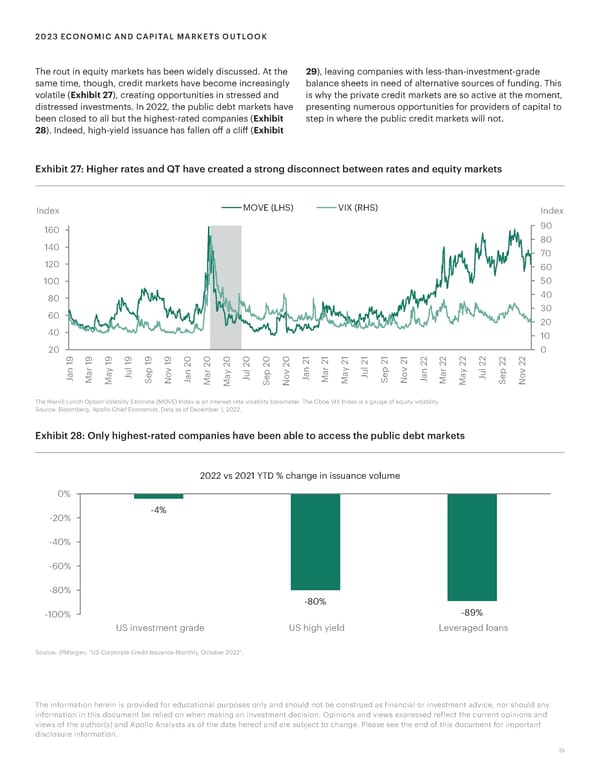

2023 ECONOMIC AND CAPITAL MARKETS OUTLOOK The rout in equity markets has been widely discussed. At the 29), leaving companies with less-than-investment-grade same time, though, credit markets have become increasingly balance sheets in need of alternative sources of funding. This volatile (Exhibit 27), creating opportunities in stressed and is why the private credit markets are so active at the moment, distressed investments. In 2022, the public debt markets have presenting numerous opportunities for providers of capital to been closed to all but the highest-rated companies (Exhibit step in where the public credit markets will not. 28). Indeed, high-yield issuance has fallen off a cliff (Exhibit Exhibit 27: Higher rates and QT have created a strong disconnect between rates and equity markets Index MOVE S VI S Index 160 90 140 80 70 120 60 100 50 80 40 60 30 20 40 10 20 1 1 1 1 1 1 2 2 2 2 2 2 0 9 9 9 9 9 9 0 0 0 0 0 0 2 2 2 2 2 2 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 2 2 l n r y l p v n r y l p v n r y u p v n r y l p v a a a u e o a u a a a J e o a a a u o J M J a a J e o J M S J J e M S N J M M S N M N M M S N The Merrill Lynch Option Volatility Estimate (MOVE) Index is an interest-rate volatility barometer. The Cboe VIX Index is a gauge of equity volatility. Source: Bloomberg, Apollo Chief Economist. Data as of December 1, 2022. Exhibit 28: Only highest-rated companies have been able to access the public debt markets 2022 vs 2021 YTD % hange in issane volme 0% -20% -4% -40% -60% -80% -80% -100% -89% US investment grade US high yield Leveraged loans Source: JPMorgan, “US Corporate Credit Issuance Monthly, October 2022”. The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the author(s) and Apollo Analysts as of the date hereof and are subject to change. Please see the end of this document for important disclosure information. 19

Apollo 2023 Economic and Capital Markets Outlook Page 18 Page 20

Apollo 2023 Economic and Capital Markets Outlook Page 18 Page 20