Benefit Guide Team Members May 2024

Team Members | Health, dental, and vision insurance, life and disability insurance, and programs to help save for the future, such as 401(k) and Health Savings Account (HSA)

2024 Bene昀椀t Guide TEAM MEMBERS Copyright ® 2024 UnityPoint Health. All Rights Reserved. ® SM trademarks of UnityPoint Health. 003465j4-1 05/24 CS

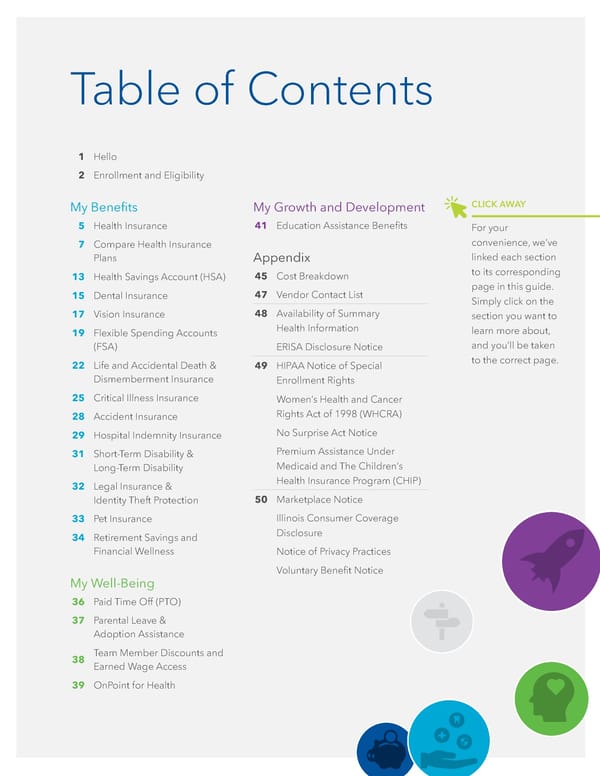

Table of Contents 1 Hello 2 Enrollment and Eligibility My Bene昀椀ts My Growth and Development CLICK AWAY 5 Health Insurance 41 Education Assistance Bene昀椀ts For your 7 Compare Health Insurance convenience, we’ve Plans Appendix linked each section 13 Health Savings Account (HSA) 45 Cost Breakdown to its corresponding 47 Vendor Contact List page in this guide. 15 Dental Insurance Simply click on the 17 Vision Insurance 48 Availability of Summary section you want to 19 Flexible Spending Accounts Health Information learn more about, (FSA) ERISA Disclosure Notice and you’ll be taken 22 Life and Accidental Death & 49 HIPAA Notice of Special to the correct page. Dismemberment Insurance Enrollment Rights 25 Critical Illness Insurance Women’s Health and Cancer 28 Accident Insurance Rights Act of 1998 (WHCRA) 29 Hospital Indemnity Insurance No Surprise Act Notice 31 Short-Term Disability & Premium Assistance Under Long-Term Disability Medicaid and The Children’s 32 Legal Insurance & Health Insurance Program (CHIP) Identity Theft Protection 50 Marketplace Notice 33 Pet Insurance Illinois Consumer Coverage 34 Retirement Savings and Disclosure Financial Wellness Notice of Privacy Practices Voluntary Bene昀椀t Notice My Well-Being 36 Paid Time Off (PTO) 37 Parental Leave & Adoption Assistance 38 Team Member Discounts and Earned Wage Access 39 OnPoint for Health

hello. UnityPoint Health is proud to offer you a comprehensive TOTAL REWARDS . PROGRAM Total Rewards is the value provided to our team members and their families throughout their career at UnityPoint Health by combining Compensation, Bene昀椀ts, Personal Growth and Development, Recognition, Well-Being, and Purpose into one, simple program. UnityPoint Health is committed to providing bene昀椀ts that support our team members from various backgrounds, experiences, and identities. We offer bene昀椀ts aimed to meet the needs of all of our team members and their families. How to Use this Guide We know there is a lot of information in this guide, and you may be feeling a little overwhelmed. We put together a few tips for how to get the most out of this guide as you prepare to select your bene昀椀ts. › Use the Table of Contents Click on the title of the bene昀椀t you want to learn more about for quick navigation around the guide. › Know Where to Get the Most Up to Date Information Please remember that these enrollment guides are sometimes updated throughout the year. For the most up to date information, head to unitypoint.org/totalrewards. › AskHR is Here to Help! If you have questions about anything in the enrollment guide, reach out to AskHR by creating a case in Lawson or by calling (888) 543-2275. | 1 |

Enrollment and Eligibility Eligible team members have 30 days from their start date to enroll in bene昀椀ts using the Lawson portal. Bene昀椀ts coverage begins the 昀椀rst day of the month following your start date. You can 昀椀nd a link to Lawson and instructions for how to enroll on the Total Rewards Site. Who is Eligible You are eligible to enroll in UnityPoint Health bene昀椀ts if you are in a bene昀椀ts- eligible status. You are eligible for bene昀椀t coverage if you are: FULL-TIME team member who is PART-TIME team member who is regularly scheduled to work regularly scheduled to work 64 hours or more per pay period. 32-63 hours or more per pay period. (0.8 - 1.0 FTE) (0.4 - 0.79 FTE) Dependents In most cases, you can also cover your eligible dependents. If adding a spouse/ domestic partner or dependent child, UnityPoint Health highly encourages adding their social security number (identi昀椀cation number) into their dependent pro昀椀le. Dependent You may be asked to verify your dependent’s eligibility by providing Veri昀椀cation documentation. If asked to do so, you must submit all documents within 30 days of request or risk having your dependents removed from the elected bene昀椀t. Eligible dependents include: › Spouse/par tner (spouse, civil union partner, domestic partner*, common law spouse) › Y our children under age 26. › Unmarried childr en of any age who are unable to support themselves because of a physical or mental disability.** Working Team members that choose to enroll a working spouse or domestic partner who Spouse is eligible for health insurance coverage through their employer will pay a $75 Surcharge working spouse surcharge. The $75 surcharge only applies to medical coverage and will be added to your per pay period medical premium. * When enrolling a domestic partner, you will be required to verify and acknowledge that they are eligible for the plans you have selected. After you complete your enrollment our HR Shared Services team will reach out within a few business days to advise on the next steps towards verifying your domestic partner. **Applies if not covered by other government programs and meets the eligibility requirements as de昀椀ned by each bene昀椀t plan. | 2 |

Domestic Partner Imputed Income STATUS CHANGES If you choose to add your domestic partner to Current team members who your medical and/or dental coverage, you will be are newly bene昀椀t eligible responsible for imputed income tax on the difference have 30 days from their in the employer premium for the additional coverage. status change date to enroll in bene昀椀ts. If moving from a Status and Bene昀椀t Changes full-time to part-time position You can change your coverage during the year if or vice versa you have 30 you have a qualifying life event. The changes you may days from status change date make depend on the type of qualifying event that occurs. to request a change to your If you experience a qualifying life event and wish to health insurance through make changes to your bene昀椀ts, you must declare a life AskHR. event through Lawson within 30 days from the date of the event (60 days for the birth of a child, adoption, or LIFE EVENT GUIDE adoption placement). Team members are allowed to make changes mid- For additional information year between plan options under health insurance or check out the Quali昀椀ed dental insurance. For example you may change from Life Event Guide the Network Plan to the Health Savings Plan (HSA) or vice versa. Note: Deductible and maximum out of pocket accumulators will not transfer between plan options, team members will be responsible for any Transferring Employment Within excess health saving account contributions and team UPH Af昀椀liates members are not able to change 昀氀exible spending account annual election amounts. If you transfer employment to another UnityPoint Health af昀椀liate, your bene昀椀ts will Qualifying Life Events continue unchanged if you continue to meet eligibility requirements. You cannot make › Marriage, divorce, or legal separation changes to your bene昀椀t elections if you › Birth or addition of an eligible child transfer employment as this is not a qualifying › event for making changes during the year. Loss of other coverage › New eligibility for other coverage › Dependent Eligibility Quali昀椀ed medical child support order › Eligibility for your dependent begins Status changes › or ends with: Commencement or return from an unpaid leave of absence › Change in residence or place of work resulting in change in health insurance availability › Death of spouse/domestic partner or child | 3 |

My Bene昀椀ts Health, dental, and vision insurance, life and disability insurance, and programs to help save for the future, such as 401(k) and Health Savings Account (HSA)

Health Insurance Key Health Care Terms We’ve compiled this list of health care terms to help you navigate this section of the enrollment guide: › year after the out-of-pocket maximum is Deductible: Dollar amount you must pay for covered care each calendar year before the reached - providing 昀椀nancial protection for medical plan pays bene昀椀ts for services. The you by limiting your out-of-pocket expenses in deductible doesn’t apply to every service so a given calendar year. The out-of-pocket limit be sure to check out the summary schedule is a combined amount for both medical and of bene昀椀ts. Under the Network plan, the family prescription coverage under each medical plan. must collectively satisfy the family deductible. Additionally, each family member has an Which Medical Plan is the Best individual deductible in addition to the overall Choice for Me? family deductible. Meaning if an individual in You will have the choice to waive medical the family reaches his or her deductible before coverage or select coverage from one of two the family deductible is reached, his or her HealthPartners medical plans. Both medical plans: services will be paid by the insurance company. › Under the Health Savings plan (HSA), the family Cover the same basic medical services deductible must be reached, either by an › C over the same network of doctors, hospitals and individual or by the family, before services will health care specialists who deliver quality care be paid by the insurance company. There is no according to network standards and have agreed individual deductible under the HSA plan. to lower, preferred rates for covered services. › Coinsurance: Percentage of the cost for However, depending on the plan selected, your eligible medical expenses that you pay after share of the cost of the medical services you you meet the deductible. For example, under receive differs. the Health Savings Plan, after you meet the NETWORK PLAN deductible, the plan will pay 80% of covered › Higher biweekly pr emium cost for coverage costs and you pay the remaining 20% up to the › C ost of care (deductible amounts and out-of plan’s out-of-pocket maximum limit. The 20% is your coinsurance. pocket limit) lower than › the Health Savings Plan Copayment (or copay): A 昀椀xed amount that HEALTH SAVINGS PLAN (HSA) you must pay for a service. Copays can vary depending on the service you receive. › P ay less in biweekly premium cost for › coverage Network Providers: Providers who have agreed › C ost of care (deductible amounts and out-of- to lower rates for services. The UnityPoint Health pocket limit) will be higher than the Network medical plans provide bene昀椀ts for covered Plan services provided by network providers. › › UnityP oint Health contributes to your Health Out-of-Pocket Maximum (OOPM): Maximum Savings Account to help offset out-of-pocket dollar amount that you pay for eligible expenses costs in a calendar year. The plan pays 100% of eligible expenses for the rest of the calendar | 5 |

Health Insurance, continued Preventive Care Bene昀椀ts Working in health care, we know how adopting a healthy lifestyle can help us stay well and live better. Therefore, it is important that you periodically receive physical exams and health screenings that help you identify health risks early to avoid developing more serious problems down the road. The following preventive services are covered at 100%, with no deductible, whether you enroll in the Health Savings Plan or the Network Plan as long as you see a network provider: › › › Routine health exams and Routine hearing exams Women’s preventive health periodic health assessments › services including all FDA Adult immunizations › approved contraceptive Well-child visits › Obesity screenings and methods as prescribed › Routine screening management by a physician procedures for cancer Walk-In & Virtual Care Our insurance plans cover walk-in and virtual care if you are unable to see your primary care provider or it is outside of clinics operating hours. Walk- In Care: Our Urgent Care, Express or Express Care locations treat minor medical problems and injuries that are not life-threatening. You can save time by reserving your spot online. Click here to search for a walk-in care clinic near you. Virtual Care in MyUnityPoint: See a provider through video with Virtual Urgent Care for minor medical problems that are not life-threatening. Please note: some conditions and certain age groups can’t be treated through virtual care. Team members must be in Iowa to use this service. For more information visit unitypoint.org/virtualcare. | 6 |

Health Insurance, continued Compare Health Insurance Plans Deductibles, Out-of-Pocket Maximums and Premiums HEALTH SAVINGS PLAN NETWORK PLAN (HSA) Annual Medical Deductible Individual Limit $2,000 $900 Family Limit $3,500 $1,800 Annual Out-of-Pocket Limit (includes medical deductible) Individual Limit $4,250 $3,125 Family Limit $7,000 $6,750 Health Savings Account (HSA)* Eligibility Eligible $750 for EE Only Coverage; UnityPoint Health $1,500 for EE+ C, EE+S/DP, Contribution** or Family Coverage Not Eligible Up to $3,400 for EE Only; Your Personal Contribution Up to $6,800 for EE+C, EE+S/DP, (Not required) or Family Additional catch-up contribution of $1,000 (if age 55 or older) Cost of Coverage / Per Pay Period Full-Time Part-Time Full-Time Part-Time Premium Premium Premium Premium Amounts*** Amounts*** Amounts*** Amounts*** (0.80 - 1.0 FTE) (0.4 - 0.79 FTE) (0.80 - 1.0 FTE) (0.4 - 0.79 FTE) Employee Only $47.05 $71.63 $79.82 $119.73 Employee + Child(ren) $92.55 $138.81 $154.71 $232.07 Employee + Spouse/DP $112.50 $168.75 $188.09 $282.13 Family $154.27 $231.41 $257.94 $386.91 * Funds can be carried over year-to-year if you don’t use them for medical or pharmacy expenses like meeting deductibles and out-of-pocket limits for the team member, spouse, or tax dependent. The spouse and tax dependent don’t have to be covered under a UnityPoint Health Medical Plan to be able to use HSA funds. Refer to the Health Savings Account section to learn more. ** UnityPoint Health advances the employer contribution to your account when you enroll in the Health Savings Plan which allows you to have access to those funds immediately. This amount is prorated based on your bene昀椀t eligibility date and number of months remaining in the year. *** Premium amounts shown above do not include the working spouse surcharge. For more information, please refer to the Enrollment and Eligibility section. | 7 |

Health Insurance, continued Compare Health Insurance Plans, continued The percentages in the following table are the percentages you pay. For example, if you see “20%” that means the plan pays 80% and the remaining 20% is your responsibility. If you see “100% covered” that means there is no member responsibility for that type of care or service. Anytime you see “after deductible is met,” that means the annual medical deductible for the plan must be met before the plan will pay. Please keep in mind that these do not re昀氀ect any services not covered by the plan or bene昀椀t reductions caused by not complying with preauthorization. HEALTH SAVINGS PLAN NETWORK PLAN (HSA) Network Facilities and Providers Network Facilities and Providers Wellness and Preventive Care 100% Covered 100% Covered Annual Medical Deductible Individual Limit $2,000 $900 Family Limit $3,500 $1,800 Annual Out-of-Pocket Limit (includes medical deductible) Individual Limit $4,250 $3,125 Family Limit $7,000 $6,750 Of昀椀ce Visits $10 or $50 copay Primary Care Provider (PCP) 20% after deductible is met (See zip code table to determine if higher copay applies) Specialist 20% after deductible is met $50 copay Chiropractic Care 20% after deductible is met $10 copay (Up to 5 visits per year) Infertility Services 20% after deductible is met, up 20% after deductible is met, up to a $15,000 lifetime maximum to a $15,000 lifetime maximum Urgent Care 20% after deductible is met $20 copay* Emergency Room Services 20% after deductible is met 1-3 visits: $150 copay, then 20% after deductible is met 4-5 visits: $400 copay, then 30% after deductible is met 6 or more visits: $600 copay, then 40% after deductible is met * Primary Care Provider (PCP) copay may apply at some locations if not able to bill as urgent care. | 8 |

Health Insurance, continued Compare Health Insurance Plans, continued HEALTH SAVINGS PLAN NETWORK PLAN (HSA) Ambulance 20% after deductible is met $0 copay Virtual Care Services Virtual Care Of昀椀ce Visits $10 or $50 copay 20% after deductible is met See zip code table to determine if higher copay applies Virtual Care Urgent Care 20% after deductible is met $10 copay Mental Health and Substance Abuse Outpatient Of昀椀ce Visits 20% after deductible is met $10 copay Inpatient 20% after deductible is met 20% after deductible is met Outpatient Therapy Services PT/OT 20% after deductible is met $10 copay Cardiac Rehab/Dialysis 20% after deductible is met 20% after deductible is met Outpatient Imaging and Lab Diagnostic Testing 20% after deductible is met 20% after deductible is met (CT/PET Scan/MRI) Diagnostic X-Rays 20% after deductible is met 20% after deductible is met Labs: Preventive 100% coverage 100% coverage Labs: Diagnostic 20% after deductible is met 100% coverage Hospice 20% after deductible is met 20% after deductible is met Durable Medical Equipment 20% after deductible is met 20% after deductible is met (DME) | 9 |

Health Insurance, continued Compare Health Insurance Plans, continued HEALTH SAVINGS PLAN NETWORK PLAN (HSA) Prescription Drug Coverage Tier 2 Retail Clinic Any Retail Pharmacy Tier 1 Pharmacies (Up to 30-day supply) (excluding CVS pharmacies) Pharmacies (excluding CVS pharmacies) Formulary Generic 20% after deductible is met $10 copay $20 copay Formulary Brand 20% after deductible is met $40 copay $50 copay Specialty Drugs Designated Network Specialty Designated Network Specialty Pharmacy only Pharmacy only Formulary Specialty 20% after deductible is met $60 copay Up to 90-Day Supply HealthPartners Mail Order HealthPartners UPH Af昀椀liate Pharmacy and UPH Af昀椀liate Mail Order Pharmacies Pharmacy Formulary Generic 20% after deductible is met $30 copay $25 copay Formulary Brand 20% after deductible is met $120 copay $100 copay | 10 |

Health Insurance, continued About Your Medical Plan’s Prescription Drug Coverage If you take any medications regularly, prescription drug costs can add up to a signi昀椀cant part of your overall health care expenses. Knowing how your medical plan’s prescription drug coverage works and what to do to manage costs can help you make smarter purchases and lower your out-of-pocket costs. Here are a few items that are important to note: › Under the Network Plan, lower Tier 1 copays for generic or brand drug 昀椀lls ($10 copay for formulary generic drugs and $40 copay for formulary brand drugs) will apply when having prescriptions 昀椀lled at a UnityPoint Health or Hy-Vee pharmacy. In addition, Tier 1 copays will apply to any retail pharmacy located outside a 15 mile radius of a UnityPoint Health or Hy-Vee pharmacy. › Please note, to further support our rural communities and those with limited access to a UnityPoint Health or Hy-Vee pharmacy, the lower Tier 1 copays explained above will apply to a few additional pharmacies. For a full list, please click here. › Under the Network Plan, higher Tier 2 copays for generic or brand drug 昀椀lls ($20 copay for formulary generic drugs and $50 copay for formulary brand drugs) will apply when having prescriptions 昀椀lled at any retail pharmacy located within a 15 mile radius of a UnityPoint Health or Hy-Vee pharmacy. › Both medical plans only provide coverage for formulary drugs. The formulary is compiled by a group of doctors and pharmacists. Medications are reviewed and approved for the formulary based on medical effectiveness and cost, which helps keep costs affordable for you. If you’d like to check to see if your prescriptions are on the formulary list, head to healthpartnersunitypointhealth.com/uph and click “Check Prescriptions.” › Coverage at CVS pharmacies (including Target locations) is not provided. › The Rx shopping tool is an online prescription cost- saving tool. It helps you 昀椀nd the lowest cost for medicines, based on your current health plan. Visit healthpartnersunitypointhealth.com/uph and log on to your myHealthPartners account. Once logged on, you’ll be able to use the Rx shopping tool. › A UnityPoint Health Medication Therapy Management (MTM) pharmacist can help you focus on your medicines to make sure they are a good 昀椀t for you and your health conditions. Your personal pharmacist will work with you and your care team to check that your medicines, doses, and schedules meet your needs. Your pharmacist will also make sure that your drugs work well together and aren’t causing side effects. Visits can often be provided by phone or video conference, making them easier to 昀椀t into your schedule. Working with a pharmacist on a regular basis might also save you money on your medicine copays. | 11 |

Health Insurance, continued Zip Code Table for PCP Of昀椀ce Visit Copay and QUICK SEARCH Provider Network If you enroll in the Network Plan and your home residence zip code is bolded in For a quick way to see if your the table below, your Primary Care Provider (PCP) of昀椀ce visit copay will increase to home residence zip code is listed in the table below, use $50 if you choose to see an in-network, non-UnityPoint Health PCP. If your PCP “ctrl+F” on your keyboard, Of昀椀ce Visit is to a UnityPoint Health PCP, your copay will remain $10. which will open a search bar. › Once that appears, enter your If your home residence zip code is NOT bolded in the table below, your home residence zip code and Primary Care Provider (PCP) of昀椀ce visit copay will be $10 as long as you press “enter”. see an in-network PCP. Your home residence zip code will also determine your provider network access. To locate in network providers visit healthpartnersunitypointhealth.com/uph, select “Find covered care” and pick the appropriate plan based on the zip code table below. Team members who reside within the zip code table and have dependents residing in a different zip code should contact AskHR to start the process of authorizing providers in that area. 50001 50002 50003 50005 50006 50007 50009 50010 50011 50012 50013 50014 50021 50023 50026 50027 50028 50029 50031 50032 50033 50034 50035 50036 50037 50038 50039 50040 50041 50043 50044 50046 50047 50048 50049 50050 50051 50054 50055 50056 50057 50058 50060 50061 50062 50063 50064 50066 50068 50069 50070 50071 50072 50073 50075 50078 50099 50101 50102 50104 50105 50106 50107 50109 50111 50112 50115 50116 50118 50119 50120 50122 50124 50125 50126 50127 50128 50129 50130 50131 50132 50134 50135 50136 50137 50138 50139 50141 50142 50143 50145 50146 50148 50149 50150 50151 50152 50153 50154 50156 50157 50158 50160 50161 50162 50163 50164 50166 50167 50168 50169 50170 50171 50173 50174 50201 50206 50207 50208 50210 50211 50212 50213 50214 50216 50217 50219 50220 50223 50225 50226 50227 50228 50229 50230 50231 50232 50233 50234 50235 50236 50237 50238 50239 50240 50241 50242 50243 50244 50246 50247 50248 50249 50250 50251 50252 50254 50256 50257 50258 50259 50261 50263 50264 50265 50266 50268 50269 50271 50275 50276 50277 50278 50301 50302 50303 50304 50305 50306 50307 50308 50309 50310 50311 50312 50313 50314 50315 50316 50317 50318 50319 50320 50321 50322 50323 50324 50325 50327 50328 50329 50330 50331 50332 50333 50334 50335 50336 50339 50340 50359 50360 50361 50362 50363 50364 50367 50368 50369 50380 50381 50391 50392 50393 50394 50395 50396 50398 50441 50501 50510 50516 50518 50519 50520 50521 50523 50524 50525 50526 50527 50529 50530 50532 50533 50535 50538 50540 50541 50542 50543 50544 50545 50546 50548 50551 50552 50554 50557 50558 50560 50561 50562 50563 50566 50567 50568 50569 50570 50571 50573 50574 50575 50576 50577 50579 50581 50582 50583 50585 50586 50588 50591 50592 50593 50594 50595 50599 50601 50602 50604 50607 50608 50609 50611 50612 50613 50614 50616 50619 50621 50622 50623 50624 50626 50627 50629 50630 50631 50632 50633 50634 50635 50636 50638 50641 50642 50643 50644 50647 50648 50649 50650 50651 50654 50655 50657 50658 50660 50661 50662 50664 50665 50666 50667 50668 50669 50670 50671 50672 50673 50674 50675 50676 50677 50680 50681 50682 50701 50702 50703 50704 50706 50707 50801 50830 50831 50845 50849 50858 50859 50861 50936 50940 50947 50950 50980 50981 50982 50983 51001 51002 51003 51004 51005 51006 51007 51008 51009 51010 51012 51014 51016 51018 51019 51020 51022 51024 51025 51026 51027 51028 51029 51030 51031 51033 51034 51035 51036 51037 51038 51039 51041 51044 51046 51047 51048 51049 51050 51051 51052 51053 51054 51055 51056 51058 51060 51061 51062 51063 51101 51102 51103 51104 51105 51106 51108 51109 51111 51234 51238 51239 51245 51250 51401 51431 51433 51436 51439 51440 51443 51444 51445 51448 51449 51450 51451 51452 51453 51455 51458 51459 51460 51461 51462 51463 51466 51483 51572 51609 52001 52002 52003 52004 52030 52031 52032 52033 52035 52036 52037 52038 52039 52040 52041 52042 52043 52044 52045 52046 52048 52049 52050 52052 52053 52054 52056 52057 52060 52064 52065 52066 52068 52069 52073 52074 52076 52078 52079 52142 52147 52164 52171 52202 52203 52204 52205 52206 52207 52208 52209 52210 52211 52212 52213 52214 52215 52216 52217 52218 52219 52220 52221 52222 52223 52224 52225 52227 52228 52229 52232 52233 52236 52237 52243 52244 52249 52251 52252 52253 52254 52255 52257 52301 52302 52305 52306 52307 52309 52310 52312 52313 52314 52315 52316 52317 52318 52320 52321 52322 52323 52324 52325 52326 52328 52329 52330 52332 52333 52334 52335 52336 52337 52338 52339 52340 52341 52342 52344 52345 52346 52347 52348 52349 52351 52352 52354 52355 52356 52358 52361 52362 52401 52402 52403 52404 52405 52406 52407 52408 52409 52410 52411 52497 52498 52499 52501 52530 52531 52536 52537 52553 52561 52569 52701 52720 52721 52722 52726 52727 52728 52729 52731 52733 52734 52736 52739 52742 52745 52746 52747 52748 52749 52750 52751 52752 52753 52754 52755 52756 52757 52758 52759 52760 52761 52765 52766 52768 52769 52772 52773 52774 52776 52777 52778 52801 52802 52803 52804 52805 52806 52807 52808 52809 53554 53803 53804 53806 53807 53808 53810 53811 53812 53813 53816 53818 53820 61025 61036 61075 61201 61232 61233 61234 61235 61236 61238 61239 61240 61241 61242 61244 61250 61254 61256 61257 61258 61259 61262 61263 61264 61265 61266 61272 61273 61274 61275 61276 61277 61278 61279 61281 61282 61283 61284 61314 61336 61344 61345 61361 61369 61375 61413 61414 61419 61421 61424 61427 61432 61434 61443 61449 61451 61465 61468 61479 61483 61486 61489 61491 61516 61517 61519 61520 61523 61524 61525 61526 61528 61529 61530 61531 61533 61534 61535 61536 61537 61539 61540 61541 61542 61543 61544 61545 61546 61547 61548 61550 61552 61553 61554 61555 61559 61560 61561 61564 61565 61568 61569 61570 61571 61572 61601 61602 61603 61604 61605 61606 61607 61610 61611 61612 61614 61615 61616 61625 61654 61725 61729 61732 61733 61734 61742 61747 61755 61759 61771 62682 Note: The Family Medicine clinic in Grinnell, IA is eligible for a $10 copay. | 12 |

Health Savings Account (HSA) What are the There are many bene昀椀ts of establishing an HSA. Some of the top bene昀椀ts include: bene昀椀ts of › C ontributions reduce taxable income, funds grow tax-free and distributions for establishing a quali昀椀ed expenses are not taxed. Health Savings › UnityP oint Health makes a contribution to your health savings account. Account › T he balance can roll over from year to year. Unlike a 昀氀exible spending account (FSA), the HSA is not a “use it or lose it” account. (HSA)? › Y ou can change or update contributions throughout the year. › HSA funds belong to you even if you leave UnityPoint Health, change medical plans, or retire. Receive › Y ou will need to open an account with Fidelity (instructions below.) This will and Make allow your payroll contributions and the UnityPoint Health contribution to be Contributions deposited at Fidelity. to Your HSA › I n order to make pre-tax contributions to your HSA, you will need to elect those contributions within the Fidelity website. This will be the only method of making and changing your contributions throughout the year. Opening an When you’re ready, opening and managing your HSA with Fidelity is fast and account with easy. You’ll get information on investment choices, payment options, and Fidelity ongoing support to help you build and manage your savings. For convenience, you can open a Fidelity HSA online. Here’s how it works: › › › Log into F rom the home If you do not have access NetBene昀椀ts® at page, click “Open” to NetBene昀椀ts, contact a NetBene昀椀ts.com next to Health Fidelity Representative at Savings Account. 1-800-544-3716. | 13 |

Health Savings Account (HSA), continued HSA Account Transfer Process To transfer an HSA account from another provider, team members must 昀椀rst set up their Fidelity HSA: Log in to NetBene昀椀ts.com. 1 Click the “Open” link next to “Health Savings Account.” 2 Follow the online instructions. Establishing a Fidelity HSA is not automatic. › Af ter the Fidelity HSA is open, team members may transfer savings from other HSA providers. › F idelity can coordinate the transfer for team members and does not charge a fee for this transaction. › T his transfer is not considered a taxable event and will not be reported to the IRS. › T he assets being transferred are not applied toward the team member’s HSA maximum annual contributions limit. To transfer other HSA assets team members can click here. 2024 Annual HSA Contribution Limits* Individual health care coverage $4,150** Family health care coverage $8,300** Additional catch-up contribution $1,000** (if age 55 or older) * Please remember to not exceed the annual IRS HSA contribution limit, which is the total of your personal contribution plus UnityPoint Health contribution. **T he maximum amount you may contribute to your HSA, assuming you enroll at the start of 2024. These amounts include UnityPoint Health contributions. If you enroll into an HSA after the 昀椀rst of the year, this amount will change based on the monthly prorated UnityPoint Health contribution. | 14 |

Dental Insurance Which Dental We offer dental coverage through Delta Dental with a choice of two plans: Plan is the best BASIC and PREMIER. Both dental plans provide coverage for preventive and choice for Me? basic care services. BASIC PLAN: PREMIER PLAN: › Lower premiums › C overs orthodontia if under 19 › Doesn’t cover or thodontia or › C overs major services major services The Enhanced Bene昀椀ts Program (EBP) is available under SAVE MONEY ON THE both plans. The EBP offers additional oral health services BASIC PLAN to Eligible Covered Persons with qualifying dental or medical conditions. Qualifying participants may be If you and your eligible eligible for additional cleanings and topical 昀氀uoride dependents don’t have application. orthodontia (under age 19) or major dental service needs, the Coverage and Costs Basic Plan offers you a way to save money while still getting Delta Dental contracts with dentists and other dental coverage for your diagnostic, care providers in all of the communities where UnityPoint preventive and routine Health af昀椀liates are located. restorative services. You can review the coverage levels and premium information for each dental plan on the next page to help you determine which plan is best for you. The percentages DELTA DENTAL PPO NETWORK in the table are the percentages you pay. When you see a dental provider who is in the Delta Dental PPO network, you will commonly pay less than when you see a dental provider who is in the Delta Dental Premier network or an out-of-network provider. | 15 |

Dental Insurance, continued BASIC PLAN PREMIER PLAN Delta Delta Premier/ Delta Delta Premier/ PPO*** Out of Network PPO*** Out of Network Deductible $25 $50 $15 $25 Individual Annual Maximum* $750 $750 $1,500 $1,500 Diagnostic & Preventive Exams, cleanings, space maintainers, Sealants, X-rays, Fluoride (Dependent 100% covered 100% covered Children Under 19) Routine Restorative Services Simple extractions, surgical services Emergency Treatment 10% after 20% after 10% after 20% after deductible deductible deductible deductible Routine Oral Surgery Posterior Composites 50% after deductible 50% after deductible Major Services Endodontics – root canal therapy Periodontics – conservative and 20% after deductible maintenance therapies Periodontics – complex procedures Not covered Crowns, inlays, onlays 50% after deductible Bridges and dentures Repairs and adjustments Orthodontics (Dependent Children Under 19) Appliances, treatment & related 50% after deductible services Not covered Lifetime Maximum** per $2,000 dependent child Dental Premium Cost – Per Pay Period Employee Only $5.89 $9.54 Employee + Child(ren) $13.20 $21.63 Employee + Spouse/DP $11.58 $19.05 Family $17.50 $28.85 *The Individual Annual Maximum is the maximum bene昀椀t each covered person is eligible to receive for certain covered services in 2024. **The Lifetime Maximum is the maximum bene昀椀t each covered person is eligible to receive for orthodontics in a lifetime. *** You will commonly pay less when seeing a Participating Delta Dental Dentist. For more information, please see the Dental SPD located on the HR Landing Page. | 16 |

Vision Insurance Under the vision plan, you may purchase your eyeglasses and contacts at the eye care provider of your choice. When you use an Avesis network provider, you receive the highest level of plan bene昀椀ts and have the lowest out-of-pocket costs. For routine eye exams, you can see any Optometry provider; in or out-of-network. However, for non- routine eye care, you’ll need to visit an in-network provider. Vision Examination IN-NETWORK OUT-OF-NETWORK Includes refraction Covered in full after $10 copay Up to $35 Retinal Imaging Up to $45 member out-of-pocket N/A (OOP) maximum Materials $10 copay (Materials copay applies to frame or spectacle lenses, if applicable.) Frame Allowance Members receive a $65 wholesale Up to 20% discount above allowance up to $175 retail value† Up to $55 frame allowance.* Standard Spectacle Lenses Single Vision Up to $25 Bifocal Up to $40 Covered in full after $10 copay Trifocal Up to $50 Lenticular Up to $80 Preferred Pricing Options Level 6 Option Package Polycarbonate (Single $40/$44 N/A Vision/Multi-Focal) (Covered in full up to age 19) (Up to $10 for ages up to 19) Standard Scratch-Resistant $17 Coating Ultraviolet Screening $15 Solid or Gradient Tint $17 N/A Standard Anti-Re昀氀ective $45 Coating † Value may be less depending on the providers retail pricing. * Discounts are not insured bene昀椀ts. ‡ Enhanced bene昀椀t for certain conditons. ¥ Save up to 25% on average LASIK prices when you use Qualsight (visit qualsight.com/-avesis for more information). | 17 |

Vision Insurance, continued Preferred Pricing Options, continued Level 1 Progressives Covered in full Up to $40 Level 2 Progressives Covered in full Up to $48 All Other Progressives $140 allowance + Up to $48 up to 20% discount Transitions® (Single Vision/ $70/$80 Multi-Focal) Polarized $75 n/a PGX/PBX $40 Other Lens Options Up to 20% discount* Contact Lenses (In lieu of frame and spectacle lenses) Elective $175 allowance Up to $160 Medically Necessary** Covered in full Up to $250 Refractive Laser Surgery Up to 25% provider Onetime/lifetime $150 allowance Onetime/lifetime $150 discount ¥ Provider discount up to 25%* Frequency Eye Examination Once every 12 months Lenses or contact lenses Once every 12 months Glasses Frames Once every 24 months Vision Premium Cost Employee Only Employee + Employee + Family Child(ren) Spouse/DP Full & Part Time Rates $3.29 $7.16 $6.32 $9.38 | 18 |

Flexible Spending Accounts (FSA) Flexible Spending Accounts (FSAs) give you the opportunity to lower your taxes by paying for eligible health care and dependent care expenses on a pretax basis. You choose whether to participate in one or both of the accounts during each year. The FSAs are funded entirely with your contributions, which are made with pretax dollars from your paycheck. Eligible Expense Reimbursement: 2024 FSA Plan Funds For your 2024 plan year, you will be able to submit an eligible expense with a date of service between January 1, 2024 and December 31, 2024 and be reimbursed with your 2024 plan year funds. All eligible claims must be submitted by March 31, 2025. As you choose to participate, there are a few things to keep in mind: UNDERSTAND THE “USE-IT- EACH ACCOUNT IS SEPARATE. NO AUTOMATIC RENEROLLMENT OR-LOSE-IT” RULE. Unspent You cannot transfer money IRS rules require you to actively re- money left in your FSA between the health care and enroll in the FSAs each year if you accounts is forfeited after the dependent care accounts. want to contribute pretax dollars. end of the year. SAVE YOUR RECEIPTS. CHOOSE YOUR ENROLL IN DIRECT DEPOSIT. You may be required CONTRIBUTION AMOUNT The fastest way to get your to submit them to WISELY. Once you choose your reimbursement is to enroll in HealthPartners to document FSA contribution amount, your direct deposit. Besides accessing your expenditures. election cannot be changed your reimbursement faster, during the year without a you’ll also avoid a fee of $5 per qualifying life event. reimbursement check issued. | 19 |

Flexible Spending Accounts (FSA), continued Health Care FSA › T his account is for eligible health care MANAGE YOUR FSA ON THE GO expenses for you and your dependents. › Download the free HealthPartners Eligible e xpenses include medical, dental, orthodontia, vision and hearing aid expenses myHP app from the iTunes Store not covered by another health bene昀椀t plan. or Google Play to: › › Check your account balances Y ou can contribute up to $3,200 to your on the go. Health Care FSA in 2024. › Snap and submit photos of your Limited Use FSA receipts and 昀椀le claims. › › And more! If you enroll in the Health Savings Plan, you cannot have a regular Health Care FSA, but you can have a Limited Use FSA. › With the Limited Use FSA, eligible expenses include dental, orthodontia and vision expenses — not medical or prescription drugs. › Y ou can contribute up to $3,200 to your Limited Use FSA in 2024. Dependent Care FSA › T his account can be used to pay dependent care expenses for children under 13 or adult dependents who can’t care for themselves. › Quali昀椀ed e xpenses include in-home child care, licensed day care, preschool facilities, before- or after-school programs, and elder care. › Y ou can contribute up to $5,000 to your Dependent Care FSA in 2024. Note: If your spouse also participates in a dependent care FSA, the tax-free bene昀椀t is limited to $5,000 for both of you combined. If you are married but 昀椀ling taxes separately, the tax-free bene昀椀t is limited to $2,500. | 20 |

Flexible Spending Accounts (FSA), continued Your FSA Debit Card FSA TIPS & RESOURCES When you enroll in the health care or limited Tips to help automatically approve your use FSA, you will receive a debit card from expenses: HealthPartners, which you can use to pay for › your eligible FSA expenses. P ay your bill in full as soon as possible. › Some card transactions will be veri昀椀ed at the P ay separately for each date of service. point of purchase and others will be veri昀椀ed Tips for submitting documentation: › later through an automatic process. However, Save your documenta tion electronically if HealthPartners cannot determine whether so it’s easy to attach to your a transaction was for an eligible health care reimbursement request. You can take a product or service, you will need to submit a picture with your smartphone or scan detailed receipt to verify your purchase. it. Submit your reimbursement request You may also submit claims and requested using the myHP mobile app or your documentation from the myHP mobile app. myHealthPartners account. You can also You can 昀椀nd more FSA resources at mail or fax a copy to HealthPartners at HealthPartners.com. If you have questions or (877) 624-2287. › need assistance with your FSA account, call K eep all receipts. › HealthPartners Member Services at (888) 735-9200. If you don’t have a HealthPartners medical plan, get a copy of your How long do you have to use your Explanation of Bene昀椀ts (EOB). › R ead all letters and emails from debit card for plan year expenses? HealthPartners. They let you know when You shouldn’t use your debit card for expenses documentation is needed. › once the plan year has ended. For example, Send in documenta tion right away. Your you shouldn’t use the card in 2025 for 2024 card could be suspended if you wait too expenses. If you still have 2024 expenses to long. If documentation is requested and submit in 2025, you’ll need to do it in the app, not received you may be taxed on the online, by mail, or fax. amount of the transaction. Additional FSA resources can be found at HealthPartners.com. If you have questions or need assistance with your FSA account, call HealthPartners Member Services at (888) 735-9200. | 21 |

Life and Accidental Death & Dismemberment Insurance Life insurance coverage helps protect your loved ones in the event of your death or serious injury. Even if you’re single, your bene昀椀ciary can use your life insurance bene昀椀ts to pay off your debts, such as credit cards, mortgages and other 昀椀nal expenses. Accidental Death & Dismemberment (AD&D) insurance pays a bene昀椀t if the covered person dies as a result of an accident. It will also pay all or part of the coverage amount if the covered person suffers a dismemberment injury or other covered loss due to an accident. You can purchase coverage for yourself, your spouse/domestic partner, and/or your dependent children. Basic Life and AD&D Insurance COVERED COVERAGE PERSON AMOUNTS PREMIUM UnityPoint Health offers group term life and AD&D insurance automatically at no Full-time and 1 times your base No cost to you cost to you. part-time bene昀椀t annual pay, up to eligible team $100,000 members Voluntary Life and AD&D COVERED COVERAGE Insurance PERSON AMOUNTS PREMIUM You may purchase additional life and Increments of Based AD&D insurance at favorable group rates. $10,000 up to the on team You pay for this coverage with after-tax lesser of: member’s age dollars. Premiums for this coverage are Employee › 8 times your as of January shown in Lawson during your enrollment annual base pay, 1, 2024 experience. or › $500,000 Based Spouse/domestic Increments of on team partner $10,000 up to member’s age $100,000 as of January REVIEW & UPDATE 1, 2024 Flat amount Flat rate no Review and update your Children (up to of $5,000 or matter how bene昀椀ciaries with Prudential at age 26) $10,000 per child many children prudential.com/mybene昀椀ts are covered | 22 |

Life and Accidental Death & Dismemberment Insurance, continued Amount Limit Due to Age Life AD&D Insurance EOI Process If you are age 70 and over, the life and AD&D › I f you are currently enrolled in voluntary life insurance bene昀椀t amount you are eligible for is and AD&D insurance and you elect an amount reduced. Team members aged 70-74 will have life greater than $10,000 after your initial enrollment and AD&D insurance value at 65% of the bene昀椀t, period, you will be required to submit EOI. If this and those aged 75 and over will have a life and is the case, you will receive an email with a link AD&D insurance value of 50% of the bene昀椀t. to an online questionnaire about you and/or your spouse/domestic partner’s health. You must What You Need to Know About complete the questionnaire in order for your Evidence of Insurability (EOI) requested coverage increase to be considered. › Based on the answers in your questionnair e, you When it comes to voluntary life and AD&D may also need to get a basic physical exam. insurance, you may be required to provide Evidence of Insurability, or EOI, to the insurance carrier as part of the application process. DON’T BE DENIED › If you are newly bene昀椀t eligible and enrolling in life and AD&D insurance for the 昀椀rst time: Evidence of Insurability is important! Your – you may purchase voluntary employee life coverage may be delayed or denied if you and AD&D coverage in increments of $10,000 don’t submit EOI. up to the lesser of 8 times your annual base pay or $500,000, without providing EOI. – you may purchase voluntary spouse/ domestic partner life and AD&D coverage in increments of $10,000 up to $100,000, without providing EOI. › Each ye ar after your initial enrollment period, you may increase your coverage for yourself and/or spouse/domestic partner by $10,000 (not to exceed the maximum) without providing EOI as long as you are currently enrolled in voluntary life and AD&D insurance. | 23 |

Life and Accidental Death & Dismemberment Insurance, continued Bi-Weekly Voluntary Life and AD&D Insurance Premiums (per $1,000 of coverage) AGE EMPLOYEE AND SPOUSE/ DOMESTIC PARTNER* Under 25 $0.027 25-29 $0.031 30-34 $0.040 35-39 $0.044 40-44 $0.051 45-49 $0.074 50-54 $0.111 55-59 $0.203 60-64 $0.309 65-69 $0.563 70-74 $0.910 75+ $0.955 Children $0.026 Flat Rate *Premium based on team member’s age as of January 1, 2024 Calculating Your Voluntary Life and AD&D Cost Follow these steps to calculate your bi-weekly voluntary Life and AD&D insurance premium: Enter the amount of Voluntary Life and AD&D Insurance you want: $ ________(1) Employee: Increments of $10,000, up to the lesser of 8x your base annual pay or $500,000 Spouse/Domestic Partner: Increments of $10,000 up to $100,000 Divide the amount in Line 1 by 1,000 and enter: $ ________(2) Use the chart above to 昀椀nd the bi-weekly cost for employee’s age and enter: $ ________(3) Multiply the amount in Line 2 by the amount in Line 3 and enter: This is your bi-weekly cost for Voluntary Life and AD&D Insurance $ ________(4) Note: Your cost can change if your coverage amount changes, your age changes, or if the insurance rates change. | 24 |

Critical Illness Insurance Critical Illness Insurance through Voya pays a lump sum bene昀椀t if you are diagnosed with a covered illness or condition. You can use the bene昀椀t payment for any purpose you choose. You can purchase coverage for yourself, your spouse/domestic partner, and your children under age 26. If you leave UnityPoint Health, you can take this coverage with you. The following coverage amounts are available: COVERED PERSON COVERAGE AMOUNTS Employee $10,000 | $20,000 | $30,000 Spouse/domestic partner $10,000 Watch the Children $5,000 per child critical illness insurance You must elect critical illness insurance for yourself in order to video elect coverage for your spouse/domestic partner or child(ren). If a covered person is diagnosed with a covered condition, WELLNESS BENEFIT the plan will pay this amount: The plan also pays a wellness 100% OF COVERAGE bene昀椀t of $50 once per › › calendar year for each family Heart attack Type 1 Diabetes member enrolled when an › › Stroke Major organ failure eligible health screening › › test is completed. For more Coma Permanent paralysis › › information, review the Cancer End stage renal failure Wellness Bene昀椀t Claims Checklist & FAQ. 25% OF COVERAGE › › Coronary artery bypass Open heart surgery for › valve replacement or Carcinoma in situ repair 10% OF COVERAGE › › Skin cancer Transcatheter heart valve replacement or repair | 25 |

Critical Illness Insurance, continued Infectious Condition Additional Bene昀椀t Rider If you are diagnosed with COVID-19*, this pays a bene昀椀t** of $100. If you are hospitalized for COVID-19* and there is a room and board charge for that hospitalization, this pays a bene昀椀t** amount of $1,000. Speci昀椀ed Conditions Diagnosis Bene昀椀t This bene昀椀t will pay you a Speci昀椀ed Condition Diagnosis bene昀椀t if you are diagnosed with autism spectrum disorder Level 3 on or after the coverage effective date. Speci昀椀ed Condition Facility Con昀椀nement Bene昀椀t If you are diagnosed with bipolar disorder or depressive disorder that results in a con昀椀nement to a hospital, rehabilitation facility or transitional care facility, this bene昀椀t will pay you a Speci昀椀ed Condition Facility Con昀椀nement Bene昀椀t. Although there is not a pre-existing condition limitation on the Critical Illness plan, the plan will only cover illnesses/diseases that are diagnosed after the effective date of coverage. At the time of claim, each claimant will be asked to provide supporting medical documentation along with the Attending Physician’s Statement of Critical Illness/ Speci昀椀ed Disease form. *COVID-19 diagnosis must be con昀椀rmed by a medical professional. **A bene昀椀t is payable up to a maximum of 1 time per Covered Person per policy calendar year | 26 |

Critical Illness Insurance: Bi-Weekly Premiums PREMIUMS - EMPLOYEE (BI-WEEKLY) $10,000 $20,000 $30,000 Age 29 and under $2.22 $4.43 $6.65 Age 30-34 $2.77 $5.54 $8.31 Age 35-39 $2.77 $5.54 $8.31 Age 40-44 $5.22 $10.43 $15.65 Age 45-49 $5.22 $10.43 $15.65 Age 50-54 $10.15 $20.31 $30.46 Age 55-59 $10.15 $20.31 $30.46 Age 60-64 $14.68 $29.35 $44.03 Age 65-70 $18.88 $37.75 $56.63 Age 70+ $25.48 $50.95 $76.43 PREMIUMS - PREMIUMS - SPOUSE/DOMESTIC PARTNER (BI-WEEKLY) CHILD (BI-WEEKLY $10,000 $5,000 Age 29 and under $2.68 Per Family Unit $1.41 Age 30-34 $3.18 Age 35-39 $3.18 Age 40-44 $6.00 Age 45-49 $6.00 Age 50-54 $12.55 Age 55-59 $12.55 Age 60-64 $19.15 Age 65-70 $21.92 Age 70+ $33.05 | 27 |

Accident Insurance Accident Insurance through Voya pays you bene昀椀ts for speci昀椀c injuries and events resulting from a covered accident. You can purchase coverage for yourself, spouse/domestic partner, and your children under age 26. If you leave UnityPoint Health, you can take this coverage with you. The amount paid depends on the type of injury and care received. For those who experience an accident claim and visit a UnityPoint Health facility, you will receive an additional 25% bene昀椀t up to $1,000. You can use the payments for any purpose you choose. Here are some examples of payment provided: EVENT/CONDITION BENEFIT AMOUNT EVENT/CONDITION BENEFIT AMOUNT Ground ambulance $400 Coma (14 or more days) $18,500 Air ambulance $2,000 Surgery (open abdominal, $1,500 thoracic) Emergency room treatment $250 Follow-up doctor visit $100 Hospital admission $1,500 Medical equipment $275 Hospital con昀椀nement (per $375 Physical or occupational $60 day, up to 365 days) therapy (per treatment, up to 6) Critical care unit con昀椀nement $600 Mental health therapy $60 (per day, up to 15 days) (up to 10 per accident) Accident Insurance also pays bene昀椀ts for accident- related transportation, lodging, family care, prosthetic devices, burns, eye injuries, lacerations, dislocations, fractures and more. ACCIDENT INSURANCE: Watch the BI-WEEKLY PREMIUMS accident Employee Only $4.69 insurance video Employee + Spouse/ $7.70 Domestic Partner Employee + Child(ren) $8.91 Family $11.92 WELLNESS BENEFIT Your coverage also includes accidental death The plan also pays a wellness bene昀椀t and dismemberment bene昀椀ts. If you are severely of $50 once per calendar year for injured or pass away due to an accident additional each family member enrolled when bene昀椀ts may apply. an eligible health screening test is completed. For more information, review the Wellness Bene昀椀t Claims Checklist & FAQ. | 28 |

Hospital Indemnity Insurance What is Hospital Indemnity Insurance? Hospital Indemnity Insurance through Voya pays a daily bene昀椀t if you have a covered stay in a hospital, critical care unit or rehabilitation facility. The bene昀椀t amount is determined by the type of facility and the number of days you stay. Hospital Indemnity Insurance is not health insurance and does not satisfy the requirement of minimum essential coverage under the Affordable Care Act. How can Hospital Indemnity Insurance help? Below are a few examples of how your Hospital Indemnity Insurance bene昀椀t could be used (coverage amounts may vary): MEDICAL EXPENSES, TRAVEL, FOOD AND EVERYDAY EXPENSES CHILD SUCH AS DEDUCTIBLES LODGING EXPENSES FOR LIKE UTILITIES AND CARE AND COPAYS FAMILY MEMBERS GROCERIES Who is eligible for Hospital Indemnity Insurance? › All UnityP oint Health bene昀椀t eligible team members, their spouses/domestic partners and children. Watch the › Y our children are eligible for coverage up to age 26. hospital › indemnity If you elect coverage for your family members, your insurance video spouse/domestic partner and children will have the same Hospital Indemnity bene昀椀ts as you do. | 29 |

Hospital Indemnity Insurance, continued How much does Hospital Indemnity Insurance cover? STANDARD BENEFIT BENEFIT AT UPH FACILITY Hospital Admission $1,000 $1,250 Critical Care Unit Admission $2,000 $2,500 Hospital Con昀椀nement $100/day, up to 30 days $125/day, up to 30 days Hospital Intensive Care $200/day, up to 15 days $250/day, up to 15 days Rehabilitation Facility Bene昀椀t $50/day, up to 30 days $62.50/day, up to 30 days Pregnancy Covered? Yes Yes Pre-Existing Condition Exclusion? No Portable and Transferable? Yes Bi-Weekly Premium Rates Employee $9.39 Employee + Spouse/DP $18.20 Employee + Child(ren) $13.79 Family $22.60 | 30 |

Short-Term Disability & Long-Term Disability Short-Term Disability (STD) NO COST TO YOU The Short-Term Disability (STD) Plan provides income UnityPoint Health protection if you become disabled and cannot work due to a automatically provides Short- non-work-related illness or accidental injury. Term and Long-Term Disability UnityPoint Health automatically provides Short-Term Disability coverage- at no cost to you- coverage – at no cost to you – for all eligible team members. for all eligible team members. Participation begins on the 昀椀rst of the month following your start date or bene昀椀t status change date. The Short-Term Disability Plan begins to pay bene昀椀ts after 7 days of continuous disability. Short-Term Disability bene昀椀ts replace 60% of your regular weekly base pay, to a maximum of $2,500 per week, for up to 26 weeks. Long-Term Disability ABSENCEONE If you become disabled for an extended period of time and All approved Leaves of cannot work, no bene昀椀t becomes more important to your Absence (LOA), including 昀椀nancial security than disability income protection. intermittent FMLA and BASIC LONG-TERM DISABILITY continuous LOA, including If you remain totally disabled and unable to work for more Short-Term Disability (STD), than 180 days, you may be eligible for Long-Term Disability medical, personal, and military (LTD) bene昀椀ts through Prudential. UnityPoint Health leave, are administered automatically provides you LTD bene昀椀ts that replace up to through AbsenceOne. Access 50% of your monthly base pay, up to a maximum of $10,000 the AbsenceOne online per month. portal at AbsenceOne.com/ Monthly LTD bene昀椀ts will be reduced by Social Security and unitypointhealth. any other disability income you are eligible to receive, such as Workers’ Compensation. BUY-UP LONG-TERM DISABILITY You can purchase additional LTD coverage through Prudential that will increase your monthly bene昀椀t to 60% of your monthly pay. The cost of this additional coverage is available in Lawson during your enrollment. | 31 |

Legal Insurance & Identity Theft Protection Whether you need assistance writing your will, disputing Diversity, Equity & a traf昀椀c ticket, or protecting yourself against identity theft, Inclusion Coverage Legal Insurance and Identity Theft protection from ARAG is here to help. ARAG is constantly evolving and adapting to meet the needs of all For only $9.46 per pay period, you and your covered team members. dependents will have access to a nationwide network of attorneys who will work with you to address and resolve life’s Whether it’s a team member with legal, 昀椀nancial, and identity theft issues, such as: a disability, a veteran or a member › › of the LGBTQ+ community, their Consumer and fraud protection Government bene昀椀ts coverage provides solutions that › › Wills and estate planning Small claims court include: › › › Real estate Tax issues Domestic Partnership Agreement › › › Family law Traf昀椀c matters HIPAA/Hospital Visitation › › Authorization Civil damage claims (defense) Debt-related matters › › › Funeral Directive Criminal matters Landlord disputes › In the event that your identity is stolen, the ARAG Identity Gender Identi昀椀er Change › Theft Protection program provides full-service restoration Social Security/Veterans/ including access to Certi昀椀ed Identity Theft Restoration Medicare Dispute › Specialists and reimbursement for up to $1 million for School Administration Hearing expenses associated with restoring your identity. and, network attorney fees for most To see a full list of coverages available under this plan, visit covered matters like these are paid ARAGLegalCenter.com (access code 18191uph) and click 100% in full. on Plan Details. For any legal matters not covered and not excluded under the plan (including immigration assistance), TRACK YOUR ACTIVITY you are eligible to receive at least 25% off the Network This service can track your Attorney’s normal rate. credit activity or online identity and you are noti昀椀ed immediately of suspicious activity. | 32 |

Pet Insurance Now more than ever, pets are playing a signi昀椀cant role in our lives, and it’s important to keep them safe and healthy. Help make sure your furry family members are protected against unplanned vet expenses for covered accidents or illnesses with MetLife Pet Insurance*. Like health insurance for you and your family, pet Watch the pet insurance is coverage for dogs and cats that can help you insurance video be prepared for unexpected vet costs. With MetLife Pet Insurance, you may be able to cover up to 100% of the veterinary care expenses from any licensed veterinarian, specialist, or emergency clinic across the U.S. What are the coverage options? WHAT’S COVERAGE COVERED? ALSO INCLUDES Coverage is 昀氀exible and customizable so that you can Exam fees Hip dysplasia choose the plan that works for you. Accidental Hereditary Options include: injuries conditions › X-rays and Congenital L evels of coverage from $500 – unlimited › diagnostic tests conditions $0 - $2,500 deductible options Chronic › Surgeries Reimbursement percentages from 50% - 100% conditions Medications Alternative How much does Pet Insurance cost? therapies Each pet’s premium will be unique based on the age, Ultrasounds Holistic care breed, location, as well as what coverage amount you Illnesses And much more! select. Plus, if you go claim-free in a policy year, MetLife Hospital stays will automatically decrease your deductible by at least $25. GET A QUOTE OR ENROLL How do you pay for the insurance? To get a quote or enroll, visit You can set up an automatic payment from your bank or metlife.com/getpetquote or credit card with MetLife. call (800) GET-MET8. * Marshalltown RNs are not eligible for this bene昀椀t. | 33 |

Retirement Savings and Financial Wellness We are proud to invest in your 昀椀nancial health and future by continuing to provide a core contribution to you that is equal to 2% of your pay and also matching 50% for each dollar you contribute to your 401(k), up to the 昀椀rst 6%. To maximize your employer match, you would want to contribute 6% of your paycheck so you can receive the full 3% match from UnityPoint Health. While there isn’t any action required on your behalf for your enrollment, we do encourage you to log into the Fidelity portal (netbene昀椀ts.com). From there you can do things like: SPEAK WITH A FIDELITY REPRESENTATIVE CHANGE YOUR UPDATE YOUR INVESTMENTS BENEFICIARIES To speak with a Fidelity representative who can answer your questions or DETERMINE HOW CHANGE YOUR to schedule a one-on-one MUCH YOU SHOULD CONTRIBUTIONS consultation, you can call BE SAVING (800) 343-0860. GET HELP WITH YOUR GET A SNAPSHOT OF FINANCES BY TALKING YOUR RETIREMENT BY ELIGIBILITY TO A RETIREMENT ANSWERING A FEW You are eligible to PLANNER QUESTIONS participate in the retirement savings plan Check out the Financial Wellness Portal for an interactive once you have reached experience that brings together resources and tools you need age 19. to plan your 昀椀nancial wellness strategy. | 34 |

My Well-Being Programs, activities and resources designed to enhance physical, 昀椀nancial and emotional well-being | 35 |

Paid Time Off (PTO) The chart below will help provide you with details on our system-wide PTO plan. The purpose of PTO is to give team members 昀氀exibility in scheduling time away from work. PTO combines vacation, individual or family related sick days, holidays, and personal days you might need during the year. The PTO plan includes time off required under all state and local paid leave laws to include sick and safe leave. UnityPoint Recognized Holidays: New Year’s Day, Memorial Day, Fourth of July, Labor Day, Thanksgiving Day, Christmas Day. UnityPoint Health PTO Accrual Chart YEARS OF SERVICE PTO ACCRUED MAXIMUM ANNUAL ACCRUAL* MAXIMUM COMPLETED PER HOUR* (BASED ON 2080 HOURS ANNUALLY) CARRYOVER 0-4 0.0923 192 hours / 24 days 320 5-9 0.1115 232 hours / 29 days 320 10-14 0.1231 256 hours / 32 days 320 15-19 0.1346 280 hours / 35 days 320 20+ 0.1385 288 hours / 36 days 320 * To calculate your PTO accrual per pay period, multiply the “PTO Accrued per Hour” number above by the number of hours you are paid per pay period (not to exceed 80 hours per pay period or 2080 hours annually). For example, if you are a team member who has 16 years of service and are a .75 FTE or work 60 hours per pay period, your calculation to project your PTO accrual in the future would be as follows: .1346 x 60 = 8.07 accrued hours in a pay period. PTO Cash Bene昀椀t eligible team members are eligible to cash out up to 40 hours of PTO, in 5-hour increments, annually. Please review the information below for further details and contact AskHR if you have questions. › › Component Eligibility* PTO Cash Guidelines Active, bene昀椀t eligible team members who › are budgeted to work 32 hours or more per Maximum Hours to Declare pay period (0.4 FTE or more). Executives and 40 hours Physicians are not eligible for PTO Cash. › Election Period** › Required Remaining Balance*** During Open Enrollment There is no requirement to have any › remaining balance in your PTO account after Payout Dates the cash out occurs. Announced during the annual open enrollment period * In order to receive a PTO Cash election, you must be an active, bene昀椀t eligible team member at the time of the payout. Executives and Physicians are not eligible for PTO Cash. ** PTO cash elections can only be made within the election period. You will not be able to make changes, including cancellation, to your PTO cash election(s) outside of the election period. *** While there is no required remaining balance, if you elect to cash out more hours than you have in your bank at the time of the payout dates, you will not receive the full elected cash-out amount. Instead, your payout will be reduced to the number hours in your bank at the time of the payout. | 36 |

Parental Leave & Adoption Assistance Parental Leave We know it is important for you to take time to care for your newborn or adopted child. Any full-time bene昀椀t eligible team member (0.8 FTE or more) who has at least six months of employment with UnityPoint Health will have the ability to: › › R eceive 40 hours of additional Utilize a position- Paid Time Off (PTO) guaranteed leave ABOUT YOUR BENEFIT ABSENCEONE When you request a parental leave following the birth or adoption of a child, UnityPoint Health will provide 40 hours To speak with of additional Paid Time Off (PTO). The additional days will an AbsenceOne be added to your PTO bank and can be used through your representative who can regular time off request. answer your questions UnityPoint Health will also extend a position-guaranteed leave or to request a Parental for two additional weeks. This extension will take place upon Leave, please contact the exhaustion of Family Medical Leave Act (FMLA), Wisconsin AbsenceOne by Family and Medical Leave Law (WFMLL), Iowa Pregnancy Leave visiting absenceone. Law (IPLL), and/or Short- Term Disability. These additional two com/unitypointhealth weeks must be taken consecutively. or calling (877) 467- 2671. Adoption Assistance UnityPoint Health will grant up to $6,000 in reimbursement, per child, for expenses related to the process of the legal adoption of a child to full-time and part-time bene昀椀t eligible team members who have completed at least 90 days of employment. For reimbursement, bene昀椀t eligible team members must complete the Application for Assistance and provide a copy of 昀椀nalized adoption paperwork along with copies of appropriate bills, invoices, receipts, or other statements that verify the amount of adoption assistance being requested. This is done by submitting a case in Lawson to AskHR. If both parents work for UnityPoint Health, the total amount of reimbursement per legal adoption of a child is up to $6,000 per child. | 37 |

Team Member Discounts Team Member Discounts UnityPoint Health partners with PerkSpot to provide a one-stop shop for thousands of exclusive discounts in more than 25 categories including: › › Restaurants Insurance › › Clothing and Jewelry Of昀椀ce Supplies › › Gym Memberships Movie and Enter tainment Tickets › › V ehicles and Car Services Sports › › Electr onics and Cell Phones Hotels › › Home Services Flights PerkSpot is a free bene昀椀t to all UnityPoint Health team members. Visit https://unitypoint.perkspot.com to get started. DID YOU KNOW? If you would like to suggest a merchant for PerkSpot to work with, you can log in and click the “Suggest a Merchant” link in the upper right corner of the screen. Once you submit the suggestion, PerkSpot will contact the merchant. Merchants can also contact PerkSpot directly by calling 866-606-6057 if they would like to offer a discount to you and others. Earned Wage Access UnityPoint Health partners with Wisely by ADP to offer 昀氀exible pay options for our team members. You can request your earned wages through either the myWisely app (if you currently receive your paychecks through Wisely) or the DailyPay app. The available balance is based on your regular compensation and hours (minus any withholdings) worked to date during a pay period. Learn more here. | 38 |

OnPoint for Health: Wellness Credit and Wellness Rewards 2025 Wellness Credit DID YOU KNOW? Team members and their spouses or domestic partners who are Both UnityPoint enrolled in the health plan will have two opportunities to earn Health medical plans rewards – A wellness credit and a wellness reward. completely cover the Please note: New hires as of October 1, 2024 and on will be cost of your annual grandfathered into the 2025 Wellness Credit. physical with your PCP. 1 Complete an annual physical with your primary care provider (PCP) between December 1, 2023 - November 30, 2024. 2 Log into the OnPoint for Health portal between October 1, 2024 - December 20, 2024 to complete the online Health Risk Assessment (HRA). 2024 Wellness Rewards HEALTH RISK Bene昀椀t-eligible team members (even if they are not enrolled in a ASSESSMENT (HRA UnityPoint Health medical plan) and their spouse/domestic partner Review the Notice (who must be enrolled in a UnityPoint Health medical plan) can Regarding Wellness earn points by completing challenges that will be available after Program for January 1, 2024 in order to earn 昀椀nancial rewards. information on what will be collected, how ACHIEVE 1,500 POINTS ACHIEVE 3,000 points it will be used, who earn a $100 REWARD paid earn a $150 REWARD paid will receive it and what out on your paycheck out on your paycheck will be done to keep it con昀椀dential. Please note: All wellness rewards are subject to tax and you must be in an active, bene昀椀t-eligible status at the time the reward is paid out in order to receive it. * Eligibility for these rewards will be reviewed on a monthly basis between February and December 2024. The 昀椀nancial reward will be paid out by the 2nd paycheck of the following month in which the point total is achieved. | 39 |

My Growth & Development Learning, career opportunities and other experiences that support professional and personal growth

Education Assistance Bene昀椀ts UnityPoint Health offers tuition assistance to eligible Team Members who seek to pursue education that supports the current business needs and future objectives of the organization. All education programs must be related to Team Member’s current job or an established career path within UnityPoint Health. Visit the HR Landing page for more information. Tuition Reimbursement Reimbursement Amounts FULL-TIME and PART-TIME BENEFIT ELIGIBLE TEAM CLASSIFICATION MAXIMUM AMOUNTS MEMBERS who have been actively employed with UnityPoint Health for at least six months are eligible Full Time (64-80) $5,250/year for Tuition Reimbursement. Team members must be in good standing and have not had a formal Part Time (32-63) $2,625/year performance corrective action plan within the previous 12 months. Terms of Tuition Reimbursement › All courses related to a degree or certi昀椀cate program must be completed with a minimum grade equivalent of C or better and award college credit. Courses that are based on a pass/fail grading system must be completed with a passing grade. Courses in which a Team Member receives an incomplete, withdrawal, or equivalent grade are ineligible. › Eligible expenses include tuition, required textbooks, and mandatory course-related fees such as registration or admissions fees, lab fees, technology fees, library cards, and graduation fees. › Ineligible expenses include, but are not limited to, meals, lodging, transportation and tools or supplies (other than textbooks) that can be kept after completing the course of instruction › Educational programs not covered include, but are not limited to, individual courses for sports, recreation or hobbies, unless part of a degree program and seminars, conferences and workshops. › Although attainment of educational goals often leads to improved performance and new career opportunities, participation in this program does not guarantee a speci昀椀c career result such as a promotion or salary increase. › In compliance with IRS regulations (section 127), employer provided educational assistance is exempt from taxation up to a maximum of $5,250 per calendar year. Taxes will be assessed if, at the time of payment processing, the total amount of tuition assistance paid in the calendar year exceeds $5,250. Please consult with your tax advisor for additional information. | 41 |

Education Assistance, continued Work Commitment A Team Member who voluntarily terminates employment or is terminated for cause within 12 months of receiving education assistance through Traditional Reimbursement will be required to refund UnityPoint Health 100% of the payments received within that time period on a pro-rated basis from the time of last payment and date of termination. Public Service Loan Forgiveness (PSLF) Support PSLF is a federal program created for those in public service jobs, offering the opportunity to have your federal loan balances forgiven after 10 years and 120 qualifying payments. All tax free! Team Members can receive PSLF support through Fidelity’s Summer program aimed at streamlining and automating the process while reducing stress with resources that may help increase 昀椀nancial well- being and con昀椀dence. KEY FEATURES OF THE PROGRAM INCLUDE: › Complete PSLF coverage – Summer manages the entire PSLF process for borrowers from checking eligibility to employer coordination and online form submission. › Recerti昀椀cation support – Summer works with borrowers and their employers to ensure all PSLF requirements are met. › Protection from server mistakes – Summer has deep experience navigating rejections from loan servicer mistakes. For help from an expert to determine your eligibility or support 昀椀lling in your forms, visit 昀椀delity.com/forgiveness. Employment certi昀椀cation forms ready for completion should be sent to [email protected]. Student Loan Origination & Re昀椀nancing Fidelity’s Credible program is one way to 昀椀nd options to pay for college. Credible is an online marketplace that provides borrowers looking for private student loads with competitive, personalized, prequali昀椀ed rates from up to 8 vetted lenders. There is no cost to request offers, and checking rates will not impact your credit score. Key features of the program include: › Personalized rates, not ranges from multiple lenders › Ability to comparison shop across lenders to 昀椀nd the best solution for your situation › No hidden fees, original fees, or prepayment penalties › Simple online process that keeps your data con昀椀dential. To access Credible log into the Fidelity portal at netbene昀椀ts.com. | 42 |

This booklet highlights the main features of the bene昀椀t plans sponsored by UnityPoint Health. Full details of these bene昀椀ts are contained in the legal documents governing the plans. If there is any discrepancy or con昀氀ict between the plan documents and the information presented here, the plan documents will govern. In all cases, the plan documents are the exclusive source for determining rights and bene昀椀ts under the plans. UnityPoint Health reserves the right to change or discontinue the plans at any time with appropriate noti昀椀cation. Participation in the plans does not constitute an employment contract. UnityPoint Health reserves the right to modify, amend, or terminate any bene昀椀t plan or practice described in this booklet. Nothing in this booklet guarantees that any new plan provisions will continue in effect for any period. Plan documents are available at the HR landing page on the Hub or by contacting AskHR at (888) 543-2275. | 43 |

Appendix

Cost Breakdown You and UnityPoint Health (UPH) share the cost of your bene昀椀ts. You pay your share of most bene昀椀t costs before federal, state and Social Security taxes are calculated. UNITYPOINT HEALTH PAYS FOR YOU PAY FOR YOU AND UNITYPOINT › Health Savings Account › HEALTH SHARE THE Health Savings Account (Employer Contribution) (Employee Contributions) COST OF › › Basic Life and AD&D Insurance › Health Insurance* Vision Insurance › › Short-Term Disability › Dental Insurance Voluntary Life and AD&D Insurance › Long-Term Disability › Legal Insurance & Identity Theft › Protection Employee Assistance Program (EAP) › › Flexible Spending Paid Leave (Bereavement, Jury Duty, Parental Leave, etc.) Accounts (FSA) › › Critical Illness Insurance OnPoint for Health Wellness Program LISTED BELOW › › Hospital Indemnity Insurance Education Assistance All premiums › › Accident Insurance Paid Time Off (PTO) listed below are › › Pet Insurance 401(k) Employer Match deducted over › 401(k) Employee Contributions 26 pay periods Health Insurance EMPLOYEE ONLY EMPLOYEE + EMPLOYEE + FAMILY CHILD(REN) SPOUSE/DP Network Plan Full-Time Rates $79.82 $154.71 $188.09 $257.94 Part-Time Rates $119.73 $232.07 $282.13 $386.91 Health Savings Plan Full-Time Rates $47.05 $92.55 $112.50 $154.27 Part-Time Rates $71.63 $138.81 $168.75 $231.41 Premium amounts shown above do not include the working spouse surcharge. For more information, please refer to the Enrollment and Eligibility section. Dental Insurance Basic Plan – Full & Part Time Rates $5.89 $13.20 $11.58 $17.50 Premier Plan – Full & Part Time Rates $9.54 $21.63 $19.05 $28.85 Vision Insurance Full & Part Time Rates $3.29 $7.16 $6.32 $9.38 *UnityPoint Health pays for the majority of these costs | 45 |

Voluntary Life and AD&D Insurance (Bi-Weekly Premiums, per $1,000 of coverage) AGE EMPLOYEE & SPOUSE/ AGE EMPLOYEE & SPOUSE/ DOMESTIC PARTNER* DOMESTIC PARTNER* Under 25 $0.027 55-59 $0.203 25-29 $0.031 60-64 $0.309 30-34 $0.040 65-69 $0.563 35-39 $0.044 70-74 $0.910 40-44 $0.051 75+ $0.955 45-49 $0.074 Children $0.026 Flat Rate 50-54 $0.111 *Premium based on team member’s age as of January 1, 2024 Hospital Indemnity Insurance EMPLOYEE ONLY EMPLOYEE + CHILD(REN) EMPLOYEE & SPOUSE/ FAMILY DOMESTIC PARTNER $9.39 $13.79 $18.20 $22.60 Accident Insurance EMPLOYEE ONLY EMPLOYEE + CHILD(REN) EMPLOYEE & SPOUSE/ FAMILY DOMESTIC PARTNER $4.69 $8.91 $7.70 $11.92 Legal Insurance & Identity Theft Protection $9.46 for employee and all dependents Critical Illness Insurance PREMIUMS - EMPLOYEE PREMIUMS - PREMIUMS - CHILD (BI-WEEKLY) SPOUSE/ DP (BI-WEEKLY) (BI-WEEKLY) $10,000 $20,000 $30,000 $10,000 $5,000 Age 29 $2.22 $4.43 $6.65 $2.68 Per Family Unit and under $1.41 Age 30-34 $2.77 $5.54 $8.31 $3.18 Age 35-39 $2.77 $5.54 $8.31 $3.18 Age 40-44 $5.22 $10.43 $15.65 $6.00 Age 45-49 $5.22 $10.43 $15.65 $6.00 Age 50-54 $10.15 $20.31 $30.46 $12.55 Age 55-59 $10.15 $20.31 $30.46 $12.55 Age 60-64 $14.68 $29.35 $44.03 $19.15 Age 65-70 $18.88 $37.75 $56.63 $21.92 Age 70+ $25.48 $50.95 $76.43 $33.05 | 46 |

Vendor Contact List PLAN CONTACT PHONE WEBSITE Health Insurance/ HealthPartners (888) 735-9200 healthpartnersunitypointhealth.com/uph FSA Dental Insurance Delta Dental of Iowa (800) 544-0718 deltadentalia.com Vision Insurance Avesis (855) 214-6777 avesis.com OnPoint for Health Applied Health (855) 581-9910 onpointforhealthuph.personal Analytics healthportal. net/login Health Savings Fidelity (800) 544-3716 netbene昀椀ts.com Account (HSA) Accident Insurance Voya Financial (877) 236-7564 voya.com Critical Illness Voya Financial (877) 236-7564 voya.com Insurance Life Inquires: Life/AD&D/ Disability Prudential (800) 524-0542 EOI Inquires: www.prudential.com/mybene昀椀ts (888) 257-0412 Hospital Indemnity Voya Financial (877) 236-7564 voya.com Insurance Legal Insurance (800) 247-4184 & Identity Theft ARAG (access code ARAGLegalCenter.com Protection 18191uph) Pet Insurance MetLife (800) GET-MET8 metlife.com/getpetquote Retirement Savings Fidelity (800) 343-0860 netbene昀椀ts.com Education Assistance EdAssist live chat available unitypoint.edassist.com on website UnityPoint Health IT UnityPoint Health (800) 681-2060 N/A Service Center | 47 |