Calvert Tools of Change

2023 Calvert Engagement Report

Tools of Change 2023 Calvert Engagement Report Calvert Research and Management A Global Leader in Responsible Investing

Contents 3 Engagement Philosophy 4 Calvert’s Engagement Approach 6 Tools of Change 9 2022 Engagement Results: Key Themes 2

Engagement Philosophy Calvert Research and Management has a long history of supporting the health and sustainability of global markets and improving investment returns through its active engagement with corporations. As a responsible investor, we seek to understand the challenges facing the world today, ascertain how companies are positioned to respond to those challenges and allocate capital in a manner that drives positive change and strengthens the companies in which we invest. As a complement to our research, structured engagement in pursuit of improving environmental and social outcomes—as well as long-term shareholder value—is a core component of our investment approach. Calvert maintains a dedicated team of engagement professionals who use our research to uncover financially material opportunities where a change in a company’s environmental, social and governance (ESG) approach could help mitigate risk or take advantage of opportunities more effectively. Our engagement program over the past year continued our decades-long history of working with companies to address critical issues. In 2022, these issues included dialogues on public disclosure of EEO-1 data, improving board/employee diversity, climate change, workplace rights and the ability to manage through a global energy transition, among many other important issues. Responsible investors work within and help strengthen a set of global norms. These global norms, expressed in agreements such as the United Nations Sustainable Development Goals, United Nations Principles for Responsible Investment (UN PRI) and the Paris Climate Accord, provide a framework for investors and businesses to create a more just and sustainable world. Critical to these efforts is a robust program for engaging corporations on material ESG issues, which is more essential now than ever before. We believe that as investors, we have a responsibility to engage in oversight of companies to ensure management is acting in our long-term interests. Leveraging our rigorous research process, we believe we can make a valuable contribution to corporate governance, improve long-term financial and market outcomes, and bring about social and environmental benefits. 3

Calvert’s Engagement Approach Company Engagement Corporations exert substantial influence across all aspects of global societies. Engaging with corporations allows Calvert to help address critical sustainability issues that matter to these companies, our shareholders and society as a whole. As the connection between a company’s ESG practices and its financial success becomes clearer, engagement aimed at improving corporate ESG performance increasingly aligns with the creation of shareholder value. As a responsible investor, Calvert considers opportunities to improve our position as a shareholder in our portfolio companies and which tools are best suited for driving the positive change we hope to see. We believe active ownership is essential for improving one’s position as a shareowner and, therefore, have made it an integral part of Calvert’s approach to Responsible Investing. Our engagement philosophy encompasses the following characteristics: „ INFORMED: We leverage Calvert’s extensive ESG and investment research to select targets with the potential for positive change, and to contribute meaningful ideas for the improvement of company financial and social performance. „ OUTCOME-ORIENTED: Our engagements are rooted in the unique ESG risks and opportunities associated with each company. We set differentiated objectives for transparency, policy and performance for each target company to ensure that our engagement catalyzes tangible performance improvements. „ LONG-TERM: We intend to build a long-term constructive relationship with the company to bring about lasting change and continual improvement. „ THOUGHT-LEADING: We promote ESG innovations developed by internal and external partners, such as new methods to measure corporate impact, to contribute to ongoing progress in the ESG field and in corporate best practices, generally. „ COLLABORATION AND ESCALATION: While our goal is to work collaboratively with companies, we will escalate our engagement where necessary with reluctant companies, including filing shareholder proposals (also referred to as shareholder resolutions), alerting other investors to our concerns and speaking out in the media. Rigorous corporate engagement can improve corporate behaviors, contributing to a more sustainable and equitable world, and potentially contribute to an investment’s business prospects. 4

Company Selection Calvert’s engagement team has specific expertise advocating for change in corporations on matters of importance to shareholders. Working closely with our dedicated ESG research team and investment professionals, we leverage our company and industry knowledge to identify opportunities to improve a company’s overall approach to ESG, its response to controversies, or its management of ESG-related risks and opportunities. Provided for illustrative purposes only. Our goal is to select companies for engagement where we have the opportunity to create meaningful progress that can improve our clients’ portfolio performance, using the following criteria: „ MATERIALITY: Based on our internal research, we look for concerns about the company’s ESG performance that may have a material impact on our position as an investor, or an emerging issue that may raise concerns in the future. „ OPPORTUNITY: We believe that there is a reasonable likelihood of successful engagement, and that the company has practical options to improve performance. „ POSITION SIZE: We primarily engage with companies that are significant for Calvert portfolios—for example, active holdings or large passive holdings—or where we believe successful engagement will allow us to increase our ownership stake. „ FINANCIAL PERFORMANCE: We may prioritize engagements with companies that are lagging financial performers. „ EXPERIENCE: We have expertise in an area that allows us to credibly engage the company and/or the possibility of collaboration that complements our strengths. 5

Tools of Change There are a variety of tools available to drive positive change. Calvert typically focuses on direct dialogue and proxy voting, using shareholder resolutions as a last resort. Direct dialogue Calvert engages directly with companies both on its own and as part of investor or broader stakeholder coalitions, as noted earlier. When Calvert’s research team uncovers an opportunity to potentially enhance shareholder value and improve company performance by taking advantage of an opportunity or mitigating a risk, we engage directly with management through periodic phone calls, letters and meetings to raise concerns and identify opportunities, operating on our commitment to encourage concrete progress across sectors of the economy. Prior to initiating engagement, Calvert establishes objectives regarding our engagement with each company. These objectives may include improved disclosure, governance policies designed to address the issue and performance metrics. Positive outcomes may include a company establishing or strengthening a policy, adding members to the board, developing risk management approaches, or committing to specific performance improvements. Over time, where appropriate, we measure the change in key performance metrics for the relevant issues. When an engagement is completed, we typically maintain contact with the company to track progress. More broadly, our engagement activities seek to develop constructive relationships with companies we hold in our portfolios, raise awareness among investors broadly, and contribute to the development and widespread adoption of industry-best practices. Proxy voting Proxy voting is one of the most direct means to influence corporate behavior. Calvert’s proxy voting guidelines outline our approach to voting on critical ESG issues facing corporations. Our voting promotes the alignment of corporate policies with the long-term interests of shareholders, including: „ LONG-TERM VALUE. Calvert seeks to support governance structures and policies that keep the focus of company management on long-term corporate health and sustainable financial, social and environmental performance. A focus on long-term value creation increases the relevance of companies’ environmental management, treatment of workers and communities, and other sustainability and social responsibility factors. „ ACCOUNTABILITY. Accountable governance structures emphasize transparency, alignment of interests and inclusiveness: independent boards that represent a wide variety of interests and perspectives; full disclosure of company performance on financial, environmental and social metrics; charters, bylaws, and policies and procedures to effectively communicate with management; and compensation structures that work to align the interests and time frames of management and shareholders. „ SUSTAINABILITY. Well-governed companies are financially, socially and environmentally sustainable. Sustainability requires fair treatment of shareholders and other stakeholders in order to position the company for continued viability and growth over time. Effective corporate governance cannot indefinitely ignore or exploit certain groups or interests to the benefit of others without incurring material risks for the corporation. 6

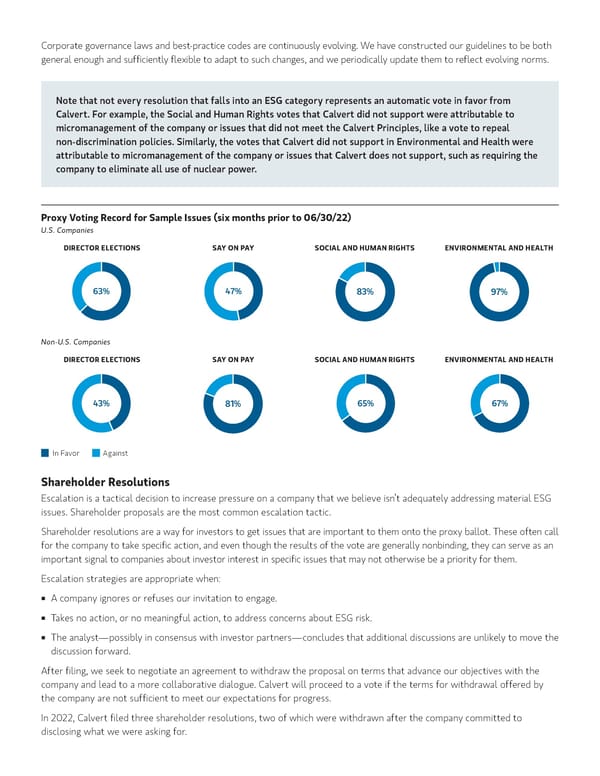

Corporate governance laws and best-practice codes are continuously evolving. We have constructed our guidelines to be both general enough and sufficiently flexible to adapt to such changes, and we periodically update them to reflect evolving norms. Note that not every resolution that falls into an ESG category represents an automatic vote in favor from Calvert. For example, the Social and Human Rights votes that Calvert did not support were attributable to micromanagement of the company or issues that did not meet the Calvert Principles, like a vote to repeal non-discrimination policies. Similarly, the votes that Calvert did not support in Environmental and Health were attributable to micromanagement of the company or issues that Calvert does not support, such as requiring the company to eliminate all use of nuclear power. Proxy Voting Record for Sample Issues (six months prior to 06/30/22) U.S. Companies DIRECTOR ELECTIONS SAY ON PAY SOCIAL AND HUMAN RIGHTS ENVIRONMENTAL AND HEALTH 63% 47% 83% 97% Non-U.S. Companies DIRECTOR ELECTIONS SAY ON PAY SOCIAL AND HUMAN RIGHTS ENVIRONMENTAL AND HEALTH 43% 81% 65% 67% In Favor Against Shareholder Resolutions Escalation is a tactical decision to increase pressure on a company that we believe isn’t adequately addressing material ESG issues. Shareholder proposals are the most common escalation tactic. Shareholder resolutions are a way for investors to get issues that are important to them onto the proxy ballot. These often call for the company to take specific action, and even though the results of the vote are generally nonbinding, they can serve as an important signal to companies about investor interest in specific issues that may not otherwise be a priority for them. Escalation strategies are appropriate when: „ A company ignores or refuses our invitation to engage. „ Takes no action, or no meaningful action, to address concerns about ESG risk. „ The analyst—possibly in consensus with investor partners—concludes that additional discussions are unlikely to move the discussion forward. After filing, we seek to negotiate an agreement to withdraw the proposal on terms that advance our objectives with the company and lead to a more collaborative dialogue. Calvert will proceed to a vote if the terms for withdrawal offered by the company are not sufficient to meet our expectations for progress. In 2022, Calvert filed three shareholder resolutions, two of which were withdrawn after the company committed to disclosing what we were asking for.

Engagement in Action: Tesla Calvert has long engaged with Tesla on numerous issues, and a shareholder resolution we filed in 2021 on workforce diversity disclosure got majority support, the first environmental or social proposal to get that level of support. While the company issued the report with some of the data we requested, the underlying problems of discrimination and harassment do not seem to have been resolved. As a result, we continue to cast our proxy votes in a way we hope will push the company toward greater progress on managing key ESG risks. At Tesla's annual meeting on August 4, 2022, shareholders presented several environmental, social and governance (ESG) proposals for consideration. Among the key results: „ The proposal asking Tesla to report on its anti-harassment/discrimination policies received 47% of the vote, nearly a majority. Tesla has faced attention and criticism for allegations of harassment and discrimination in the workplace, and increased transparency would help shareholders assess how the company is managing associated risks. „ Calvert voted in favor of a resolution asking Tesla to produce a report on eradicating child labor in the battery supply chain. Tesla is growing rapidly and sourcing battery cells from new suppliers, increasing the risk of its supply chain being exposed to controversial metals often associated with child labor and labor abuses. As the world's top seller of electric vehicles, Tesla faces a proportionally larger risk on its battery manufacturing supply chain relative to other automakers, making detailed reporting on the battery supply chain even more important. „ We voted against the re-elections of Ira Ehrenpreis and Kathleen Wilson-Thompson for seats on Tesla's board as independent nonexecutive directors (INEDs). Calvert wrote letters addressed to both prior to the publication of Tesla's Impact Report in May 2022, urging them to have a discussion with Calvert on the importance of strengthening diversity, equity and inclusion policies and practices. The company and board never responded to our outreach. The unresponsiveness and unwillingness to communicate with Calvert was among the reasons we voted against their nominations. Both were ultimately elected but received less than 70% of the vote. This is particularly notable, given that during the most recent proxy season, 85.2% of all directors received 90% or greater support, and only 5.7% received between 50%-80% support. Public Policy In 2022, Calvert provided comments to the Securities and Exchange Commission (SEC) on a set of rules for companies to disclose their carbon emissions in order to facilitate market function and to stimulate the innovation and entrepreneurship needed to hasten the transition to a cleaner energy system. It contained many items raised in our comments to the SEC in 2021 on the same topic and we believe it will result in decision-useful, comparable climate-risk information for investors that will significantly improve the quality of company disclosures over the information available today. We believe disclosure on climate change metrics needs to match the same practices used for financial disclosures, including attestation and assurance as well as being auditable and comparable across peers, and the SEC's proposed tile takes important steps toward making that a reality. In the letter, signed by Chairman John Streur, we expressed our support for the majority of provisions within the proposed rule as we believe they will strongly increase our ability to access more detailed climate-related data on registrants. We also shared some strategies for how we think the rule could be strengthened and modified. The full letter can be found on the SEC’s website. 8

2022 Engagement Results: Key Themes Diversity and Inclusion Engagement in Action For the 2022 proxy season, we filed a total of three shareholder proposals. Two of them were withdrawn following successful engagements. Because research indicates that diversity is likely material to company performance, investors require consistent, comparable and complete information about diversity performance. However, we as investors often lack the information we need to evaluate corporate diversity performance as a material issue for our investment decisions. Companies currently provide this information to the U.S. government through the Equal Employment Opportunity reporting standard known as the EEO-1 report, but they are not required to release this information publicly. We believe corporate commitments to diversity are credible only if the company releases full EEO statistics on its workplace demographics. In 2020, Calvert began an organized effort to make this information more transparent. We began by writing to 100 of the largest companies in our portfolios, asking them to release their EEO-1 reports. Of these, 18 were already 112 releasing the report, and we encouraged them to continue to Total U.S. do so. For those that did not disclose the report, we asked engagements 53% for a meeting so we could explain why we thought doing so was important. We also reached out to other investors to Voted against or Voted against encourage them to support this initiative, and to coordinate withheld from “Say on Pay” with those that were already committed to the issue. By Oppose nominating proposals 37% committees the end of 2022, all 100 companies on our original list had director seats of boards that agreed to release the information publically. in the U.S. weren’t at least The results of this effort indicate that among large 40% companies, EEO-1 reporting has become the norm. This diverse represents significant progress. Investors must now use that information to drive engagement with clients and encourage laggards to improve their DEI practices. 9

Climate Change Climate change is one of the primary ESG issues for Calvert’s engagement team. We expect companies to set realistic “net zero” or science-based emissions-reduction targets, put in place management systems to achieve these targets, and set meaningful performance goals to ensure management accountability. Calvert has continued to see progress on data over the past few years. Reporting on climate-related data and climate change strategies is now the norm among U.S. and European companies, after many years of engagement, with an increasing emphasis on how companies and investors execute against those targets. However, the quality of the data available remains inconsistent. In particular, the disclosure of Scope 3 emissions significantly lags that of Scopes 1 and 2, which obscures a holistic view into a company’s true carbon impact and exposure across the value chain. Our engagement approach is tailored to each sector and company. Some sectors have established emissions-reduction processes already in place. Others are looking for ways to effectively decarbonize, with potential opportunities available for first movers. In 2022, we continued to press companies we’ve had long-standing engagements with on the issue of climate change. Given how far-reaching climate change is as a material business risk—regulatory, operational, physical and reputational— our engagements and underlying objectives vary: from encouraging companies to align their reporting with the Task Force on Climate-Related Financial Disclosures (TCFD) to setting clearly defined GHG emissions reduction targets and ensuring that lobbying activities align with the Paris Supported Voted for Agreement’s goal of limiting temperature rise to 1.5 C. 100% 16 out Calvert examines how companies follow through on the of U.S. commitments made. environmental of 16 proposals climate proposals „ Disclosure, governance etc. „ Leading through the energy transition Engagement in Action: Xcel Energy As the shift to a low-carbon economy continues, investors and others are becoming increasingly aware of the need for a "Just Transition" that integrates climate change and human capital management to create the necessary environment for action. Calvert engages with companies on Just Transition in a number of ways, both on our own and as a part of investor coalitions. One example of Calvert's engagement is our work with Xcel Energy, which we undertake as a part of our work with Climate Action 100+, an investor-led coalition that asks corporate greenhouse gas emitters to take necessary action on climate change. Xcel was the first CA100+ utility sector company to commit to a net-zero target. Moreover, Xcel has significant operations in Colorado, which is the first state in the U.S. to have Just Transition legislation. We are working directly with Xcel to strengthen its net-zero commitments, associated targets and interim steps. In addition, we are asking the company to align climate lobbying policy and human capital management policies, including Just Transition, to support the achievement of net-zero targets. We asked that Xcel consider including its natural gas utility operations in its net-zero commitment. Subsequent to meeting with the company, Xcel announced its ambition to achieve net-zero greenhouse gas emissions from its natural gas business by 2050–becoming the first integrated U.S. utility company to commit to an enterprise-wide net-zero target. 10

Engagement in Action: AGL Energy When Australia's top power producer, AGL Energy, announced plans to separate the company into a retail electricity provider and a generation business, Calvert released an investor letter expressing our concerns about the proposed demerger. The company is one of the most carbon-intensive utilities in the world, by some measures, because of its dependence on coal. The demerger was promoted as a means of accelerating the company’s decarbonization. While some active investors expressed skepticism about the likely financial benefits of the proposed restructure, our letter detailed concerns about the proposed demerger proposal as it related to a robust climate change mitigation strategy. AGL Energy claimed that separating the company into independent retail and generation businesses would accelerate a low-carbon energy transition at both companies. We anticipated that it would instead greatly slow the company’s energy transition by leaving the retail company in a financially weaker position and a cash-rich generation business without incentives to invest in renewables. In Calvert’s view, the result would have been the creation of two entities that were poorly positioned to support Paris-aligned decarbonization goals. AGL Energy subsequently announced that it had abandoned its plans for a demerger. 2023 Engagement: Key Themes Calvert’s team and processes continue to evolve. We intend to build on our existing engagement strategies and continue to innovate our systems and processes to support our objectives to influence positive change. We have identified the thematic focus areas for 2023 engagement: „ Climate change (such as improved disclosure, strategy, governance and execution) „ Diversity, equity and inclusion (EEO-1 reporting, diversity performance, workplace inequality) „ Human capital management (integration into our existing diversity and climate engagements) „ Data and artificial intelligence „ Environment, health and safety „ Product impact „ Access to medicine Company Names/GICS Subindustries Calvert portfolios hold the following companies within the GICS subindustry noted, as of 12/31/22: AUTOMOBILE MANUFACTURERS Bayerische Motoren Werke AG NIO Inc. Class A BYD Company Limited Class H Renault SA Ford Motor Company Rivian Automotive, Inc. Class A Geely Automobile Holdings Limited Stellantis N.V. General Motors Company SUBARU CORP Great Wall Motor Co., Ltd. Class H Tata Motors Limited Guangzhou Automobile Group Co., Ltd. Class H Tesla, Inc. Hyundai Motor Company Thor Industries, Inc. Isuzu Motors Limited Toyota Motor Corp. Kia Corp. Volkswagen AG Mahindra & Mahindra Ltd. Volvo Car AB Class B Maruti Suzuki India Limited XPeng, Inc. Class A Mercedes-Benz Group AG 11

ELECTRIC UTILITIES MULTI-UTILITIES Acciona SA A2A S.p.A. Alliant Energy Corp Acea S.p.A. Avangrid, Inc. Algonquin Power & Utilities Corp. BKW AG Ameren Corporation Companhia Energetica de Minas Gerais SA Pfd CMS Energy Corporation Companhia Paranaense de Energia - COPEL Pfd Registered B Consolidated Edison, Inc. Compania de Transmissao de Energia Eletrica Paulista Pfd ENGIE SA. Constellation Energy Corporation Hera S.p.A. EDP - Energias do Brasil S.A. National Grid plc EDP-Energias de Portugal SA Sempra Elia Group SA/NV Veolia Environnement SA Enel Americas S.A. Enel SpA Equatorial Energia S.A. Eversource Energy Fortum Oyj Hawaiian Electric Industries, Inc. Hydro One Limited Iberdrola Interconexion Electrica SA ESP Mercury NZ Ltd. Neoenergia SA NextEra Energy, Inc. NRG Energy, Inc. Orsted Portland General Electric Company Public Power Corporation S.A. Red Electrica Corp. SA SSE plc Terna S.p.A. VERBUND AG Class A Xcel Energy Inc. References to individual companies are provided solely for informational purposes and are intended only to illustrate certain relevant environmental, social and governance factors. This information does not constitute an offer to sell or a solicitation to buy securities. The information presented has been developed internally and/or obtained from sources believed to be reliable; however, Calvert does not guarantee the accuracy, adequacy or completeness of such information. Opinions and other information reflected in this material are subject to change continually without notice of any kind and may no longer be true after the date indicated or hereof. Past performance is no guarantee of future results. 12

About Risk There is no assurance that a Portfolio will achieve its ESG Strategies that incorporate impact investing and/or investment objective. Portfolios are subject to market risk, Environmental, Social and Governance (ESG) factors could which is the possibility that the market values of securities result in relative investment performance deviating from owned by the Portfolio will decline and that the value of other strategies or broad market benchmarks, depending on Portfolio shares may therefore be less than what you paid whether such sectors or investments are in or out of favor in for them. Market values can change daily due to economic the market. As a result, there is no assurance ESG strategies and other events (e.g. natural disasters, health crises, could result in more favorable investment performance. terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Investments in foreign markets entail special risks such as currency, political, economic, and market risks. IMPORTANT INFORMATION There is no guarantee that any investment strategy will work under all market This material is not a product of Morgan Stanley’s Research Department and conditions, and each investor should evaluate their ability to invest for the long- should not be regarded as a research material or a recommendation. term, especially during periods of downturn in the market. The Firm has not authorised financial intermediaries to use and to distribute this A separately managed account may not be appropriate for all investors. material, unless such use and distribution is made in accordance with applicable Separate accounts managed according to the Strategy include a number of law and regulation. Additionally, financial intermediaries are required to satisfy securities and will not necessarily track the performance of any index. Please themselves that the information in this material is appropriate for any person consider the investment objectives, risks and fees of the Strategy carefully to whom they provide this material in view of that person’s circumstances and before investing. A minimum asset level is required. purpose. The Firm shall not be liable for, and accepts no liability for, the use or For important information about the investment managers, please refer to misuse of this material by any such financial intermediary. Form ADV Part 2. This material may be translated into other languages. Where such a translation The views and opinions and/or analysis expressed are those of the author or the is made this English version remains definitive. If there are any discrepancies investment team as of the date of preparation of this material and are subject between the English version and any version of this material in another language, to change at any time without notice due to market or economic conditions and the English version shall prevail. may not necessarily come to pass. Furthermore, the views will not be updated The whole or any part of this material may not be directly or indirectly reproduced, or otherwise revised to reflect information that subsequently becomes available copied, modified, used to create a derivative work, performed, displayed, published, or circumstances existing, or changes occurring, after the date of publication. posted, licensed, framed, distributed or transmitted or any of its contents disclosed The views expressed do not reflect the opinions of all investment personnel to third parties without the Firm’s express written consent. This material may at Morgan Stanley Investment Management (MSIM) and its subsidiaries and not be linked to unless such hyperlink is for personal and non-commercial use. affiliates (collectively “the Firm”), and may not be reflected in all the strategies All information contained herein is proprietary and is protected under copyright and products that the Firm offers. and other applicable law. This material has been prepared on the basis of publicly available information, Calvert is part of Morgan Stanley Investment Management. Morgan Stanley internally developed data and other third-party sources believed to be reliable. Investment Management is the asset management division of Morgan Stanley. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from DISTRIBUTION public and third-party sources. This material is a general communication, which is not impartial and all information This material is only intended for and will only be distributed to persons resident provided has been prepared solely for informational and educational purposes and in jurisdictions where such distribution or availability would not be contrary to does not constitute an offer or a recommendation to buy or sell any particular local laws or regulations. security or to adopt any specific investment strategy. The information herein has MSIM, the asset management division of Morgan Stanley (NYSE: MS), and its not been based on a consideration of any individual investor circumstances and is affiliates have arrangements in place to market each other’s products and services. not investment advice, nor should it be construed in any way as tax, accounting, Each MSIM affiliate is regulated as appropriate in the jurisdiction it operates. legal or regulatory advice. To that end, investors should seek independent legal MSIM’s affiliates are: Eaton Vance Management (International) Limited, Eaton and financial advice, including advice as to tax consequences, before making any Vance Advisers International Ltd, Calvert Research and Management, Eaton investment decision. Vance Management, Parametric Portfolio Associates LLC, and Atlanta Capital Charts and graphs provided herein are for illustrative purposes only. Past Management LLC. performance is no guarantee of future results. This material has been issued by any one or more of the following entities: 13

EMEA ASIA PACIFIC This material is for Professional Clients/Accredited Investors only. Hong Kong: This material is disseminated by Morgan Stanley Asia Limited for use in In the EU, MSIM and Eaton Vance materials are issued by MSIM Fund Management Hong Kong and shall only be made available to “professional investors” as defined (Ireland) Limited (“FMIL”). FMIL is regulated by the Central Bank of Ireland and under the Securities and Futures Ordinance of Hong Kong (Cap 571). The contents is incorporated in Ireland as a private company limited by shares with company of this material have not been reviewed nor approved by any regulatory authority registration number 616661 and has its registered address at 24-26 City Quay, including the Securities and Futures Commission in Hong Kong. Accordingly, save Dublin 2, DO2 NY19, Ireland. where an exemption is available under the relevant law, this material shall not be Outside the EU, MSIM materials are issued by Morgan Stanley Investment issued, circulated, distributed, directed at, or made available to, the public in Hong Management Limited (MSIM Ltd) is authorised and regulated by the Financial Kong. Singapore: This material is disseminated by Morgan Stanley Investment Conduct Authority. Registered in England. Registered No. 1981121. Registered Management Company and should not be considered to be the subject of an invitation for subscription or purchase, whether directly or indirectly, to the Office: 25 Cabot Square, Canary Wharf, London E14 4QA. public or any member of the public in Singapore other than (i) to an institutional In Switzerland, MSIM materials are issued by Morgan Stanley & Co. International investor under section 304 of the Securities and Futures Act, Chapter 289 of plc, London (Zurich Branch) Authorised and regulated by the Eidgenössische Singapore (“SFA”); (ii) to a “relevant person” (which includes an accredited investor) Finanzmarktaufsicht ("FINMA"). Registered Office: Beethovenstrasse 33, 8002 pursuant to section 305 of the SFA, and such distribution is in accordance with Zurich, Switzerland. the conditions specified in section 305 of the SFA; or (iii) otherwise pursuant Outside the US and EU, Eaton Vance materials are issued by Eaton Vance to, and in accordance with the conditions of, any other applicable provision of Management (International) Limited (“EVMI”) 125 Old Broad Street, London, the SFA. This publication has not been reviewed by the Monetary Authority of EC2N 1AR, UK, which is authorised and regulated in the United Kingdom by the Singapore. Australia: This material is provided by Morgan Stanley Investment Financial Conduct Authority. Management (Australia) Pty Ltd ABN 22122040037, AFSL No. 314182 and its Italy: MSIM FMIL (Milan Branch), (Sede Secondaria di Milano) Palazzo Serbelloni affiliates and does not constitute an offer of interests. Morgan Stanley Investment Corso Venezia, 16 20121 Milano, Italy. The Netherlands: MSIM FMIL (Amsterdam Management (Australia) Pty Limited arranges for MSIM affiliates to provide Branch), Rembrandt Tower, 11th Floor Amstelplein 1 1096HA, Netherlands. financial services to Australian wholesale clients. Interests will only be offered France: MSIM FMIL (Paris Branch), 61 rue de Monceau 75008 Paris, France. Spain: in circumstances under which no disclosure is required under the Corporations MSIM FMIL (Madrid Branch), Calle Serrano 55, 28006, Madrid, Spain. Germany: Act 2001 (Cth) (the “Corporations Act”). Any offer of interests will not purport MSIM FMIL Frankfurt Branch, Große Gallusstraße 18, 60312 Frankfurt am Main, to be an offer of interests in circumstances under which disclosure is required Germany (Gattung: Zweigniederlassung (FDI) gem. § 53b KWG). Denmark: MSIM under the Corporations Act and will only be made to persons who qualify as a FMIL (Copenhagen Branch), Gorrissen Federspiel, Axel Towers, Axeltorv2, 1609 “wholesale client” (as defined in the Corporations Act). This material will not be Copenhagen V, Denmark. lodged with the Australian Securities and Investments Commission. MIDDLE EAST Japan Dubai: MSIM Ltd (Representative Office, Unit Precinct 3-7th Floor-Unit 701 and For professional investors, this material is circulated or distributed for informational 702, Level 7, Gate Precinct Building 3, Dubai International Financial Centre, Dubai, purposes only. For those who are not professional investors, this material is 506501, United Arab Emirates. Telephone: +97 (0)14 709 7158). provided in relation to Morgan Stanley Investment Management (Japan) Co., Ltd. (“MSIMJ”)’s business with respect to discretionary investment management This document is distributed in the Dubai International Financial Centre by agreements (“IMA”) and investment advisory agreements (“IAA”). This is not for Morgan Stanley Investment Management Limited (Representative Office), an the purpose of a recommendation or solicitation of transactions or offers any entity regulated by the Dubai Financial Services Authority (“DFSA”). It is intended particular financial instruments. Under an IMA, with respect to management of for use by professional clients and market counterparties only. This document assets of a client, the client prescribes basic management policies in advance is not intended for distribution to retail clients, and retail clients should not act and commissions MSIMJ to make all investment decisions based on an analysis of upon the information contained in this document. the value, etc. of the securities, and MSIMJ accepts such commission. The client This document relates to a financial product which is not subject to any form of shall delegate to MSIMJ the authorities necessary for making investment. MSIMJ regulation or approval by the DFSA. The DFSA has no responsibility for reviewing exercises the delegated authorities based on investment decisions of MSIMJ, and or verifying any documents in connection with this financial product. Accordingly, the client shall not make individual instructions. All investment profits and losses the DFSA has not approved this document or any other associated documents belong to the clients; principal is not guaranteed. Please consider the investment nor taken any steps to verify the information set out in this document, and has objectives and nature of risks before investing. As an investment advisory fee for no responsibility for it. The financial product to which this document relates may an IAA or an IMA, the amount of assets subject to the contract multiplied by a be illiquid and/or subject to restrictions on its resale or transfer. Prospective certain rate (the upper limit is 2.20% per annum (including tax)) shall be incurred purchasers should conduct their own due diligence on the financial product. If in proportion to the contract period. For some strategies, a contingency fee may you do not understand the contents of this document, you should consult an be incurred in addition to the fee mentioned above. Indirect charges also may be authorised financial adviser. incurred, such as brokerage commissions for incorporated securities. Since these charges and expenses are different depending on a contract and other factors, MSIMJ cannot present the rates, upper limits, etc. in advance. All clients should U.S. read the Documents Provided Prior to the Conclusion of a Contract carefully NOT FDIC INSURED | OFFER NO BANK GUARANTEE | MAY LOSE VALUE | before executing an agreement. This material is disseminated in Japan by MSIMJ, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A DEPOSIT Registered No. 410 (Director of Kanto Local Finance Bureau (Financial Instruments Firms)), Membership: the Japan Securities Dealers Association, The Investment Trusts Association, Japan, the Japan Investment Advisers Association and the Latin America (Brazil, Chile Colombia, Mexico, Peru, and Uruguay) Type II Financial Instruments Firms Association. This material is for use with an institutional investor or a qualified investor only. © 2023 Morgan Stanley. All rights reserved. All information contained herein is confidential and is for the exclusive use and review of the intended addressee, and may not be passed on to any third party. This material is provided for informational purposes only and does not constitute a public offering, solicitation or recommendation to buy or sell for any product, service, security and/or strategy. A decision to invest should only be made after reading the strategy documentation and conducting in-depth and independent due diligence. 14

15

To view our latest engagement, advocacy and public policy initiatives, go to www.calvert.com/impact.php calvert.com © 2023 Morgan Stanley. All rights reserved. CRC TBD 09.13.23 38031_KC_0823 Lit-Link: TBD LTR