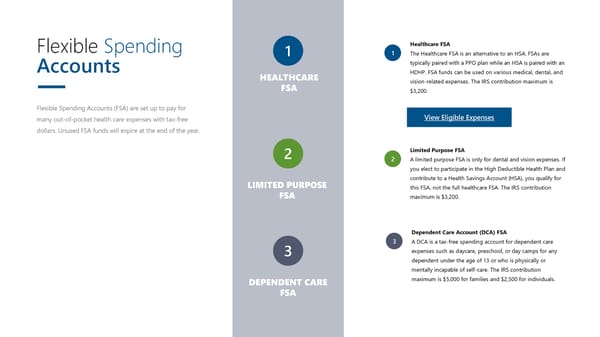

Flexible Spending Healthcare FSA 1 1 The Healthcare FSA is an alternative to an HSA. FSAs are Accounts typically paired with a PPO plan while an HSA is paired with an HEALTHCARE HDHP. FSA funds can be used on various medical, dental, and FSA vision-related expenses. The IRS contribution maximum is $3,200. Flexible Spending Accounts (FSA) are set up to pay for many out-of-pocket health care expenses with tax-free View Eligible Expenses dollars. Unused FSA funds will expire at the end of the year. 2 Limited Purpose FSA 2 A limited purpose FSA is only for dental and vision expenses. If you elect to participate in the High Deductible Health Plan and LIMITED PURPOSE contribute to a Health Savings Account (HSA), you qualify for FSA this FSA, not the full healthcare FSA. The IRS contribution maximum is $3,200. Dependent Care Account (DCA) FSA 3 A DCA is a tax-free spending account for dependent care 3 expenses such as daycare, preschool, or day camps for any dependent under the age of 13 or who is physically or mentally incapable of self-care. The IRS contribution DEPENDENT CARE maximum is $5,000 for families and $2,500 for individuals. FSA

ACME Benefits Guide Page 18 Page 20

ACME Benefits Guide Page 18 Page 20