American Express ESG Report

The Powerful Backing of American Express 2021–2022 Environmental, Social, and Governance Report

TABLE OF CONTENTS 3 About This Report 4 A Message From Our Chairman and CEO 8 Our Commitment to ESG 10 Our ESG Objectives and Goals 1 1 Aligning Our Community Giving Priorities to Our ESG Strategy 12 Our Inaugural $1 Billion ESG Bond 13 Responding to Global Events 15 Amex Flex: Our New Way of Working 17 Awards and Recognition 18 Advancing the United Nations Sustainable Development Goals 19 Promoting Diversity, Equity, and Inclusion 20 Our Vision for Promoting Diversity, Equity, and Inclusion 2 1 Progress and Highlights 23 Supporting Our Colleagues, Customers, and Communities 24 Backing Our Colleagues 32 Backing Our Customers and Partners 35 Backing Our Communities 38 Advancing Climate Solutions 39 Our Vision for Advancing Climate Solutions 40 Progress and Highlights 41 Minimizing Our Climate Impact 43 Moving to Net-Zero 48 Backing Our Colleagues 50 Backing Our Customers and Partners 53 Backing Our Communities 56 Building Financial Confidence 57 Our Vision for Building Financial Confidence 58 Progress and Highlights 59 Building Financial Confidence and Resilience for Our Colleagues, Customers, and Communities 60 Backing Our Colleagues 62 Backing Our Customers and Partners 69 Backing Our Communities 76 Our ESG Governance and Operating Responsibly 78 Our Corporate Governance Framework 79 ESG Governance 81 ESG and Executive Compensation 82 Our Business Ethics 84 Data Protection and Privacy 85 Risk Management 86 Responsible Sourcing Throughout the Global Supply Chain 87 Prioritizing Colleagues’ Health, Safety, and Well-being 88 Responsible Lending 89 Supporting Data: Our Commitment to Transparency 93 Workforce Diversity and EEO-1 Data 96 Environmental Performance Data Summary 100 Limited Assurance Statement of GHG Emissions 103 Indexes TCFD Index SASB Index GRI Content Index

ABOUT THIS REPORT This report covers calendar year 2021 and provides qualitative and quantitative information on our approach to managing our Environmental, Social, and Governance (ESG) opportunities and risks. In some cases, we also share highlights from programs and initiatives that were launched in 2022 to provide more up-to-date information to our stakeholders. When we use the terms “American Express,” “company,” “we,” “us,” or “our” in this report, we mean the American Express Company and its subsidiaries, on a consolidated basis, unless we state, or the context implies, otherwise. Reporting guidelines and content This report follows the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-Related Financial Disclosures (TCFD) reporting guidelines with respect to our priority ESG issues. GRI, SASB, and TCFD indexes can be found in the Supporting Data section of the report. In this report, the use of the term “materiality” and other similar terms is intended to reflect our priority ESG issues. We are not using such terms as they are used under the securities or other laws of the United States or any other jurisdiction or as these terms are used in the context of financial statements and financial reporting. We report on ESG issues that pertain to us through this ESG report and the American Express Corporate Sustainability website . Additional information about our company can be found through our Diversity, Equity, and Inclusion (DE&I) Report , submissions to the CDP (formerly Carbon Disclosure Project), in our annual and quarterly reports and our proxy statement on file with the U.S. Securities and Exchange Commission and on the American Express Investor Relations website . Links and references included throughout the report provide direction on where to find additional information. This report includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 which are subject to risks and uncertainties. The forward-looking statements, including the company’s aspirational ESG commitments and goals, contain words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” “potential,” “commit,” “continue,” or other similar expressions. Actual results may differ from those set forth in the forward-looking statements due to a variety of factors, including: competition, brand perceptions and reputation; an inability to develop and market value propositions that appeal to Card Members and new customers; the amount and efficacy of investments in product innovations, resources, marketing campaigns and programs; changing customer behaviors, interest in the company’s products, resources and programs, and willingness to access capital provided by the company, spend money at small businesses, and value environmentally and socially responsible products and services; management’s inability to identify suitable suppliers, grantees, partners and community investments and negotiate acceptable terms; the actual amount the company spends with suppliers, on ESG initiatives and to make appropriate salary adjustments, all while implementing operating expense control initiatives; an inability to build partnerships and execute programs with other companies and of partners to meet their obligations to the company; changes in developing standards and certifications; the cost and availability of renewable energy, carbon removal and carbon offset projects, energy attribute certificates, certified paper, and green buildings, and alternatives to single-use plastic; supply chain and market disruption; regulation; potential M&A activity; severe weather conditions, natural disasters and other catastrophic events; changes in the company’s real estate, technology, colleague and community engagement, and risk management strategies; an inability of waste management systems to divert waste to recycling and composting facilities; and changes in economic or business conditions and the company’s ability to grow, improve its financial performance and execute on its strategies. A further description of these and other risks and uncertainties can be found in the company’s Annual Report on Form 10-K for the year ended December 31, 2021 (the “2021 Annual Report”), the company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2022, and the company’s other filings with the U.S. Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements. Data in this report reflect estimates using methodologies and assumptions, which may change in the future as a result of new information or subsequent developments. Statements regarding the company’s future direction and intent are subject to change or withdrawal without notice and represent goals and objectives only. This report includes trademarks, such as American Express®, which are protected under applicable intellectual property laws and are the property of the American Express Company or its subsidiaries. Solely for convenience, our trademarks and trade names referred to in this report may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names. 3

A MESSAGE FROM OUR CHAIRMAN AND CEO “ Our strength comes from the impact we can make on people’s lives—or what we call “the powerful backing of American Express”— and our ESG strategy is a natural extension of this.” — STEPHEN J. SQUERI CHAIRMAN AND CHIEF EXECUTIVE OFFICER American Express is built on trust, integrity, and service excellence. Living up to this legacy means doing what is right for our colleagues, customers, and communities. Our strength comes from the impact we can make on people’s lives—or what we call “the powerful backing of American Express”—and our ESG strategy is a natural extension of this. The myriad of challenges facing the world today, many unprecedented in our lifetime, underscore the importance of our powerful backing promise. We are now over two years into navigating the pandemic; the effects of climate change are more apparent than ever; macroeconomic and geopolitical instability is on the rise; and, just in the last few months, we have witnessed the war in Ukraine unfold into a devastating humanitarian crisis. Against this backdrop, we continue to back our colleagues, customers, and communities to drive positive impact. INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 4

As the way we live and work has evolved with the pandemic, we have been focused on creating a new work model that supports our colleagues. In March 2022, we officially launched Amex Flex, our new way of working that provides colleagues with the flexibility to work full time in the office, fully virtually, or a hybrid of both. Amex Flex is designed to recapture the creativity and collaboration of working together in person, while also retaining the agility and productivity we were able to achieve in a virtual environment during the pandemic. This approach also enables us to broaden the talent pool we can attract and strengthen retention as we provide colleagues with a compelling value proposition that offers choice, leading benefits, competitive compensation, and opportunities for growth and career advancement. Our colleagues are critical to our success, and they are the driving force behind the impact we make in people’s lives and in the communities we serve. I am exceptionally proud of what we achieved to date on our ESG strategy, thanks to the dedication of our colleagues around the world who bring our company’s purpose to life. Advancing Our ESG Priorities We announced our ESG framework in 2020, centered around three core priorities: Promote Diversity, Equity, and Inclusion (DE&I); Advance Climate Solutions; and Build Financial Confidence . Since then, we have solidified our strategy by developing a clear roadmap to translate our objectives into action. Promote Diversity, Equity, and Inclusion (DE&I) We are continuing to strengthen our culture of inclusion and belonging across the company and providing transparency into our efforts. In 2021, we published our inaugural DE&I Report, which included detailed disclosures on diversity representation among colleagues and our ongoing efforts to maintain a diverse and equitable workplace through inclusive hiring, career growth, retention, and equal pay practices. In addition to sharing our progress across these areas in 2021, in this report we have included additional details related to representation of our ethnically and racially diverse colleagues in the US. We also exceeded $1 billion in spending toward our DE&I Action Plan announced in October 2020. The plan supported our efforts to increase spending with underrepresented-owned suppliers, expanding access to capital and financial education and partnering with nonprofit organizations focused on promoting equality, among other initiatives. To build on this momentum, I am pleased to announce an additional $3 billion—which means we now aim to spend $4 billion in total from late 2020 through 2025—toward our DE&I Action Plan and initiatives globally. The majority of additional spending will continue to be allocated with suppliers. INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 5

Advance Climate Solutions We are focused on advancing solutions that address the climate crisis by minimizing our carbon footprint and helping our customers and communities do the same. Last year marked an important step forward for us, as we committed to net-zero emissions by 2035, in alignment with the Science Based Target initiative (SBTi), building on our CarbonNeutral® operations powered by 100% renewable electricity since 2018. To reduce our environmental impact across our global real estate portfolio, we have spent more than $150 million since 2019 on the development of facilities that have received green building certification. In addition to these investments, we have a goal to provide at least $10 million toward philanthropic efforts for climate action as part of our new community giving category: Backing Low-Carbon Communities. We have already pledged over $3 million in grants to support climate and nature-based solutions. Last November, at the UN Climate Change Conference of the Parties (COP26), we joined the World Economic Forum’s Clean Skies for Tomorrow Coalition and Global Future Council on Sustainable Tourism to help promote sustainable travel practices. In addition, during Earth Month 2022, we announced several new low-carbon solutions in line with our 2022 goal. These included new digital tools to help corporate clients better understand and manage their carbon footprint, such as a Carbon Footprint Dashboard and a Carbon Offset Referral Suite. We also announced a goal of having the vast majority of plastic cards issued by American Express made of at least 70% recycled or reclaimed plastic by the end of 2024. We have already begun expanding our offerings to integrate recycled plastic into our cards worldwide, starting with Canada and France. Build Financial Confidence Rooted in our company’s purpose is helping people achieve their aspirations, not only through our differentiated products and services, but also through our investments to strengthen the financial well-being, security, and resilience of our communities. As a longstanding champion of small businesses, we continue to support business owners globally as they navigate new challenges from inflation, supply chain disruptions, and labor shortages, in addition to the ongoing impacts from the pandemic. Our Shop Small campaign is foundational to these efforts. Since 2020, we spent more than $300 million toward campaign initiatives to help jumpstart spending at small businesses. In November 2021, we held our 12th annual Small Business Saturday event, which reached an all-time high of $23.3 billion in estimated consumer spending at small businesses in the US. 1 Consumers reported spending an estimated £598 million at small businesses in the UK on Small Business Saturday held on December 4, 2021, 2 and both campaigns contributed toward our goal to drive $100 billion in consumer spending at small businesses through 2025. We also launched a new community giving category for building financial confidence, “Backing Small,” which supports small businesses by bringing together all our grant programs focused on supporting small business. We have already pledged $17 million to support Backing Small programs, including Inclusive Backing, in partnership with Main Street America, focused on underrepresented and economically vulnerable business-owners, and the second year of our Backing Historic Small Restaurants program across the US in 2022. Our new Backing International Small Restaurants program with the International Downtown Association is expanding our support beyond the US by helping culturally significant, independent restaurants operated by underserved populations and those in economic need in five major cities: London, Mexico City, Sydney, Tokyo, and Toronto. We also deepened our focus on financial literacy, training, and mentoring programs for individuals and business owners through our community giving. Building on our longstanding partnership with Junior Achievement, we plan to offer bespoke financial literacy education and programs to more than 5,000 students in 11 countries, focusing on underrepresented and underserved communities, through JA Worldwide. 1. The American Express 2021 Small Business Saturday Consumer Insights Survey was conducted by Teneo on behalf of American Express and the National Federation of Independent Business (NFIB). The study is a nationally representative sample of 2,426 U.S. adults 18 years of age or older. The sample was collected using an email invitation and an online survey. The study gathered self-reported data and does not reflect actual receipts or sales. It was conducted anonymously on November 28, 2021. The survey has an overall margin of error of +/- 2.0%, at the 95% level of confidence. Projections are based on the current U.S. Census estimates of the U.S. adult population, age 18 years and over. 2. Estimated spend based on data collected from 4000 UK adults polled by Opinium between 5pm on Saturday 4 December 2021 and 10pm on Sunday 5 December 2021. The £598 million figure for national spending calculated using ONS estimation of the UK adult population based on self-reported shopper estimates of spend and does not reflect actual receipts or sales. INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 6

In May 2022, we issued our inaugural $1 billion ESG Bond, which we will use to finance new and existing Green and Social projects. This is our first-ever financing instrument dedicated to support our ESG strategy and will serve to advance our programs and promote ESG-related investments. Enhancing Our ESG Governance In addition to progressing on our ESG goals, we have been focused on the governance and disclosures around our ESG strategy and programs. In 2022, we incorporated ESG risks, including climate-related risks, as an emerging risk for the Company within our Enterprise Risk Management framework. To help manage our climate-related risks, in 2021, we became a formal supporter of the Task Force on Climate-Related Financial Disclosures (TCFD) and assessed physical and transition risks to our business in alignment with the TCFD recommendations. Conclusion Over the last two years we have created more opportunities to collaborate and innovate across the enterprise and we have done a significant amount of work to define our ESG priorities and objectives. We also established measurable goals and action plans to achieve them as we continue to execute across each of our three ESG pillars. All of this work has accelerated our progress and put us on a clear path to strengthen our global impact in the coming years. Our work has only just begun. As we look ahead, we will continue to build on our momentum, putting our ESG strategy into action to back our colleagues, customers, and communities and make a positive impact in people’s lives and the world we live in. STEPHEN J. SQUERI CHAIRMAN AND CHIEF EXECUTIVE OFFICER INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 7

Our Commitment to ESG 10 Our ESG Objectives and Goals 11 Aligning Our Community Giving Priorities to Our ESG Strategy 12 Our Inaugural $1 Billion ESG Bond 13 Responding to Global Events 15 Amex Flex: Our New Way of Working 17 Awards and Recognition 18 Advancing the United Nations Sustainable Development Goals

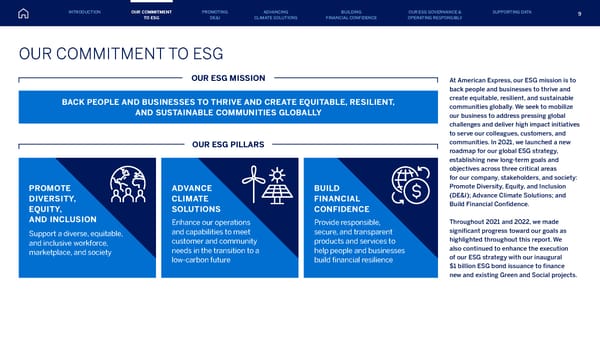

At American Express, our ESG mission is to back people and businesses to thrive and create equitable, resilient, and sustainable communities globally. We seek to mobilize our business to address pressing global challenges and deliver high impact initiatives to serve our colleagues, customers, and communities. In 2021, we launched a new roadmap for our global ESG strategy, establishing new long-term goals and objectives across three critical areas for our company, stakeholders, and society: Promote Diversity, Equity, and Inclusion (DE&I); Advance Climate Solutions; and Build Financial Confidence. Throughout 2021 and 2022, we made significant progress toward our goals as highlighted throughout this report. We also continued to enhance the execution of our ESG strategy with our inaugural $1 billion ESG bond issuance to finance new and existing Green and Social projects. OUR COMMITMENT TO ESG OUR ESG MISSION BACK PEOPLE AND BUSINESSES TO THRIVE AND CREATE EQUITABLE, RESILIENT, AND SUSTAINABLE COMMUNITIES GLOBALLY OUR ESG PILLARS ADVANCE CLIMATE SOLUTIONS Enhance our operations and capabilities to meet customer and community needs in the transition to a low-carbon future BUILD FINANCIAL CONFIDENCE Provide responsible, secure, and transparent products and services to help people and businesses build financial resilience PROMOTE DIVERSITY, EQUITY, AND INCLUSION Support a diverse, equitable, and inclusive workforce, marketplace, and society 9 INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG

OUR ESG OBJECTIVES AND GOALS Enhance diverse representation, equal opportunity, and an inclusive culture at all levels of the company Meet the needs of underrepresented businesses and consumers and develop more inclusive marketing initiatives Advance racial equality and social justice in our communities • Maintain 100% pay equity across genders globally and across races and ethnicities in the US • Double annual spend with underrepresented-owned suppliers in the US from a 2019 baseline to $750 million by the end of 2024, including increasing spend with Black-owned suppliers to at least $100 million annually • Provide access to capital and financial education to at least 250,000 underrepresented-owned small- and medium-sized businesses in the US from late 2020 through 2024 • Develop more inclusive marketing initiatives, as well as design and build product experiences and programs that better meet the needs of underrepresented consumer and business customers • Provide $50 million in grants from late 2020 through 2024 to nonprofits focused on addressing inequality and promoting social justice, including those led by members of underrepresented groups • Increase the representation of American Express Leadership Academy participants in the US who are from underrepresented groups from 50% in 2019 to 75% by the end of 2024 Minimize our climate impact and manage our climate-related risks and opportunities Enable our customers and partners to transition to a low- carbon economy through the development of new capabilities Support community programs and initiatives to help build more climate resilience and equitable communities • Commit to net-zero emissions by 2035 in alignment with the Science Based Targets initiative (SBTi) 1 • Enhance the management of climate-related risks and opportunities across the business • Pilot low-carbon product innovations, including carbon tracking and offset solutions by the end of 2022 • Provide at least $10 million to support initiatives, partnerships, and programs that address the adverse effects of climate change and pollution on communities from 2021 through 2025 • Engage our colleagues in sustainability initiatives through the Green2Gether program Empower individuals to build and maintain their financial well-being through products, services, tools, and education, while providing robust account security Strengthen the financial security and money management capacity of small businesses through products, services, campaigns, and initiatives Help build resilient communities through grants, programs, and initiatives that support economic empowerment and equity • Provide access to credit to at least 4 million individuals from underrepresented populations from 2021 through 2025 • Provide at least 5 million individuals with tools, resources, and educational content to improve financial well-being from 2021 through 2025 • Support small businesses, including by reaching $100 billion in spending by consumers at small, independently owned retailers or restaurants on Small Business Saturday and during other Shop Small campaigns from 2021 through 2025 2 • Invest $500 million to build more resilient and equitable communities from 2021 through 2025 1. American Express is following the methodology of the SBTi for our commitment to net-zero by 2035, which covers all Scope 1 and 2 emissions and a minimum of two-thirds of total Scope 3 emissions in conformance with the GHG Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard. 2. Based on spend as reported by consumers in surveys commissioned by American Express (not actual receipts or sales). BUILD FINANCIAL CONFIDENCE PROMOTE DIVERSITY, EQUITY, AND INCLUSION ADVANCE CLIMATE SOLUTIONS 10 INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG

ALIGNING OUR COMMUNITY GIVING PRIORITIES TO OUR ESG STRATEGY In 2022, we announced new grant priorities that build on our legacy of community giving and directly support our ESG strategy roadmap launched in 2021. Going forward, the American Express Foundation will direct its resources to three core priorities: Backing Small Support for underrepresented and economically vulnerable small business owners and entrepreneurs through our “Backing Small” initiative, including grants, mentoring support, and technical assistance through established community partnerships. Programs include: • Inclusive Backing • Coalition to Back Black Businesses • Backing Historic Small Restaurants • Backing International Small Restaurants • Blueprint: Backing BIPOC Businesses in Canada • First Nations Business Growth Program in Australia Financial literacy education, training, and mentoring for underrepresented individuals and families to build financial awareness, fiscal acumen, and success, including for school age grades 5-12, during higher education, or when individuals are entering or re-entering the workforce. Backing Low-Carbon Communities Advance climate innovation and solutions, particularly in urban areas, through: • Programs, partnerships, and action focused on energy transition, emissions reduction, and efficiency. • Community-led climate projects focused on nature-based or clean energy initiatives, including those led by underrepresented groups. • Disaster relief and resilience building programs and initiatives in extreme weather prone areas and cities where our colleagues and customers live and work to provide immediate and/or long-term relief to natural and man-made disasters and help create climate-resilient communities. Backing Equal Futures Programs that provide skills and pathways to prepare youth (ages 13 to 30) for long-term success and the future of work, including the green economy, digital futures, and STEAM fields such as science, technology, engineering, the arts, and mathematics: • Programs may include school-based, college, trade school, public service, or workforce- related training or mentoring to support skill building, education, the transition to meaningful employment, or self-sufficiency for underrepresented populations. Advocacy to support education and workforce development in underrepresented communities: • Eligible organizations for underrepresented communities include those supporting racial, ethnic, and Indigenous minorities, women, refugees, incarcerated or formerly incarcerated, unhoused and formerly unhoused people, veterans or families of veterans, disadvantaged or people with disabilities, and members of the LGBTQ+ community. 11 INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG

OUR INAUGURAL $1 BILLION ESG BOND In May 2022, American Express completed its first-ever ESG bond offering, maturing in 2029. We intend that an amount equivalent to the net proceeds of the $1 billion ESG bond will be allocated toward new and/or existing eligible projects in the Green and Social categories, as directed by the newly developed American Express Sustainable Financing Framework , which is aligned with the company’s global ESG strategy. Projects in the Green category include those related to green buildings, energy efficiency improvements and renewable energy, and the circular economy, such as expenditures related to updating American Express Cards to reclaimed or recycled plastics. Projects in the Social category include socioeconomic advancement and empowerment initiatives, such as expenditures and programs designed to drive economic growth among diverse groups through the procurement of products and services from diverse suppliers and vendors at least 51% owned by members of diverse populations, independently certified through a qualified agency. Other projects in the Social category include merchant support programs like our Shop Small campaign, financial empowerment programs, including support of the ByBlack platform to verify businesses as majority-owned by Black individuals, and community investments such as programs to enhance access to essential services and affordable housing. All net proceeds from the sustainable financing are expected to be fully allocated to eligible projects within two years of the date of issuance. Part I Introduction Part II Sustainable Financing Framework Part III Appendix Part IV Disclaimers The Powerful Backing of American Express April 2022 Sustainability Financing Framework Learn more by reading our newly developed American Express Sustainability Financing Framework , which is aligned with our global ESG strategy. 12 INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG

RESPONDING TO GLOBAL EVENTS Our ESG strategy also guides our response to global events, including our support for community resilience and equity. SUPPORTING HUMANITARIAN RELIEF EFFORTS IN UKRAINE In light of the attacks on the Ukrainian people, we have taken several actions to support our colleagues, customers, and the humanitarian relief efforts in the region. For example, we teamed up with Hilton to donate up to one million hotel room nights in hotels across Europe to support Ukrainian refugees and first responders who are helping them. We also enabled our US Consumer, Small Business, and Corporate Card Members who are enrolled in the Membership Rewards® program to use their Membership Rewards to support select charities that are providing humanitarian relief efforts in Ukraine and affected parts of Europe and matched the dollar value of their contributions made using points with PayPal Giving Fund through June 15, 2022. We are continuing to match colleague donations through the American Express Match program. We also provided $1 million in aid to the following organizations that are providing assistance to impacted populations: • $250,000 to the International Rescue Committee (IRC) to provide necessary resources where they are needed most, including to those who have fled their homes. • $250,000 to the International Medical Corps (IMC), which has deployed mobile medical teams to provide essential emergency and primary health services, mental health and psychosocial support services, and COVID-19 awareness and prevention services to help keep affected populations safe from the pandemic. • $250,000 to the American Red Cross to support coordinated relief efforts by the International Federation of Red Cross and Red Crescent Societies and other Red Cross partners who are responding to urgent needs and providing technical assistance on the ground. • $250,000 toward UNICEF’s emergency appeal to support children and families as the crisis escalates with life-saving programs, safe water, emergency health, hygiene, education aid, and other immediate help for those in need of support. BACKING OUR COMMUNITIES WITH $1 BILLION+ TOWARD CHARITABLE CAUSES Since creating the American Express Foundation in 1954, we have provided more than $1 billion to charitable causes around the world through the Foundation and our Corporate Giving Program. In 2021, we provided $38 million in charitable giving globally, including grants from our company, the American Express Foundation, our Center for Community Development, and gift-matching programs. See our 2021 Community Giving Grants List to learn more about our American Express Foundation and company charitable giving in 2021. $1B+ 13 INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG

PROVIDING POWERFUL BACKING THROUGHOUT THE PANDEMIC We have provided support to our colleagues, customers, and communities over the last two years of the COVID-19 pandemic. For colleagues, this included: • Providing coverage of out-of-pocket medical and pharmacy costs related to COVID-19 testing and treatment for colleagues enrolled in our US medical plans. • Up to 16 hours of paid time off for obtaining COVID-19 vaccines and boosters. • Partnering with departments of health and hospitals in the US and India to host onsite vaccine clinics for our colleagues, families, and contractors. For customers: • We continued to help merchant partners do business while keeping their own customers and staff safe. • For businesses, we raised contactless transaction thresholds to reduce physical contact at points of sale and reminded merchants that we do not require them to collect Card Members’ signatures. In the communities we serve: • We provided more than $11 million in philanthropic support for COVID-19 relief efforts since the start of the pandemic through 2021, delivering financial support to nonprofits worldwide working on the front lines of the ongoing global crisis. One of these partners was (RED), which we’ve highlighted below. In 2021, we joined forces with (RED) to support equitable access to testing, treatment, and vaccines in response to the impact of COVID-19 in the world’s poorest countries. To shine a spotlight on the campaign, we partnered with (RED) to launch CODE (RED) alongside the reopening of Broadway, with Lin-Manuel Miranda joining American Express at a special performance of the hit musical “Hamilton.” CODE (RED): A POWERFUL PARTNERSHIP FOR PUBLIC HEALTH We provided Card Members with the option to use Membership Rewards points to make donations through PayPal’s Pay with Rewards feature to help provide COVID-19 testing, treatment, and vaccines for people most in need. We also donated $250,000 to COVID-19 relief efforts championed by (RED) and its partners, Fund for the Global Fund, and COVAX, and matched employee contributions to the campaign. Community support during the COVID-19 pandemic has remained a priority. We provided more than $11 million in philanthropic support for COVID-19 relief efforts since the start of the pandemic through 2021. $11M+ COVID-19 relief efforts 14 INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG

AMEX FLEX: OUR NEW WAY OF WORKING AMEX FLEX HAS THREE WORK DESIGNATIONS Our colleagues remained productive during the pandemic, which required us to become even more agile in how we work, and our new Amex Flex model is designed to continue this trend while leveling the playing field for colleagues across jobs and locations. In-person connections at the office will also continue to play an important role in American Express’ future. We believe that being together in person has benefits, including spontaneous connections and idea sharing, team bonding and camaraderie, workspaces designed for creativity and collaboration, and more opportunities for mentorship, in-person coaching, and networking. In March 2022, we officially launched Amex Flex, our new way of working where colleagues can work in the office, at home, or can take a hybrid approach that combines both. Amex Flex is designed to leverage the best of both in-person and remote work and to enable colleagues to have greater flexibility in their personal and professional lives. ONSITE ONSITE COLLEAGUES WORK IN THE OFFICE 4-5 DAYS PER WEEK. THIS OPTION APPLIES TO LIMITED SELECT ROLES THAT CAN ONLY BE PERFORMED IN AN OFFICE, THOSE WHO CANNOT PERFORM THEIR ROLES REMOTELY, OR FOR ANYONE WHO WANTS TO BE IN THE OFFICE EVERY DAY. HYBRID HYBRID COLLEAGUES WORK A MIX OF IN-OFFICE AND VIRTUAL DAYS, COMING INTO THE OFFICE ABOUT TWO DAYS PER WEEK ON AVERAGE. LEADERS AND COLLEAGUES MAY PLAN COMMON DAYS FOR IN-PERSON CONNECTION, COLLABORATION, AND EVENTS. FULLY VIRTUAL VIRTUAL COLLEAGUES WORK EXCLUSIVELY OR FOR THE VAST MAJORITY OF DAYS FROM HOME. To back our colleagues during this transition, we are: • Phasing-in Amex Flex and avoiding a “one-size-fits-all" approach • Surveying our colleagues to garner feedback • Remaining flexible to meet the needs of our colleagues • Deploying our real estate, technology, and medical teams to help create a welcoming and safe office environment • Conducting informational and re-orientation sessions on topics such as the ongoing health resources we are offering • Introducing new office technologies to enhance the workplace experience and make it easy to collaborate with colleagues, such as equipping conference and huddle rooms with high-definition videoconferencing technology • Adding new technology benefits that provide colleagues the opportunity to order company-issued hardware and software to support working from home, regardless of their work designation 15 INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG

Kicking off Amex Flex We have launched Amex Flex in 18 countries. 3 3. As of June 1, 2022 Offering flexibility has always been a part of our culture. In fact, before the pandemic around 20% of our US workforce was virtual. Since we announced Amex Flex, the majority of our colleagues in the US have chosen hybrid schedules, opting to spend their time between in-office and virtual days, coming into the office about two days per week, while more than 40% have opted to be fully virtual, a percentage that has doubled over the last two years. As part of Amex Flex, all colleagues, except for those who are required to work onsite, will have the opportunity to work up to 30 days per calendar year from a location other than their primary work location. Our first office sites to adopt Amex Flex were in the UK and the US in the first quarter of 2022. Since then, offices in 18 countries in total have started Amex Flex. 16 INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG

AWARDS AND RECOGNITION Our commitment to be a great place to join, stay, and grow a career continues to earn us industry awards and recognition. Here are some of the recognitions from 2021 and 2022 that make us proud. • Anita Borg Top Companies for Women Technologists • Bloomberg’s Gender-Equality Index (since 2016) • Human Rights Campaign Corporate Equality Index— 100% score (since 2004) • Forbes America’s Best Employers for Diversity—ranked #24 • Forbes Best Companies to Work for in Spain—ranked #1 • FORTUNE 100 Best Companies to Work For—ranked #8 • FORTUNE 100 Best Workplaces for Millennials—ranked #9 • FORTUNE 100 Best Workplaces for Women—ranked #2 • FORTUNE Best Workplaces in Financial Services & Insurance—ranked #3 • FORTUNE Best Workplaces in New York—ranked #1 • FORTUNE World’s Most Admired Companies— ranked #13 • Great Place to Work: Best Workplaces for Parents— ranked #21 • Great Place to Work: Best Workplaces in Italy— ranked #2 • JUST Capital—JUST 100 List • Newsweek and Statista America’s Most Responsible Companies—ranked #13 • PEOPLE 2021 Companies that Care—ranked #48 • Working Families Top 10 Employers in the UK • Seramount 100 Best Companies—ranked top 10 • Seramount Companies for Dads CDP (CLIMATE) A- FTSE4GOOD INDEX SERIES MSCI (ESG) RATING AA SUSTAINALYTICS ESG RISK RATING Low Risk THIRD-PARTY ESG RATINGS We monitor our performance across several environmental, social, and governance-related ratings and rankings. Below are highlights from our most recent ratings: 17 INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG

ADVANCING THE UNITED NATIONS SUSTAINABLE DEVELOPMENT GOALS (SDG s ) We believe our actions can contribute positively to achieving the UN’s 2030 Agenda for Sustainable Development. We map our corporate and ESG initiatives and programs to the 17 United Nations Sustainable Development Goals (SDGs) and believe our work contributes most to the following 11 SDGs: 3 GOOD HEALTH AND WELL-BEING 4 QUALITY EDUCATION 5 GENDER EQUALITY 7 AFFORDABLE AND CLEAN ENERGY 8 DECENT WORK AND ECONOMIC GROWTH 9 INDUSTRY INNOVATION AND INFRASTRUCTURE 10 REDUCED INEQUALITIES 11 SUSTAINABLE CITIES AND COMMUNITIES 12 RESPONSIBLE CONSUMPTION AND PRODUCTION 13 CLIMATE ACTION 17 PARTNERSHIPS FOR THE GOALS 18 INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG

20 Our Vision for Promoting Diversity, Equity, and Inclusion 21 Progress and Highlights 23 Supporting Our Colleagues, Customers, and Communities 24 Backing Our Colleagues 32 Backing Our Customers and Partners 35 Backing Our Communities Promoting Diversity, Equity, and Inclusion

STRATEGIC OBJECTIVES GOALS • Provide $50 million in grants by the end of 2024 to nonprofits focused on addressing inequality and promoting social justice, including those led by members of underrepresented groups • Increase the representation of American Express Leadership Academy participants in the US who are from underrepresented groups from 50% in 2019 to 75% by the end of 2024 • Double annual spend with underrepresented-owned suppliers in the US from a 2019 baseline to $750 million by the end of 2024 and increase spend with Black-owned suppliers to at least $100 million annually. We expect the ongoing progress towards this goal and the cumulative spend with underrepresented-owned suppliers from late 2020 through 2025 will comprise a significant portion of the $4 billion we aim to spend toward DE&I initiatives over this period. • Provide access to capital and financial education to at least 250,000 underrepresented-owned small- and medium-sized business in the US from late 2020 through 2024 • Develop more inclusive marketing initiatives, as well as design and build product experiences and programs that better meet the needs of underrepresented consumer and business customers • Maintain 100% pay equity across genders globally and across races and ethnicities in the US Enhance diverse representation, equal opportunity, and an inclusive culture at all levels of the company Meet the needs of underrepresented businesses and consumers and develop more inclusive marketing initiatives Advance racial equality and social justice in our communities OUR VISION FOR PROMOTING DIVERSITY, EQUITY, AND INCLUSION SUPPORT A DIVERSE, EQUITABLE, AND INCLUSIVE WORKFORCE, MARKETPLACE, AND SOCIETY INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 20

100% Maintained 100% pay equity across genders globally and across races and ethnicities in the US for the 2nd consecutive year 76% of US participants in the American Express Leadership Academy in 2021 were from underrepresented groups, exceeding our goal of 75% by 2024 More than $14 million in grants provided to nonprofits focused on addressing inequality and promoting social justice, including those led by members of underrepresented groups, since announcing our goal of $50 million in October 2020 as part of our DE&I Action Plan $14M+ Spent more than $1 billion since announcing our DE&I Action Plan in October 2020 through March 2022 and announced an additional $3 billion toward DE&I initiatives through 2025 $1B+ Published inaugural DE&I Report in 2021 and continued to enhance transparency, including by providing additional data on hiring, promotions, and retention by race and ethnicity in this report INAUGURAL DE&I REPORT #8 on FORTUNE 100 Best Companies to Work For Progress and Highlights INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 21

Strategy Into Action: Exceeding $1 Billion of Spend Toward Our DE&I Action Plan, Announcing an Additional $3 Billion When we announced our $1 billion Diversity, Equity, and Inclusion (DE&I) Action Plan in October of 2020, we sought to build on our foundation of supporting diverse representation and equal opportunities for our colleagues, customers, and communities. That legacy includes a longstanding commitment to fostering an inclusive and welcoming workplace that reflects the diversity of our communities, promoting equal economic opportunity for our diverse customer base and business partners, and supporting community initiatives focused on advancing equality and social justice. As of March 2022, we exceeded $1 billion in spending since October 2020 toward our DE&I Action Plan, ahead of schedule. Our investments included spending with underrepresented-owned suppliers, expanding access to capital and financial education for underrepresented-owned small businesses, supporting partnerships with nonprofit organizations focused on promoting equality and social justice, and investments in pay equity. $4B toward DE&I Building on our progress, we now plan to spend an additional $3 billion toward DE&I initiatives—for an ambition to spend $4 billion in total from late 2020 through the end of 2025. The majority of additional spend will continue to be allocated to underrepresented-owned suppliers. Global investments outside the United States may include initiatives like Blueprint: Backing BIPOC Businesses, ™ a mentorship and grant program designed to support the advancement of Black, Indigenous, or People of Color (BIPOC) business owners in Canada. Launched last year, 100 Blueprint recipients own and operate small businesses in cities across Canada and represent a wide range of industries, including agriculture, consulting services, and technology solutions. INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 22

SUPPORTING OUR COLLEAGUES, CUSTOMERS, AND COMMUNITIES At American Express, we work to create an inclusive culture in the workplace, where our colleagues feel welcome and supported to reach their full potential; the marketplace, where businesses and consumers have equal economic opportunities; and society, where equality is supported and diversity is celebrated. We bring our DE&I vision to life by embedding diversity, equity, and inclusion in our company culture and operations, executing on the priorities and goals we set for ourselves, and holding our company and leaders accountable for progress on and achievement of those goals. INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 23

We are committed to delivering a great colleague experience at American Express. We seek to foster an inclusive environment where colleagues can grow and develop in ways that are unique and meaningful to them and have the backing and flexibility they need to bring their authentic selves to work and thrive in their professional and personal lives. Based on the findings from our 2021 annual Colleague Experience Survey, we are continuing our focus on strong enterprise leadership and agile decision-making in the way we work. In the spring of 2022, we launched Amex Flex, a hybrid work model that is designed to recapture in-person connections, collaboration, and relationship building, while also retaining the flexibility and efficiencies of working virtually. Learn more in Amex Flex: Our New Way of Working in the Our Commitment to ESG section of this report. We are focused on creating an inclusive and welcoming culture where colleagues feel that they belong, that their contributions are highly valued, and that their voices are heard. Through our 14 Colleague Networks globally, we are providing our colleagues with opportunities to engage, share common experiences, support each other’s development, and give back to their communities. BACKING OUR COLLEAGUES In our 2021 annual Colleague Experience Survey, 90% of survey participants said they would recommend American Express as a great place to work. 90% INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 24

2021 Global workforce representation We have established recruitment, hiring, and promotion practices to attract, develop, and retain a diverse workforce. Our focus is on fostering an inclusive and equitable culture for all colleagues. 50 % BOARD OF DIRECTORS DEMOGRAPHICS 2 57 % Racial/ Ethnic Diversity 29 % 7 % 64 % Gender Diversity 71 % 29 % 2021 SENIOR VICE PRESIDENTS & ABOVE 3 53 % 53 % 1. Based on data for the 2021 U.S. Employer Information Report (EEO-1) submission for Black/African American, Hispanic/Latino, Asian, Native American, or Alaskan Native, Native Hawaiian, or Pacific Islander, and two or more races. 2. Based on self-identified characteristics. Data is following our 2022 annual meeting. 39.1 % Women (Global) 9.1 % Black/ African American (US) 15.2 % Asian (US) 5.3 % Hispanic/Latinx (US) Our full US Workforce Employer Information Report (EEO-1) data can be found in the Supporting Data section. A Focus on Our Global Workforce Diversity From hiring and onboarding to growing careers, we seek to foster an inclusive environment where colleagues can grow and thrive in ways that are unique and meaningful to them and have the backing and flexibility they need to deliver their best. 2021 WORKFORCE HIGHLIGHTS OF OUR EXECUTIVE COMMITTEE WERE WOMEN OR FROM DIVERSE RACES AND ETHNIC BACKGROUNDS OF OUR BOARD MEMBERS WERE WOMEN OR FROM DIVERSE RACES AND ETHNIC BACKGROUNDS 10 MEN 4 WOMEN OF OUR US WORKFORCE WERE FROM DIVERSE RACES AND ETHNIC BACKGROUNDS 1 OF OUR TOTAL GLOBAL WORKFORCE WERE WOMEN 3. As of year-end 2021; based on the U.S. EEO-1 job categories. 4 BLACK/AFRICAN AMERICAN 1 HISPANIC/ LATINX 9 WHITE Since 2015, American Express has been included on the Bloomberg Gender-Equality Index (GEI). The GEI highlights public companies committed to disclosing their efforts to support gender equality through policy development, representation, and transparency. INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 25

Hiring, promotions, and retention To help inform and improve our diversity, equity, and inclusion practices, we track our hiring, promotions, and talent retention rates, including for gender globally and for race and ethnicity in the US. As part of our commitment to ongoing transparency, we’re providing additional detailed disclosures in this year’s report, including disaggregated representation data by race and ethnicity in the US as shown in the table below. 2021 HIRING, PROMOTIONS, AND RETENTION RATES Women Globally Men Globally US Asian 5 US Black or African American 5 US Hispanic or Latinx 5 US Other 5, 6 US White 5 New Colleague Hires 53% 47% 20% 23% 16% 3% 36% Colleague Promotions 52% 48% 27% 8% 11% 3% 51% Colleague Retention 87% 84% 83% 81% 86% 82% 86% Maintaining 100% pay equity We regularly review our compensation practices to ensure colleagues in the same job, level and location are compensated fairly regardless of gender globally, and race and ethnicity in the United States. In 2021, for the second consecutive year, we achieved 100% pay “equity”—meaning no statistical differences in pay—across genders globally and across races and ethnicities in the US. Our pay equity achievement is supported by compensation policies, processes, and practices designed to pay colleagues in all roles and at all levels based on performance and other business-related criteria, making appropriate salary adjustments where needed. As part of the evaluation of our pay practices and reward structure, we have conducted annual pay equity reviews with independent experts since 2017. Since 2019, this analysis has covered our entire global colleague population across genders globally and across races and ethnicities in the US, assessing pay on a statistical basis and considering key factors that influence compensation, including but not limited to tenure, role, level, geography, and performance. In 2021, we began disclosing the “raw median pay gap” for women globally and for diverse colleagues in the United States. This metric compares differences in raw median base pay, with no adjustments for factors such as role, level, tenure, performance, or geography. In 2021, the median pay for women globally at American Express was 106.7% of the median pay for men. The median pay for racially/ethnically diverse colleagues in the US was 95.2% of that for white colleagues. 7 We believe our pay equity review provides a more accurate and comprehensive picture of our compensation practices overall because it provides a more granular view that considers many important factors known to affect an individual’s compensation. For this reason, we use pay equity as the standard we hold ourselves accountable to. We remain committed to maintaining 100% pay equity for colleagues across genders globally and across races and ethnicities in the US by continuing our annual pay equity review process. 7. US racially/ethnically diverse colleagues based on US EEO-1 categories including Black or African American, Hispanic or Latino, Asian, Native American, or Alaskan Native, Native Hawaiian or Pacific Islander, and two or more races. 4. As of year-end 2021; based on the U.S. EEO-1 job categories. Some percentages do not sum due to rounding. 5. Race/ethnicity based on self-identified information. Less than 1% of new colleague hires did not disclose their race or ethnicity in 2021. 6. Includes colleagues that self-identify as Native American or Alaskan Native, Native Hawaiian or Pacific Islander, or two or more races. 2021 US WORKFORCE DIVERSITY 4 Racial/ Ethnic Diversity 19.5 % 13.3 % 50.2 % 3.1 % 13.8 % Gender Diversity 44.7 % 55.3 % MEN WOMEN ASIAN BLACK/AFRICAN AMERICAN HISPANIC/LATINX WHITE OTHER INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 26

Workplace awards and recognition We attribute our success to the more than 64,000 colleagues who drive our business. We’re proud that our efforts to provide an environment where a diverse workforce can thrive has garnered outside recognition, from our highest-ever ranking of #8 on FORTUNE’s 100 Best Companies to Work For to LinkedIn naming us one of the top 10 companies to grow your career in the UK, to GirlCode® naming us to the “Top 10 Diversity and Inclusion Power List” for 2022, to the Human Rights Campaign naming us to their Best Places to Work for LGBTQ+ Equality list in 2022. Learn more in Awards and Recognition in the Our Commitment to ESG section. Diversifying talent through strategic partnerships We have established over 30 partnerships to help us broaden our reach and support our enterprise objectives to recruit new talent and retain high performing colleagues. One of our key partners is PowertoFly (PTF), an organization focused on connecting underrepresented talent to companies. Through our engagement efforts, PTF supports our global hiring efforts across multiple talent segments and levels of the organization. “ American Express has partnered with PowerToFly since 2017 to help build and retain their inclusive and diverse workplace in the US, UK, and India. Together, we’ve targeted talent segments including Tech, Finance, Sales & Marketing, and Risk & Analytics through events, virtual job fairs, sponsorship of PowerToFly’s Diversity Reboot Summit series, and more. Our partnership has only strengthened throughout the years, and we look forward to what’s to come!” – KRISTINA TEPPO , CUSTOMER SUCCESS MANAGER AT POWERTOFLY PowerToFly INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 27

2021 Colleague Experience Survey 85 % of participants indicated that they feel valued as a colleague at American Express 91 % of participants responded that they feel supported by their leader in making decisions about their well-being Belonging and inclusion at American Express To support our efforts to create an inclusive and welcoming culture for our colleagues, we introduced two trainings in 2020: a “Strengthening Our Culture of Belonging and Inclusion” course and a “Belonging at Amex” workshop. We supplemented these trainings with conversations and informational sessions on how colleagues can contribute to a culture of inclusion. Throughout, colleagues had access to numerous resources on leading inclusively, having meaningful conversations, and making their voices heard. To further help colleagues feel a sense of belonging, we have 14 Colleague Networks, with over 100 chapters worldwide, for sharing common experiences and interests: • Asian Network at American Express (ANA) • Black Engagement Network (BEN) • Christian Network (SALT) • Disability Awareness Network (DAN) • Families at American Express Network • Generations Network (NextGen) • Hispanic Origin & Latin American Network (HOLA) • Jewish Network (CHAI) • Muslim Network (PEACE) • PRIDE+ Network • Veterans Network (VET) • Virtual Office Network • Women in Technology Network (WIT) • Women’s Interest Network (WIN) In addition to our Colleague Networks, we have nine Diversity, Equity, and Inclusion Councils across Business Units and in office locations to address local priorities. EXPANSIVE AND IMPACTFUL FAMILY SUPPORT For US colleagues who use adoption, surrogacy, or egg/sperm donors, we offer reimbursement that covers expenses up to $35,000—for up to two events, with a lifetime maximum of $70,000. Those who undergo reproductive treatments are eligible for up to $35,000 in medical assistance. “ We adopted our son and in fact, Amex has been there for us since day one and throughout every step of the way,” says Sean B., an analyst in our Global Risk and Compliance department. “The company’s family planning and assistance program provided us with the financial support to adopt earlier than what we thought was possible. Additionally, the family concierge benefit helped us throughout the adoption process and is a resource we continue to use when we need childcare.” “ The dependent care flexible spending account has also provided comfort financially,” Sean added, “which has especially been helpful during these current times when we’re doing the best we can in a lot of situations that are entirely new and the challenges we’ve had to navigate around due to COVID.” This support continues after colleagues welcome their new family members. Under our gender-neutral parental leave policy, eligible colleagues in the United States can take up to 20 weeks parental leave with full base pay, whether they’re welcoming a child through pregnancy, adoption, or surrogacy. We also provide six to eight weeks of additional leave if medically necessary. We also provide colleagues in Canada, the UK, and the US access to in-home or center- based childcare when their regular arrangements fall through, as well as connection with 24/7 consultants who can help arrange in-home care for an adult loved one recovering from an illness or injury. INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 28

Backing women colleagues In 2021, women represented more than half of our workforce worldwide, and approximately four out of 10 senior executives were women. We are invested in engaging, retaining, and backing our women colleagues and helping them realize their professional potential through initiatives and programs that help them grow, develop, and thrive. For example, in India, we have established more than 20 small peer group “Lean In Circles” designed to build connection and new skills. Through customized training and partnerships with external organizations, we offer colleagues a variety of meaningful learning and development opportunities. In 2020, we launched the Ambition Project in partnership with The New York Women’s Foundation to encourage our women colleagues to fully embrace their ambition and support the ambitions of others. In 2022, we once again partnered with the New York Women’s Foundation for a global study on women’s relationship with ambition, both in their careers and personal lives—and their confidence in achieving success after a global pandemic. Amidst a rapidly changing workforce, women remain ambitious, and we continue to proudly back their aspirations. Backing colleagues with disabilities We are committed to providing colleagues with an inclusive work environment, from accessibility tools on the job to benefits that support a healthy work-life balance. In 2021, we enabled closed captioning as a standard for virtual livestream events to make broadcast content more accessible. We also launched enhanced accessibility features for online meetings, such as closed captioning, screen reader notifications, and the ability to change chat font size. These represent just a few of the resources and best practices we’ve made available to colleagues across the enterprise. To advance our disability inclusion initiatives, we’re now members of the Inclusion Works community as part of our Disability:IN partnership, in which we collaborate with disability inclusion experts to implement best practices in this space. We’ve continued our membership in the Valuable 500 in the UK, which enlists companies to keep disability inclusion on the leadership agenda and make a commitment to action. Within our company, our Disability Awareness Network (DAN) plays an important role in creating a sense of belonging and community among our colleagues with seen and unseen disabilities and raising awareness for disability inclusion. For International Day of Persons with Disabilities in December 2021, DAN brought together authors, advocates, entrepreneurs, mental health experts, and our colleagues from India, Spain, the UK, and beyond under the common theme of “Recognize More: Proudly Backing Disability Inclusion.” This virtual event was an opportunity to drive inclusion of people with disabilities by demonstrating support and helping educate allies on how best to partner with their colleagues with disabilities. In 2022, nearly 4,000 colleagues around the world joined our enterprise-wide International Women’s Day events live, featuring American Express leaders and external guests, in addition to 30 local events. For example, our Japan Women’s Network organized an event with a guest speaker on the topic of how to “Design Your Ambition.” INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 29

Backing Black and African American colleagues A culture of belonging gains strength when colleagues worldwide have opportunities to make their voices heard, listen, learn, and build their skills for inclusive leadership. Heritage months and cultural moments provided valuable occasions to spark these conversations and connections. For instance, Black Engagement Network (BEN) chapters across Canada and the United States celebrated Black History Month with a variety of events, open to all colleagues, under the theme of “Say It Loud.” BEN, in partnership with its executive committee sponsors, also promoted networking and development for vice presidents and above. Executive BEN held its sixth Global Forum in June 2021. The forum brought together 72 Black leaders from across the company, our CEO and Executive Committee members, and host Anré Williams, CEO, American Express National Bank and Group President of Enterprise Services. Attendees gained exposure to new perspectives, networked, honed their leadership skills, and helped shape plans for driving change for our Black colleagues. In 2022, we made Juneteenth, also known as Black Independence Day, a company holiday in the US, giving colleagues the day to learn, celebrate, and reflect. Juneteenth is a reminder of both the progress that has been made and the work still left to be done to ensure all people have equal opportunities to achieve dignity, happiness, and success. Backing Hispanic and Latinx colleagues During Hispanic and Latinx Heritage Month, our Hispanic Origin and Latin American Colleague Network (HOLA), hosted global events focused on “Amplifying the Impact: Proudly Backing Hispanic and Latinx Achievement.” Our theme showcased our commitment to celebrating our Hispanic and Latinx colleagues—appreciating who they are, acknowledging the strength they bring to our organization, and amplifying the lasting impact of their accomplishments. Backing Asian, Asian American, and Pacific Islander colleagues During Asian Pacific American Heritage Month in 2022, we celebrated the rich cultural diversity of our colleagues with the theme “Make Culture Shine: Proudly Backing All Asian Communities.” We also hosted a conversation titled “American Express Voices” with some of our Asian Network Amex leaders about bringing their whole selves to work and telling their stories. Names are often tied to heritage and culture, and we took the opportunity during Asian Pacific American Heritage Month in 2021 to introduce a new pronunciation feature in our company Slack channel where colleagues can list the phonetic spelling of their names. We also published an internal colleague feature titled “What’s in a Name?” and encouraged colleagues to ask and learn about each other’s names so we can all get to know each other on a deeper level. INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 30

Backing LGBTQ+ inclusion In 2021, our PRIDE+ Colleague Network developed a powerful theme in honor of Pride Month to continue driving a message of inclusion to our colleagues around the globe “Live Beyond Labels: Proudly Backing All of You” and engaged colleagues in enterprise-wide conversations. In October 2021, we announced that we commenced an exclusive three-year principal partnership with the Sydney Gay and Lesbian Mardi Gras and that we will partner with Sydney WorldPride in 2023. As principal partner, we will work alongside the Sydney Gay and Lesbian Mardi Gras and Sydney WorldPride teams to coordinate a festival of events across Greater Sydney that celebrate our diverse LGBTQ+ communities, which include the iconic Mardi Gras Fair Day. These partnerships build upon our support of LGBTQ+ communities, including our membership with Open for Business—a coalition of companies making the economic and business case for LGBTQ+ inclusion in companies around the world. We also received Silver status in the 2022 Australian Workplace Equality Index (AWEI). Backing our service members and veterans The Amex Veterans Network (VET) was launched in 2012 and supports our colleagues who are currently serving in the military, are veterans, have friends or family in the military, or just want to show their support for our troops. In 2021, American Express, in partnership with VET, provided a $50,000 grant to American Corporate Partners (ACP), a national nonprofit organization focused on helping returning veterans and active-duty spouses find their next careers through one- on-one mentoring, networking, and online career advice. Learn more about our support for veteran-owned small businesses in Inclusive Backing for Veterans . 18 YEARS AND COUNTING OF LEADING LGBTQ+ BENEFITS AND PRACTICES The Human Rights Campaign Foundation’s Corporate Equality Index is the national benchmarking tool on corporate policies, practices, and benefits pertinent to LGBTQ+ colleagues. Each year since 2004, American Express has scored 100% on this index. Additionally, in 2022, we were named to their list of Best Places to Work for LGBTQ+ Equality. INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 31

Raising the bar for supply chain diversity Successful strategies and innovative products and services require diverse perspectives and contributions. For these reasons, American Express has a goal to increase spending with underrepresented-owned suppliers who provide us with professional services, marketing, and beyond. To build a more diverse, inclusive supply chain, we consider at least one diverse vendor for each request for proposal. We track and measure our annual spend with certified business enterprises run by underrepresented owners and operators, including: • Minority-owned Business Enterprises (MBE) • Black-owned Businesses • Women-owned Business Enterprises (WBE) • LGBT-owned Business Enterprises (LGBTE) • Veteran’s Business Enterprises (VBE) • Service-Disabled Veteran’s Business Enterprises (SDVBE) • Disability-owned Business Enterprises (DOBE) • Small Business Enterprises/8(a)/HUBZone firms BACKING OUR CUSTOMERS AND PARTNERS American Express seeks to meet the needs of under represented businesses and consumers and develop more inclusive marketing initiatives. We are also focused on our efforts to help underrepresented-owned businesses through our supplier diversity program. In 2021, we introduced more than 65 new underrepresented- owned suppliers to grow our program and in 2022 started working with select suppliers to begin tracking diverse supplier spend within their own supply chains. Our supplier diversity partners include: • Disability: IN • Financial Services Roundtable for Supplier Diversity (FSRSD) • Minority Supplier Development UK (MSDUK) • National LGBT Chamber of Commerce (NGLCC) • National Minority Supplier Development Council (NMSDC) • National Veterans Business Development Council (NVBDC) • Supply Nation • US Black Chambers • WEConnect International • Women’s Business Enterprise National Council (WBENC) In October 2020, we announced a goal to double our annual spend with underrepresented-owned suppliers in the United States from a 2019 baseline to $750 million by the end of 2024, including increasing spend with Black-owned suppliers to at least $100 million annually. In 2021, we not only made progress toward this goal, but also exceeded our initial expectations for the year, as shown in the graphic below. SUPPLIER DIVERSITY: BY THE NUMBERS $100M $72M $50M 2021 Target 2021 Actual 2024 Goal US Black-owned Annual Spend 2021 Target Exceeded! 237 Underrepresented-owned Suppliers in 2021 US Underrepresented- owned Annual Spend 2021 Target Exceeded! $750M $550M $500M 2021 Target 2021 Actual 2024 Goal Learn more about our Backing Small initiatives in the Backing Small for Underrepresented and Economically Vulnerable Small Business Owners section. INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 32

Extending our reach through grants and community investment In 2021, we provided $20 million to Accion Opportunity Fund, a nonprofit Community Development Financial Institution and small business lender, to expand access to loans for historically underfunded small businesses in the United States, including those owned by underrepresented groups. Learn more about our investments in the communities we serve in Backing Our Communities in the Building Financial Confidence section. Joining forces for more inclusive travel In March 2022, we proudly announced our global platinum- level sponsorship of the International LGBTQ+ Travel Association (IGLTA), a global leader in advancing LGBTQ+ travel and have signed a multi-year agreement to join IGLTA. IGLTA provides information and resources for LGBTQ+ travelers and expands LGBTQ+ tourism globally by demonstrating its significant social and economic impact. This partnership supports diversity, equity, and inclusion in the travel industry by enriching our Card Members’ journeys through inclusive travel choices and practices. Backing our customers with purpose-driven travel options Our customers are traveling with more purpose and seeking to have a positive impact on the places they visit. According to our Global Travel Trends report, 81% of respondents reported that they want to travel to destinations where they can immerse themselves in the local culture and 81% of respondents want the money they spend while traveling to go back to the local community. 8 To help our customers navigate purpose-driven travel options and experience destinations in a more meaningful way, American Express Travel is partnering with Kensington Tours to launch bespoke itineraries in countries around the world geared toward cultural exchange and supporting the local economies. Our initial launch features customizable tours for Denmark, Kenya, Peru, South Africa, and Vietnam available for US Platinum Card Members to book exclusively through American Express Travel. By leveraging existing partnerships and cultivating new ones, American Express Travel is identifying new thoughtful travel options that align with what our customers value. 8. Methodology: Amex Trendex online poll was conducted by Morning Consult between February 3–11, 2022, among a national sample of 2,000 travelers in the US and 1,000 travelers in Japan, Australia, Mexico, India, UK, and Canada who have a household income of at least $70K and defined as adults who typically travel by air at least once a year. Results from each country survey have a margin of error of plus or minus 3 percentage points. INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 33

Connecting underrepresented-owned businesses to capital and support As part of our ESG strategy to Promote Diversity, Equity, and Inclusion, we have a goal to provide at least 250,000 underrepresented-owned small- and medium-sized US businesses access to capital and financial education from late 2020 through 2024. We’re progressing toward this goal by delivering educational resources, expanded access to credit and loans, grants, marketing support, and more. For nine years, we’ve partnered with Women Impacting Public Policy and the US Small Business Administration to help boost the prospects of women entrepreneurs to gain government contracts. Our ChallengeHER program offers free training webinars, workshops, mentoring, and direct access to government buyers and local partner resources. From 2013 through the end of 2021, this initiative has hosted 170 webinars and facilitated over 4,800 meetings between women-owned small businesses and government officials. In 2021, there were more than 2,300 total attendees for ChallengeHER webinars. We also hosted Contract Connections for the ninth year at the 2021 Business Class LIVE virtual event for small business owners, connecting many underrepresented-owned small business suppliers with large corporate and government buyers in one-on-one sessions. We continued to offer small business owners’ access to Business Class, a platform offering customized business education resources. We also maintained our support of Minority- and Women-Owned Business Enterprises (MWBEs) as part of our capital markets funding and share repurchase programs. In 2021, we engaged four MWBEs for underwriting and share repurchases, and through May of 2022, we engaged six such MWBEs. We have a goal to provide at least 250,000 underrepresented-owned small- and medium- sized US businesses access to capital and financial education from late 2020 through 2024. 2024 250K INTRODUCTION PROMOTING DE&I ADVANCING CLIMATE SOLUTIONS BUILDING FINANCIAL CONFIDENCE OUR ESG GOVERNANCE & OPERATING RESPONSIBLY SUPPORTING DATA OUR COMMITMENT TO ESG 34