BNY Mellon ESG Report

ENTERPRISE ESG REPORT 2021

BNY MELLON ENTERPRISE ESG 2 ABOUT THIS REPORT ABOUT THIS REPORT This is BNY Mellon’s 15th report covering environmental, social and governance (ESG) topics. Our annual updates in this report are not just about our company’s environmental and social impact, but also about how we view and integrate ESG considerations throughout our operations, leveraging opportunities and mitigating risks cross-functionally and across our lines of business. We publish our Enterprise ESG report annually, generally in the second quarter, on www.bnymellon. com/futurefirst . Unless otherwise noted, this report includes data and activities from BNY Mellon’s global operations for the calendar year 2021, and all data is as of 12/31/2021 and covers The Bank of New York Mellon Corporation and its subsidiaries. The report also provides select data from past years in order to facilitate year-over-year analysis. The methodologies, assumptions and estimates used to calculate climate- related data (including greenhouse gas emissions) throughout the industry are continuing to develop and are likely to change in future periods, including as a result of regulatory or other developments. As such, this could result in changes to the data, scope and time periods presented. This is our 13th report using the Global Reporting Initiative (GRI) Standards, a leading sustainability reporting framework. This report has been prepared in accordance with the GRI Standards Comprehensive option. NEW IN THIS REPORT This report describes our progress toward reporting against the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and serves as an update to our Considering Climate at BNY Mellon report, released in February 2021. Reflecting our integrated approach to the TCFD recommendations, the related content is contained throughout this report. A TCFD Index indicates the location of relevant public information in both this report and others. United Nations Global Compact As a participant of the UN Global Compact, our commitment to a culture of integrity is supported at the highest level. We report on our alignment with the Ten Principals of the UN Global Compact through our Communication on Progress , which is included in this report. As part of our pledge to the UN Global Compact , we continue to support broader societal goals, such as the UN Sustainable Development Goals (SDGs). From our administration of green bond issuances to our efforts to build the workforce of the future, we contribute in tangible ways to achieving a more sustainable world. In this report, we highlight the SDGs that correspond to each of our Enterprise ESG pillars. Glossary of Key Terms Finally, to advance transparency and consistency in ESG disclosures, this report includes a glossary of key terms related to ESG issues and responsible investing. We believe that sharing these definitions with our stakeholders will contribute to achieving consistent terminology and shared understanding. We welcome your comments about this or any of our reports via the contact form on our website. Task Force on Climate-related Financial Disclosures (TCFD)

This is a modal window.

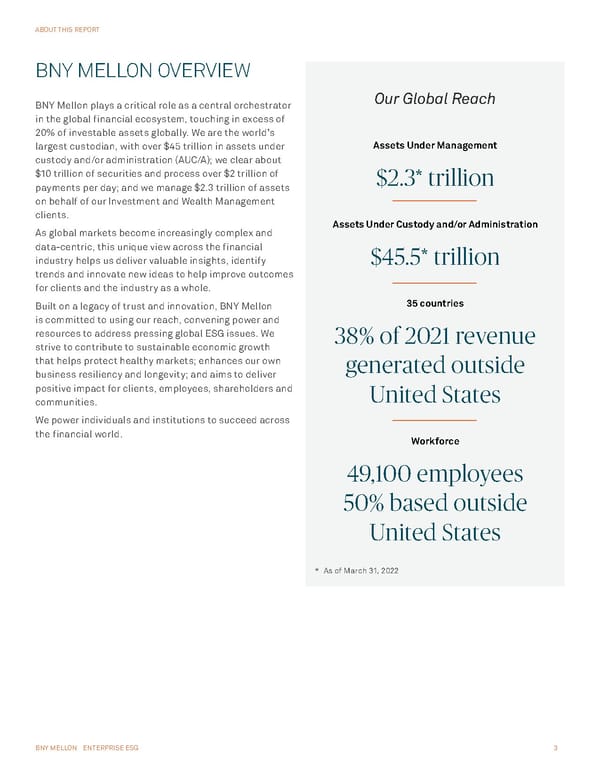

BNY MELLON ENTERPRISE ESG 3 ABOUT THIS REPORT BNY MELLON OVERVIEW BNY Mellon plays a critical role as a central orchestrator in the global financial ecosystem, touching in excess of 20% of investable assets globally. We are the world’s largest custodian, with over $45 trillion in assets under custody and/or administration (AUC/A); we clear about $10 trillion of securities and process over $2 trillion of payments per day; and we manage $2.3 trillion of assets on behalf of our Investment and Wealth Management clients. As global markets become increasingly complex and data-centric, this unique view across the financial industry helps us deliver valuable insights, identify trends and innovate new ideas to help improve outcomes for clients and the industry as a whole. Built on a legacy of trust and innovation, BNY Mellon is committed to using our reach, convening power and resources to address pressing global ESG issues. We strive to contribute to sustainable economic growth that helps protect healthy markets; enhances our own business resiliency and longevity; and aims to deliver positive impact for clients, employees, shareholders and communities. We power individuals and institutions to succeed across the financial world. Our Global Reach Assets Under Management $2.3* trillion Assets Under Custody and/or Administration $45.5* trillion 35 countries 38% of 2021 revenue generated outside United States Workforce 49,100 employees 50% based outside United States * As of March 31, 2022

BNY MELLON ENTERPRISE ESG 4 ABOUT THIS REPORT 2021 ESG PERFORMANCE HIGHLIGHTS At BNY Mellon, we are committed to the principles of ESG $1.9 trillion 1 Assets managed by investment firms that are signatories to the PRI $62 billion 2 Green debt under administration One of the Leading Trustees 2 for green bond deals in 2021 And we put the Future First SM in how we run our business ENVIRONMENTAL Carbon neutral 3 in our operations since 2015 Paper neutral in the U.S. and India since 2017 Reduction in GHG 4 emissions from 2018 baseline for Scopes 1 & 2 12% SOCIAL ISO/IEC 27001:2013 Certified Information Security Management System 40% Female globally 36% Diverse backgrounds, U.S. $34.5M Corporate, foundation and employee community support GOVERNANCE 100% Active employees certified on Code of Conduct provisions 36% 5 Women on board of directors 96% Stockholder approval on say-on- pay during the prior three years 1 A UM figure represents the aggregate total of investment firm PRI signatories’ assets under management at December 31, 2021. Includes Alcentra, ARX Investimentos, Insight Investment (including North America), Mellon Investments Corporation, Newton Investment Management (including North America) and Walter Scott & Partners. It does not include assets managed by investment firm personnel as dual officers of The Bank of New York Mellon and The Dreyfus Corporation. Siguler Guff AUM is not included in this calculation, given the minority interest in the firm held by BNY Mellon. Insight’s AUM is represented by the market value of cash, securities and derivatives held in client accounts. Where a client mandate requires Insight to manage some or all of a client’s liabilities, and Insight is to be paid an investment management fee based upon the value of such liabilities, the AUM for the account will be based on the value of the liabilities plus the gross notional value of any derivatives used in the management thereof. 2 Da ta reflective of FY 2021; Dealogic and Refinitiv. 3 F or Scope 1 and Scope 2 greenhouse gas emissions, including our data centers, as well as Scope 3 business travel emissions, through the use of renewable energy and carbon offsets. 4 Since 2018, including data centers. 5 The fig ure provided is based on Board membership following the 2022 Annual Meeting of Stockholders. ESG Awards and Recognition Dow Jones Sustainability North America Index (DJSI) 8 consecutive years CDP A List for climate management leadership 9 consecutive years FTSE4Good Global Benchmark Index 10 consecutive years Perfect score on the Corporate Equality Index for LGBTQ workplace equality, Human Rights Campaign Foundation 14 consecutive years Bloomberg Gender- Equality Index 7 consecutive years BNY Mellon Awards and Recognition

BNY MELLON ENTERPRISE ESG 5 ABOUT THIS REPORT TABLE OF CONTENTS Message From Our CEO 6 Approach 7 Putting the Future First SM 8 Future First SM ESG 8 Enterprise ESG Implementation 11 How We Consider Climate 17 Culture and Purpose 18 Diversity, Equity and Inclusion 19 Leadership and Development 26 Employee Engagement, Retention and Wellbeing 30 Our Community Impact 35 Responsible Business 41 Risk Management 42 Strong Governance 48 ESG and Responsible Investment Client Solutions 52 Global Citizenship 68 Managing Climate Change 69 Environmental Sustainability 79 Supply Chain 83 Advocacy and Political Engagement 85 Protecting Human Rights 86 Appendix 90 Global Reporting Initiative (GRI) Index 91 UN Global Compact Communication on Progress (COP) 107 Task Force on Climate-Related Financial Disclosures Recommendations Index 109 Glossary 112 Le gal Notices 117

BNY MELLON ENTERPRISE ESG 6 ABOUT THIS REPORT The challenges facing business and society are more complex than ever. As a leading global financial institution, we believe that BNY Mellon has a significant opportunity to make a positive impact and contribute to a more sustainable future. Through our culture and purpose, and responsible business and global citizenship initiatives, we strive to be a catalyst for the betterment of our stakeholders. It is these values that inspired us to take action in March to help those impacted by the war in Ukraine. Our employees gave generously and we matched their donations to further humanitarian efforts in the region. Along with financial contributions, our team in Poland has been providing tireless support, compassion and community to Ukrainians since the war began, assisting with refugee efforts and in many cases welcoming those in need into their homes. This is just one example of the many ways we advanced our environmental, social and governance (ESG) efforts in 2021. The Future First SM ESG framework, which was introduced last year, is another. It guides our own enterprise practices and conduct, underpins the strength of our client solutions and establishes a platform for thought leadership. 6 F or Scope 1 and Scope 2 emissions, including our data centers, as well as Scope 3 business travel emissions. Additionally, we introduced global caregiver leave that provides ten days of paid leave to care for immediate and extended family members. This is the second year we outline progress against our Enterprise ESG goals, which we remain focused on achieving by 2025. Our ESG strategy will continue to evolve to reflect new challenges and needs. As it does, we will embrace our responsibilities, and strive to contribute to sustainable economic growth—helping to protect healthy markets, enhancing our own business resiliency, and aiming to deliver positive impact for our clients, employees, shareholders and communities. MESSAGE FROM OUR CEO We also achieved carbon neutrality 6 in our operations for the seventh consecutive year by reducing energy use, procuring renewable electricity through the use of RECs, the accepted market-based legal instruments that represent the rights to renewable energy generation, and purchasing carbon offsets. Further, we achieved paper neutrality in our operations globally in 2021 via a certified offset program. With this report, we reaffirm our support of the T en P rinciples of the United Nations Global Compact in the areas of human rights, labor, environment and anti- corruption. This serves as our initial communication on progress, describing our actions to integrate the Global Compact and its principles into our strategy, culture and daily operations. Furthermore, we are committed to sharing this information in our 2022 Enterprise ESG Report, to be published next year. A Message from Todd Gibbons, CEO, BNY Mellon

BNY MELLON ENTERPRISE ESG 7 APPROACH APPROACH

BNY MELLON ENTERPRISE ESG 8 APPROACH PUTTING THE FUTURE FIRST SM At BNY Mellon, we’re committed to putting the Future First by using our global reach, influence and resources not just to power success today, but to help safeguard the future. Our approach, termed Future First , starts with our own ESG practices and conduct referred to as Enterprise ESG, then extends that thinking to the way we serve clients through our ESG and Responsible Investment Client Solutions. As a key participant of the global financial system, we believe it is part of our responsibility to help build the infrastructure that can facilitate investing with an ESG, responsible and sustainable lens. BNY Mellon is well positioned to help clients across the value chain. Our ESG approach empowers clients with strategies, data and analytics for every phase of the investment life cycle. Because our clients’ needs include ever-evolving ESG demands, our solutions are multifaceted. FUTURE FIRST ESG At BNY Mellon, we utilize a twofold approach to managing our ESG impact. Through Enterprise ESG —“Who we are” — we seek to integrate an ESG lens across our enterprise. Delivering on our ESG framework, we Consider Everything SM , starting with our own enterprise-wide practices, considering our business impacts on global issues and contributing to opportunities that help communities thrive. Through our ESG and Responsible Investment Client Solutions — “What we do” — we create and deliver ESG and Responsible Investment products and services . In this way, we expand on our actions by providing leading products and services that can help our clients meet their own ESG investment objectives and contribute progress toward ESG goals. We believe this approach leverages our reach, market influence and resources. Our actions can more powerfully drive shared value and significant progress toward global issues while simultaneously supporting our business objectives. Our Enterprise Environmental, Social and Governance (ESG) Commitment Statement articulates how we address these responsibilities and how we work to mitigate risks and capitalize on opportunities related to ESG. Adopted in September 2021, this statement aligns with existing BNY Mellon ESG-related statements and policies. Fu ture First SM — Our ESG Framework Who we are: Enterprise ESG What we do: ESG Client Solutions We firmly believe the strength of our client solutions is underpinned by our own actions and behavior as an enterprise. Culture and Purpose Responsible Investment Responsible Business Data and Analytics Global Citizenship Financing and Payments

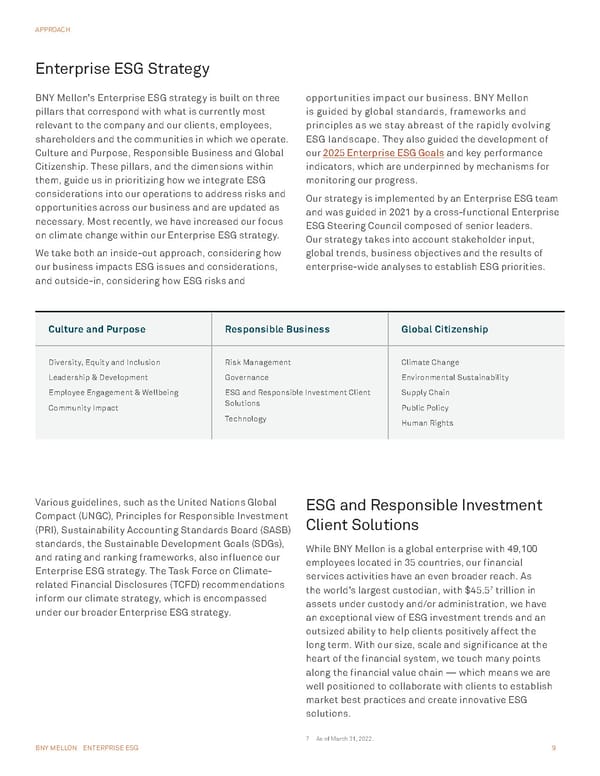

BNY MELLON ENTERPRISE ESG 9 APPROACH Enterprise ESG Strategy BNY Mellon’s Enterprise ESG strategy is built on three pillars that correspond with what is currently most relevant to the company and our clients, employees, shareholders and the communities in which we operate. Culture and Purpose, Responsible Business and Global Citizenship. These pillars, and the dimensions within them, guide us in prioritizing how we integrate ESG considerations into our operations to address risks and opportunities across our business and are updated as necessary. Most recently, we have increased our focus on climate change within our Enterprise ESG strategy. We take both an inside-out approach, considering how our business impacts ESG issues and considerations, and outside-in, considering how ESG risks and opportunities impact our business. BNY Mellon is guided by global standards, frameworks and principles as we stay abreast of the rapidly evolving ESG landscape. They also guided the development of our 2025 Enterprise ESG Goals and key performance indicators, which are underpinned by mechanisms for monitoring our progress. Our strategy is implemented by an Enterprise ESG team and was guided in 2021 by a cross-functional Enterprise ESG Steering Council composed of senior leaders. Our strategy takes into account stakeholder input, global trends, business objectives and the results of enterprise-wide analyses to establish ESG priorities. Culture and Purpose Responsible Business Global Citizenship Diversity, Equity and Inclusion Leadership & Development Employee Engagement & Wellbeing Community Impact Risk Management Governance ESG and Responsible Investment Client Solutions Technology Climate Change Environmental Sustainability Supply Chain Public Policy Human Rights Various guidelines, such as the United Nations Global Compact (UNGC), Principles for Responsible Investment (PRI), Sustainability Accounting Standards Board (SASB) standards, the Sustainable Development Goals (SDGs), and rating and ranking frameworks, also influence our Enterprise ESG strategy. The Task Force on Climate- related Financial Disclosures (TCFD) recommendations inform our climate strategy, which is encompassed under our broader Enterprise ESG strategy. ESG and Responsible Investment Client Solutions 7 As of March 31, 2022. While BNY Mellon is a global enterprise with 49,100 employees located in 35 countries, our financial services activities have an even broader reach. As the world’s largest custodian, with $45.5 7 trillion in assets under custody and/or administration, we have an exceptional view of ESG investment trends and an outsized ability to help clients positively affect the long term. With our size, scale and significance at the heart of the financial system, we touch many points along the financial value chain — which means we are well positioned to collaborate with clients to establish market best practices and create innovative ESG solutions.

BNY MELLON ENTERPRISE ESG 10 APPROACH We are meeting client and investor demand to elevate the scope and focus of our collaboration with clients, and our focus on Responsible Investment. We expect Responsible Investment to expand significantly as asset managers increasingly understand that it is no longer possible to successfully manage portfolios without a comprehensive analysis of the risks and opportunities associated with the transition to a more sustainable future. Additionally, we see the role of stewardship of capital as profoundly changing. Businesses without a sustainable model may cease to be attractive to customers, employees and ultimately investors. We believe that in the long run, investments will be expected to deliver a twin benefit of financial returns and a positive impact to society. Because our clients’ needs must respond to ever-evolving ESG demands, our solutions are multifaceted and fall into three categories: Responsible Investment: BNY Mellon offers a range of Responsible Investment options and advice for professional and personal investors to help them achieve their investment goals. Empowering Investors Through ESG Data and Analytics: Our breakthrough tools and analytics capabilities power investment processes and portfolio reviews for asset owners and asset managers, helping them to achieve their ESG goals. Enabling ESG Financing and Payments: We offer an end- to-end suite of ESG financing and payments solutions through our global market infrastructure, Issuer Services and Treasury Services. Learn more about our ESG and Responsible Investment Client Solutions . SPOTLIGHT Innovations for Future Value Leveraging our leading position in the global capital markets, BNY Mellon convened clients and other stakeholders at our inaugural Future First Forum in May 2021. BNY Mellon leaders and industry experts discussed the innovations that are helping companies have a positive impact on people, communities and the planet while also driving long-term value. As BNY Mellon CEO Todd Gibbons noted, the pandemic has accelerated the need for widespread adoption of ESG principles and responsible investing. Over the course of the day, various perspectives pointed to a key theme: Participants saw an urgent need for clarity, consistency and transparency in how the financial industry addresses ESG considerations — whether via predictable policy, more transparent ESG data, or consistent frameworks for measuring impact. However, it will take time, innovation and initiative to accelerate the evolution of ESG to deliver positive global impact. Future First Insights Series As we work with our clients to help them achieve their ESG and responsible investment goals, we gain insights into key issues and share those through our Future First Insights thought leadership series. Authored by experts across the organization, these articles have addressed topics such as fixed income and responsible investing, helping investors understand climate risk, key ESG trends in retail investing, and addressing the challenges of ESG data.

BNY MELLON ENTERPRISE ESG 11 APPROACH ENTERPRISE ESG IMPLEMENTATION The Enterprise ESG function is composed of four main focus areas: strategy setting, reporting, disclosures and stakeholder engagement. Each of these focus areas relies on strong cross-functional collaboration across the enterprise and ESG integration across the lines of business and functions. In 2021, we placed a particular focus on climate change, having built out our climate change strategy and issued our first stand-alone report, Considering Climate at BNY Mellon , dedicated to how we’re considering the risks and opportunities brought on by climate change effects. Learn how we are Managing Climate Change . ESG Materiality We focus on what matters most and where we can drive business transformation. Thus, BNY Mellon periodically adjusts our approach to remain current with stakeholder concerns, global trends and our own business strategies. In 2020, we increased alignment of our ESG efforts both within our organization and with external reporting frameworks. In addition to updating our Enterprise ESG strategy, we introduced goals and key performance indicators (KPIs) to guide our actions from 2020 through 2025. Our Enterprise ESG strategy and goals are based on research and stakeholder input gathered through an ESG materiality assessment process conducted in 2019 that helped us determine the most relevant ESG issues for BNY Mellon. 8 8 2020 Enterprise ESG Report , page 10 ESG MATERIALITY ASSESSMENT KEY THEMES Technological Resilience: Information security and resilience to cyberattacks represent a key intersection of societal needs and BNY Mellon business priorities. The Importance of the Employee: Employee issues such as diversity & inclusion, talent attraction, retention and development, and gender pay equity can help differentiate BNY Mellon in an increasingly competitive business environment. Climate Readiness & Response: The impending impacts from climate change require every institution to act. In financial services, frameworks such as the TCFD recommended disclosures help facilitate a robust and substantive assessment of climate-related vulnerabilities and opportunities. Integrating ESG: Increasing evidence of the benefit of systematically integrating environmental, social and governance considerations into the investment process is bolstering demand for such products and services. Tr u s t & Tr a n s p a r e n c y : Board oversight, responsiveness and transparency regarding evolving sustainability challenges are important to respond to stakeholder expectations. We consider the impact of the choices we make and the decisions we take — and report on those enterprise-wide practices. The commitments we make at the global level guide the execution of our Enterprise ESG and climate change strategies, and the reporting of our performance. Enterprise ESG impacts the culture at BNY Mellon, informs our responsible business practices, and inspires our global citizenship. We contribute to sustainable economic growth that helps protect healthy markets, enhances our own business resiliency, and aims to deliver positive impact for key stakeholders.

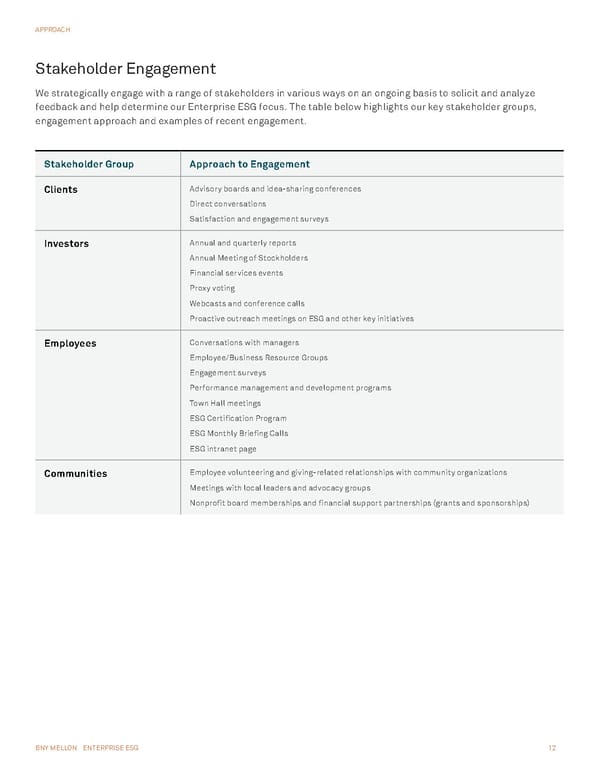

BNY MELLON ENTERPRISE ESG 12 APPROACH Stakeholder Engagement We strategically engage with a range of stakeholders in various ways on an ongoing basis to solicit and analyze feedback and help determine our Enterprise ESG focus. The table below highlights our key stakeholder groups, engagement approach and examples of recent engagement. Stakeholder Group Approach to Engagement Clients Advisory boards and idea-sharing conferences Direct conversations Satisfaction and engagement surveys Investors Annual and quarterly reports Annual Meeting of Stockholders Financial services events Proxy voting Webcasts and conference calls Proactive outreach meetings on ESG and other key initiatives Employees Conversations with managers Employee/Business Resource Groups Engagement surveys Performance management and development programs Town Hall meetings ESG Certification Program ESG Monthly Briefing Calls ESG intranet page Communities Employee volunteering and giving-related relationships with community organizations Meetings with local leaders and advocacy groups Nonprofit board memberships and financial support partnerships (grants and sponsorships)

BNY MELLON ENTERPRISE ESG 13 APPROACH Enterprise ESG 2025 Goals and Progress We continue to report against the goals and key performance indicators (KPIs) that we announced in 2019 to guide our actions from 2020 through 2025. Our ESG performance is reported regularly to our Executive Committee and to the Corporate Governance Nominating and Social Responsibility (CGNSR) Committee of our Board of Directors. Culture and Purpose 2025 Goals and Key Performance Indicators Diversity, Equity and Inclusion GOAL: Drive a culture of inclusion and advance diverse representation In progress Increase senior leadership positions held by women and ethnically and racially diverse employees with unique percentage point targets by Executive Committee member Increase percentage of participation in Employee/Business Resource Groups (E/BRGs), as evidenced by employee registered membership in at least one group, by 3% year over year, starting from the 2019 baseline year Consistently rank among the top employers for leadership in the field of diversity, equity and inclusion Leadership & Development GOAL: Drive a culture of high productivity, engagement and commitment to continuous learning and development to support successful leaders, managers and their teams In progress Improve manager effectiveness score by 5% year over year, as measured through Manager Upward Feedback process Increase the number of discrete employees participating in/utilizing nonmandatory learning programs, on a year-over-year basis Employee Engagement & Wellbeing GOAL: Support a culture of wellbeing through a holistic program focused on engaging employees and developing key management behaviors to decrease health risk In progress Increase positive response to employee health survey question “Do you think your workplace supports a culture of health and wellbeing?” by 5% Offer at least two wellbeing programs that meet or exceed market benchmarks; increase enrollment and/or active participation by 10% year over year Community Impact GOAL: Leverage the company’s resources and employee talent to significantly increase impact of community support in the regions and countries in which BNY Mellon operates In progress Direct 65% of corporate grants and sponsorship giving donations to organizations and causes that are aligned with our strategic focus of developing the workforce of the future Facilitate 130,000+ hours of employee volunteerism annually Increase total hours of Signature Pro Bono consulting delivered to nonprofits by 10% over the 2019 baseline year Achieve a skills-based volunteering target of 40% of total employee volunteer hours, ensuring that a significant portion of volunteer efforts leverage employees’ professional experience

BNY MELLON ENTERPRISE ESG 14 APPROACH Responsible Business 2025 Goals and Key Performance Indicators Risk Management * GOAL: Risk Framework - Continue to evolve and fortify our risk infrastructure's integration into BAU practices across the organization In progress Promote consistent and aligned utilization of the risk lifecycle (identification, measurement, mitigation, monitoring) across the company as a key factor in risk/reward decisions for product, client and geography prioritization GOAL: Risk Culture - Sustain strong global risk and compliance culture focused on risk awareness, ownership and ethical behavior In progress Drive active employee engagement and ownership of risk and compliance requirements through ongoing strategic communication and development Technology GOAL: Continually evolve business protocols to help ensure systems continuity in every jurisdiction in which we operate, and across borders In progress Expand our information security management system based on an internationally recognized specification (i.e., ISO 27001) for all critical applications and business services GOAL: Evolve business protocols to provide technology knowledge, resilience and business continuity In progress Cultivate a globally competitive level of workforce awareness concerning information systems security Governance GOAL: As part of the director recruitment and refreshment efforts for our Board of Directors, continue to ensure that candidate slates include individuals with diverse backgrounds and perspectives in order to maintain the Board’s diverse composition In progress Review at least annually, the diversity criteria applied by the Board in its process of evaluating the qualifications of potential candidates Integrate into the evaluation of external search firms’ performance a review of such firms’ capabilities in developing diverse candidate pools GOAL: Formalize proactive outreach program to engage shareholders on ESG performance In progress Increase proactive engagement with top shareholders on ESG topics Enhance integration of ESG content in public reporting, including but not limited to BNY Mellon’s Proxy materials ESG and Responsible Investment Client Solutions GOAL: Provide best-in-class client solutions to the global ESG community by enabling ESG financing In progress Increase assets managed by investment firms that are signatories to the UNPRI Increase number of clients who use our ESG Global Risk Solutions, and Data and Analytics solutions Increase volume of new green bonds administered Demonstrate ESG thought leadership and proof points as measured by industry recognition and client satisfaction metrics * Language in the goals were refined to provide clarity

BNY MELLON ENTERPRISE ESG 15 APPROACH Responsible Business 2025 Goals and Key Performance Indicators Environmental Sustainability GOAL: Maintain commitment to environmental sustainability, including effectively managing natural resource usage, such as energy and greenhouse gas emissions, waste, paper and water In progress Reduce greenhouse gas emissions by 20% from a 2018 base year, for Scopes 1 & 2 including data centers, in line with Science Based Targets (SBTi) methodology Maintain carbon neutrality commitment Divert 80% of office waste from landfills Target zero waste to landfills for technology equipment Achieve paper neutrality in the U.S. and India Drive water use reduction in building operations Supply Chain GOAL: Build a Supplier Diversity Program that has longevity, consistent with BNY Mellon’s value proposition and diversity initiatives In progress Refine program resources to improve program processes and increase efficiencies Implement a company-wide sustainable training program on supplier diversity Increase outreach with diverse suppliers through supplier development and education experiences Public Policy GOAL: Continue to engage with stakeholders on key regulatory and legislative issues important to BNY Mellon In progress Expand internal awareness of regulatory and legislative impacts and trends Strategically advocate on priority legislative and regulatory issues affecting BNY Mellon Human Rights GOAL: Continue the commitment to preventing modern slavery and human trafficking in our operations, supply chain and communities In progress Conduct due diligence and training practices to promote understanding of Modern Slavery Act principles

BNY MELLON ENTERPRISE ESG 16 APPROACH Enterprise ESG Governance A clear governance structure drives the integration of our Enterprise ESG strategy throughout our company and helps to align our activities with our business goals and cultural values. Our governance mechanisms balance the interests of our varied stakeholders and help inform our policies, practices, reporting and disclosure. Enterprise ESG Governance Structure Corporate Governance, Nominating and Social Responsibility (CGNSR) Committee of the Board of Directors Provides primary oversight of BNY Mellon’s ESG efforts. Consists of independent directors who regularly review our Enterprise ESG performance, monitor progress against goals, and provide guidance to management Read more in the CGNSR Committee Charter . Executive Committee Responsible for ESG progress and success; monitors progress on goals, anticipates market trends and future client needs, and drives business innovation Enterprise ESG Steering Council Composed of senior employees spanning our business functions, was active in 2021 to help integrate ESG globally and regionally ESG and Responsible Investment Client Solutions Working Group Composed of senior employees spanning our business functions, was active in 2021 to help integrate ESG globally and regionally Enterprise ESG Team Leads strategy development and governance processes, provides subject matter expertise, collaborates with company functions and departments to assist in development of ESG integration initiatives, manages public reporting and disclosures related to ESG activities, facilitates external stakeholder input, and collaborates with experts and facilitates thought leadership Working Groups Ad hoc as needed Subject Matter Experts Staff across varying areas of the company who execute ESG-related policies, practices and programs Employee Groups Employee/Business Resource Groups (E/ BRGs), sustainability ambassadors, and volunteer and philanthropic fundraising committees that support social or environmental impact initiatives Learn more about Enterprise ESG .

BNY MELLON ENTERPRISE ESG 17 APPROACH HOW WE CONSIDER CLIMATE BNY Mellon is developing a framework to consider climate-related risks, which often manifest in the long term, as well as opportunities throughout our business. In 2019, we signed on to support the TCFD recommendations, in part to guide the execution of that framework. In addition, four of the investment firms in our Investment Management business have also signed on as supporters. Additionally, across our business, we maintain numerous affiliations with industry and thought leadership initiatives to support corporate considerations of climate change and climate risk. We utilize the TCFD recommendations to inform our climate-related disclosure to provide investors, lenders, insurers and other stakeholders the necessary information on our approach to considering our climate-related risks and opportunities. This provides a framework for substantive conversations about our analysis, action plans and work to embed climate- related matters into our business strategy. The consideration of climate risks and opportunities is part of our larger body of work to address the integration of ESG into the way we operate and serve our clients and is thus embedded in our Enterprise ESG strategy and approach. We seek to respond to climate risks and opportunities throughout our business strategy and across our entire enterprise. Thus, additional information about our management of climate-related risks can be found throughout this report, primarily in Risk Management , Managing Climate Change and Environmental Sustainability . In early 2021, building on our support of TCFD, in early 2021 we published our first stand-alone climate-related report, Considering Climate at BNY Mellon . In that report, we outlined our approach, plan and actions to address climate-related risk and opportunities. In this Enterprise ESG report, we provide an update on our progress. It is not meant to be an exhaustive account of our work, but rather examples of areas where we have initiatives in place related to climate risks and opportunities. Our most recent progress is flagged by “New in 2021” headings.

CULTURE AND PURPOSE Culture is the driving force behind our success as a global leader in financial services. We maintain a high-performance culture by engaging across our global team, leveraging the rich diversity of our people and equipping them to contribute to our shared purpose: powering individuals and institutions to succeed across the financial world. In our communities we prepare young people to prosper in the workplace of the future, and fund programs that teach students next-generation business and technology skills. United by the common values of Passion for Excellence, Integrity, Strength in Diversity and Courage to Lead, our people demonstrate behaviors that enable us to deliver on purpose-driven growth. By enabling people to thrive, we contribute to the following SDGs:

BNY MELLON ENTERPRISE ESG 19 CULTURE AND PURPOSE DIVERSITY, EQUITY AND INCLUSION The unequal impacts of the pandemic and climate change have shone a light on how these issues disproportionately fall on the underserved and marginalized in our communities. Ongoing racial disparities and serious social justice issues weigh not just on the lives of individuals but also on society as a whole. These unresolved issues emphasize the importance of making our diverse society more equitable and inclusive. In an interconnected world, shaped and accelerated by globalization, having a diverse workforce improves social equity and inclusion as well as creates a competitive business advantage. Research shows that the business case for diversity remains robust and that organizations benefit when they adopt systematic, business-led approaches to inclusion and diversity. 9 Embracing diversity, advancing equity and fostering inclusion can drive organizational performance by enabling individuals to achieve their full potential and contribute to the success of a company. Our Opportunity and Approach Diversity, Equity and Inclusion (DEI) at BNY Mellon is integral to our business strategy. We invest in attracting, developing, advancing, supporting and retaining top and high-potential talent. With Strength in Diversity as one of our four core values, we actively seek diversity of thought, perspectives and problem-solving. We strive to create an ecosystem and environment that unleashes the power of diverse backgrounds, experience and expertise to produce better ideas and business outcomes. We deliver programs, adjust our practices and create policies that embed DEI in our operating and governance models and throughout the talent life cycle. We are strengthening our culture to promote a sense of belonging and support wellbeing — whether working in the office or virtually — that enables us to do our best work, build great careers and lead fulfilling lives. 9 Diversity Wins: How Inclusion Matters , McKinsey 2020 2021 ACHIEVEMENTS Workforce Diversity: Increased women among new hires, senior leaders globally and Board of Directors, and increased ethnic/racial representation in our U.S. workforce among senior and mid-level leaders and on our Board, when compared to 2020. Executive Development: Graduated the first cohort of 23 diverse, high-potential candidates from our flagship Executive Sponsorship program. Disability Inclusion: Achieved 100% on the Disability Equality Index and named a Best Place to Work for Disability Inclusion. * Inclusive Workplace: Ranked among the top 20 Fortune 500 Companies on Diversity and Inclusion, ** achieved 100% on the HRC Corporate Equality Index, named a Best Place to Work for LGBTQ+ Equality and included in the Bloomberg Gender-Equality Index. *** * BNY Mellon Named to 2021 Disability Equality Index , July 14, 2021 ** The top 20 Fortune 500 companies on diversity and inclusion , June 2, 2021 *** BNY Mellon Recognized for Championing a Culture of Inclusion and Equity , January 27, 2022

BNY MELLON ENTERPRISE ESG 20 CULTURE AND PURPOSE Strategy and Governance Diversity, equity and inclusion (DEI) is integral to who we are as a company, what our people experience as members of our global team, and how we serve all our stakeholders. From the time people join our organization, we work to welcome them into a culture that is respectful, equitable and fosters a sense of belonging. We appreciate the differences and unique contributions of our employees and seek to offer them opportunities for advancement. These values are codified in policies such as our Equal Opportunity Policy in the United States and our global Code of Conduct, which prohibits discrimination. Our four-pillar DEI strategy is embedded in our business strategy, operating model, talent experience and client value proposition. The Global Head of Diversity, Equity and Inclusion engages with Executive Committee members and the Board of Directors on DEI goals, progress and challenges. Executive Committee members’ variable compensation is informed by performance against these and other goals. Our global head and regional leads, covering the Americas, EMEA, APAC and India, work with other subject matter professionals to develop the global DEI strategy. The team then consults and collaborates with Human Resources colleagues, business leaders and the Executive Committee to adapt the DEI strategy locally. Employees across the company bring fresh perspectives to our work through their membership in, and leadership of, our Employee/Business Resource Groups (E/BRGs) and by serving on various business-line and regional DEI councils. DIVERSITY, EQUITY AND INCLUSION STRATEGY Our global strategy stands on a foundation of four pillars: Business Imperative Enable businesses to leverage DEI to improve and differentiate performance Ta l e n t Build the best global team, reflecting the rich diversity of our talent and client markets and the communities we serve Inclusive Culture Ensure our culture is respectful, equitable and fosters a sense of belonging Market Leadership Set a high bar for our company and our people to actively champion and drive DEI progress

BNY MELLON ENTERPRISE ESG 21 CULTURE AND PURPOSE Addressing Racial Injustice BNY Mellon continues to enact programs, policies and actions to address social inequities and systemic racial disparities. Our momentum grows as diversity, equity and inclusion are woven more deeply into the fabric of our organization. Some progress has been made, but we are by no means satisfied. While we have accelerated planned DEI actions, we realize that meaningful results arise from sustained action over time. In the U.S., we continue to work toward representation goals in our most underrepresented ethnic/racial talent populations. We aim to achieve these increases from a 2020 baseline by year-end 2023 by improving outcomes in diverse hiring, advancement and retention. • Achieve a 15% increase in overall Black representation to 12% • Achieve a 30% increase in Black representation of Senior Leaders (Directors and Managing Directors) to over 4% • Achieve a 15% increase in overall Hispanic/Latinx representation to almost 8% • Achieve a 30% increase in Hispanic/Latinx representation of Senior Leaders (Directors and Managing Directors) to over 5.5% We have also publicly pledged to increase senior women representation among Directors and Managing Directors across our EMEA region from 28% to 33% by year-end 2025. A Business Imperative We believe that our entire workforce shares responsibility in building a culture where all people feel a sense of belonging. Thus, each employee has a DEI goal in their performance management plan. Our people come from all races, ethnicities, cultures, genders, sexual orientations, ages, abilities and backgrounds. To ensure that diversity advances and continues to inform how we grow our business and serve our clients, we embed DEI in every stage of the talent life cycle and partner with lines of business to enhance performance, innovation and impact by leveraging DEI. For example, through an expansion of our relationship with a federally designated Minority Depository Institution, we intend to do more work with underserved community banks to help close gaps in racial wealth and access to capital. GLOBAL GENDER DIVERSITY The events of the past year, including the COVID-19 pandemic, acutely affected women, as more women than men are opting to leave the workforce or downshifting their careers. Working mothers, women in senior management positions and Black women are experiencing some of the largest challenges. 10 While attrition among women at BNY Mellon is up year over year, bright spots include an increase in the proportion of women among new hires and representation of women in our senior leadership ranks and on our Board of Directors at the end of 2021. While many of our DEI initiatives contribute to the increased representation of women at all grades across the company, several initiatives are intended to advance women in the organization. These efforts include improved candidate sourcing, including from existing employees, through the utilization of software, and enhanced recruiting expertise and pipeline affiliates. In addition, we are paying attention to internal talent pipelines, supporting high-potential employees with development plans, and increasing the inclusion of women in our candidate and promotion slates and talent referrals. To bolster retention and advancement, we promote a culture of sponsorship, whereby senior leaders act as sponsors to advocate for and empower high-potential employees to position themselves as protégés. Development plans should have promotion-readiness objectives and may include sponsorship or coaching to support top women to advance their careers. We have recently expanded and added employee benefits and programs that support life balance, including our global Caregiver Leave Policy, providing employees up to 10 days of paid leave to prioritize planned and unplanned family care circumstances. 10 COVID-19’s Impact on Women’s Employment , McKinsey.

BNY MELLON ENTERPRISE ESG 22 CULTURE AND PURPOSE The visibility of underrepresented employees in senior positions can improve gender and intersectional diversity throughout an organization as it creates role models for others. Our intentional progress toward advancing women in leadership positions was recognized by American Banker when four BNY Mellon leaders were again included in its 2021 Most Powerful Women program and four other employees were named to the 2021 HERoes Women Role Models Lists. GLOBAL GENDER DIVERSITY* % women U.S. Workforce 2020 44% 2021 43% Global Workforce 2020 41% 2021 40% New Hires 2020 39% 2021 40% Mid-level Leaders 2020 35% 2021 35% Senior Leaders 2020 29% 2021 30% Executive Leaders 2020 29% 2021 26% Board of Directors 2020 27% 2021 31% Among U.S.-based BNY Mellon employees, overall representation of individuals from underrepresented ethnic/racial backgrounds rose to 36% in 2021 from 35% the previous year. Continuing a multiyear trend, ethnic/ racial diversity also improved year over year in our senior and mid-level leadership ranks, up to 26% and 34%, respectively. Additional details can be found in the EE01 Report at the end of this report. U.S. ETHNICITY* % of U.S. workforce from underrepresented ethnic/racial backgrounds U.S. Workforce 2020 35% 2021 36% U.S. New Hires 2020 44% 2021 44% Executive Leaders 2020 20% 2021 18% Senior Leaders 2020 25% 2021 26% Mid-Level Leaders 2020 33% 2021 34% Board of Directors 2020 36% 2021 38% * “Mid-l evel leaders” are inclusive of BNY Mellon’s vice president-level employees, “Senior leaders” are inclusive of BNY Mellon’s director-level and above employees, excluding executive leaders, and “Executive leaders” are inclusive of BNY Mellon’s Executive Committee. Data is based on employee voluntary disclosures, as of 31 December 2021. Current, accurate data provides visibility into the composition of our workforce. The BNY Mellon People Analytics team maintains and publishes workforce representation data, conducts analyses and facilitates workforce planning activities, which enables us to track diversity, identify changes and improve representation throughout the talent life cycle.

BNY MELLON ENTERPRISE ESG 23 CULTURE AND PURPOSE Attracting and Retaining Diverse Talent To broaden our talent pool diversity, we have forged strategic alliances with professional associations, educational institutions, think tanks and nonprofits that reach Black, Hispanic/Latinx, Asian, LGBTQ+, people with disabilities, neurodiverse individuals, veterans and other talent from backgrounds currently underrepresented in our workforce. We aim for fair opportunity by requiring diverse candidate slates, creating inclusive job descriptions and involving diverse interview panels. We engage nontraditional candidates such as those reentering the workforce after an extended leave of absence. We took a number of steps in 2021 so our recruitment process engages and includes candidates from diverse backgrounds and offers equitable access to our job openings. We equipped hiring managers with resources, tools and training, such as a recruitment process checklist and an Inclusive Hiring course, so our hiring process is more inclusive of a broadly diverse talent pool. BNY Mellon has incorporated an artificial-intelligence-powered platform that enhances our ability to identify promising candidates and reach our diversity hiring goals. The platform is now live, and we are beginning to collect data and metrics that reveal efficacy of different methods, approaches, communications and external affiliates in increasing the diversity of applicants and hires. PAY E Q U I T Y BNY Mellon is committed to providing equal pay for equal work. To achieve our goal, we periodically review our pay practices and processes and publicly share the results. This transparency holds us accountable to our stakeholders and contributes to change. Earlier in 2022, we once again voluntarily published the results of our most recent pay practices review and adjusted median pay gap and unadjusted median pay data. The adjusted median pay gap analysis measures whether we are paying employees, regardless of gender or race/ ethnicity, comparably for doing the same/similar work. In this adjusted median pay gap analysis, we account for legitimate factors, including geography, level and job. Unadjusted median pay compares the 50th percentile of pay of a defined group (women or racial/ethnic group) against the 50th percentile of pay for the comparison group (men or majority group). In this analysis, pay is unadjusted, meaning that we do not adjust pay for any factors like job, geography or job level. Our recent pay practices review, based on 2021 total compensation data (which includes incentive compensation paid in early 2022), found that compensation for both women globally and U.S. employees from underrepresented ethnic/racial backgrounds are, on average, 100% of their respective counterparts. We also published our 2021 UK Gender Pay Gap Report in accordance with the UK Government’s criteria, our fifth such report. Measuring a gender pay gap is not the same as measuring equal pay. This report provides an overview of the difference between the average earnings of men and women in our largest UK employing entity, notes the drivers behind any gaps, and describes the steps we are taking to improve gender representation at all levels of the company. Finally, we aim to compensate employees fairly and competitively. Learn more about Fair Pay . DIVERSITY AT ALL LEVELS As workforce representation is an outcome of successful talent retention, we are proactively enhancing programs, practices and policies to reduce voluntary attrition, particularly among talent from underrepresented groups, and increase diversity at all levels in our organization, especially at the senior levels. We embed DEI in succession bench criteria and design development plans that improve promotion readiness, offer sponsorship and advance talent diversity. In its second year, our Sponsor Ready course continues to build awareness and skill in sponsoring colleagues. Open to all employees, this course is creating a sponsorship culture that will contribute to sustained knowledge sharing, skill building, diversity of thought, talent advancement and retention, and competitive advantage across our businesses. In 2022, the first cohort of 23 diverse, high-potential candidates graduated from our flagship Executive Sponsorship program. Initiated by our executive leaders, the first phase of the program engaged Black and Hispanic/Latinx high performers. Candidates in this inaugural cohort were each paired with a member of

BNY MELLON ENTERPRISE ESG 24 CULTURE AND PURPOSE BNY Mellon’s Executive Committee and participated in programmatic engagement and development of inclusion as a differentiated skill, including the five-week Sponsor Ready e-learning course, speaker series and peer- networking/coaching forums. Participants learned to strengthen a culture of sponsorship across the company that engages and elevates more of our underrepresented top talent. In addition to this formal program, we provide other resources to support the development and retention of diverse talent and improve managers’ inclusive leadership competency. While we hold a common set of core values across our enterprise and work toward a shared DEI strategy, the implementation approach is often adapted to take into account regional context. India. The Maximizing Personal and Professional Potential (MP3) talent development program helps women in mid-management build skills to weather challenges with resilience. Successful candidates complete group mentoring sessions and then are coached by sponsors for role readiness. EMEA. This region has set a goal to increase the representation of women in senior management roles across EMEA from 28% in 2020 to 33% by the end of 2025. We have made progress, as women held 29% of senior management roles in that region, as of December 9, 2021. This builds on the achievement of an earlier goal set upon signing the HM Treasury Women in Finance Charter. In 2016, BNY Mellon UK set a goal that a minimum of 30% of all hires in the region be women and/ or diverse across all job levels by the end of 2017. We met that goal ahead of the target date. RACE ACTION IN THE UK AND EMEA In the UK, we have implemented an array of measures aimed at improving equity and outcomes for employees from underrepresented racial and ethnic groups, including collecting employee ethnicity/race data, and increased participation in voluntary self-identification surveys by UK employees. Using a combination of data analyses and focus group feedback, we launched a UK Race Action Plan to enhance the employee experience and support employee growth, development and retention. We will continue to track and report UK employee ethnicity data to monitor progress and the impact of the Plan. Across the region, our EMEA Business Inclusion Council strives to enhance an inclusive culture by embedding DEI into the way we operate. Since it was formed in 2020, this council has developed plans to expand employee self-identification options beyond gender and beyond the UK, and conducted campaigns to encourage employees to share their demographic information. The council has also created and promoted resources to build and measure inclusion and has identified techniques to attract, develop and retain employees from underrepresented groups. DISABILITY INCLUSION AT WORK As we continue our work to be an even more inclusive employer, we seek to reach people with disabilities, the largest and most diverse underrepresented group globally. HEART, our diverse abilities employee resource group, drives change by increasing awareness and understanding of visible and invisible disabilities and health-related conditions. These include physical and mental health issues, chronic ill health and neurodiversity. To assess and benchmark our efforts, we participated in the Disability Equality Index for the third time in 2021 and scored 100% for the second consecutive year. 11 BNY Mellon was also named to the Disability Equality Index ® “Best Places to Work” list by Disability:IN and the American Association of People with Disabilities. 11 BNY Mellon Named to 2021 Disability Equality Index, July 14, 2021

BNY MELLON ENTERPRISE ESG 25 CULTURE AND PURPOSE SPOTLIGHT Autism@Work Our efforts to seek out and include individuals with diverse abilities includes our Autism@Work pilot program, through which we recruited diverse talent on the autism spectrum to take part in an apprenticeship and ultimately work full-time at BNY Mellon. Five of eight apprentices in 2021 accepted full-time positions with our Global Operations and Technology team. We believe that this neurodiversity initiative accelerates innovation, adds significant business value and helps us harness the power of difference. In addition to Autism@Work, BNY Mellon’s Enterprise Quality Engineering team engages contract workers who are neurodiverse. Company plans for 2022 include expanding our neurodiversity initiative to more parts of our business and other regions, including Ireland and India. We are also rebranding the program as Neurodiversity Inclusion@BNY Mellon, signaling our intention to engage capable talent with other forms of neurodiversity, such as attention deficit hyperactivity disorder (ADHD) and dyslexia. Through these initiatives and others, we are fulfilling our pledge as a member of the Valuable 500, a CEO-led movement committed to disability inclusion, including neurodiversity. EMPLOYEE-LED INCLUSION As remote working and social distancing continued for a second year, our employees took advantage of the level playing field of digital, truly global engagement to gain deeper appreciation for the value of connection and inclusion. E/BRG membership continues to grow year over year. With nearly 400 leaders and 11,500 unique members, one in four BNY Mellon employees is a member of an E/BRG. Our six E/BRGs help us achieve enterprise DEI goals through initiatives that provide a supplemental support system, community of belonging and peer network for our people throughout their career journey. For example, E/BRGs lead mentoring and reverse mentoring programs that create exposure to different thinking, which benefits both emerging leaders and experienced, established leaders. In BNY Mellon India, the Inclusion Ambassador program fosters experiential learning for the Inclusion Ambassadors to enable them drive a culture of inclusion and belonging across their respective teams. Enterprise ESG 2025 Diversity, Equity and Inclusion Goal Drive a culture of inclusion and advance diverse representation KPI: Increase percentage of participation in E/BRGs, as evidenced by employee registered membership in at least one group, by 3% year over year, starting from the 2019 baseline year Progress: Membership in BNY Mellon’s six E/BRGs grew from 11,408 to 11,500 in 2021, an increase of 5% ADDITIONAL DIMENSIONS OF REPRESENTATION (BNY MELLON IN THE U.S. AND UK) Data based on employee voluntary disclosures, as of 31 December 2021 People with Disabilities LGBTQ+ Veterans 5 .1% U.S. Workforce 1.5% U.S. Workforce 1.8% U.S. Workforce 0.3% UK Workforce 2.0% UK Workforce 0.0% UK Workforce

BNY MELLON ENTERPRISE ESG 26 CULTURE AND PURPOSE Driving DEI Change in Our Industry BNY Mellon serves as a powerful catalyst for change when we join with other organizations in making public diversity goals and working toward them collectively. Our support for the following initiatives underpins our long- term commitment to help drive DEI progress across our industry and society more broadly. We are a signatory to: • Association of Business Service Leaders’ #WorkingTogether Pledge, Poland • Chartre De La Diversite, Luxembourg • Gender Equality Charter, Belgium • HM Treasury Women in Finance Charter • Social Mobility Pledge • United Nations Standards of Conduct for Business Tackling Discrimination against Lesbian, Gay, Bi, Trans, and Intersex People • Valuable 500 • Women in Finance Charter, Ireland Enterprise ESG 2025 Diversity, Equity and Inclusion Goal Goal: Drive a culture of inclusion and advance diverse representation KPI: Consistently rank among the top employers for leadership in the field of diversity, equity and inclusion Progress: 2022 Bloomberg Gender- Equality Index 2021 Disability Equality Index, 100% score Human Rights Campaign Foundation 2021 Corporate Equality Index, 100% Score Ranked #15 of the Fortune 500 companies on diversity and inclusion A listing of additional DEI awards and recognition is available on our website. LEADERSHIP AND DEVELOPMENT Offering robust and varied experiences for continuous learning and development provides a competitive advantage for organizations seeking to attract and retain the best talent. With the talent shortage and focus on the candidate-centric market, organizations will be required to devote more attention to internal mobility, reskilling and upskilling existing employees. They will need to keep sustainability at their core to attract, develop and retain the right talent to help drive ESG strategy and outcomes. Dynamic learning journeys give existing employees avenues for building skills and capabilities, preparing them to meet the changing needs of our organization and preparing them for the future of work. Our Opportunity and Approach BNY Mellon continuously reviews learning and development trends and collaborates with industry- leading vendors to ensure that our offerings are highly competitive and aligned to employee interests and expectations for professional growth. In particular, the concepts of employee scarcity and sustainability 12 have shaped our 2021 workforce strategy and continue to inform our learning and development strategy. Our organization supports employees’ development as individual contributors and leaders. We strive to create a lifelong learning culture that provides opportunities for them to acquire new skills and competencies at every stage of their BNY Mellon journey. 12 Future of Work Trends in 2022: The new era of humanity , Korn/Ferry

BNY MELLON ENTERPRISE ESG 27 CULTURE AND PURPOSE 2021 ACHIEVEMENTS Return to Office: Prepared managers for workplace transition through information sessions and a toolkit on adapting and adjusting to employees’ return to office. Purpose-Driven Growth: Equipped leaders and managers at all levels to advance our vision for the future by embedding our new values into the BNY Mellon culture. Developing Digitally: Introduced multiple new learning and development experiences to develop employees’ technical and digital knowledge and skills. Connecting Virtually and Learning Digitally Now in its second year, our Leadership and Professional Development Academy online learning platform enables our global workforce to connect virtually and learn digitally. The platform’s social functionalities, learning cohorts and points system also support a collaborative and engaging learning environment. The 24/7 Resource Library, composed of videos and brief articles, facilitates immediate learning on a topic. As employees continue to navigate the ongoing public health crisis, our Remote Work Bootcamp and Leading in the New Normal courses, as well as our Virtual Leadership journey, help them improve their work on virtual platforms. Managers’ and leaders’ success starts with their transition to a new role. Our first-line managers and directors participate in comprehensive leadership development programming that sets them up for success. Enterprise ESG 2025 Leadership and Development Drive a culture of high productivity, engagement and commitment to continuous learning and development to support successful leaders and managers and their teams KPI: Increase the number of discrete employees participating in/utilizing nonmandatory learning programs, on a year-over-year basis Progress Year 2020 2021 YoY change Total elective learning hours (excludes mandatory courses) 390,801 4 0 9 ,14 5 5% Average hours per year 9 8 -11% Distinct count of courses completed 7, 3 0 2 8,657 19% % of year-end active employee population that completed nonmandatory training 91% 98% 8% KPI: Improve manager effectiveness score by 5% year over year, as measured through Manager Upward Feedback process Progress: Due to systems updates, there was no Upward Feedback process conducted in 2021

BNY MELLON ENTERPRISE ESG 28 CULTURE AND PURPOSE EXPANDING OPPORTUNITIES FOR GROWTH BNY Mellon provides a wealth of development opportunities to help people advance their careers and progress within our organization. We believe the strength of our offerings contributes to the fact that 33% of open positions were filled by internal candidates in 2021. However, in recognition of the need to stay current with changing workplace dynamics and worker expectations, we made several additions and changes during 2021. BNY Mellon encourages employees to continue their education by reimbursing certain expenses related to educational courses through a tuition assistance program. In addition to tuition reimbursement discounts and school savings, the program also includes access to education coaches who can provide expert academic and college financing advice and help with choosing the best path for furthering education. At the enterprise level, our new DEI Academy is developing leadership acumen and building critical skills to drive purpose-driven growth and a values- based culture. More than 99% of employees completed the foundational unconscious bias course, and we have added modules on Inclusive Leadership, Inclusive Hiring and Inclusive Performance Management. Our increasingly inclusive culture arises not only from formal training but also the efforts of our leaders as they seek to model behaviors that create a sense of belonging and psychological safety. We introduced training to equip managers and senior leaders with the skills to create an effective work environment that aligns with current workforce needs and the direction of our future of work. In response to our employees returning to the office, we proactively prepared our managers to meet the needs of their employees. We provided a comprehensive toolkit, including frameworks for team working arrangements and exceptions, and a discussion guide, talking points and FAQs to guide the dialogue. We provided training on our Purpose-Driven Growth Agenda, which connects the company’s purpose and vision to build a culture that is both high performing and human centered. Targeted training was delivered to all senior leaders to equip them to hold culture activation sessions that engage teams to discuss how the new values can be applied and integrated into daily performance. SPOTLIGHT ESG-Aware Employees We introduced an ESG Certification program to help all employees build and advance their knowledge of the management and integration of ESG factors into business operations and the investment process. In addition to an introductory video, the three ESG-focused modules cover ESG fundamentals, client solutions and the regulatory landscape. This new offering supports our ESG objectives by enhancing our ability to deliver a powerful and differentiated client experience. ADOPTING A DIGITAL FOCUS To evolve our training delivery, we accelerated our approach to blended learning through the expansion and availability of online learning. For example, we introduced a technology workforce development platform to offer easy access to technical and digital training to a wider audience. We increased our investment in developing employees’ technical and digital capabilities by introducing multiple new learning and development opportunities, including the following: Technology Role-Based Learning Pathways. We provide 56 role-targeted learning pathways to help employees advance skills in their current role or begin to cross-train for future roles. Global Payments, Treasury, Issuer Services and Markets Learning Hub. This new online portal provides directed learning recommendations based on identified skill development for select individual contributors, people managers and directors in our Operations business. The hub provides exciting and innovative learning content, sourced from external vendors, where employees can aim to develop the skills and behaviors required for their current and future roles. Tour de Learning. This innovative seven-week gamified learning event delivers technology and digital learning to our Global Operations and Technology organization.

BNY MELLON ENTERPRISE ESG 29 CULTURE AND PURPOSE EMERGING TALENT PROGRAMS Attracting outstanding individuals from all backgrounds to our organization is vital to achieving our corporate value “passion for excellence” and remaining a global leader in financial services. We invest in our coordinated suite of programs for individuals at key transition points in their career progression. These opportunities, which are structured to attract qualified individuals to our organization and advance career growth, range from one-day Sophomore Summits and summer internships to one- and two-year rotational and immersion programs. In tandem, our philanthropic focus on developing the workforce of the future synergistically aligns our commitments to DEI, digital transformation and Community Impact giving and employee volunteering. United States. Our 2021 campus recruiting season utilized a virtual format, including eight Historically Black Colleges and Universities as well as three Hispanic Serving Institutions. We also strengthened outreach to diverse candidates by collaborating with and sponsoring the Society of Hispanic Engineers, National Society of Black Engineers and Grace Hopper (a female engineering conference). EMEA. Our EMEA Business Inclusion Council strives to embed DEI in the way we operate in that region. The council identifies ways to improve access to diverse talent to tap into more diverse talent pools. For example, in the UK we engage with Black Young Professionals, the largest UK network of Black professionals, to promote vacancies and participate in the #10000BlackInterns program. India. A fellowship program in India utilizes a six- month internship program to attract underrepresented individuals, e.g., those with disabilities, returning women, LGBTQ+ and veterans. The internships offer a learning pathway, buddy and mentor, and regular assessments, followed by the opportunity for qualified candidates to convert to full-time roles upon completion. SPOTLIGHT Cultivating Technology Talent BNY Mellon prepares and recruits future technology talent through a growing system of campus recruiting and training. In 2021, Campus Recruiting and Global Operations and Technology launched two bespoke mentor-to-intern-to- full-time-hire pathways to our existing summer internship and 18-month full-time program for new full-time technology hires. These new routes include the Student Technology and Readiness Training Upskill Program (S.T.A.R.T.U.P.), a school- year mentorship program with the City University of New York (CUNY) as well as The Community College of Allegheny County (CCAC), and a summer internship Technology Future Talent program for second-year students in associate and bachelor’s degree programs. Through this continuum of training, we are advancing technology talent in the financial services industry and increasing our access to qualified candidates in a competitive marketplace. PREPARING NEW YORKERS FOR WORK As a cofounder of the 30-member New York Jobs CEO Council, BNY Mellon is addressing employer needs for skilled employees by training and hiring New Yorkers, with a focus on Black, Hispanic/Latinx and Asian communities. In collaboration with CUNY, a BNY Mellon philanthropic partner, the New York City Department of Education and other groups, the council aims to hire 100,000 New Yorkers by 2030, including 25,000 CUNY students. The program offers EverUp Micro-Credentials in eight prioritized job areas to provide participants with a competitive boost at landing jobs and internships at Jobs Council companies. In 2021, the program engaged more than 1,600 students in information sessions, and 820 CUNY students completed EverUp Micro-Credential Skills Training. In addition, five redesigned degree programs were codeveloped by CUNY faculty and over 30 company subject matter experts.

BNY MELLON ENTERPRISE ESG 30 CULTURE AND PURPOSE Performance Management Our performance management process plays a critical role in building a high-performance culture and facilitates the alignment of individual contributions with enterprise strategy. Manager and team member conversations create a rich feedback loop to reinforce performance standards and to fuel ongoing professional development. DEI goals are included in the performance management plans of all employees, placing on them the responsibility to help build inclusive teams and an equitable culture that enable all members to thrive. By elevating inclusion as a leadership competency, we have made inclusive leadership an imperative for anyone responsible for managing, or who aspires to manage, high-performance teams. In 2021 we embedded our corporate values in our annual performance management process as part of our Values and Behaviors initiative. This sets the expectation for not only what we do, but also how we do it and why. Values and Behaviors conversations are now more deeply embedded into performance reviews and development conversations. For example, for the first time, performance ratings include two separate ratings, one for results and one for behaviors. EMPLOYEE ENGAGEMENT, RETENTION AND WELLBEING Employees in job markets globally left their jobs at record rates in 2021, many citing a lack of connection to their organization as a primary reason. Feeling burned out and undervalued, workers reported a desire to restore life balance and the ability to prioritize their physical, mental, emotional and social wellbeing. Successful employers are evolving by listening to understand employees’ perspectives and increasing employee engagement. In addition to encouraging employees to embrace corporate values and purpose, employers are equipping workers with the skills to manage their personal growth and life balance, and boost their resilience and overall wellbeing. 13 Our Opportunity and Approach We continue to build a distinctive people experience to engage BNY Mellon employees. Our offerings cover the full life cycle of our relationship, from first contact through alumni status. Employees want a supportive workplace that meets them in their life moments. We continually evaluate our employee engagement and wellbeing offerings to better realize those expectations. Engaged employees are critical to our success: When employees are at their best, they are more productive, creative, purpose-driven and collaborative members of our workforce. We strive to maintain a listening culture that is open to varying employee needs and respond by addressing employees’ physical, emotional, social and financial wellbeing. 13 The Great Attrition: The power of adaptability , McKinsey Organization Blog, Nov. 22, 2021

BNY MELLON ENTERPRISE ESG 31 CULTURE AND PURPOSE 2021 ACHIEVEMENTS Employee Engagement: Introduced a digitally powered program to equip managers with real- time insights on employee sentiment. Higher Wages: Increased the minimum hourly salary rate for employees based in the U.S. from $16.50 to $18.00. Life Balance: Introduced global Caregiver Leave Policy: 10 days of paid time off to manage planned and unplanned family care circumstances. Enhanced Time Off: Introduced U.S. enhanced paid sick and safe-time of 13 days, inclusive of both physical and mental health needs. Employee Engagement and Retention Employees are BNY Mellon’s most valuable resource. Our people generate the innovations, administer the programs and deliver the services that enable our success day by day and year to year. It follows that their continued engagement as members of a highly inclusive, diverse and collaborative community is essential to our continued business success. We support engagement by: • Connecting the work of our employees to company success in the context of an inclusive culture of recognition and appreciation • Providing platforms for employee opinions and ideas • Catalyzing personal and professional growth • Supporting physical, mental, social and financial wellbeing • Establishing a comprehensive set of competitive benefits and compensation to equitably compensate strong performance and meaningful work Establishing a highly competitive employee value proposition is another critical element of hiring and retaining top talent. We have articulated an employee value proposition to guide our engagement with current and future employees and make a compelling case as to why top employees should choose to build a career with us. Toward that end, in 2021 BNY Mellon engaged in an extensive review of our employer brand and value proposition. We evaluated existing messaging and resourcing, interviewed employees and benchmarked key competitors. Key findings provide insights about how BNY Mellon has a differentiated advantage as an innovative culture, our strong commitment to diversity, and the range and strength of our benefit and wellbeing offerings. We are now focused on implementing strategic recommendations in 2022. Our work in this space is intended to provide focused messaging and positioning of BNY Mellon as an employer of choice that is both realistic and aspirational for attracting future generations of talent while also helping to retain and engage our current employee base. PURPOSE-DRIVEN GROWTH A foundational component of engaging and retaining employees is our Purpose-Driven Growth Agenda, which is centered on the core purpose of “powering individuals and institutions to succeed across the financial world.” Introduced in 2021, this agenda aims to help each employee to connect what they do to broader efforts at the team, line of business and enterprise levels. Our shared purpose is informed by our vision “to define what it means to be the trusted financial institution for the next generation of clients and employees.” It builds on our Values and Behaviors Initiative, which was launched in December 2020. Through this initiative we have been encouraging employees to have the courage to lead from wherever they are, act with integrity always, and renew their passion for excellence . Our power flows from our strength in diversity . These values are activated by behaviors that are defined by role, from senior leaders to managers to frontline employees. Our goal is to help employees center their daily activities on our purpose and vision in practical, observable ways.