Amazon 2022 Proxy Statement

Notice of 2022Annual Meeting of Shareholders& Proxy Statement

Notice of 2022 Annual Meeting of Shareholders &ProxyStatement 9:00 a.m., Pacific Time Wednesday,May25,2022 Virtual Meeting Site: www.virtualshareholdermeeting.com/AMZN2022

PROXYOVERVIEW ANNUALMEETINGOFSHAREHOLDERS ToBeHeldonWednesday,May25,2022 Meeting Agenda ThankyouforbeinganAmazonshareholder.Nomatterhowlargeorsmallyourholdingsmaybe,yourvoteis importanttous,andweencourageyoutovoteyoursharesinaccordancewiththeBoard’srecommendations.The information here is only an overview, and you can learn more before you vote by reading our Proxy Statement and Annual Report. Board’s Voting MoreInformation VotingItems Recommendation BeginningonPage 1. Election of 11 directors FOR 2 (each nominee) 2. Ratification of Ernst & Young as independent auditors FOR 19 3. Advisory vote to approve executive compensation FOR 22 4. Approval of a 20-for-1 stock split and a proportionate increase in FOR 24 authorized shares 5-19. Shareholder proposals AGAINST 26 (each proposal) Toexpressourappreciationforyourparticipation,Amazonwillmakea $1charitable donation to The Nature Conservancy on behalf of every shareholder account that votes. Stock Price Performance as of FYE 2021 30,716% 1,826% 345% 122% 20year 10year 5year 3year Executive Compensation • Ourexecutivecompensationphilosophyfocusesonthetruelong-termsuccessofourbusiness,noton isolated one-, two-, or three-year goals that encompass only a limited and selective portion of our objectives andthatcanrewardexecutives with above-target payouts even when the stock price remains flat or declines. • Ouremphasisonperiodicgrantsoftime-vested restricted stock units that vest over the long term perfectly aligns our executives’ compensation with the returns we deliver to shareholders. • Having considered other approaches to structuring executive compensation arrangements, we remain committedtothestructureofourexecutivecompensationbecauseithasworkedeffectively,having allowed us to: ✓attract and retain incredibly talented people who have guided our business through countless challenges; ✓developourbusinessinwaysthatwecouldnothaveconceivedafewyearsearlier,includinginitiatives that later became AWS, Kindle, Alexa, and our robust third-party seller business; ✓makelong-termcommitmentstosustainabilityandotherenvironmental, social, and human capital initiatives andgoals; and ✓deliver strong long-term returns to our shareholders.

Global Impact Highlights OurPeople Wenowemploymorethan1.6millionpeopleworldwide—havingcreatedmorethan750,000full-andpart-timejobsin the U.S. since the start of the pandemic—and continue to invest in offering competitive pay and benefits. In the U.S., this includes an average starting wage for our front-line employees of more than $18 per hour and comprehensive benefits for regular full-time employees. These benefits include health, vision, and dental insurance; a 401(k) with a company match; up to 20 weeks of paid parental leave for birthing parents; adoption assistance; and access to Amazon’s Career Choice program. AmazonhasbeennamedNo.2onFortune’sWorld’sMostAdmiredCompanieslistforsixyearsrunningandiscurrentlyinthe Top10onLinkedIn’sTopCompanieslistsintheU.S.(No.1), Australia, Canada, China, India, Japan, Spain, and the UK. Someoftheprogramsthatearnusthisrecognitioninclude: • Familysupportprograms,includingLeaveShare,whichallowsU.S. employees to donate up to six weeks of their paid parental time to their partner should their partner’s employer not offer paid parental leave, and Ramp Back, which enables employeestoreturn to work at a flexible schedule for up to eight consecutive weeks after birth or adoption. • Free mental health resources available 24/7 to all U.S. employees, their families, and anyone in their household, including free counseling sessions. • AmazonReturnships,whichhelppeoplewhohavebeenwithoutajoborunderemployedforatleastayearbyprovidinga newopportunity to rejoin the U.S. workforce. • Amazon’sCareerChoiceprogram,whichoffersfullyfundedtuitionopportunities, including bachelor’s degrees, high school diplomas, GEDs, and ESL programs. This offering, which we began in 2021, is part of Amazon’s $1.2 billion Upskilling 2025commitmenttoprovidefreetrainingto300,000employeesintheU.S.by2025. Safety is integral to everything we do. Our work environments allow employees, regardless of background, skill level, or experience, to work with confidence. In 2022, we published Delivered with Care, a report on safety, health, and well-being at Amazon.In2021,weinvestedover$300millionin safety improvements, and we have incurred more than $15billion in COVID-19-related costs since March 2020 to help keep employees safe and deliver for customers. Ourscale, resources, and technology allow us to undertake initiatives that benefit the entire industry. For example, we are investing to create technology to improve universal fork truck safety, and we established afirst-of-its-kind partnership with the National Safety Council to uncover new ways to prevent and address musculoskeletal disorders. Webelieveourfutureisdiverse,inclusive, and accessible across every race, gender, belief, origin, and community. In 2021, we again set ambitious goals focused on increasing diversity in our hiring, building an inclusive work environment, and providing equitable access for all. We’ve also increased the amount and specificity of the data wesharepublicly, which shows there is more work to do, but also demonstrates progress. We take steps to give employees a sense of belonging, value, and opportunity, such as through our 13 affinity groups (employee resource groups) with more than 90,000employeesacrosshundredsofchaptersworldwide.Weactively recruit diverse candidates through our partnerships withHistoricallyBlackCollegesandUniversities,Hispanic-ServingInstitutions,women’scolleges,andtribalcolleges,andwehave over 45,000 U.S. veterans and military spouses working at Amazon. Learn more at aboutamazon.com/workplace.

OurPartners Weworkwithmorethan2millionindependentpartnersintheU.S.,includingsellers, developers, content creators, authors, anddelivery providers. We openly share information, tools, and services with third parties that work with Amazon to foster their business growth. When they thrive, our customers benefit from the products and services they offer. We support a number of different types of partners, including: • Smallandmedium-sizedbusinessessellinginAmazon’sstores.ThesebusinessescomefromeverystateintheU.S. andmorethan130countriesaroundtheworld. Amazonspentmorethan$100milliontohelpsmall andmedium-sizedbusinessesreachmorecustomers during Prime Day and throughout the holiday season, andthird-party sellers—most of which are small andmedium-sizedbusinesses—achievedrecord worldwide sales in Amazon’s store for the 2021 holiday season. More than half of sales from Black Friday through Cyber Monday were from third-party sellers, andmorethan130,000third-partysellerssurpassed $100,000insales during the holiday season. • Morethan3,000independentDeliveryService Partners. This program began in 2018 and now has companiesintheU.S., Canada, the UK, Germany, France, Italy, Spain, Ireland, Brazil, the Netherlands, and India, employing morethan260,000drivers. More than 2.2 billion packages have been delivered worldwide, and their businesses have generated over $12 billion in revenue, benefitting the community and customers. To address inequality and create long-term change, Amazon launched its diversity grant program in 2020 to help develop pathways for Black, Latinx, and Native American entrepreneurs. • Millions of organizations in 190 countries around the world powered by Amazon Web Services (AWS). The fastest- growing startups and largest enterprises, as well as nonprofits and government agencies, are powered by AWS’s highly secure, reliable, scalable, and low-cost cloud technology. Using AWS, customers and partners around the world are innovatingatafasterpacethaneverbefore,includingextraordinaryaccomplishmentslikedeliveringlife-savingmedications to patients faster, making self-driving cars a reality, and expediting real-world sustainability solutions that are helping everyone on the planet. • DevelopersbuildingforAlexaandAppstore.Builders,developers,andentrepreneurshavetheopportunitytoinnovate, build a business, and connect with customers across hundreds of millions of Alexa devices, like Fire TV, Fire Tablet, and Echo. There are over 900,000 developers building for Alexa. Alexa helps generate billions of dollars for the developer and device-makercommunity,andthereareskilldevelopersmakingmorethan$1millionannuallythroughin-skillpurchasing. AmazonrecentlyintroducedtheAppstoreSmallBusinessAcceleratorandtheAlexaSkillDeveloperAccelerator,whichhelp smaller developers build and grow their app and skill businesses while inventing for customers. Amazon Appstore is also curating apps for the Windows 11 storefront, which brings mobile apps and games directly to Windows. • Millions of writers around the world building successful careers using Kindle Direct Publishing (KDP). KDP authors self-publish and distribute their books to millions of readers around the world, choosing where they want to sell, setting their own prices, and earning up to 70% of every sale in royalties. Thousands of independent authors earned morethan$50,000inroyaltiesin2021,withmorethan2,000authorssurpassing$100,000inroyalties.Inaddition, since 2009, the Amazon Literary Partnership has provided more than $14 million to organizations across the country that empowerwriterstocreate, publish, learn, teach, experiment, and thrive. Learn more at aboutamazon.com/impact/empowerment/small-businesses.

OurPlanet TheClimatePledgeisAmazon’scommitmenttobenet-zerocarbonby2040,andweareonapathtopoweringour operations with 100% renewable energy by 2025. As the world’s largest corporate buyer of renewable energy, Amazon announceddozensofnewrenewableenergyprojectsin2021andnowhas274projectsglobally.TheClimatePledgehas beensignedbyAmazonandover300othercompaniesthatcommittothesamegoals,includingBestBuy,IBM,JetBlue,Microsoft, Uber, Unilever, and Verizon. Pledge signatories in total generate over $3.5 trillion in global annual revenues and have more than 8 million employees across 51 industries in 29 countries. Amazoncontinuestotakemeaningfulstepsinour journey to be net-zero carbon, including: • ExpandingClimatePledgeFriendly.Thisprogram includesmorethan200,000products,makingiteasier for customers to shop for products that have one or moreof37differentsustainability certifications. • Supportingthedevelopmentofsustainableand decarbonizing technologies and services through TheClimatePledgeFund.Withaninitial$2billion infunding,thisprogramhasinvestedin11visionary companieswhoseproductsandsolutionswillfacilitate the transition to a low-carbon economy, such as CMCMachinery,atechnologycompanythatmanufacturescustom-sizedboxeswhileeliminatingtheneedforsingle-use plastic padding, and Infinium, a company developing low-carbon electrofuels for air, marine, and heavy-truck fleets. • Restoring and conserving forests, wetlands, and grasslands around the world through the Right Now Climate Fund.Lastyear,this $100million fund announced investments in a nature-based carbon removal initiative in the Brazilian Amazonandacommitmentofapproximately$23.5million(€20million)forprojectsacrossEurope.Thefirst recipient of new funding aims to plant 22 million trees across 14 metropolitan areas in Italy. Someofourlatestinitiatives include: • Mobilizing $1 billion to protect tropical forests via the LEAF (Lowering Emissions by Accelerating Forest finance) Coalition, an ambitious public-private initiative designed to protect tropical forests. • OpeningClimatePledgeArenainSeattle,thefirstnet-zerocarboncertified arena in the world, which Amazon secured namingrights to in 2020. • Partnering with automakers who share in our decarbonization ambitions. We are excited to work with partners like Rivian, Stellantis, and others to help us accelerate the available supply of high-performance electric vehicles. Our custom order of 100,000 electric delivery vehicles in partnership with Rivian will hit the road by 2030. • Collaboratingwithotherstoreducepackagingwaste.Since2015,wehavereducedtheweightofoutboundpackaging bymorethan36%andeliminatedtheequivalentof2billionshippingboxes. • Issuing a $1 billion sustainability bond. The bond funds new and ongoing projects in five areas: renewable energy, clean transportation, sustainable buildings, affordable housing, and socioeconomic advancement and empowerment. • Participating in industry and government efforts, such as co-founding The Cargo Owners for Zero Emission Vessels networkalongsidetheAspenInstitute, which aims to transition ocean freight vessels from fossil fuels to zero-carbon fuels by2040;participating in the launch of The First Movers Coalition, which targets emissions reductions in aviation, ocean shipping, steel, and trucking; supporting the creation of the Sustainable Aviation Buyers Alliance’s Aviators Group, which is focused on accelerating the transition to net-zero emissions air transport; and supporting the launch of the Clean Energy DemandInitiative, which advances clean energy goals by leveraging corporate clean energy commitments. • Becomingthefirstconsumerelectronicsmanufacturertocommittoaddressing,throughrenewableenergy development,theelectricity used by its devices. By 2025, Amazon aims to produce the clean energy equivalent of all the electricity used by Fire TV and Ring devices worldwide. Learn more at sustainability.aboutamazon.com.

OurCommunities Weworksidebysidewithcommunitypartnershelpingtosolvesomeoftheworld’smostpressingchallengesandbuildboth long-term programs and what we call “Right Now Needs” programs to help build strong inclusive communities. Ourlong-termprogramssupportcommunitiesinarangeofways.Forexample: • AmazonFutureEngineerisourglobalchildhood-to-careercomputerscienceprogramthatinspiresandeducates students from underserved and underrepresented communities. In 2021, the program reached 1.8 million students in the U.S., Canada, France, Germany, India, and the UK. Students explore computer science by meeting Amazon employees in career talks or exploring our innovations. We support educators with school curriculum on topics like using code to make music and programming robots; we award 100 students in the U.S. each year with four-year, $40,000 scholarships and paid internships at Amazon; and we honor Teacher of the Year Award winners with more than $30,000. • Weprovidefreecloudskillstraining, with the goal to reach 29 million people around the world by 2025. The AWS- designed programs range from self-paced online courses to intensive reskilling programs that help participants build new careers in the technology industry. In 2021, we launched AWS Skill Builder, a new digital learning experience; added AWScoursestotheAmazon.comwebsite;expandedtheAWSre/Startglobalreskillingprogram;andopenedAmazon’s first dedicated, in-person cloud learning space in Seattle. • AmazonlaunchedtheAWSArtificialIntelligence & Machine Learning Scholarship, a $10 million education and scholarship programaimedatpreparingunderrepresentedandunderservedstudentsgloballyforcareersinmachinelearning. • AmazonlaunchedtheAmazonHousingEquityFundinJanuary2021.ThisistheCompany’smorethan$2billion commitmenttopreserveandcreateaffordablehomesinWashingtonstate’sPugetSoundregion;theWashington,D.C., andArlington,Virginia,metropolitanareas;andNashville,Tennesseebyprovidinglow-rateloansandgrantstotraditional andnon-traditional housing partners, public agencies, and minority-led organizations. As of March 2022, Amazon has announceddetailsof$1.2billionofthecommitment,whichwillcreateandpreservemorethan8,000affordable housing units helping an estimated 18,000 people. OurRightNowNeedsprogramsincludeincreasingaccesstofoodandbasicgoodsforchildrenandtheirfamilies. For example: • Amazondonatesitslogistics network to support food banks and community organizations, delivering groceries and pre-packagedmealsdirectly to vulnerable families andthosedisproportionately impacted by COVID-19. Deliveries in 2021 totaled more than 20 million meals in the U.S., Australia, Japan, Singapore, Spain, andtheUK. • Weleverageouroperationalexcellence, technologies, andworldwidelogistics network to support organizations fighting large-scale natural disasters.Forexample,wefillcargojetswithAmazon- donateditemsforcommunitiesravagedbyhurricanes, helpgovernmentsandnonprofitsexpediteresponse efforts through our AWS cloud services, and respond morequickly to natural disasters in the region from our Disaster Relief Hub in an Atlanta fulfillment center. In late 2021, Amazon donated more than 300,000 emergency aid items to support communities affected by tornadoes in the Midwest and Southern U.S.; wildfires in Colorado; and flooding in Chennai and Uttarakhand, India and in British Columbia, Canada. Through the AWS Disaster Response team, weworkedwithorganizations to rebuild infrastructure and connectivity in the aftermath of hurricanes in the Atlantic. Learn more at aboutamazon.com/impact/community.

NOTICEOF2022ANNUALMEETING OFSHAREHOLDERS DateandTime Virtual Meeting Site Wednesday,May25,2022 www.virtualshareholdermeeting.com/AMZN2022 9:00 a.m., Pacific Time Items of Business: OurBoardofDirectors RecommendsYouVote: • Toelect the eleven directors named in the Proxy Statement to serve until the FORtheelectionofeach next Annual Meeting of Shareholders or until their respective successors are director nominee elected and qualified • Toratify the appointment of Ernst & Young LLP as our independent auditors for FORtheratification of the fiscal year ending December 31, 2022 the appointment • Toconductanadvisoryvotetoapproveourexecutivecompensation FORapproval, on an advisory basis • ToapproveanamendmenttoourRestatedCertificateofIncorporationtoeffect FORapprovalofthe a 20-for-1 split of our common stock and a proportionate increase in the number amendmenttoour of authorized shares of common stock Restated Certificate of Incorporation • Toconsider and act upon the shareholder proposals described in the Proxy AGAINST Statement, if properly presented at the Annual Meeting each of the shareholder proposals • Totransact such other business as may properly come before the meeting or any adjournment or postponement thereof TheBoardofDirectors has fixed March 31, 2022 as the record date for determining shareholders entitled to receive notice of, and to vote at, the Annual Meeting or any adjournmentorpostponementthereof.Onlyshareholdersofrecordattheclose of business on that date will be entitled to notice of, and to vote at, the Annual Meeting. ByOrderoftheBoardofDirectors DavidA.Zapolsky Secretary Seattle, Washington April 14, 2022 ImportantNoticeRegardingtheAvailabilityofProxyMaterialsfortheAmazon.com,Inc.ShareholderMeetingtobeHeldon May25,2022.TheProxyStatementandour2021AnnualReportareavailableatwww.proxyvote.com.

TABLEOFCONTENTS ITEM1—ElectionofDirectors 2 KeyProxy BOARDOFDIRECTORSINFORMATION 3 Information Biographical Information 3 Director Nominee Diversity, Tenure, Skills, and Characteristics 9 Corporate Governance 10 Boarddiversity Board Meetings and Committees 14 CompensationofDirectors 17 (page9) ITEM2—RatificationoftheAppointmentofErnst&YoungLLPas IndependentAuditors 19 Risk oversight AUDITORS 20 (page10) Fee Information 20 Pre-Approval Policies and Procedures 20 Audit Committee Report 21 Environmental, social, ITEM3—AdvisoryVotetoApproveExecutiveCompensation 22 andhumancapital ITEM4—ApprovalofAmendmenttoRestatedCertificateofIncorporation 24 initiatives SHAREHOLDERPROPOSALS 26 (page11) BENEFICIALOWNERSHIPOFSHARES 87 EXECUTIVECOMPENSATION 88 Ourshareholder CompensationDiscussion and Analysis 88 engagementprogram Leadership Development and Compensation Committee Report 97 (page13) SummaryCompensationTable 98 Grants of Plan-Based Awards 99 Outstanding Equity Awards and Stock Vested 100 Ourexecutive Potential Payments Upon Termination of Employment or Change-in-Control 101 compensation SECURITIESAUTHORIZEDFORISSUANCEUNDEREQUITY philosophy COMPENSATIONPLANS 103 (page89) ANNUALMEETINGINFORMATION 104 General 104 Considerations for our Outstanding Securities and Quorum 104 2021equitygrants Internet Availability of Proxy Materials 104 Proxy Voting 104 (page92) Other Matters 105 Voting Standard 106 Revocation 106 Participating in the Annual Meeting 106 OTHERINFORMATION 108 This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current facts, including statements regarding our environmental, social, and othersustainability plans, initiatives, projections, goals, commitments, expectations, or prospects, are forward-looking. We use words suchasanticipates,believes,commits,expects,future,goal,intends,plans,projects,seeks,andsimilarexpressionstoidentifyforward- looking statements. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Actual results or outcomes could differ materially due to a variety of factors. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our 2021 Annual Report on Form 10-K and our 2020 AmazonSustainability Report. Any standards of measurement and performance made in reference to our environmental, social, andothersustainabilityplansandgoalsaredevelopingandbasedonassumptions,andnoassurancecanbegiventhatanysuchplan, initiative, projection, goal, commitment, expectation, or prospect can or will be achieved. Website references throughout this documentareprovidedforconvenienceonly, and the content on the referenced websites is not incorporated by reference into this document.

AMAZON.COM,INC. PROXYSTATEMENT ANNUALMEETINGOFSHAREHOLDERS ToBeHeldonWednesday,May25,2022 Theenclosedproxyis solicited by the Board of Directors of Amazon.com, Inc. (“Amazon” or the “Company”) for the Annual MeetingofShareholderstobeheldvirtually,viatheInternet,at9:00a.m.,PacificTime,onWednesday,May25,2022,andany adjournment or postponement thereof. For more information about the Annual Meeting, including how to attend and vote your shares, please see “Annual Meeting Information” on page 104. Voting via the Internet, mobile device, or by telephone helps save money by reducing postage and proxy tabulation costs. Tovotebyanyofthesemethods,readthisProxyStatement,haveyourNoticeofInternetAvailabilityofProxyMaterials,proxy card, or voting instruction form in hand, and follow the instructions below for your preferred method of voting. Each of these voting methods is available 24 hours per day, seven days per week. Weencourageyoutocastyourvotebyoneofthefollowingmethods: VOTEBYINTERNET VOTEBYQRCODE VOTEBYTELEPHONE Shares Held of Record: Shares Held of Record: Shares Held of Record: http://www.proxyvote.com See Proxy Card 800-690-6903 Shares Held in Street Name: Shares Held in Street Name: Shares Held in Street Name: See Notice of Internet Availability or See Notice of Internet Availability or See Voting Instruction Form Voting Instruction Form Voting Instruction Form Ourprincipal offices are located at 410 Terry Avenue North, Seattle, Washington 98109. This Proxy Statement is first being madeavailable to our shareholders on or about April 14, 2022. 2022ProxyStatement 1

ITEM1—ELECTIONOFDIRECTORS In accordance with our Bylaws, the Board has fixed the number of directors constituting the Board at eleven. The Board, basedontherecommendationoftheNominatingandCorporateGovernanceCommittee,proposedthatthefollowingeleven nomineesbeelectedattheAnnualMeeting,eachofwhomwillholdofficeuntilthenextAnnualMeetingofShareholders or until his or her successor shall have been elected and qualified: • Jeffrey P. Bezos • Judith A. McGrath • AndrewR.Jassy • Indra K. Nooyi • Keith B. Alexander • Jonathan J. Rubinstein • Edith W. Cooper • Patricia Q. Stonesifer • Jamie S. Gorelick • Wendell P. Weeks • Daniel P. Huttenlocher Each of the nominees is currently a director of Amazon.com, Inc. and has been elected to hold office until the 2022 Annual Meeting or until his or her successor has been elected and qualified. Andrew R. Jassy and Edith W. Cooper were elected as directors by the BoardofDirectorseffectiveJuly5,2021andSeptember20,2021,respectively,andtheothernomineeswere mostrecently elected at the 2021 Annual Meeting. Biographical and related information on each nominee is set forth below. Thomas O. Ryder retired from the Board of Directors effective December 31, 2021. TheBoardexpectsthattheelevennomineeswillbeavailable to serve as directors. However, if any of them should be unwilling or unable to serve, the Board may decrease the size of the Board or may designate substitute nominees, and the proxies will be voted in favor of any such substitute nominees. WhyWeRecommendYouSupportThisProposal • Wehavetheappropriatemixofskills, qualifications, backgrounds, and tenures on the Board to support and help drive the Company’s long-term performance. • Ourdirectors reflect our commitment to diversity, with five women and two directors from underrepresented racial/ ethnic groups. • TheBoardactively oversees our numerous environmental, sustainability, social, and corporate governance policies and initiatives, receives periodic reports on and discusses our enterprise risk assessments, and reviews shareholder feedback on these topics as we evolve our practices and disclosures. TheBoardofDirectorsrecommendsavote“FOR”eachnominee. 2

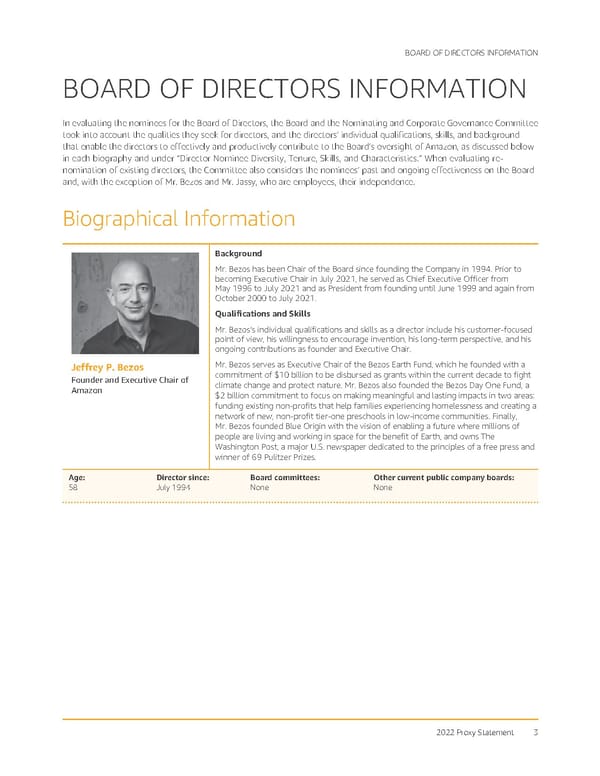

BOARDOFDIRECTORSINFORMATION BOARDOFDIRECTORSINFORMATION In evaluating the nominees for the Board of Directors, the Board and the Nominating and Corporate Governance Committee took into account the qualities they seek for directors, and the directors’ individual qualifications, skills, and background that enable the directors to effectively and productively contribute to the Board’s oversight of Amazon, as discussed below in each biography and under “Director Nominee Diversity, Tenure, Skills, and Characteristics.” When evaluating re- nomination of existing directors, the Committee also considers the nominees’ past and ongoing effectiveness on the Board and, with the exception of Mr. Bezos and Mr. Jassy, who are employees, their independence. Biographical Information Background Mr. Bezos has been Chair of the Board since founding the Company in 1994. Prior to becomingExecutive Chair in July 2021, he served as Chief Executive Officer from May1996toJuly2021andasPresidentfromfoundinguntilJune1999andagainfrom October 2000 to July 2021. Qualifications and Skills Mr. Bezos’s individual qualifications and skills as a director include his customer-focused point of view, his willingness to encourage invention, his long-term perspective, and his ongoing contributions as founder and Executive Chair. Jeffrey P. Bezos Mr. Bezos serves as Executive Chair of the Bezos Earth Fund, which he founded with a FounderandExecutiveChairof commitmentof$10billiontobedisbursedasgrantswithinthecurrentdecadetofight Amazon climate change and protect nature. Mr. Bezos also founded the Bezos Day One Fund, a $2billion commitment to focus on making meaningful and lasting impacts in two areas: funding existing non-profits that help families experiencing homelessness and creating a network of new, non-profit tier-one preschools in low-income communities. Finally, Mr. Bezos founded Blue Origin with the vision of enabling a future where millions of people are living and working in space for the benefit of Earth, and owns The WashingtonPost, a major U.S. newspaper dedicated to the principles of a free press and winner of 69 Pulitzer Prizes. Age: Director since: Boardcommittees: Othercurrentpubliccompanyboards: 58 July 1994 None None 2022ProxyStatement 3

BOARDOFDIRECTORSINFORMATION Background Mr. Jassy has been President and Chief Executive Officer of the Company since July 2021. He founded and led Amazon Web Services since its inception, serving as its CEOfromApril2016toJuly2021anditsSeniorVicePresidentfromApril2006until April 2016. Mr. Jassy joined the Company in 1997, and, prior to founding AWS, he held various leadership roles across the Company, including both business-to-business and business-to-consumer. Mr. Jassy has served as a trustee and sponsor of Rainier Scholars, a program that offers a pathwaytocollege graduation and career success for underrepresented students of color, since 2011, and serves as Chair and is a founding member of the board of AndrewR.Jassy directors of Rainier Prep, a charter middle school committed to college and career readiness for limited-income and immigrant students and students of color. President and Qualifications and Skills CEOofAmazon Mr. Jassy’s individual qualifications and skills as a director include his customer-focused point of view, his long-term perspective, his deep understanding of Amazon’s business andculture, his in-depth knowledge of human capital management issues, including oversight of workplace environment and culture, administration of diversity and inclusion initiatives, and implementation of policies and practices to promote employee engagementandeffectiveness, and his ongoing contributions as President and CEO. Age: Director since: Boardcommittees: Othercurrentpubliccompanyboards: 54 July 2021 None None Background General (Ret.) Keith B. Alexander has been the Co-Chief Executive Officer, President, and Chair of IronNet, Inc. (“IronNet”), a cybersecurity technology company he founded, since 2014. Gen. Alexander served as the Commander of U.S. Cyber Command from May2010toMarch2014andwasDirectoroftheNationalSecurityAgencyandChiefof the Central Security Service from August 2005 to March 2014. Gen. Alexander served as a director of CSRA, Inc. from November 2015 to April 2018. Qualifications and Skills General(Ret.) Keith B. Gen. Alexander’s individual qualifications and skills as a director include his leadership Alexander andpublic policy experience as a high-ranking military official responsible for intelligence Co-CEO,President, and andnational security affairs, through which he gained experience with emerging Chair of IronNet technologies and cybersecurity. Gen. Alexander further honed his entrepreneurial and commercial experience and customer experience skills in his role at IronNet. Age: Director since: Boardcommittees: Othercurrentpubliccompanyboards: 70 September2020 Audit IronNet, Inc. 4

BOARDOFDIRECTORSINFORMATION Background Ms. Cooper is a co-founder of Medley Living, Inc., a membership-based community for personal and professional growth that launched in September 2020. In addition, Ms. Cooper served as Executive Vice President, Global Head of Human Capital ManagementofGoldmanSachsGroup,Inc.(“GoldmanSachs”)fromMarch2008to December2017.Previously at Goldman Sachs, Ms. Cooper led various client franchise businesses for the firm. Ms. Cooper has served as a director of PepsiCo, Inc. since September 2021, a director of MSDAcquisition Corp. since March 2021, a director of EQT AB since October 2018, a director of Etsy, Inc. from April 2018 to September 2021, and a director of Slack Edith W. Cooper Technologies, Inc. from January 2018 to July 2021. Ms. Cooper has also served as a trustee of the Museum of Modern Art since 2017, as a member of the Museum Council Co-FounderofMedleyLiving,Inc. of the Smithsonian National Museum of African American History and Culture since andFormerEVPofGoldmanSachs 2018, and as a trustee of Mount Sinai Health Systems, Institute for Health Equity Research, an organization dedicated to addressing longstanding disparities in health and health care, since 2017. Qualifications and Skills Ms. Cooper’s individual qualifications and skills as a director include her leadership, finance, and human capital management experience, including as a longtime senior executive at Goldman Sachs, through which she gained experience with talent development, recruiting, retention, and workplace culture, as well as her customer experience skills. Age: Director since: Boardcommittees: Othercurrentpubliccompanyboards: 60 September2021 Leadership Development and EQTAB,MSDAcquisitionCorp., Compensation PepsiCo, Inc. Background Ms. Gorelick has been a partner with the law firm Wilmer Cutler Pickering Hale and Dorr LLPsince July 2003. She has held numerous positions in the U.S. government, serving as DeputyAttorney General of the United States, General Counsel of the Department of Defense, Assistant to the Secretary of Energy, and a member of the bipartisan National CommissiononTerrorist Threats Upon the United States. Ms. Gorelick has served as a director of VeriSign, Inc. since January 2015, a director of United Technologies Corporation from February 2000 to December 2014, and a director of Schlumberger Limited from April 2002 to June 2010. Ms. Gorelick has also served as Chair of the Urban Institute, the United States’ leading research organization dedicated JamieS.Gorelick to developing evidence-based insights that improve people’s lives and strengthen communities, since 2014 and as a director since 2004. She was one of the founding Partner with Wilmer Cutler supporters and a long-time board member of the Washington Legal Clinic for the Pickering Hale and Dorr LLP HomelessandservedontheboardoftheNationalWomen’sLawCenter. Qualifications and Skills Ms. Gorelick’s individual qualifications and skills as a director include her experience as a lawyer, her leadership experience in senior governmental positions, including experience with regulatory and compliance matters, her corporate governance experience, as well as her customer experience skills and skills relating to public policy and financial statement andaccounting matters. Ms. Gorelick also has deep experience addressing diversity, equity, and inclusion, both on a policy level and in practice in the workplace, through her workadvising companies and institutions on anti-harassment, non-discrimination, and gender and race issues, and is sought as a counselor on climate, environmental regulation, and environmental justice issues. Age: Director since: Boardcommittees: Othercurrentpubliccompanyboards: 71 February 2012 Nominating and Corporate VeriSign, Inc. Governance (Chair) 2022ProxyStatement 5

BOARDOFDIRECTORSINFORMATION Background Mr. Huttenlocher has been the Dean of MIT Schwarzman College of Computing since August 2019. He served as Dean and Vice Provost, Cornell Tech at Cornell University from2012toJuly2019andworkedforCornellUniversityfrom1988to2012invarious positions. Mr. Huttenlocher has served as a director of Corning Incorporated since February 2015. Mr. Huttenlocher has also served as the Chair of the John D. and Catherine T. MacArthur Foundation, an independent foundation that makes grants and impact investments to support non-profit organizations that are addressing global social challenges, since 2018 andasadirector since 2010. Daniel P. Huttenlocher Qualifications and Skills DeanofMITSchwarzmanCollege Mr. Huttenlocher’s individual qualifications and skills as a director include his experience of Computing as an internationally recognized computer scientist and in senior positions at MIT and Cornell University, both leading universities, Cornell Tech, a research, technology commercialization, and graduate-level educational facility, and the Xerox Palo Alto Research Center, a technology research facility, through which he gained experience with emerging technologies, as well as his customer experience skills. Age: Director since: Boardcommittees: Othercurrentpubliccompanyboards: 63 September2016 Leadership Development and Corning Incorporated Compensation Background Ms. McGrath served as Chair and Chief Executive Officer of MTV Networks Entertainment Groupworldwide, a division of Viacom, Inc., including Comedy Central and Nickelodeon, fromJuly 2004 until May 2011. She was part of the original founding and launch team for MTV in 1981. Subsequent to leaving Viacom, Ms. McGrath formed a multi-media joint venture with Sony Music Entertainment called Astronauts Wanted: No Experience Necessary, identifying and creating content with emerging digital media talent, at which Ms. McGrath served as President from June 2013 to March 2018 and continued as a senior advisor from March 2018 to December 2019. Ms. McGrath served as a board member of the American Red Cross from 2011 until 2014, and has served on the board of the Rock and Roll Hall of Fame since 2007. Judith A. McGrath Qualifications and Skills FormerChairandCEO Ms. McGrath’s individual qualifications and skills as a director include her leadership and of MTVNetworks multimedia operations experience as a longtime senior executive of MTV Networks Entertainment Group, through which she gained experience with content creation, advertising, and content distribution, as well as her customer experience skills. As CEO of MTV,Ms.McGrathwasresponsibleforthecompensationstrategyforover12,000 employees, diversity and inclusion initiatives for the employee population, and launching newmultimediabrandslike LOGO,acablechanneldedicatedtolifestyle and entertainment aimed at the LGBTQ+ consumer. Ms. McGrath further honed her digital andentrepreneurial experience with global customers in her role at Astronauts Wanted: NoExperience Necessary. Age: Director since: Boardcommittees: Othercurrentpubliccompanyboards: 69 July 2014 Leadership Development and None Compensation(Chair) 6

BOARDOFDIRECTORSINFORMATION Background Mrs. Nooyi was the Chief Executive Officer of PepsiCo, Inc., a multinational food, snack, andbeveragecompany,fromOctober2006toOctober2018,whereshealsoservedas the Chair of its board of directors from May 2007 to February 2019. She was elected to PepsiCo’s board of directors and became its President and Chief Financial Officer in 2001, and held leadership roles in finance and corporate strategy and development after joining PepsiCo in 1994. Mrs. Nooyi has served as a director of Royal Philips since May 2021 and a director of Schlumberger Limited from April 2015 to April 2020. Mrs. Nooyi has also served as a trustee of The Asia Society, a global non-profit organization forging closer ties with Asia through arts, education, policy, and business outreach, since 2014; as a director of Indra K. Nooyi Partnership for Public Service, a non-profit, nonpartisan organization that strives for a moreeffective government for the American people, since 2019; as a trustee of FormerChairandCEO Memorial Sloan Kettering Cancer Center, the world’s oldest and largest private cancer of PepsiCo, Inc. center, since 2020; and as a trustee of the National Gallery of Art since 2021. Qualifications and Skills Mrs. Nooyi’s individual qualifications and skills as a director include her leadership experience as a longtime senior executive at a large corporation with international operations, through which she gained experience with consumer-focused product development, international operations, and marketing issues, as well as her customer experience skills and skills relating to financial statement and accounting matters when she was CFO. At PepsiCo, Mrs. Nooyi was the architect of Performance with Purpose (“PwP”), a strategy focused on delivering financial performance while shifting the company’s portfolio to healthier products (human sustainability), reducing water use and the company’s carbon footprint and moving to a closed loop plastics system (environmental sustainability), and creating an environment at PepsiCo where all employeescouldbesupportedasassociates and family builders/nurturers (talent sustainability). Mrs. Nooyi’s PwP was lauded for advancing environmental issues, implementing excellent governance, and sensible people practices. Age: Director since: Boardcommittees: Othercurrentpubliccompanyboards: 66 February 2019 Audit (Chair) Royal Philips Background Mr. Rubinstein was co-CEO of Bridgewater Associates, LP, a global investment managementfirm,fromMay2016toApril2017.Previously,Mr.RubinsteinwasSenior Vice President, Product Innovation, for the Personal Systems Group at the Hewlett- Packard Company(“HP”), a multinational information technology company, from July 2011 to January 2012, and served as Senior Vice President and General Manager, PalmGlobalBusiness Unit, at HP from July 2010 to July 2011. Mr. Rubinstein was Chief Executive Officer and President of Palm, Inc., a smartphone manufacturer, from June 2009 until its acquisition by HP in July 2010, and Chair of the Board of Palm, Inc. fromOctober2007throughtheacquisition. Prior to joining Palm, Mr. Rubinstein was a Senior Vice President at Apple Inc., also serving as the General Manager of the iPod Division. JonathanJ.Rubinstein Mr. Rubinstein has served as the lead director of Robinhood Markets, Inc. since May 2021 Formerco-CEOofBridgewater andadirector of Qualcomm Incorporated from May 2013 to May 2016. Associates, LP Qualifications and Skills Mr. Rubinstein’s individual qualifications and skills as a director include his leadership and technology experience as a senior executive at large financial and technology companies, through which he gained experience with hardware devices and emerging technologies, as well as his customer experience skills and skills relating to financial statement and accounting matters. Mr. Rubinstein also has deep experience addressing human capital managementissues,including oversight of workplace environment and culture, as well as in-depth knowledge of diversity, equity, and inclusion matters and environmental issues, through his roles as a senior executive and director at numerous technology and finance companies. Age: Director since: Boardcommittees: Othercurrentpubliccompanyboards: 65 December2010 Nominating and RobinhoodMarkets, Inc. Corporate Governance 2022ProxyStatement 7

BOARDOFDIRECTORSINFORMATION Background Ms. Stonesifer served as the President and CEO of Martha’s Table, a non-profit, from April 2013 to March 2019. She served as Chair of the Board of Regents of the Smithsonian Institution from January 2009 to January 2012 and as Vice Chair from January 2012 to January 2013. From September 2008 to January 2012, she served as senior advisor to the Bill and Melinda Gates Foundation, a private philanthropic organization, where she was Chief Executive Officer from January 2006 to September2008andPresidentandCo-chairfromJune1997toJanuary2006.Since September2009,shehasalsoservedasaprivatephilanthropyadvisor. From 1988 to 1997, she worked in many roles at Microsoft Corporation, including as a Senior Vice President of the Interactive Media Division, and also served as the Chairwoman of the Patricia Q. Stonesifer Gates Learning Foundation from 1997 to 1999. FormerPresident and CEO of Ms. Stonesifer has served as a trustee of The Rockefeller Foundation, a private foundation dedicated to promoting the well-being of humanity throughout the world, Martha’s Table since 2019, as an emeritus member of the Museum Council of the Smithsonian National MuseumofAfricanAmericanHistoryandCulturesince2021,andasamemberofthe MuseumCouncilfrom2012to2020.Ms.StonesiferhasbeenamemberoftheBoardof Advisors of TheDream.US, a college access and success program for immigrant students, since 2020. Qualifications and Skills Ms. Stonesifer’s individual qualifications and skills as a director include her leadership experience as a senior executive at the Bill and Melinda Gates Foundation and at Microsoft, through which she gained experience with emerging technologies and consumer-focused product development and marketing issues, her knowledge of Amazonfromhavingservedasadirectorsince1997,herexperiencewithnon-profits fromherleadership of Martha’s Table and the Bill and Melinda Gates Foundation, as well as her customer experience skills and skills relating to public policy and financial statement and accounting matters. Age: Director since: Boardcommittees: Othercurrentpubliccompanyboards: 65 February 1997 Nominating and Corporate None Governance Background Mr. Weeks has been the Chief Executive Officer of Corning Incorporated, a glass and materials science innovator, since April 2005 and Chairman of the board of directors since April 2007. He has also held a variety of financial, commercial, business development, and general management positions across Corning’s market access platforms and technologies since he joined the company in 1983. Mr. Weeks has served on the Board of Trustees for the Corning Museum of Glass, which is dedicated to enriching and engaging local and global communities by sharing knowledge, collections, programs, facilities, and resources, since 2001. He also served as a director of Merck & Co., Inc. from February 2004 to May 2020. WendellP.Weeks Qualifications and Skills ChairmanandCEOof Mr. Weeks’s individual qualifications and skills as a director include his leadership and Corning Incorporated operations experience as a senior executive at a large, multinational corporation, experience with restructuring, emerging technologies, and product development, including his experience having earned 33 U.S. patents, as well as his customer experience skills and skills relating to financial statement and accounting matters. Mr. Weeks’s qualifications and skills also include his oversight of climate change initiatives in the areas of clean air and renewable energy, including overseeing Corning’s creation of new products in glass and ceramics vital to industry transformation, and his knowledgeofdiversity, equity, and inclusion initiatives through his experience launching Corning’s Office of Racial Equality and Social Unity, which is responsible for advancing communitypartnerships to support school diversity, community activism, and economic growth. Age: Director since: Boardcommittees: Othercurrentpubliccompanyboards: 62 February 2016 Audit Corning Incorporated 8

BOARDOFDIRECTORSINFORMATION Director Nominee Diversity, Tenure, Skills, and Characteristics TheNominatingandCorporateGovernanceCommitteeannuallyreviewsthetenure,performance,andcontributions of existing Board members to the extent they are candidates for re-election, and considers all aspects of each candidate’s qualifications and skills in the context of the Company’s needs at that point in time. Among the qualifications and skills of a candidateconsideredimportantbytheNominatingandCorporateGovernanceCommitteeare:acommitmenttorepresenting the long-term interests of shareholders; customer experience skills; Internet savvy; an inquisitive and objective perspective; the willingness to take appropriate risks; leadership ability; human capital management; personal and professional ethics, integrity, and values; practical wisdom and sound judgment; international business experience; and business and professional experience in fields such as retail, operations, technology, finance/accounting, product development, intellectual property, law, multimedia entertainment, and marketing. BoardDiversity As stated in the Board of Directors Guidelines on Significant Corporate Governance Issues, the Nominating and Corporate GovernanceCommitteeseeksoutcandidateswithadiversityofexperienceandperspectives,includingdiversity with respect to race, gender, geography, and areas of expertise. The Nominating and Corporate Governance Committee includes, and has any search firm that it engages include, women, individuals from underrepresented racial/ethnic groups, and individuals whoidentify as LGBTQ+ in the pool from which the Committee selects director candidates. When considering candidates as potential Board members, the Board and the Nominating and Corporate Governance Committee evaluate the candidates’ ability to contribute to such diversity. The Board assesses its effectiveness in this regard as part of its annual Board and director evaluation process. Currently, of our nine independent director nominees, five are women, two are from underrepresented racial/ethnic groups, and three have served for five years or less. BoardDiversity Matrix (As of April 14, 2022) Total NumberofDirectors 11 Female Male Directors 56 NumberofDirectorsWhoIdentifyinAnyoftheCategoriesBelow: African American or Black 1— Asian 1— White 36 BoardTenure OurBoard’s composition also represents a balanced approach to director tenure, allowing the Board to benefit from the experience of longer-serving directors combined with fresh perspectives from newer directors (with five new directors on- boarding and three directors leaving in the last three years). The tenure range of our director nominees is as follows: TenureonBoard NumberofDirectorNominees Morethan10years 3 6-10years 4 5years or less 4 2022ProxyStatement 9

BOARDOFDIRECTORSINFORMATION Corporate Governance BoardLeadership TheBoardisresponsible for the control and direction of the Company. The Board represents the shareholders and its primary purpose is to build long-term shareholder value. The Chair of the Board is selected by the Board, and Jeff Bezos, our founder, currently serves as Executive Chair. The Board believes that this leadership structure is appropriate given Mr. Bezos’s role in founding Amazon and his significant ownership stake. The Board believes that this leadership structure improves the Board’s ability to focus on key policy and operational issues and helps the Company operate in the long-term interests of shareholders. In addition, the independent directors on the Board have appointed a lead director from the Board’s independent directors, currently Jonathan J. Rubinstein, in order to promote independent leadership of the Board. Theleaddirector presides over the executive sessions of the independent directors, chairs Board meetings in the Chair’s absence, works with management and the independent directors to approve agendas, schedules, information, and materials for Board meetings, and is available to engage directly with major shareholders where appropriate. In addition, the lead director confers from time to time with the Chair of the Board and the independent directors and reviews, as appropriate, theannualscheduleofregularBoardmeetingsandmajorBoardmeetingagendatopics.Theguidanceanddirectionprovided bytheleaddirector reinforce the Board’s independent oversight of management and contribute to communication amongmembersoftheBoard. Director Independence TheBoardhasdeterminedthatthefollowingdirectors are independent as defined by Nasdaq rules: Gen. Alexander, Ms.Cooper,Ms.Gorelick,Mr.Huttenlocher,Ms.McGrath,Mrs.Nooyi,Mr.Rubinstein,Ms.Stonesifer,andMr.Weeks.Inaddition, the Board determined that Rosalind G. Brewer and Mr. Ryder, who served as directors until February 16, 2021 and December 31, 2021, respectively, were independent during the time they served as directors. In assessing directors’ independence, the Board took into account certain transactions, relationships, and arrangements involving some of the directors and concluded that such transactions, relationships, and arrangements did not impair the independence of the director. For Gen. Alexander, the Board considered payments in the past three years in the ordinary course of business from IronNet to Amazon for AWS services, which were under standard, arms-length terms and were not significant to the Company.ForMs.BrewerandMr.Weeks,theBoardconsideredpaymentsinthepastthreeyearsintheordinarycourseof business from the Company to Starbucks Corporation and Corning Incorporated, respectively, or their affiliates. All such paymentswerenotsignificant for any of these companies. For Mr. Ryder, the Board considered that his son-in-law has been employedwithAmazonsince2008inanon-officerandnon-strategicposition, as disclosed in “Certain Relationships and Related Person Transactions.” Risk Oversight As part of regular Board and committee meetings, the directors oversee executives’ management of risks relevant to the Company.WhilethefullBoardhasoverall responsibility for risk oversight, the Board has delegated responsibility related to certain risks to the Audit Committee, the Leadership Development and Compensation Committee, and the Nominating andCorporateGovernanceCommittee.TheAuditCommitteeisresponsibleforoverseeingmanagementofrisksrelatedto our financial statements and financial reporting process, business continuity, and operational risks, the qualifications, independence, and performance of our independent auditors, the performance of our internal audit function, legal and regulatorymatters,andourcompliancepoliciesandprocedures.TheLeadershipDevelopmentandCompensationCommittee is responsible for overseeing management of risks related to succession planning and compensation for our executive officers and our overall compensation program, including our equity-based compensation plans, as well as risks related to otherhumancapitalmanagementmatters,includingworkplacesafety,culture,diversity,discrimination,andharassment.The Nominating and Corporate Governance Committee is responsible for overseeing management of risks related to our environmental, sustainability, and corporate social responsibility practices, including risks related to our operations and our supplychain.ThefullBoardregularlyreviewsreportsfrommanagementonvariousaspectsofourbusiness,includingrelated risks and tactics and strategies for addressing them. At least annually, the Board reviews our CEO succession planning as described in our Board of Directors Guidelines on Significant Corporate Governance Issues. 10

BOARDOFDIRECTORSINFORMATION AnadhoccommitteeoftheBoardappointedin2022receivesreportsfrommanagementandreportstotheBoardatleast annually on data protection and cybersecurity matters and reviews the measures implemented by the Company to identify andmitigate data protection and cybersecurity risks. The Company requires employees with access to information systems, including all corporate employees, to undertake data protection and cybersecurity training and compliance programs annually. Corporate Governance Documents Please visit our investor relations website at www.amazon.com/ir, “Corporate Governance,” for additional information on our corporate governance, including: • our Restated Certificate of Incorporation and Bylaws; • the Board of Directors Guidelines on Significant Corporate Governance Issues, which includes policies on shareholder communicationswiththeBoard,directorattendanceatourannualmeetings,directorresignationstofacilitateourmajority vote standard, director stock ownership guidelines, succession planning, and compensation clawbacks; • thechartersapprovedbytheBoardfortheAuditCommittee,theLeadershipDevelopmentandCompensationCommittee, andtheNominatingandCorporateGovernanceCommittee; • the Code of Business Conduct and Ethics; and • our U.S. Political Engagement Policy and Statement. Environmental, Social, and Human Capital Initiatives Weregularly publish information regarding our sustainability, environmental, social, and human capital goals and initiatives onourwebsite, including in our sustainability report titled “Further and Faster, Together.” This report also includes our reporting under the Sustainability Accounting Standards Board (“SASB”), Task Force on Climate-Related Financial Disclosures (“TCFD”), and UN Guiding Principles on Business and Human Rights reporting frameworks. Key highlights from our website andthis report include: • TheClimatePledge.Withourco-founderGlobalOptimism,in2019weannouncedTheClimatePledge,acommitment to be net-zero carbon across our business by 2040, a decade ahead of the Paris Agreement’s goal of 2050. We are proud that more than 300 companies across 51 industries and 29 countries have joined The Climate Pledge. As part of this commitment, we publish our carbon footprint and calculation methodology, and we have joined the Science Based TargetsInitiative,reaffirmingourcommitmenttoreducecarbonemissionsinlinewithourongoingscience-basedapproach to tackle climate change. Amazon also launched The Climate Pledge Fund in 2020 to support the development of sustainable and decarbonizing technologies and services. This dedicated investment program—with an initial $2 billion in funding—invests in visionary companies whose products and solutions are expected to facilitate the transition to a low- carbon economy. In addition, we established the Right Now Climate Fund, a $100 million fund to remove or avoid carbon emissions by restoring and conserving forests, wetlands, and grasslands around the world. • RenewableEnergy.Weareonapathtopoweringouroperationswith100%renewableenergyby2025—fiveyears aheadofouroriginal target of 2030. In 2020, we reached 65% renewable energy across our business and became the world’s largest corporate purchaser of renewable energy. • ShipmentZero.ShipmentZeroisourgoalofdelivering50%ofAmazonshipmentswithnet-zerocarbonby2030. ShipmentZeromeansthatthefulfillmentoperationsweundertaketodeliveracustomer’sshipmentarenet-zerocarbon— fromthefulfillment center, to the packaging materials, to the mode of transportation that gets the package to the customer’s door. • Transportation. We plan to deploy 100,000 custom electric delivery vehicles by 2030. Our custom electric delivery vehicles hit the road testing with customer deliveries in Los Angeles in February 2021, and since have expanded to 15 additional U.S. cities, including San Francisco, Nashville, Tulsa, Minneapolis, Denver, and more. We are also investing in a varietyofsolutionstoreducecarbonemissionsoffreightandairtransport,includingbatteryelectricandhydrogen-powered trucks, compressed natural gas tractors, and sustainable aviation fuels and technologies. • OurBuildings. Amazonisworkingtoreducethecarbonemissionsassociated with our buildings, from the carbon embodiedinconstructionmaterialstotheoperationalemissionsfrompoweringouractivities.In2020,welaunchedanin- depth study of our operations facilities to examine the energy intensity of our buildings and identify ways to reduce 2022ProxyStatement 11

BOARDOFDIRECTORSINFORMATION carbon through energy efficiency enhancements, new technologies, and sustainable building materials. We have started applying these insights across building types and are incorporating best practices into future building development plans. • Circular Economy and Driving Toward Zero Additional Packaging. Amazon is minimizing waste, increasing recycling, andproviding options for our customers to reuse, repair, and recycle their products. We created our Frustration-Free Packaging program to encourage manufacturers to package their products in easy-to-open, 100% recyclable packaging, andsince 2015, we have eliminated more than one million tons of packaging material and reduced the weight of outboundpackagingbyover36%.Weareimprovingthedesignandmaterialsusedforourpackaging,reducingweight, andimprovingthecompositionofourplastic packaging to use less material and incorporate more recycled content. • Investing in Our Communities. Amazon supports our communities by providing access to food and basic needs, assisting in the COVID-19 community response, supporting disaster relief, and investing in access to computer science education.In2021,weestablishedtheAmazonHousingEquityFundtoprovidemorethan$2billioninbelow-marketloans andgrants to preserve and create affordable homes for individuals and families earning moderate to low incomes in our three hometowncommunities—Washingtonstate’sPugetSoundregion;theWashington,D.C.,andArlington, Virginia, metropolitan areas; and Nashville, Tennessee. • HumanRights.Ourcommitmentandapproachtohumanrightsareinformedbyleadinginternationalstandardsand frameworks developed by the United Nations (“UN”) and the International Labour Organization (“ILO”). Amazon is committedtorespecting and supporting the UN Guiding Principles on Business and Human Rights, the UN Universal Declaration of Human Rights, the Core Conventions of the ILO, and the ILO Declaration on Fundamental Principles and RightsatWork.WehavecodifiedourcommitmenttohumanrightsinourAmazonGlobalHumanRightsPrinciples.Wealso publish Supply Chain Standards, which detail the requirements and expectations for our suppliers, their supply chains, andselling partners who list products in our stores, and they are grounded in principles of inclusivity, continuous improvement, and supply chain accountability. In addition, since 2020, we have worked with a sustainability and human rights consulting firm to identify salient human rights risks across our business, and we plan to use the assessment results to build on current practice and prioritize our human rights due diligence efforts. In 2020, we also conducted our first humanrightsimpactassessmenttoassesstherawandrecoveredmaterialssupplychainforAmazon-brandeddigital devices. • HumanCapital.Wesupportouremployeesthroughinitiativesfocusingonworkplacehealthandsafety,investments in benefitsandopportunities,andemployeeengagement.WeaimtobeEarth’ssafestplacetowork.In2021,weinvestedover $300million in safety improvements such as capital improvements, new safety technology, vehicle safety controls, and engineered ergonomic solutions. In January 2022, we also published our first safety report highlighting our commitment to and innovations in worker safety and disclosing key safety metrics. In the United States, we are a leader in providing our employees an average starting wage of more than $18 per hour, more than double the federal minimum wage. In addition, we provide numerous benefits to our employees, including comprehensive medical benefits, a 401(k) plan with a Company match, and up to 20 weeks of parental leave (birth parents are eligible for up to 20 weeks of leave and partners up to six). • Diversity, Equity, and Inclusion. We continue to prioritize pay equity and publish details on gender and racial/ethnic group pay statistics. When evaluating 2021 compensation, our reported data demonstrates that women globally and in the United States earned 99.8 cents and 99.9 cents, respectively, for every dollar that men earned performing the same jobs, and racial/ethnic minorities in the United States earned 99.2 cents for every dollar that white employees earned performingthesamejobs.Weareinvestingininternalandexternalprogramstoassistdiverseleaderstoadvanceintomore senior roles. For example, we are one of the initial 12 launch employers participating in the Management Leadership for Tomorrow(“MLT”)BlackEquity at Work Certification Program, which is a clear and comprehensive new standard that requires employers to assess and make meaningful progress toward achieving Black equity internally while supporting Black equity in society. Additionally, starting in 2020, our senior leadership team dove deep into the mechanisms we use tohire,develop,andpromoteemployees,sothatwecanbetteridentifyopportunitiestoensureequitableaccessforall.We also publicly announced ambitious 2020 and 2021 Company-wide goals for diversity, equity, and inclusion. We continue toinspectandrefinethemechanismsweusetohire,develop,evaluate,andretainouremployeestopromoteequityforall candidates and employees. Our 13 employee-led Affinity Groups, which engage employees across hundreds of chapters around the world, further foster our commitment to diversity, equity, and inclusion. These ambitious and impactful goals and initiatives build on Amazon’s long-term commitment to sustainability, as well as our commitmenttosupporting our employees, partners in our supply chain, and our communities. These are just some examples of the many sustainability, environmental, social, and human capital initiatives we have underway, as we seek to 12

BOARDOFDIRECTORSINFORMATION constantly invent across the Company. We encourage you to learn more about these initiatives and our progress towards meeting our goals by reviewing our sustainability report titled “Further and Faster, Together” and website at sustainability.aboutamazon.com, our safety report titled “Delivered with Care: Safety, Health, and Well-Being at Amazon” andwebsiteatsafety.aboutamazon.com, our views on certain issues at www.aboutamazon.com/about-us/our-positions, and other postings on our “About Amazon” website at www.aboutamazon.com. Shareholder Engagement Webelievethateffective corporate governance includes year-round engagement with our shareholders and other stakeholders. We meet regularly with our shareholders, including both large and small investors, to discuss business strategy, performance, compensation philosophy, corporate governance, and environmental and social topics. In a typical year, we will engage with dozens of shareholders, including our largest shareholders, two to three times a year. This outreach is complementary to the hundreds of touchpoints our Investor Relations team has with shareholders each year. We find it beneficial to have ongoing dialogue with our shareholders throughout the year on a full range of investor priorities (instead ofengagingwithshareholdersonlypriortoourannualmeetingonissuestobevotedonintheproxystatement).Depending onthecircumstance,ourleaddirectororanotherindependentdirectormayengageintheseconversationswithshareholders as well. In 2021, as part of our corporate governance engagement, we met with corporate governance representatives at shareholders owningover35%ofourstock(notcountingtheapproximately13%votedbyourfounderandExecutiveChair) andrespondedtonumerouslettersfromourinvestors.Ourdirectengagementwithshareholdershelpsusbetterunderstand our shareholders’ priorities, perspectives, and issues of concern, while giving us an opportunity to elaborate on our many initiatives and practices and to address the extent to which various aspects of these matters are (or are not) significant given the scope and nature of our operations and our existing practices. We take insights from this feedback into consideration andregularly share them with our Board as we review and evolve our practices and disclosures. 2022ProxyStatement 13

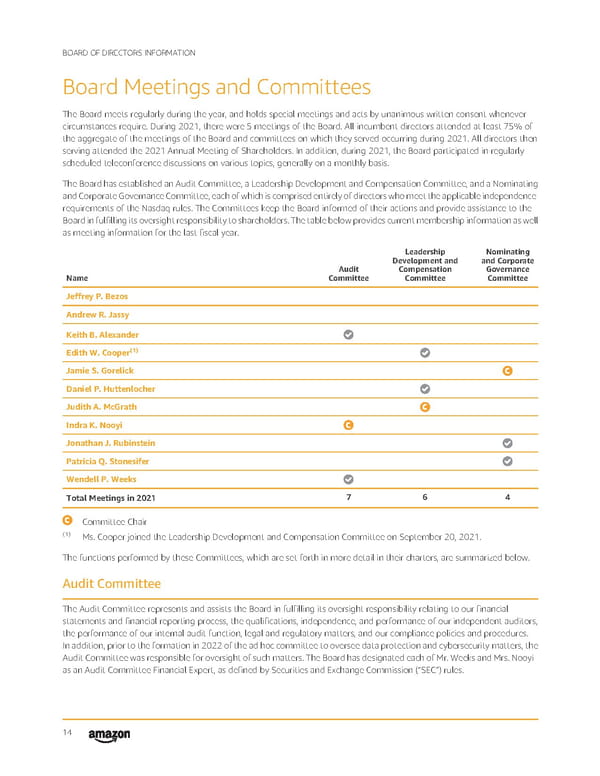

BOARDOFDIRECTORSINFORMATION Board Meetings and Committees TheBoardmeetsregularlyduring the year, and holds special meetings and acts by unanimous written consent whenever circumstances require. During 2021, there were 5 meetings of the Board. All incumbent directors attended at least 75% of the aggregate of the meetings of the Board and committees on which they served occurring during 2021. All directors then serving attended the 2021 Annual Meeting of Shareholders. In addition, during 2021, the Board participated in regularly scheduled teleconference discussions on various topics, generally on a monthly basis. TheBoardhasestablishedanAuditCommittee,aLeadershipDevelopmentandCompensationCommittee,andaNominating andCorporateGovernanceCommittee,eachofwhichiscomprisedentirelyofdirectorswhomeettheapplicableindependence requirements of the Nasdaq rules. The Committees keep the Board informed of their actions and provide assistance to the Boardinfulfillingitsoversightresponsibilitytoshareholders.Thetablebelowprovidescurrentmembershipinformationaswell as meeting information for the last fiscal year. Leadership Nominating Developmentand andCorporate Audit Compensation Governance Name Committee Committee Committee Jeffrey P. Bezos AndrewR.Jassy Keith B. Alexander (1) Edith W. Cooper JamieS.Gorelick Daniel P. Huttenlocher Judith A. McGrath Indra K. Nooyi JonathanJ.Rubinstein Patricia Q. Stonesifer WendellP.Weeks Total Meetings in 2021 764 CommitteeChair (1) Ms. Cooper joined the Leadership Development and Compensation Committee on September 20, 2021. Thefunctions performed by these Committees, which are set forth in more detail in their charters, are summarized below. Audit Committee TheAuditCommitteerepresentsandassists the Board in fulfilling its oversight responsibility relating to our financial statements and financial reporting process, the qualifications, independence, and performance of our independent auditors, the performance of our internal audit function, legal and regulatory matters, and our compliance policies and procedures. In addition, prior to the formation in 2022 of the ad hoc committee to oversee data protection and cybersecurity matters, the AuditCommitteewasresponsibleforoversightofsuchmatters.TheBoardhasdesignatedeachofMr.WeeksandMrs.Nooyi as an Audit Committee Financial Expert, as defined by Securities and Exchange Commission (“SEC”) rules. 14

BOARDOFDIRECTORSINFORMATION Recent Focus Areas During the past year, the Audit Committee met with management and reviewed matters that included: • the Company’s risk assessment and compliance functions; • data privacy and security; • public policy expenditures; • treasury and investment matters; • tax matters; • accounting industry issues; • the performance of our internal audit function; • the reappointment of our independent auditor; and • pending litigation. TheAuditCommitteeannuallyreviewstheCompany’sU.S.Political Engagement Policy and Statement and a report on the Company’spublic policy expenditures. The Audit Committee also met with the auditors to review the scope and results of the auditor’s annual audit and quarterly reviews of the Company’s financial statements. Leadership Development and Compensation Committee TheLeadership Development and Compensation Committee evaluates our programs and practices relating to talent and leadership development, reviews and establishes compensation of the Company’s executive officers, oversees management of risks for succession planning and our overall compensation program, including our equity-based compensation plans, andoverseestheCompany’sstrategiesandpoliciesrelatedtohumancapitalmanagement,allwithaviewtowardsmaximizing long-term shareholder value. The Committee may engage compensation consultants but did not do so in 2021, and during 2021 reviewed and discussed peer company compensation benchmarking and surveys prepared by management andbyaconsultingfirmhired by managementtoprovidesurveydata. The Committee oversees the Company’s Code of Business Conduct and Ethics with respect to compliance with, and reports pursuant to, the Company’s workplace non- discrimination and anti-harassment policies. Additional information on the Committee’s processes and procedures for considering and determining executive compensation is contained in the “Compensation Discussion and Analysis” section of this Proxy Statement. Recent Focus Areas During the past year, the Leadership Development and Compensation Committee met with management and reviewed matters that included: • the design, amounts, and effectiveness of the Company’s compensation of senior executives; • managementsuccessionplanning; • the Company’s benefit and compensation programs; • the Company’s human resources programs, including review of workplace discrimination and harassment reports, worker safety and workplace conditions, and diversity, equity, and inclusion matters; and • feedback from the Company’s shareholder engagement. 2022ProxyStatement 15

BOARDOFDIRECTORSINFORMATION NominatingandCorporateGovernanceCommittee TheNominatingandCorporateGovernanceCommitteereviewsandassessesthecompositionandcompensationofthe Board,assistsinidentifyingpotentialnewcandidatesfordirector,recommendscandidatesforelectionasdirector,andoversees the Company’s environmental, social, and corporate governance policies and initiatives. The Nominating and Corporate GovernanceCommitteealsorecommendstotheBoardcompensationfornewlyelecteddirectorsandreviewsdirector compensation as necessary. Recent Focus Areas During the past year, the Nominating and Corporate Governance Committee met with management and reviewed matters that included: • the Board’s composition, diversity, and skills in the context of identifying and evaluating new director candidates to join the Board; • the Board’s recruitment and self-evaluation processes; • Board compensation; • Board Committee membership and qualifications; • consideration of the Company’s policies and initiatives regarding the environment and sustainability, corporate social responsibility, and corporate governance; and • feedback from the Company’s shareholder engagement on the foregoing matters. Director Nominations TheNominatingandCorporateGovernanceCommitteeconsiderscandidatesfordirector whoarerecommendedbyits members,byotherBoardmembers,byshareholders,andbymanagement,aswellasthoseidentifiedbyathird-partysearch firm retained to assist in identifying and evaluating possible candidates. Ms. Cooper was initially recommended to the Nominating and Corporate Governance Committee by a third-party search firm pursuant to a director recruitment process conducted in 2021. The Nominating and Corporate Governance Committee evaluates director candidates recommended by shareholders in the same way that it evaluates candidates recommended by its members, other members of the Board, or other persons, as described above under “Director Nominee Diversity, Tenure, Skills, and Characteristics.” Shareholder RecommendationsforDirectors Shareholders wishing to submit recommendations for director candidates for consideration by the Nominating and Corporate Governance Committee must provide the following information in writing to the attention of the Secretary of Amazon.com,Inc. by certified or registered mail: • thename,address,andbiographyofthecandidate,andanindicationofwhetherthecandidatehasexpressedawillingness to serve; • the name, address, and phone number of the shareholder or group of shareholders making the recommendation; and • the number of shares of common stock beneficially owned by the shareholder or group of shareholders making the recommendation, the length of time held, and to the extent any shareholder is not a registered holder of such securities, proof of such ownership. TobeconsideredbytheNominatingandCorporateGovernanceCommitteeforthe2023AnnualMeetingofShareholders, a director candidate recommendation must be received by the Secretary of Amazon.com, Inc. by December 15, 2022. OurBylawsprovideaproxyaccessrightforshareholders,pursuanttowhichashareholder,orgroupofupto20shareholders, mayincludedirector nominees (representing up to 20% of the number of directors in office) in our proxy materials for annual meetings of our shareholders. To be eligible to utilize these proxy access provisions, the shareholder or group must haveownedatleast3%oftheaggregateoftheissuedandoutstandingsharesofourcommonstockcontinuouslyforatleast the prior three years and must satisfy the additional eligibility, procedural, and disclosure requirements set forth in our Bylaws. 16

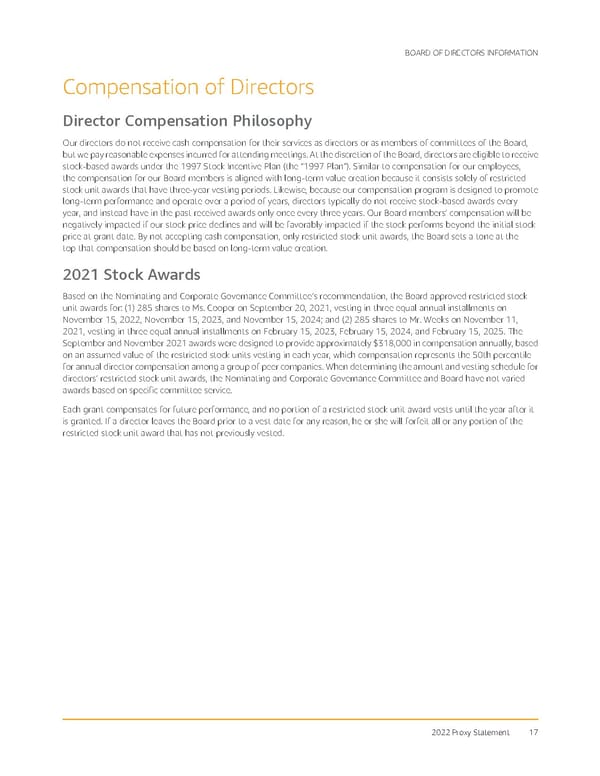

BOARDOFDIRECTORSINFORMATION CompensationofDirectors Director Compensation Philosophy Ourdirectors do not receive cash compensation for their services as directors or as members of committees of the Board, butwepayreasonableexpensesincurredforattendingmeetings.AtthediscretionoftheBoard,directorsareeligibletoreceive stock-based awards under the 1997 Stock Incentive Plan (the “1997 Plan”). Similar to compensation for our employees, the compensation for our Board members is aligned with long-term value creation because it consists solely of restricted stock unit awards that have three-year vesting periods. Likewise, because our compensation program is designed to promote long-term performance and operate over a period of years, directors typically do not receive stock-based awards every year, and instead have in the past received awards only once every three years. Our Board members’ compensation will be negatively impacted if our stock price declines and will be favorably impacted if the stock performs beyond the initial stock price at grant date. By not accepting cash compensation, only restricted stock unit awards, the Board sets a tone at the top that compensation should be based on long-term value creation. 2021StockAwards Based on the Nominating and Corporate Governance Committee’s recommendation, the Board approved restricted stock unit awards for: (1) 285 shares to Ms. Cooper on September 20, 2021, vesting in three equal annual installments on November15,2022,November15,2023,andNovember15,2024;and(2)285sharestoMr.WeeksonNovember11, 2021, vesting in three equal annual installments on February 15, 2023, February 15, 2024, and February 15, 2025. The SeptemberandNovember2021awardsweredesignedtoprovideapproximately$318,000incompensationannually,based onanassumedvalueoftherestrictedstockunits vesting in each year, which compensation represents the 50th percentile forannualdirectorcompensationamongagroupofpeercompanies.Whendeterminingtheamountandvestingschedulefor directors’ restricted stock unit awards, the Nominating and Corporate Governance Committee and Board have not varied awards based on specific committee service. Each grant compensates for future performance, and no portion of a restricted stock unit award vests until the year after it is granted. If a director leaves the Board prior to a vest date for any reason, he or she will forfeit all or any portion of the restricted stock unit award that has not previously vested. 2022ProxyStatement 17

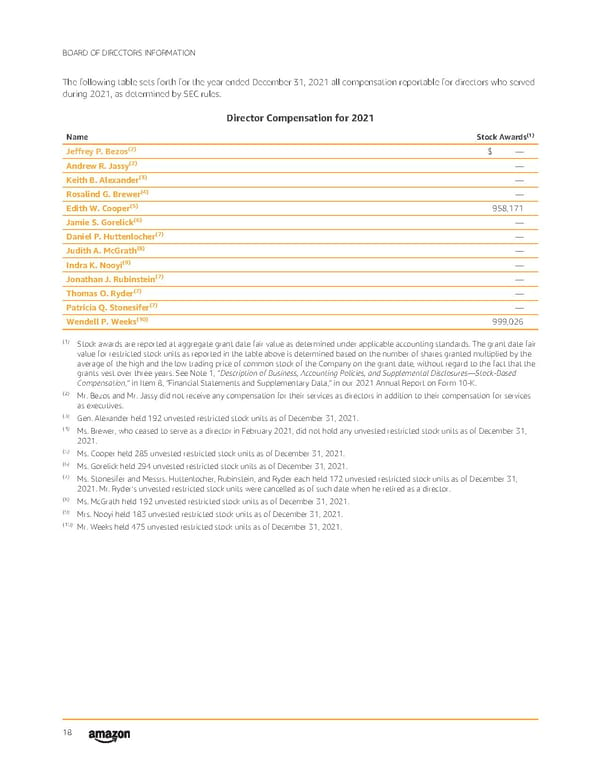

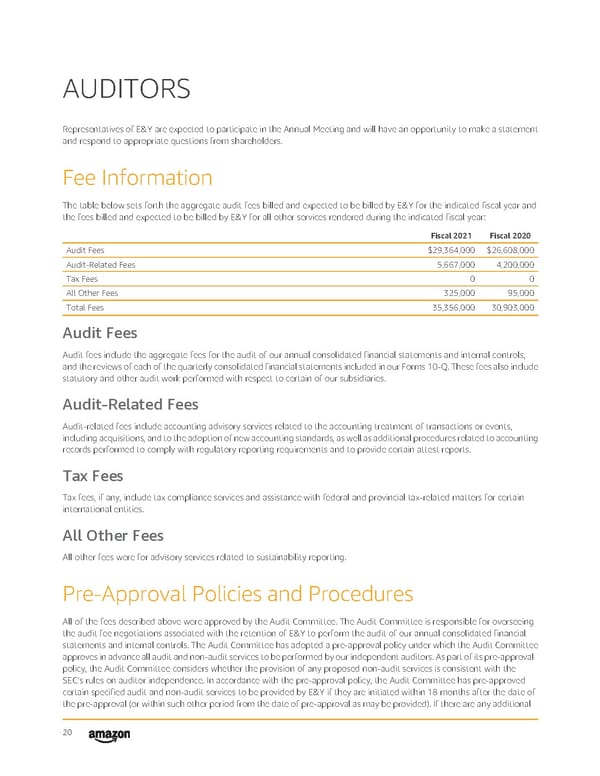

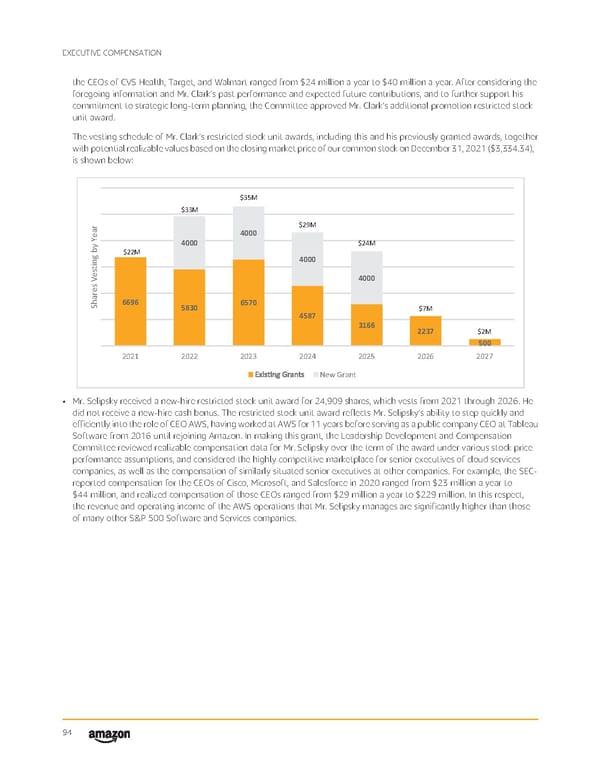

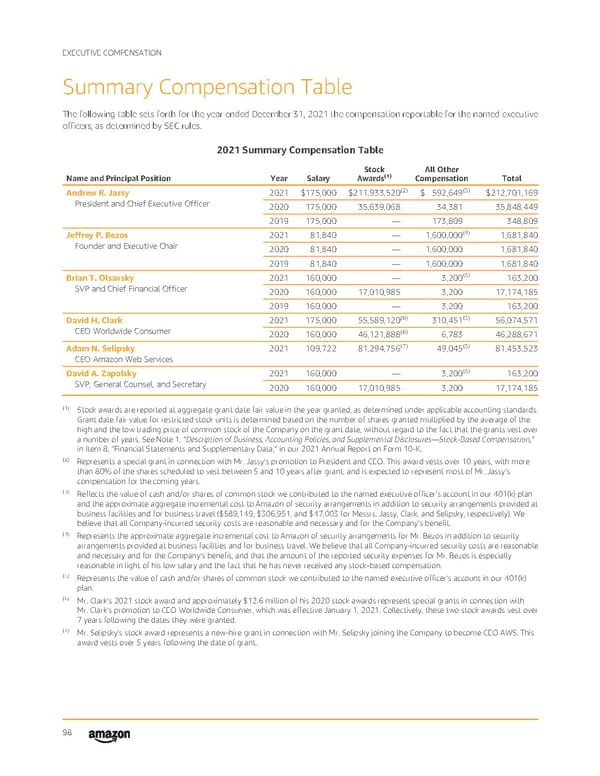

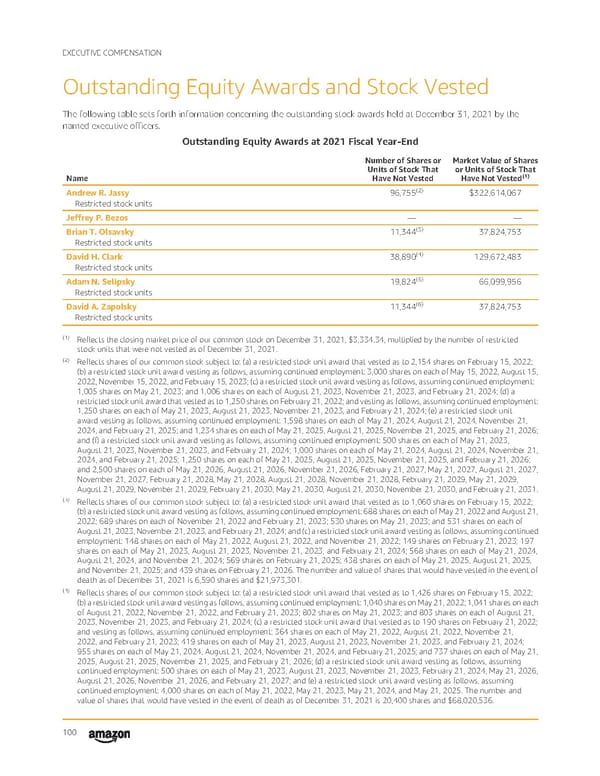

BOARDOFDIRECTORSINFORMATION Thefollowing table sets forth for the year ended December 31, 2021 all compensation reportable for directors who served during 2021, as determined by SEC rules. Director Compensation for 2021 (1) Name StockAwards (2) Jeffrey P. Bezos $— (2) AndrewR.Jassy — Keith B. Alexander(3) — Rosalind G. Brewer(4) — (5) Edith W. Cooper 958,171 (6) JamieS.Gorelick — (7) Daniel P. Huttenlocher — (8) Judith A. McGrath — (9) Indra K. Nooyi — (7) JonathanJ.Rubinstein — ThomasO.Ryder(7) — (7) Patricia Q. Stonesifer — (10) WendellP.Weeks 999,026 (1) Stock awards are reported at aggregate grant date fair value as determined under applicable accounting standards. The grant date fair value for restricted stock units as reported in the table above is determined based on the number of shares granted multiplied by the average of the high and the low trading price of common stock of the Company on the grant date, without regard to the fact that the grants vest over three years. See Note 1, “Description of Business, Accounting Policies, and Supplemental Disclosures—Stock-Based Compensation,” in Item 8, “Financial Statements and Supplementary Data,” in our 2021 Annual Report on Form 10-K. (2) Mr. Bezos and Mr. Jassy did not receive any compensation for their services as directors in addition to their compensation for services as executives. (3) Gen. Alexander held 192 unvested restricted stock units as of December 31, 2021. (4) Ms. Brewer, who ceased to serve as a director in February 2021, did not hold any unvested restricted stock units as of December 31, 2021. (5) Ms. Cooper held 285 unvested restricted stock units as of December 31, 2021. (6) Ms. Gorelick held 294 unvested restricted stock units as of December 31, 2021. (7) Ms. Stonesifer and Messrs. Huttenlocher, Rubinstein, and Ryder each held 172 unvested restricted stock units as of December 31, 2021. Mr. Ryder’s unvested restricted stock units were cancelled as of such date when he retired as a director. (8) Ms. McGrath held 192 unvested restricted stock units as of December 31, 2021. (9) Mrs. Nooyi held 183 unvested restricted stock units as of December 31, 2021. (10) Mr. Weeks held 475 unvested restricted stock units as of December 31, 2021. 18