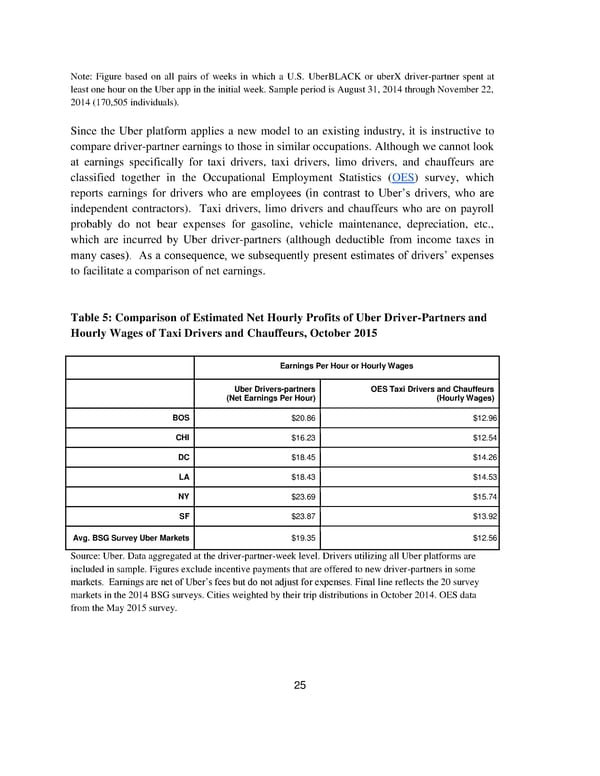

Note: Figure based on all pairs of weeks in which a U.S. UberBLACK or uberX driver-partner spent at least one hour on the Uber app in the initial week. Sample period is August 31, 2014 through November 22, 2014 (170,505 individuals). Since the Uber platform applies a new model to an existing industry, it is instructive to compare driver-partner earnings to those in similar occupations. Although we cannot look at earnings specifically for taxi drivers, taxi drivers, limo drivers, and chauffeurs are classified together in the Occupational Employment Statistics (OES) survey, which reports earnings for drivers who are employees (in contrast to Uber’s drivers, who are independent contractors). Taxi drivers, limo drivers and chauffeurs who are on payroll probably do not bear expenses for gasoline, vehicle maintenance, depreciation, etc., which are incurred by Uber driver-partners (although deductible from income taxes in many cases). As a consequence, we subsequently present estimates of drivers’ expenses to facilitate a comparison of net earnings. Table 5: Comparison of Estimated Net Hourly Profits of Uber Driver-Partners and Hourly Wages of Taxi Drivers and Chauffeurs, October 2015 Earnings Per Hour or Hourly Wages Uber Drivers-partners OES Taxi Drivers and Chauffeurs (Net Earnings Per Hour) (Hourly Wages) BOS $20.86 $12.96 CHI $16.23 $12.54 DC $18.45 $14.26 LA $18.43 $14.53 NY $23.69 $15.74 SF $23.87 $13.92 Avg. BSG Survey Uber Markets $19.35 $12.56 Source: Uber. Data aggregated at the driver-partner-week level. Drivers utilizing all Uber platforms are included in sample. Figures exclude incentive payments that are offered to new driver-partners in some markets. Earnings are net of Uber’s fees but do not adjust for expenses. Final line reflects the 20 survey markets in the 2014 BSG surveys. Cities weighted by their trip distributions in October 2014. OES data from the May 2015 survey. 25

An Analysis Of The Labor Market For Uber’s Driver-partners In The United States Page 25 Page 27

An Analysis Of The Labor Market For Uber’s Driver-partners In The United States Page 25 Page 27