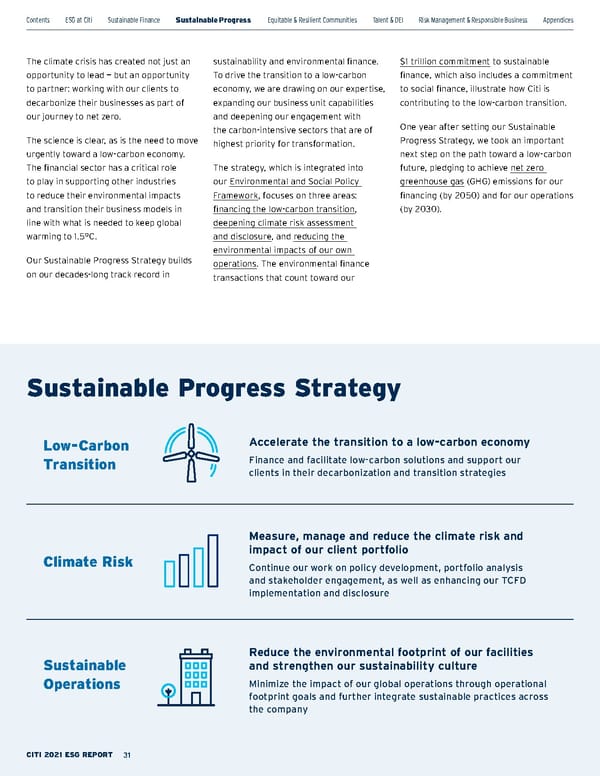

The climate crisis has created not just an opportunity to lead — but an opportunity to partner: working with our clients to decarbonize their businesses as part of our journey to net zero. The science is clear, as is the need to move urgently toward a low-carbon economy. The financial sector has a critical role to play in supporting other industries to reduce their environmental impacts and transition their business models in line with what is needed to keep global warming to 1.5°C. Our Sustainable Progress Strategy builds on our decades-long track record in sustainability and environmental finance. To drive the transition to a low-carbon economy, we are drawing on our expertise, expanding our business unit capabilities and deepening our engagement with the carbon-intensive sectors that are of highest priority for transformation. The s trategy, w hich i s i ntegrated i nto our Environmental a nd S ocial P olicy Framework , f ocuses o n t hree a reas: financing t he l ow-carbon t ransition , deepening c limate r isk a ssessment and d isclosure , a nd reducing t he environmental i mpacts o f o ur o wn operations . T he e nvironmental fi nance transactions t hat c ount t oward o ur $1 tr illion c ommitment t o su stainable finance, w hich a lso i ncludes a c ommitment to s ocial fi nance, i llustrate h ow C iti i s contributing t o t he l ow-carbon t ransition. One y ear a fter s etting o ur S ustainable Progress S trategy, w e t ook a n i mportant next s tep o n t he p ath t oward a l ow-carbon future, p ledging t o a chieve net z ero greenhouse gas (GHG) e missions f or o ur financing ( by 2 050) a nd f or o ur o perations (by 2030). Sustainable Progress Strategy Low-Carbon Transition Accelerate the transition to a low-carbon economy Finance and facilitate low-carbon solutions and support our clients in their decarbonization and transition strategies Climate Risk Measure, manage and reduce the climate risk and impact of our client portfolio Continue our work on policy development, portfolio analysis and stakeholder engagement, as well as enhancing our TCFD implementation and disclosure Sustainable Operations Reduce the environmental footprint of our facilities and strengthen our sustainability culture Minimize the impact of our global operations through operational footprint goals and further integrate sustainable practices across the company Contents ESGatCiti SustainableFinance SustainableProgress Equitable&ResilientCommunities Talent& DEI RiskManagement&ResponsibleBusiness Appendices CITI 2021 ESG REPORT 31

Citi ESG Report Page 30 Page 32

Citi ESG Report Page 30 Page 32