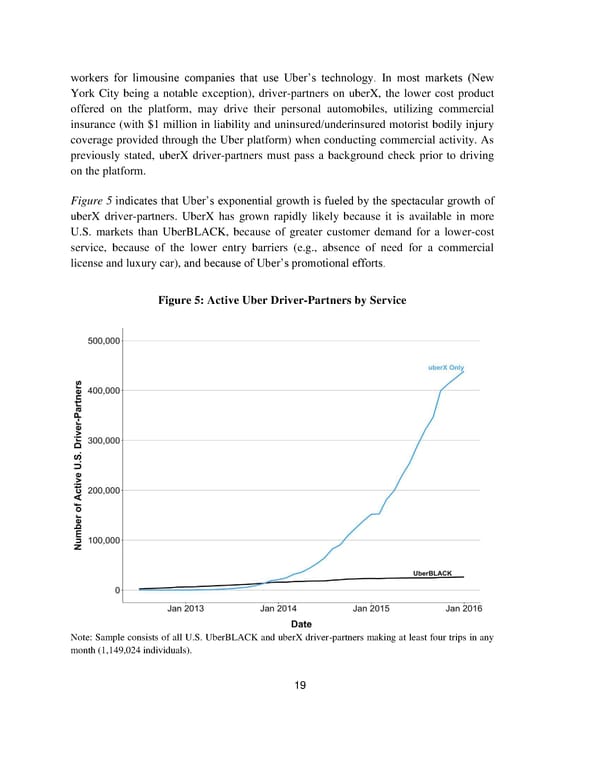

workers for limousine companies that use Uber’s technology. In most markets (New York City being a notable exception), driver-partners on uberX, the lower cost product offered on the platform, may drive their personal automobiles, utilizing commercial insurance (with $1 million in liability and uninsured/underinsured motorist bodily injury coverage provided through the Uber platform) when conducting commercial activity. As previously stated, uberX driver-partners must pass a background check prior to driving on the platform. Figure 5 indicates that Uber’s exponential growth is fueled by the spectacular growth of uberX driver-partners. UberX has grown rapidly likely because it is available in more U.S. markets than UberBLACK, because of greater customer demand for a lower-cost service, because of the lower entry barriers (e.g., absence of need for a commercial license and luxury car), and because of Uber’s promotional efforts. Figure 5: Active Uber Driver-Partners by Service Note: Sample consists of all U.S. UberBLACK and uberX driver-partners making at least four trips in any month (1,149,024 individuals). 19

An Analysis Of The Labor Market For Uber’s Driver-partners In The United States Page 19 Page 21

An Analysis Of The Labor Market For Uber’s Driver-partners In The United States Page 19 Page 21