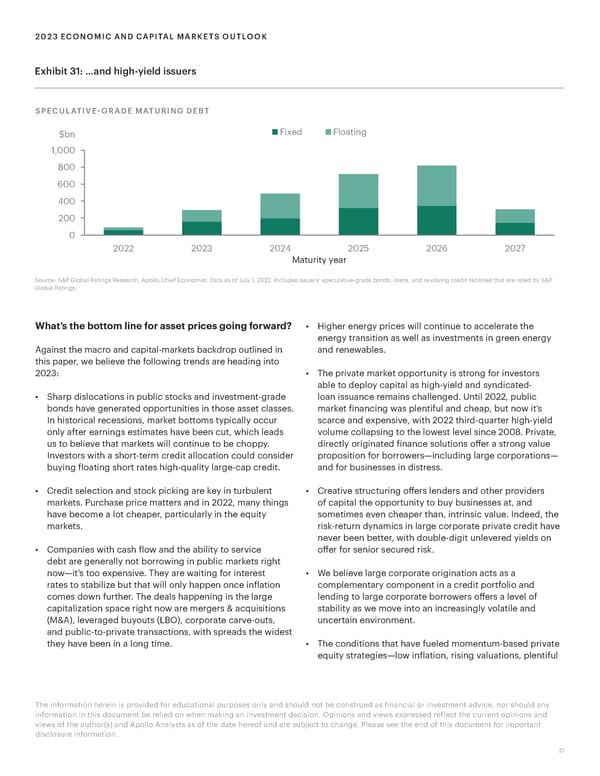

2023 ECONOMIC AND CAPITAL MARKETS OUTLOOK Exhibit 31: …and high-yield issuers SPECULATIVE-GRADE MATURING DEBT $bn Fixed Floating 1,000 800 600 400 200 0 2022 2023 2024 2025 2026 2027 Maturity year Source: S&P Global Ratings Research, Apollo Chief Economist. Data as of July 1, 2022. Includes issuers’ speculative-grade bonds, loans, and revolving credit facilities that are rated by S&P Global Ratings. What’s the bottom line for asset prices going forward? • Higher energy prices will continue to accelerate the energy transition as well as investments in green energy Against the macro and capital-markets backdrop outlined in and renewables. this paper, we believe the following trends are heading into 2023: • The private market opportunity is strong for investors able to deploy capital as high-yield and syndicated- • Sharp dislocations in public stocks and investment-grade loan issuance remains challenged. Until 2022, public bonds have generated opportunities in those asset classes. market financing was plentiful and cheap, but now it’s In historical recessions, market bottoms typically occur scarce and expensive, with 2022 third-quarter high-yield only after earnings estimates have been cut, which leads volume collapsing to the lowest level since 2008. Private, us to believe that markets will continue to be choppy. directly originated finance solutions offer a strong value Investors with a short-term credit allocation could consider proposition for borrowers—including large corporations— buying floating short rates high-quality large-cap credit. and for businesses in distress. • Credit selection and stock picking are key in turbulent • Creative structuring offers lenders and other providers markets. Purchase price matters and in 2022, many things of capital the opportunity to buy businesses at, and have become a lot cheaper, particularly in the equity sometimes even cheaper than, intrinsic value. Indeed, the markets. risk-return dynamics in large corporate private credit have never been better, with double-digit unlevered yields on • Companies with cash flow and the ability to service offer for senior secured risk. debt are generally not borrowing in public markets right now—it’s too expensive. They are waiting for interest • We believe large corporate origination acts as a rates to stabilize but that will only happen once inflation complementary component in a credit portfolio and comes down further. The deals happening in the large lending to large corporate borrowers offers a level of capitalization space right now are mergers & acquisitions stability as we move into an increasingly volatile and (M&A), leveraged buyouts (LBO), corporate carve-outs, uncertain environment. and public-to-private transactions, with spreads the widest they have been in a long time. • The conditions that have fueled momentum-based private equity strategies—low inflation, rising valuations, plentiful The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the author(s) and Apollo Analysts as of the date hereof and are subject to change. Please see the end of this document for important disclosure information. 21

Apollo 2023 Economic and Capital Markets Outlook Page 20 Page 22

Apollo 2023 Economic and Capital Markets Outlook Page 20 Page 22