solutions here inspired by blockchain design and innovations like Ripple's Interledger Protocol to connect various financial ledgers, noted Peric.

He also said to reach a goal of 80 percent financial inclusion means crowding the market with more players who are closer to customers in rural areas or the specific populations like farmers.

"These are not banks so it's important that the system implements controls of risk management and fraud management, because these new players are not necessarily equipped as well as the banks to do this in a regulated way."

4G Capital is a fintech company that is doing pretty well providing financial services to very small businesses in rural areas across Kenya. This multi-award winning unsecured business loan provider offers a highly successful line in micro-lending, complimented by customer training for self-employed traders that lack the education opportunities or the life skills to unlock their potential.

This year alone 4G Capital has scooped two impact awards, including being a finalist in the prestigious MasterCard Foundation Clients at the Centre Prize.

Wayne Hennessy-Barrett, CEO, 4G Capital reels off some impressive statistics: over 80 percent repeat business; 82 percent female customers; 65 percent of all customers over a 12 month period grow their business by an average of 300 percent.

"That is directly attributable to the credit we provide and also very importantly the business training we provide," he said.

"For last 18 months we have had 72 percent net promoter score (NPS) which is the industry standard for kind of - would you recommend this to their friends? It's a really big deal. I think Apple is about 65 percent. Generally financial services is around 36 percent."

In order to achieve these kinds of results, Hennessy-Barrett, who incidentally is also an advisor to Ethereum, has been strengthening his data strategy. He has been using simple feature phones to conduct surveys via SMS to add to his existing customer database.

He said: "We are trying to make better use of our data in order to develop more predictive credit products for micro segmentation. There is a huge amount of difference between a lady selling fruit and veg in a rural market and a small household goods trader; their business cycles and their margins are very different.

"We don't need to buy other people's data - frankly what we do is much purer. Our approach allows us to go into data-dark areas and come up with very strong insights based on conversations using low tech, feature phones. That allow us to reach, not just the financially excluded, but what I call the network excluded, the really marginalised.

In terms of data sharing, 4G Capital's customers who want to graduate to a bank can have their credit data exported with them. "This is part of what we can give you, because actually it's not our data, it's the customer's data.

"We have a platform that we want to be the go-to for business working capital across sub-Saharan Africa. And it's a platform for investors to redeploy standing pools of capital and achieve risk adjusted yield but also transformative social effects."

4G Capital is currently building out its data science and analytics capabilities. Data scientists who would like to take part in a truly innovative financial inclusion project in sub-Saharan Africa are invited to get in touch with Wayne.

Newsweek and International Business Times are hosting an Artificial Intelligence and Data Science in Capital Markets event, taking place on March 1 and 2 2017 at the Barbican in the City of London.

Newsweek and International Business Times are to host an Artificial Intelligence and Data Science event, taking place on 1 and 2 March 2017 at the Barbican in the City of London.

The event, which is taking place in association with Imperial College London will bring together data scientists from banks, hedge funds and fintech startup companies to discuss the frontiers of AI and machine learning technology in financial markets. IBT Media is the parent company of Newsweek and International Business Times.

Professor Nick Jennings CB, FREng, Vice-Provost (Research) Imperial College, said: "Imperial College London is at the forefront of getting technology and economics/business expertise working together to create real impact at the forefront of the fintech revolution.

"We have a broad and substantial expertise, from crypto-currency to financial economics, from signal processing to mathematical analysis and from AI to data processing and high performance computing.

"Academics from economics and data science work closely with computing engineers, mathematics. This melting pot is required to drive forward major advances in this strategically important area."

Day one of the event will focus on new and interesting data sets that market participants can capture, clean and extract value from, in the search for benchmark-beating returns.

The day's sessions will feature presentations and panels from a range of third party data processors, and providers of exotic data sets, such as IoT, satellite data, freight and customs data, text and social media, financial exchange and order flow data.

See all of the best photos of the week in these slideshows

The second day will look at information aggregation, risk and portfolio management, and how machine learning can be used to provide advances. It will also look at how regulators are interfacing with and incorporating new technologies.

Steve Roberts, director of the Oxford-Man Institute and professor of Information Engineering, University of Oxford, said: "We are in the midst of an information revolution, where advances in science and technology, as well as the day-to-day operation of successful organizations and businesses, are increasingly reliant on the analyses of data.

"Driving these advances is a deluge of data, which is outstripping the increase in computational power available to process it. Research in data science is already transforming our ability to work with large amounts of complex financial information.

"Over the next few years these trends will revolutionize how we think about data, how we process and visualize it, and how we put it to use. Data alone, however, is not enough. We need to create new tools and methods that can give deeper insight into financial markets - how they behave, how they become stable or unstable, how to extract value from data at scales beyond human and how they could be made to work better."

Professor David Hand, chief scientific advisor, Winton Capital Management, added: "The world is changing: big data, streaming data, open data, high frequency data, and administrative data are just some of the creatures inhabiting this new world of data. Keeping up with this evolution is critical if we are not to fall behind in our understanding of the world.

"Data science-the technology of extracting information from data-has become critically important to commercial success and public understanding. But data science itself, like the raw material it processes, does not stand still. New tools, methods, and ideas are constantly being developed. The old adage, that the half-life of knowledge is five years, seems particularly pertinent in the world of data science."

Register your interest in the event or find out about sponsorship opportunities here.

Consultancy giant Deloitte is now a gold sponsor for the EtherCamp, five-week long virtual accelerator hackathon.

Alex Shelkovnikov, Deloitte Ventures & Blockchain Lead from Deloitte, who is also a judge on the hackathon, said "We are really pleased to be sponsoring the EtherCamp online Hackathon. We are looking forward to seeing a lot of great ideas being worked on, and hope that some of these are going to become great start-ups in the future."

Deloitte joins the German energy company Innogy and WanXiang Blockchain Labs as the third gold sponsor of the hackathon, highlighting the potential of the Virtual Accelerator to extend the reach of blockchain technology across markets.

Currently over 40 teams have set up camps, laid out their plans and are working away developing their prototypes. From Thursday 24 November the audience will be able to back the teams using HackerGold, the token of the Virtual Accelerator.

Roman Mandeleil, the CEO and founder of EtherCamp, said "We're very pleased to see so many innovative teams on the platform making real progress in the first week of the competition. Others are starting to see our vision and the potential of the Virtual Accelerator, Deloitte is a partner who understands that vision and we wholeheartedly welcome them onboard"

The Virtual Accelerator and HackerGold token sale will run through until 22 December, after which the grand prize of $50,000 in cryptocurrency will be awarded to the winning team.

Bitnation, a decentralised technology-driven force for freedom and equality around the world, has further formalised its marriage blockchain marriage service - Smart Love - which will feature on the EtherCamp hackathon starting later this week (November 17th).

Since the summer of 2015, Bitnation has been working on the architecture of a Decentralised Blockchain Jurisdiction, called Pangea. After months of researching protocols, Bitnation selected a peer-to-peer and end-to-end encrypted communication protocol called Secure Scuttlebutt, which communicates with the Ethereum Blockchain to create and execute Smart Contracts.

Smart Love is both the first end user application for Pangea, as well as some of the building blocks for Bitnation's polylegal dispute resolution platform, and an ideal hackathon project.

Smart Love, as with all useful marriage agreements, will establish moderate barriers to entry and tough barriers to exit, and incorporate the legal code, arbitrators and enforcement mechanism of your choice.

Smart Love is designed to link to a broad ecosystem of other agreements, for example, child care, the sharing of assets, and inheritances.

Susanne Tarkowski Tempelhof, Bitnation founder, said: "Smart Love is the sandbox in which we can experiment with our technology to create a useful application from which we can build the entire Pangea ecosystem: an Emoji-enabled, decentralised and encrypted chat application on which Bitnation Citizens can create and enter into robust legal contracts and resolve disputes with anyone else in the world, without any third party intervention."

Bitnation organised the first blockchain marriage in the world on 5 October 2014 in Disney World, Florida, during a Bitcoin conference, and the second in London 2015 between Edurne Lolnaz and Mayel de Borniol on Bitnation's Public Notary, in cooperation with Estonia's e-Residency program.

In past, Bitnation has offered refugees arriving in Europe with the option of securing blockchain digital identities with a view to providing them with Bitcoin debit cards. Bitnation and Estonia has also started spreading sovereign jurisdiction on the blockchain. Later on, Tempelhof married her husband James Fennell Tempelhof on the blockchain at the Bitcoin Embassy in Amsterdam March 2016.

Tempelhof highlighted the fact that US Vice-President-Elect Mike Pence, has said that LGBT marriage equality would lead to "societal collapse" and called homosexuality "a choice". He is not alone, from Uganda to Iran, inter-faith, LGBT and polyamourous marriages are criminalised, and governments are actively preventing their citizens from expressing love and commitment through marriage.

The decentralised Ethereum hackaton starts November 17th and lasts for five weeks, during which Bitnation has pledged to commit time and resources to building out its decentralised marriage application: Smart Love entry.

Melon, a blockchain protocol for digital asset management on Ethereum, will be launched in collaboration with former CTO of Ethereum Dr Gavin Wood and Ethcore's Parity client, to run on the Polkadot multi-chain network.

Polkadot, a concept originally devised by Wood, the founder of Parity Technologies Ltd, will bring multiple kinds of blockchains into one large network, with pooled security. Polkadot is designed to allow blockchains which follow certain specifications to integrate easily, creating a single inclusive interoperable multi-chain network, said a release.

Melon will provide the first use case - a completely decentralised blockchain infrastructure intended to give secure and user-friendly access to manage or invest in portfolios, similar to hedge funds. It goes beyond a normal crypto wallet providing a "rule set" which forces certain elements to portfolios (eg. performance calculations and trade restrictions) to be a non-negotiable part whilst allowing user choices on more opinionated matters (eg. price feed sources, exchanges, management fee, etc).

Melon will initially be targeted at individuals looking to set up and manage crypto portfolios and build their track records on it. The protocol allows for investing and redeeming in portfolios and will become a way for people to discover and gain exposure to these crypto portfolios cheaply and transparently. As digital assets become more mainstream, we expect this protocol to be adopted by more traditional asset managers.

Wood, founder of Parity said: "We're very excited to be embarking on this path with Melonport. As a next-generation technology which is able to bring together open chains and enterprise chains, we feel Polkadot is uniquely suited to Melon's use-case and welcome the challenge of developing this technology to fruition with open arms."

Mona El Isa, former Goldman Sachs star trader and hedge fund manager who partnered with Reto Trinkler in founding Melonport earlier this year, said: "Traditional methods of wealth preservation have offered a good service for a long time but we have also seen their limitations. My experience together with Reto's technical skills have been very complimentary. We believe that a collaboration with Parity, will be very complimentary as well and will help make this idea even bigger."

Reto Trinkler, a mathematician from one of the world's leading university, ETH Zurich, developed a profit making algorithm for sports betting exchanges in C++ whilst still at university.

He said: "We thought about this a lot and we really want the Melon project to be an open, collaborative effort. Whilst we plan to develop a set of modules ourselves, we have structured our usage tokens in a way that will reward developers. In this way, we believe we can future proof development and collectively come up with the first ever blockchain protocol and software for asset management."

Melonport AG, the private company behind Melon will facilitate a Melon token pre-sale accepting Ether contributions that will go towards the building of Polkadot and Melon. More information can be expected on this towards the end of the month.

Tezos presents a self-amending blockchain, addressing the ironic fact that consensus systems often become hamstrung when their own rules need to change.

The Tezos team first proposed its "seed protocol" back in 2014, a blockchain protocol offering a voting procedure for stakeholders to approve amendments to the protocol, including changes to the voting procedure itself. In this respect, Tezos is related to the work of philosopher Peter Suber and Nomic, a game he invented which includes mechanisms for players to change the rules, usually beginning through a system of democratic voting.

Given the recent history of contentious hard forks and blocksize debates, the Tezos team must be getting tired of people pointing to the prescience of their self-amending protocol.

"No, we don't get sick of that," says Kathleen Breitman of Tezos. "Mostly because when the paper was first released [in 2014] people said 'no, the nature of Bitcoin is that there is no social element to it, code is law.'"

Her husband Arthur Breitman's initial worries about proof-of-work were later compounded by an obvious unwillingness to innovate in the protocol and what he saw as stagnation.

"I thought about the dynamics of hard forks: if you split the ledger into an old and new version, which one will retain its value? This led me to understand the importance of the social consensus around Bitcoin, and its danger as potential source of centralisation."

However, he sensed that addressing this issue could also potentially help the network overcome technological problems. "There are problems on agreeing about what to do with the network and yet we're sitting on a consensus-forming technology. Why not fold it in, use the blockchain to resolve consensus issues over protocol changes?"

These days interoperability within the blockchain universe is something you hear about quite a bit and Tezos, it has been suggested, could act as some sort of meta-layer for governance.

"I don't think this makes a whole lot of sense," says Arthur. "You should think of a protocol as having jurisdiction over its underlying blockchain. Your protocol has control over what happens in it, but nothing else, it can't dictate what will happen in some other one. You can transport proofs of what happens from one network to the other, so you could perhaps monitor a governance decision, but not enforce them. In Tezos, we can directly enforce the decision."

Kathleen added: "There's definitely a fad both in public and private blockchain thinking about interoperability. But it comes at a cost since porting proofs from one area to another is cumbersome."

In a recent interview R3's Tim Swanson sees an evolving bifurcation depending on use cases, where certain blockchains will always naturally eschew government - what he calls anarchic chains - while enterprise-type blockchains will need to interface with regulation and legal system.

Arthur said: "I mostly share this a point of view. People envision blockchains for different use-cases: this will be the blockchain of identity; that will be the blockchain of healthcare, etc. I think that the real landscape will be one of trade-offs between security, scalability, and censorship resistance. We'll see a spectrum with some completely anarchic blockchains and some highly regulated ones.

"But I don't think it's binary. There's a lot of space in between. A company like AirBnB today operates within the law, but they are also pushing the boundary on regulation with new technology. I think this leaves room for many products to emerge."

Changing a blockchain protocol is a big deal, but Tezos intends to take a conservative approach. "In addition to the ability to vote in new code to the network, we also have a testbed which I think would help out with some of the other crypto projects' arguments as well," said Kathleen. "I like that aspect of it and I think that actually helps reduce what can be a very emotional and politically driven argument down to a matter of asking, does this work, does this achieve the goals of the community - which is something that has to be established at the forefront."

Regarding the hard forking of Ethereum, Arthur said: "To me the main problem in the first hard fork in Ethereum is not so much the decision they took, as the procedure by which they reached the decision.

"A lot of it happened behind closed doors. People were not exactly privy to what was happening; it was pushed on them pretty quickly. Had they reached the same decision but with a clear governance process where they could say, 'you know what, we have a procedure for dealing with this type of situation, and in this type of situation this is the procedure we follow', then it wouldn't look as arbitrary.

"Ultimately I think what most people disliked is the realisation that the Foundation acted as a central authority. People bought into a decentralised network and all of a sudden they realised this Foundation actually wields a ton of power."

Kathleen recently left her job at R3 to run the operations for Tezos as it heads towards a release early next year. She said: "We are pretty far along in terms of development. We only have a few minor things that we are tweaking in anticipation of the testnet being released to the public which will be in January.

"Then in March we will have a crowdsale for Tezos tokens, which will take place over the course of four weeks. We don't have any particular date set yet but we anticipate a proper network release maybe a month later."

The Innovation Engineering team at Royal Bank of Scotland (RBS) has built a distributed clearing and settlement mechanism, based on Ethereum, to remove inefficiency from the patchwork system of cross-border payments.

The RBS Emerald system, which is a proof of concept with no plan or date to go live at the moment, was set up to explore the creation of a Deferred Net Settlement (DNS) system like FasterPayments. Richard Crook, head of Innovation Engineering at RBS, explained that while the UK's FasterPayments is near instantaneous, cross-border payments are a different story.

Crook said: "If you are trying to make payments in Europe - France to Germany, or UK to France - at worst, it's a three-day round trip, and it's certainly a two-day batch cycle. They do not have an equivalent of the FasterPayments service."

Unlike domestic payment systems, cross-currency international payments have no central authority, like the Bank of England. A set of requirements for an equivalent faster payments service in Europe has been tabled, but it could be years away.

In the meantime, RBS saw the opportunity to prove the Emerald distributed ledger system in a domestic setting, which it did using technology partner GFT and Google's cloud platform.

Emerald aims to meet the Single European Payments Area (SEPA) Instant Credit Transfer scheme, which allows for more than one clearing and settlement mechanism. In this case, a distributed ledger can provide a viable alternative. The performative requirements are expected to be somewhere between 10 and 25 seconds.

The goal of the Emerald performance testing was therefore set as 100 transactions entering the system every second (sufficient for a national level domestic payment system), and a round trip time of under 25 seconds (sufficient to meet the ICT requirements).

The underlying model takes a risk-based approach called the creditline model, tracking balances and limits, rather than building and counting a store of value - "a bean", to use the accountancy term. As such Emerald's bilateral counter=party model, which allowed entities to owe each other money, is closer in kind to the Ripple model.

Crook said: "But what we found with Ripple was it is highly constrained to its proprietary model and we couldn't flex it in some of the ways we wished to. Specifically we didn't want to be exposed to a digital currency -XRP - and we continue to point out that we don't enjoy using any currency where the majority of it is owned by a few."

It should be noted that RBS is speaking here about Ripple Consensus Ledger, but is considering Interledger Protocol (ILP) for cross-border payments use cases, and ILP is mentioned in this respect in the Emerald paper.

In accordance with SEPA's emerging new requirements, RBS built a clearing and settlement mechanism that was capable of performing and scaling with the GFT test rig. "We showed that Ethereum and the Emerald application that we built could meet the requirements of these emerging next-generation SEPA payments.

GFT's engineers were able to get under the hood of Ethereum and retune it for the specific Emerald use case. Nick Weisfeld, head of GFT's blockchain team, said, "in this case it was crucial to rapidly iterate through test cycles and identify components of Ethereum that were preventing RBS achieving their targets. Once we knew the blockers GFT and RBS engineers were able to retune those components to meet the use case".

"So fundamentally what we have built is a distributed clearing house, if you were to operate it as a commercial entity. Or a distributed real time gross settlement system, if you were to operate it as a central bank's ledger," said Crook.

The team used the Ethereum Virtual Machine, the part of the protocol that actually handles internal state and computation of accounts, which have the ability to maintain an internal database, execute code and talk to each other. "What we were interested in was the capability to create a distributed network, a consensus around a ledger and a very simple smart contract at the end of that."

The use of Turing-complete blockchain capabilities to carry out functions like making payments have been criticised from some quarters, with the suggestion that it's like using a sledgehammer to crack a nut.

Crook said: "We have worked quite hard to make sure that people are not using blockchain where it isn't necessary. We always start by reasoning that if you could use a database, you should use it.

"In this scenario, if there was a single entity that is doing the clearing between the different banks, or financial institutions, then you would just need a database with an API.

"In the Emerald use case we were trying to create distributed clearing house where there is no central counterparty that you are working to. Where there is a central bank such as the Bank of England or the European Central Bank, I would absolutely question anybody suggesting that you need a blockchain," he said.

Previously when IBTimes UK spoke to supply chain fintech startup Skuchain, the term "collaborative commerce" was used to describe the future of global trade. It was based on a new type of trust: a blockchain-based model of trust.

Skuchain's technology was recently used to execute a "collaborative workflow" on a private distributed ledger involving a shipment of cotton between a seller (Brighann Cotton in the US), buyer (Brighann Cotton Marketing Australia) and their respective banks (Wells Fargo and Commonwealth Bank).

This announcement became part of a rush to prove the validity of blockchain in trade finance, with banking consortium concepts and bilateral experiments looking to digitise and share the bill of lading, letters of credit etc.

But if you take a step back, there's a bigger picture here to consider, says Srinivasan Sriram, founder and CEO, Skuchain. He said: "If you take a typical supply chain, today almost everybody views this supply chain as independent transactions - the shipment of cotton, the manufacturer who purchases the raw material cotton, and the value adder who has a deal with the end buyer. Except that they all belong to the same digital thread. What we can do with Skuchain's technology is link that thread and there is a significant amount of value to all parties when that happens."

Sriram's point is that usually, in a loosely integrated supply chain where there are four or five related entities, somebody has a very high cost of capital and somebody has a very low cost of capital. The person who has the low cost of capital is typically the end buyer.

An information asymmetry and the fact that each transaction is seen atomically, prevents participants from leveraging their low cost of capital, which could in turn help the supply chain lower the cost of goods. Tracking and visibility reveals the driving motor for each atomic transaction typically requires some type of a payment or a payment guarantee.

"Imagine if that same cotton bail was tracked as it travelled through the supply chain until it became that finished good which was then sitting on a hanger that a consumer went and picked up. You can begin to recognise how the flow of goods dovetails with the flow of money. Together they form the flow of information that all parties in the supply chain can leverage," said Sriram.

"Instead of focusing on the trade, focus on how this trade fits in. Collaborative commerce is where all parties within a supply chain are working collaboratively with each other, supporting each other in their strengths and weaknesses; where a party with a low cost of capital can use that low cost of capital to work collaboratively and satisfy consumer demand.

"All this is happening in a trusted and secure environment. It's not that you are paying more for it; in fact you are paying less for it because your cost of goods goes down, your visibility goes up and your demand forecasting gets better."

Sriram, who is a qualified ship's captain, understands that the cost of working capital financing is a sufficient carrot in the supply chain model. It depends on the nature of your balance sheet and can be expensive, ranging from an annualised percentage of at least 15% to maybe 18% to 20% - and this is in the US. When it comes to large buyers the cost of capital can be almost zero percent.

"Small to medium sized business particularly today is hurting because cash flow is oxygen and they don't have access to low cost working capital. Then they are effectively selling to end customers who have got significant amounts of dollars sitting in the bank not generating returns for them, which they could tap to help lubricate their own supply chains."

This article is the first in a series that begins to outline how the blockchain allows for the true realisation of collaborative commerce. Using the cotton trade we can see how loosely integrated supply chains can gain visibility, lowered risk, COGS and the strengthening of weak balance sheets.

Going forward we will explore how Skuchain's Collaborative Commerce vision works in tightly integrated supply chains that many large enterprises with multiple divisions all using disparate ERP platforms have. We will follow that with how the flow of goods is tracked as it travels through the supply chain from raw material to finished goods and through the distribution channel. This will be followed by a look at the various payment guarantees that each buy/sell transaction has and the participation of banks either through a Letter of Credit or Open Account and finally how fiduciary code on the blockchain helps with the transfer of PO's, invoices and assets.

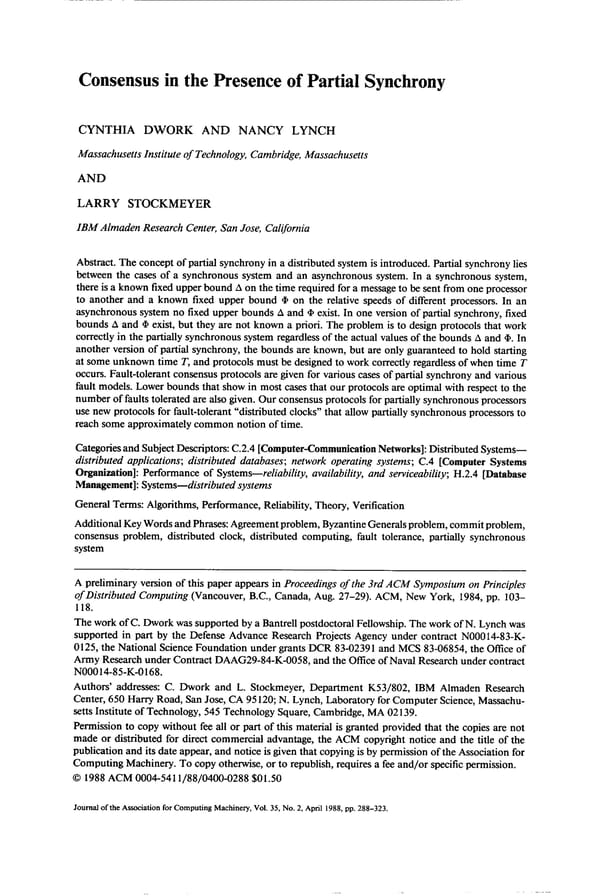

Jae Kwon, founder and CEO, Tendermint, has been studying the properties of consensus systems since he first became interested in Bitcoin. In a 1988 paper entitled, Consensus in the Presence of Partial Synchrony, Kwon saw the blueprint for the Tendermint proof of stake algorithm he would go on to build.

"I dropped everything and started working on it, and that was March of 2014," says Kwon. "The algorithm has evolved and gone through several iterations and now it turns out that what we have created is very similar to Practical Byzantine Fault Tolerance."

Practical Byzantine Fault Tolerance (PBFT) is practical because it works in asynchronous environments like the internet. Previous algorithms assumed a synchronous system or were too slow to be used in practice. For example, Bitcoin assumes a synchronous network model; if you wait long enough eventually a blockheader will be propagated across the globe. PBFT incorporates several optimisations to improve response time, and Tendermint is similar because these systems are dealing in theoretical optimums.

Tendermint nodes participate in the consensus protocol by broadcasting cryptographic signatures, or votes, to agree upon the next block. Validators' voting powers are determined at genesis, or are changed deterministically by the blockchain, depending on the application. For example, in a proof-of-stake application, the voting power may be determined by the amount of staking tokens bonded as collateral.

Voting for consensus on a block proceeds in rounds: each round has a round-leader, or proposer, who proposes a block. The validators then vote in stages on whether to accept the proposed block or move on to the next round. The proposer for a round is chosen deterministically from the ordered list of validators in proportion to their voting power.

Kwon calls Tendermint a consensus engine, or a blockchain engine. "It by itself doesn't know anything about what transactions mean or how to process them. It doesn't even know what transactions are valid unless you plug in application logic, or a state machine that can process those transactions.

"You connect Tendermint to that application via a network socket protocol and those two programmes together is a blockchain node. The idea is you get these two programmes and you replicate it across many computers and you have a blockchain."

"The nice thing about our system is that in an ideal scenario you need two rounds of vote communication to achieve consensus. And that's optimal, you can't do any better."

Tendermint core is used to power the latest innovation from the team - Cosmos, a network of many independent blockchains called "zones". The first zone on Cosmos is called the Cosmos Hub, "a multi-asset proof-of-stake cryptocurrency with a simple governance mechanism which enables the network to adapt and upgrade".

The hub and zones of the Cosmos network communicate with each other via an inter-blockchain communication (IBC) protocol, a kind of virtual UDP or TCP for blockchains. Tokens can be transferred from one zone to another securely and quickly without the need for exchange liquidity between zones. Instead, all inter-zone token transfers go through the Cosmos Hub, which keeps track of the total amount of tokens held by each zone. The hub isolates each zone from the failure of other zones.

Ethan Buchman, CTO, Tendermint, said: "Cosmos is the internet of blockchains. In cosmos all of these blockchains are literally talking to each other; they are directly sending packets of data between each other and it allows for interoperability of tokenised blockchains in a way that we don't see today.

"The cosmos hub is going to be the first blockchain that sits at the centre and many other blockchains can connect to it, and the hub tracks the total amount of tokens in each blockchain. It allows you to send any kind of token from one blockchain to another, through the hub, so the hub is acting as a central depository or a central record of which blockchains have however many tokens."

Kwon added: "There's a lot of advantage of this kind of system. It's fantastic for scalability obviously because you can just launch a new blockchain, attached to the hub, and off you go. Ethereum has a scaling problem and they are working on a scaling solution called Mauve, but Cosmos is a completely different way to solve the Ethereum scaling problem.

"Another benefit is upgradeability. Ethereum is a good example, but it could be with anything; you can have an Ethereum version one attached to the hub. Then if you design an upgrade to the virtual machine, you can have Ethereum version two attached to the hub as well, and version three. People can move their coins over to these new EVMs whenever they want."

"So you can get upgrades without having to do a hard fork, something that we can't currently do," added Buchman.

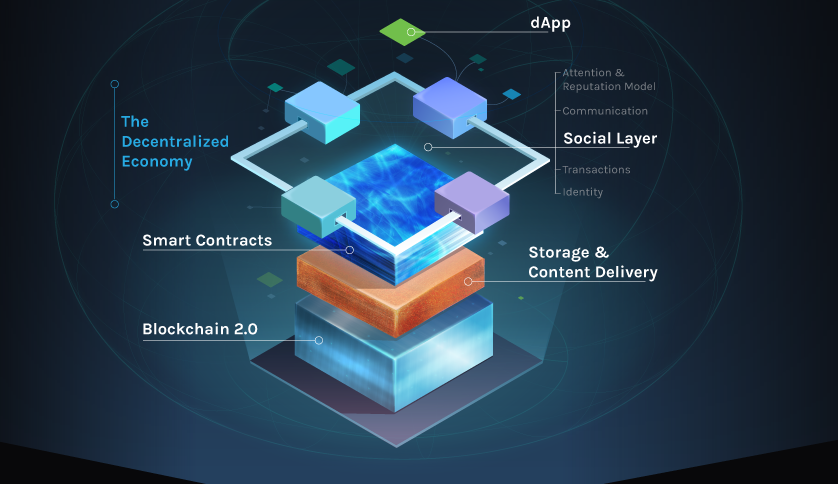

Synereo, which is developing a decentralised tech stack, allowing web applications to exist without centralised servers, has raised over $4.7m (£3.85m) from a funding campaign last week, selling both equity and AMPs, the platform's innate cryptocurrency.

Synereo was initially known for its attempt to create a decentralised social network. But after spending years developing a decentralised social media solution on the basis of existing blockchain technologies, the company recently announced that it had widened its operations considerably in order to develop its own blockchain-enabled decentralised computation platform. This is capable of running all forms of decentralised applications, the company's social network being one such.

Synereo placed itself in the forefront of the heated race towards a so-called "world computer" - a network of personal devices, functioning as a unitary virtual machine, rendering central servers and data centres redundant.

This idea of a world computer, initially proposed by the Ethereum Foundation, is something Synereo proposes to improve upon by offering a complete tech stack, incorporating all faculties needed to support decentralised computation without central servers.

The recently concluded funding campaign was launched shortly after Synereo announced its Blockchain 2.0 architecture, called RChain, which lies at the core of its stack. The company stated that funds raised during the campaign will be used to expand its team significantly, ensuring that its RChain-based tech stack can go live towards the end of 2017.

Synereo's platform comes with its own distributed cloud storage, allowing for efficient decentralised hosting of heavy media, as well as a reflective smart-contracting language.

In order to populate its platform, and to ensure fast growth and adaptation, Synereo has recently announced a sizeable grant project, inviting developers and entrepreneurs to develop decentralised applications for its platform, to foster the development of a decentralised ecosystem, competing with the current centralised paradigm.

Silicon Valley-based NFX Guild, partnered up with Synereo, and announced that it will include a selected few laureates of Synereo's grant project in its prestigious Accelerator Program.

James Currier, managing partner at NFX, explained its decision to choose Synereo's technology for the project, stating: " If you do the analysis, Synereo comes out as the superior platform for developing decentralised apps. It runs fully distributed instead of massively replicated.

"It's JVM top to bottom rather than Python. It's forward compatible, vs other platforms anticipating multiple hard-forks. Synereo has the identity layer built in which provides distribution advantages and network effects. Lastly, fine-grained concurrency, vs other platforms' linearity, provides greater speeds and scalability."

Since Synereo first announced its grant project, the company has received hundreds of applications of teams, eager to develop their applications on top of Synereo's platform. Dor Konforty, Synereo's CEO, said: "We are now in the final stage of interviews, and will soon be selecting the first projects that will receive AMP grants to build on Synereo's tech stack.

"We have 300 applications and it has taken our team a while to go through them and to choose from many amazing development teams and projects. Overall we are very excited at the level of interest to build the future of the decentralised internet with Synereo."

Multi-platform blockchain wallet Jaxx will integrate the new privacy-centric Zcash blockchain into its suite of software platforms. The integration is scheduled to come into effect a few days after the 28 October, when the Zcash genesis block will be mined.

Zcash uses zero knowledge proofs so that users will have the ability to make confidential and selectively disclosable transactions, powered by its cryptocurrency, ZEC.

CEO of Jaxx, Anthony Di Iorio said, "Zcash has garnered a lot of attention from all around the world and we at Jaxx have received a lot of interest from our users to have it available as soon as it launches.

"We will be able to offer Zcash on a number of different platforms, and are working well with the developers to enable a seamless integration.

"VCs have invested in Zcash, there's cutting edge security technology behind it and that's resulted in quite a lot chatter in the crypto community. Zcash holds an extraordinary amount of promise."

The Zcash protocol allows two parties to receive verified information without knowing who each other are, or seeing the subsequent data exchange. Zcash trades and payments will see transactions published on a public blockchain, with the option of keeping the sender, recipient, and amount confidential.

Zcash CEO Zooko Wilcox said: "Zcash is a new technology that lets you put encrypted data into a blockchain. Blockchains as they currently exist, don't offer much (or any) control over the disclosure of the data that you put on the blockchain. Any data that you put in there is visible to all users of the blockchain. Zcash is the first protocol of its kind and is the accumulation of years of academic research, hard engineering work, and diligent security work.

"I'm happy to see that established companies with their own technology, strategy, and user base are already adding Zcash support. This is a sign of a robust and diverse Zcash ecosystem already beginning to grow."

Zcash uses a type of zero-knowledge proof called a zk-SNARK, developed by a team of experienced cryptographers. Instead of publicly listing spend-authority and transaction values, the transaction metadata is encrypted and zk-SNARK is used to prove that users are spending value they actually have ownership over.

Zcash is the fifth token Jaxx has added on its wallets in less than three months, following the successful integrations of Litecoin, Ethereum Classic, Dash and Augur; all within the world's top ten list of cryptocurrency by market cap.

"Jaxx has always been blockchain agnostic, but we listen very closely to the requests of our users. I'm extremely proud of what our team has been able to achieve by including so many popular tokens in such a short time. We will continue working around the clock to make these integrations and will include even more in the near future," said Di Iorio.

A couple of months back Jaxx was somewhat taken aback when Apple demanded the wallet remove its support of Dash on its iOS app. Dash also prides itself on providing enhanced privacy. However, Apple gave no reason for passing the order.

Apple with the iPhone is the only foreign company to really have made a success of itself in China. Of course the iPhone is a great product and Chinese consumers caught the fever as fully as anyone. But Apple has mostly avoided going head to head with Chinese companies. To do so is not a recommended strategy, a fact borne out by a string of precedents, the most recent being the roadblock encountered by the supposedly unstoppable Uber.

As technology and Internet analyst Dr Richard Windsor of Radio Free Mobile points out, when Apple got its market share it took it away from Samsung - and that's not a threat.

He went on to say that "Chinese Digital Life" is now an area is completely dominated by three companies: Baidu, Alibaba and Tencent (BATs), who will gradually compete more aggressively with one another as growth slows down. As far as foreign companies are concerned, the Chinese digital life ship has probably sailed, unless they have something very specific and very different.

Windsor, who was speaking at the Cheung Kong Graduate School of Business (CKGSB) inaugural "China Start" programme in Beijing, pointed to some key differences, such as access and control, while giving a snapshot of the market. He said: "If you look at the quality of fixed and mobile access in China versus the rest of the world, they are completely reversed."

China is predominantly a mobile market with better penetration of broadband via mobile devices than fixed. There is also faster average speed over cellular connection and lower latency.

"Predominantly when people in China go to do something in the digital world, they pick up their mobile phone first. That's not generally true in the rest of the world; most people will go fixed first, and then mobile if fixed is not available.

"Mobile is a better user experience for them and that's a key fundamental difference; it's exactly the opposite of the US," said Windsor.

Another difference is no power of default in the Chinese market. Elsewhere you are either an iPhone user or a Google user and your ecosystem comes pre-installed on the device. In the Chinese market you're nothing, because the device comes blank with nothing on it.

In developed markets, there's a very strong propensity to use a service if it's pre-installed on the device. "A good example is Apple Maps," said Windsor. "Apple Maps is a vastly inferior service to anything else out there, but it has gained market share. Why? Because it's on the phone when it ships and set as default, even though it's inferior.

"This currently does not really exist in China at all. If you look at all the services and digital life that people use, they download everything. And this is how I think the market may potentially evolve going forward."

The control factor is another key differentiator. When Google famously walked away from China it was about control. The Golden Shield project also known as the Great Firewall of China turns off west coast libertarians and the result is an ecosystem of users making up a market already very well penetrated with no foreign interference at all. Apple is present but its ecosystem is blocked with the exception of Apple Maps making it a very high margin device maker and little more. This market looks set to emerge as Chinese digital life services for Chinese users by Chinese companies.

Another notable factor is privacy. In the Chinese market no one seems to really care about privacy. That means that certain services that work in China will not work overseas because people are just more sensitive about their privacy than they are in China.

Battle lines are being drawn between BATs companies, and more aggressive competition among them is bound to happen. Unlike the US and Europe where users are either in the iOS ecosystem or Android, in China everybody uses everything.

For instance, some 90% of all Chinese users used Baidu search; 85% of everybody uses WeChat; and 53% uses Alibaba. Windsor added: "There isn't any being in one camp or the other. Everybody is in every camp, which really means those companies have got a long way to evolve.

"People say Xiaomi has got a great ecosystem. Well not as far as I can see. They may have some of the digital life assets but they have no real engagement. Out of the China digital life pie China Mobile holds a tiny 2%."

A group of start-up companies from all over the world gathered in Beijing for an intensive five-day course, aiming to get them some Chinese investment and a leg up into the largest and fastest-growing internet market on the planet.

The course, the first of its kind, is run by the Cheung Kong Graduate School of Business (CKGSB), whose MBA alumni account for a host of Chinese internet company CEOs, including Alibaba's Jack Ma.

The second day of the course saw the start-ups each deliver a five minute pitch to a group of heavyweight Chinese investors, both VC and PE, including, CIAM Capital Management, Marcolink Group, SAIF Partners and Cash Capital.

First up was Gunnar Arnby founder of Yebo! World, who explained that, just as Pokemon Go lets you collect virtual monsters, his app allows you to collect places. He said you build a social graph of interesting places, shops, hotels, churches - moments that you share.

It becomes like a game which becomes more valuable over time, he said; you can get bragging rights for having bought your raincoat from the flagship Burberry store in London's Knightsbridge, for example. He added that the app can increase foot traffic and be used to promote objects in a more nuanced manner than regular advertising. On the other, it could be used to create a credit score of sorts for users in developing countries to show that someone buys and sells goods, travels, goes to markets etc.

Next was Cybertonica which does checking and authenticating payments using AI, machine learning and biometrics. Pitching, Joshua Bower-Saul pointed out that 30% of all ecommerce gets lost through the friction involved in fraud limits, charge backs and so on. The company has recently been testing its system in Russia with a major bank and is also expanding into UK and other European countries. Cybertonica is looking for $1.5m to take it into the vast Chinese ecommerce market.

EuroPas was described by its CEO Guillaume de Roquefeuli as a WeChat Pay for Chinese travellers - 120 million of whom are exported every year. Backed by the French authorities for tourism, the platform is currently used on the Metro and to get into museums. He added that it also links to other stores that take WeChat Pay.

Gloves fitted with chips on the fingertips to fly drones easily and rather elegantly was presented next by young engineer Magnus Arveng of Arveng Technology, accompanied by his brother William, CFO. The brothers imagine future use cases melded with virtual reality, pointing out that existing attempts to fly drones with wearbles use either the Spektrum or Taramis operating systems - an interoperability problem they had solved.

RELAYTO is an app for PDF presentation which allows users to recreate them as webpages with embedded slides, videos etc in a generally better user experience, particularly when it comes to viewing on mobile devices. Pitching CEO Alex Shevelenko said it is an all in one publishing software, adding that the company had been working with MIT Labs; the solution is well suited to document heavy sectors like finance and insurance, he said.

Luis Carranza is a well-known figure on the London fintech scene where his company Meetup puts on London Fintech Week and Blockchain Week. He was looking to expand his global events business into China, and also mentioned the incubator work he does with blockchain companies and IoT insurance hardware/software systems.

Flowform uses ingenious Flow Surface Technology, which circulates stagnant water in a figure of eight motion around cascading ceramic bowls, in order to introduce oxygen to it and make it useful again. Chief development officer Ian Troudsell said scientists from Cambridge University had developed the biomimicry technology, which is being trialled across Europe and also in China. He said the designs typically squeeze eight meters of flow into a single meter, redeeming a man-made water problem for the characteristics of mountain streams.

Solving the problem of corruption and flow of aid money in Africa to off-shore accounts, iNDEXinnovation aims to tokenise funds and anchor these to shared ledgers. Michelle Arnot-Kruger, who also works for Unicef, and her husband Rudi Kruger pointed out $20bn of aid money was been siphoned out of Nigeria between 2005 and 2010. She said cash has to be removed from the system and should be replaced by completely transparent Activity Specific Tokens. The trusted nodes on the network would include Unicef and Citibank.

Naturvention (NAAVA), which uses vertical racks mounted with plants that support special microbes to clean processed and unhealthy indoor air, went down well - which is not really surprising in Beijing. Aki Soudunsaari and Marrti Siniharju of Finland said the air locked around us tends to be air created by man and that it actually hampers your mental performance. Their biological air purification system uses microbes in the roots of the plants to create clean air at a rate that is orders of magnitude more than regular house plants. In the next decade biopurification will surpass mechanical means, they predict. After a while the room even starts to smell better, like a golf course, or a Finnish forest.

UK based Givvit is an app that allows users to deliver small gifts (treats) like a glass of wine, cup of coffee, a takeaway meal to people, with messages attached. Pitching James Cullen, a former Coke executive, said the app was akin to gift cards and that it has partnered with Thrifty and SE East Trains - and if anyone needs to offer its customers treats, it's them. Cullen said he was looking for 13.5m RMB to start partnering in China.

Pitching via video was Tony Craddock of the Emerging Payments Association, another well-known face in the UK fintech scene. Tony apologised for having to attend a business meeting in Shanghai; he said the opportunity was open to Chinese companies to work with the best in paytech companies from the UK, which have received authorisation from the Bank of England.

Summing up, China Start programme director Bo Ji said he had been very impressed by all the presentations. Before the next round of pitches, to take place in Shenzen at the end of the week, he offered the startups the following advice: "I would say, it's not so good to ask for only a little bit of money. Investors want to know you are going to do something really impactful. So don't be afraid to ask for a lot. Remember, this is China."

The UK's dominance of fintech looks likely to continue thanks to Chancellor Philip Hammond's pledge of £2bn for R&D and innovation to keep the UK "leading the world in disruptive technology".

The Chancellor announced the boost to innovation and technology, as well a focus on 5G testing and rollout, as part of a £23bn National Productivity Investment Fund. He added that planned infrastructure between Oxford and Cambridge would extend to a "tech corridor".

He also said a start-up VC fund of £400m via the British Business Bank would ensure UK start-ups wouldn't wither on the vine.

Kerim Derhalli, CEO and founder of invstr, said: "Much has been made of the recent dip in venture funding within fintech, but we're simply observing the typical cycle of an innovative environment. The fintech boom has seen rise to many impressive products, but also a large quantity of lower level pretenders who will, naturally, fall by the wayside. Venture capitalists have now reached a point where only the best ideas with real longevity will find funding.

"The key for foreign investors looking to invest in the booming UK fintech scene is consistency. By essentially maintaining the status quo in today's statement, Mr Hammond has gone a way to restoring calmer waters following the tidal wave of concern following Brexit and Donald Trump's election. The reality is that, despite various forecasts, no one really knows what Brexit means so businesses will look to reduce their own volatility until details emerge."

The Chancellor has been un-fazed by the Brexit threat of a new financial hub relocation somewhere like Frankfurt, for instance, which he has said "doesn't make a lot of sense".

Derhalli added: "The City is going to remain the hub of finance and fintech, irrespective of Brexit. The likes of Barclays and HSBC have already said as much. If a fintech start-up wants to succeed it needs to be where it's at - which is the UK. For now, the outlook doesn't look too bad."

Mark Boleat, policy chairman, City of London Corporation said: "While a commitment to roll out 5G is admirable, far too many people find broadband and digital infrastructure poor in comparison to other countries. At the moment London ranks 26th out of 33 European capitals when measured by download speed. Nearly every business relies on reliable and quick broadband but too many find what they are promised is not actually what they get delivered. While the Digital Infrastructure Fund will open up the market for operators, all that consumers and businesses really want is a safe, reliable and secure broadband offer."

Duncan Tait, corporate executive officer, SEVP and head of Americas and EMEIA, Fujitsu EMEIA, said: "The Digital Infrastructure Investment Fund is a vital step in enabling UK businesses to remain competitive in the digitally disrupted world. Businesses are facing a greater threat than ever before from digital disruptors in every sector, spanning Airbnb in tourism to Uber in transport. In fact Fujitsu's Fit for Digital research showed that the majority of global business leaders believe that their organisation won't exist in its current form by 2021 in the wake of digital disruption.

"To survive, businesses must be able to innovate using the latest technologies, such as the Internet of Things and artificial intelligence. Collaborating closely with technology experts will be crucial - at Fujitsu for example we're collaborating on more than 200 co-creation projects to help businesses flourish amidst digital disruption. For this companies need reliable, fast broadband speeds. The Government's move to improve the UK's infrastructure will therefore help businesses to compete and thrive against newer digital disruptors, both at home and globally."

Specifically, the government will support investment in UK FinTech, with an agreement with the Joint Money Laundering Steering Group (JMLSG) that they will modernise their guidance on electronic ID verification to support the use of technology to access financial services.

Luke Scanlon, head of fintech propositions at law firm Pinsent Masons, said: "The modernisation of the JMLSG guidance will be a major step forward in helping people and businesses make their financial lives completely digital. SMEs and consumers are aware of how difficult it can be to open up a bank account and verify and authenticate that they are who they say they are.

"Digital only banks and new payment service providers promise a future in which all financial aspects of a person or business' life can take place online, but this can only occur if it becomes easier to establish relationships with financial providers in the first instance in a wholly digital context. Digital IDs are fundamental to this transition.

"The government is likely to further the FCA's public statements which suggest that the JMLSG guidance will need to be updated in a way that enables bank accounts to be opened without relying on cumbersome offline paper-based processes. Fintech businesses are highly active in this area and there is increasing scope for biometric solutions to play a pivotal role here."

A group of start-up companies from all over the world gathered in Beijing for an intensive five-day course, aiming to get them some Chinese investment and a leg up into the largest and fastest-growing internet market on the planet.

The course, the first of its kind, is run by the Cheung Kong Graduate School of Business (CKGSB), whose MBA alumni account for a host of Chinese internet company CEOs, including Alibaba's Jack Ma.

The second day of the course saw the start-ups each deliver a five minute pitch to a group of heavyweight Chinese investors, both VC and PE, including, CIAM Capital Management, Marcolink Group, SAIF Partners and Cash Capital.

First up was Gunnar Arnby founder of Yebo! World, who explained that, just as Pokemon Go lets you collect virtual monsters, his app allows you to collect places. He said you build a social graph of interesting places, shops, hotels, churches - moments that you share.

It becomes like a game which becomes more valuable over time, he said; you can get bragging rights for having bought your raincoat from the flagship Burberry store in London's Knightsbridge, for example. He added that the app can increase foot traffic and be used to promote objects in a more nuanced manner than regular advertising. On the other, it could be used to create a credit score of sorts for users in developing countries to show that someone buys and sells goods, travels, goes to markets etc.

Next was Cybertonica which does checking and authenticating payments using AI, machine learning and biometrics. Pitching, Joshua Bower-Saul pointed out that 30% of all ecommerce gets lost through the friction involved in fraud limits, charge backs and so on. The company has recently been testing its system in Russia with a major bank and is also expanding into UK and other European countries. Cybertonica is looking for $1.5m to take it into the vast Chinese ecommerce market.

EuroPas was described by its CEO Guillaume de Roquefeuli as a WeChat Pay for Chinese travellers - 120 million of whom are exported every year. Backed by the French authorities for tourism, the platform is currently used on the Metro and to get into museums. He added that it also links to other stores that take WeChat Pay.

Gloves fitted with chips on the fingertips to fly drones easily and rather elegantly was presented next by young engineer Magnus Arveng of Arveng Technology, accompanied by his brother William, CFO. The brothers imagine future use cases melded with virtual reality, pointing out that existing attempts to fly drones with wearbles use either the Spektrum or Taramis operating systems - an interoperability problem they had solved.

RELAYTO is an app for PDF presentation which allows users to recreate them as webpages with embedded slides, videos etc in a generally better user experience, particularly when it comes to viewing on mobile devices. Pitching CEO Alex Shevelenko said it is an all in one publishing software, adding that the company had been working with MIT Labs; the solution is well suited to document heavy sectors like finance and insurance, he said.

Luis Carranza is a well-known figure on the London fintech scene where his company Meetup puts on London Fintech Week and Blockchain Week. He was looking to expand his global events business into China, and also mentioned the incubator work he does with blockchain companies and IoT insurance hardware/software systems.

Flowform uses ingenious Flow Surface Technology, which circulates stagnant water in a figure of eight motion around cascading ceramic bowls, in order to introduce oxygen to it and make it useful again. Chief development officer Ian Troudsell said scientists from Cambridge University had developed the biomimicry technology, which is being trialled across Europe and also in China. He said the designs typically squeeze eight meters of flow into a single meter, redeeming a man-made water problem for the characteristics of mountain streams.

Solving the problem of corruption and flow of aid money in Africa to off-shore accounts, iNDEXinnovation aims to tokenise funds and anchor these to shared ledgers. Michelle Arnot-Kruger, who also works for Unicef, and her husband Rudi Kruger pointed out $20bn of aid money was been siphoned out of Nigeria between 2005 and 2010. She said cash has to be removed from the system and should be replaced by completely transparent Activity Specific Tokens. The trusted nodes on the network would include Unicef and Citibank.

Naturvention (NAAVA), which uses vertical racks mounted with plants that support special microbes to clean processed and unhealthy indoor air, went down well - which is not really surprising in Beijing. Aki Soudunsaari and Marrti Siniharju of Finland said the air locked around us tends to be air created by man and that it actually hampers your mental performance. Their biological air purification system uses microbes in the roots of the plants to create clean air at a rate that is orders of magnitude more than regular house plants. In the next decade biopurification will surpass mechanical means, they predict. After a while the room even starts to smell better, like a golf course, or a Finnish forest.

UK based Givvit is an app that allows users to deliver small gifts (treats) like a glass of wine, cup of coffee, a takeaway meal to people, with messages attached. Pitching James Cullen, a former Coke executive, said the app was akin to gift cards and that it has partnered with Thrifty and SE East Trains - and if anyone needs to offer its customers treats, it's them. Cullen said he was looking for 13.5m RMB to start partnering in China.

Pitching via video was Tony Craddock of the Emerging Payments Association, another well-known face in the UK fintech scene. Tony apologised for having to attend a business meeting in Shanghai; he said the opportunity was open to Chinese companies to work with the best in paytech companies from the UK, which have received authorisation from the Bank of England.

Summing up, China Start programme director Bo Ji said he had been very impressed by all the presentations. Before the next round of pitches, to take place in Shenzen at the end of the week, he offered the startups the following advice: "I would say, it's not so good to ask for only a little bit of money. Investors want to know you are going to do something really impactful. So don't be afraid to ask for a lot. Remember, this is China."

Related Articles